Note

0.0(0)

Chat with Kai

Explore Top Notes Note

Note Studied by 306 people

Studied by 306 people Note

Note Studied by 212 people

Studied by 212 people Note

Note Studied by 1 person

Studied by 1 person Note

Note Studied by 788 people

Studied by 788 people Note

Note Studied by 21 people

Studied by 21 people Note

Note Studied by 7 people

Studied by 7 people

AP Macroeconomics Ultimate Guide (copy)

5.0(2)

AP World History - Ultimate Guide

5.0(2)

Overzicht semi-auxiliaire p223-224 (+vertaling)

5.0(1)

How to Approach the Multiple-Choice Questions

5.0(6)

3: Chemical basis of life

5.0(2)

Chapter 7 Textbook

5.0(1)

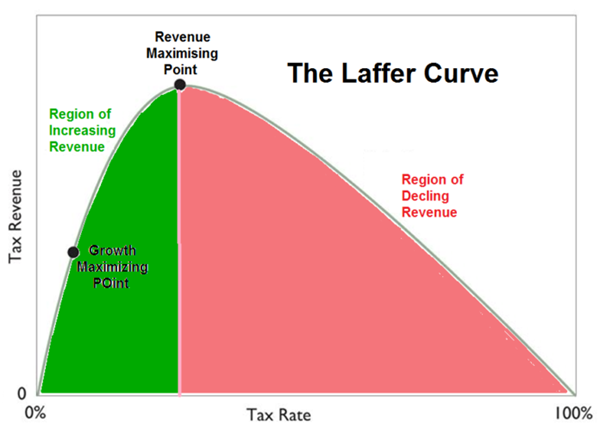

The Laffer Curve

I. Understanding the theory

laffer curve: belief that tax cuts generate additional revenue

- government won't create any revenue if tax rates are zero

- neither will it create revenue if tax rates are 100% because there will be more incentive to avoid taxes

- a revenue-maximizing tax rate exists

tax cuts are changes to tax law that effectively reduce the amount of tax you pay.

three things to understand

- not all tax cuts pay for themselves

- not all tax cuts are created equal

- they impact productive behavior differently

- the goal is not to maximize revenues

- we should be somewhere in the green region

- government is importat for things like rule of law, public safety and honest courts

- a simple and flat tax is the best way to finance those expenses

government could generate more revenue by climbing the green side

- but it would be very costly in terms of lost economic growth and lower pre-tax income for workers

Note

0.0(0)

Chat with Kai

Explore Top Notes Note

Note Studied by 306 people

Studied by 306 people Note

Note Studied by 212 people

Studied by 212 people Note

Note Studied by 1 person

Studied by 1 person Note

Note Studied by 788 people

Studied by 788 people Note

Note Studied by 21 people

Studied by 21 people Note

Note Studied by 7 people

Studied by 7 people

AP Macroeconomics Ultimate Guide (copy)

5.0(2)

AP World History - Ultimate Guide

5.0(2)

Overzicht semi-auxiliaire p223-224 (+vertaling)

5.0(1)

How to Approach the Multiple-Choice Questions

5.0(6)

3: Chemical basis of life

5.0(2)

Chapter 7 Textbook

5.0(1)