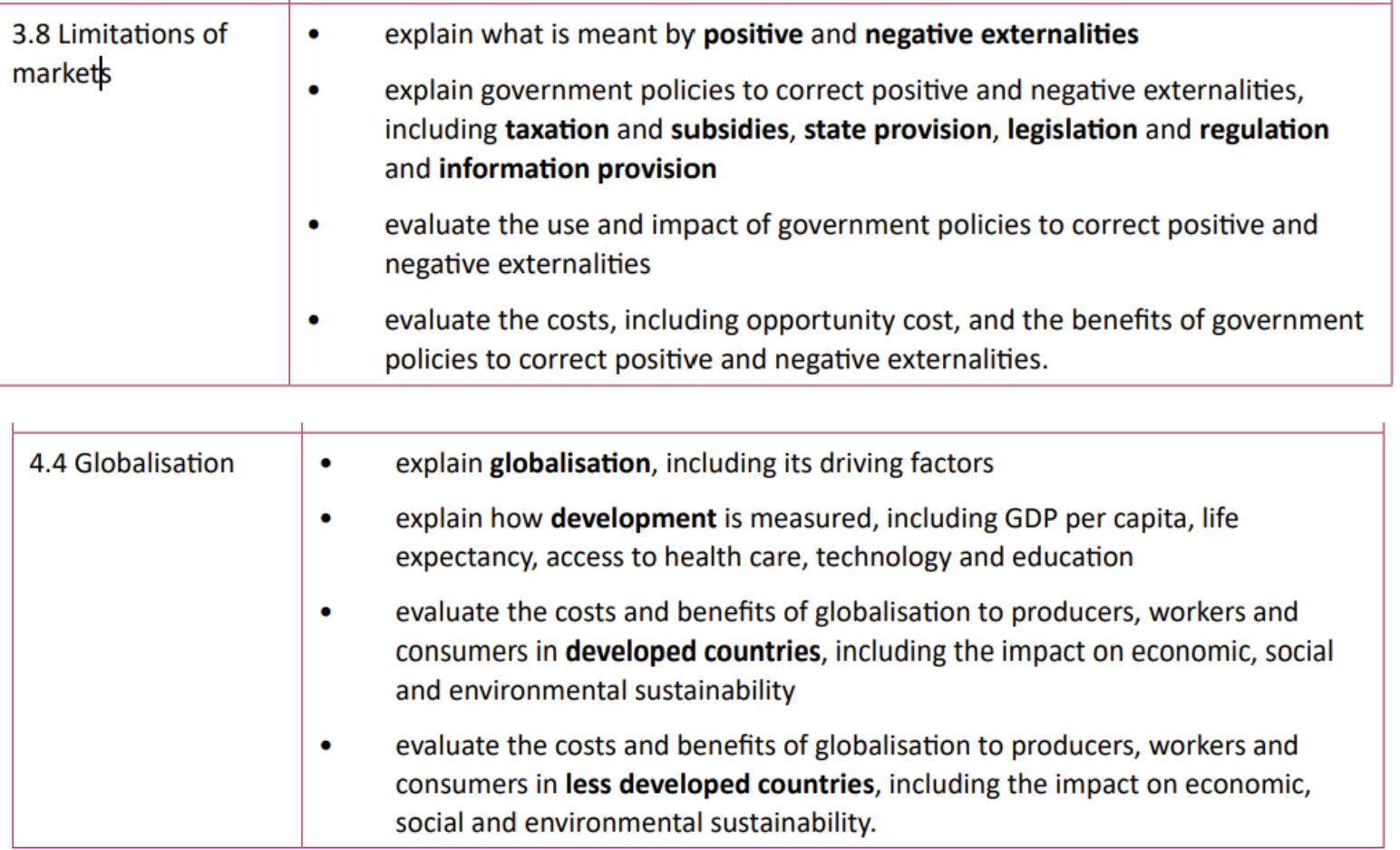

Economics: 3.8 & 4.4

externality: an effect of an economic activity from a third party

positive externality: (positive effect ^^) external benefit

negative externality: (negative effect ^^) external cost

government policies to correct positive and negative externalities

taxation

subsidies

state provision

legislation and regulation

information provision

taxation: taxes that reduce negative externalities will have a positive effect. eg excise duties on petrol and diesel will cause consumption to fall, decreasing the negative externality of pollution. TAX SHIFT SUPPLY CURVE TO THE LEFT, causing a rise in price and fall in quantity supplied.

if the government adds tax to a good that has INELASTIC demand, this won’t change the impact of the negative externality since consumers will still buy the good. e.g CIGARETTES → they are a HABIT FORMING GOOD, meaning demand is inelastic since consumers are addicted. even if a tax is added, consumers will still buy it. petrol/diesel is also inelastic since vehicles need it. if tax is added, it won’t change the level of consumption

taxation can impact lower-income individuals since a greater proportion of income is taken from them compared to those with high income.

taxation can lead to unofficial markets so people can buy goods without paying the tax. this is illegal

taxation provides revenue for the government

subsidies: the amount of money the government gives directly to firms to encourage production and consumption. eg subsidies can be given to public transport to persuade people to travel by bus and trains instead of cars, reducing the negative externality of harmful pollution. SUBSIDIES SHIFT SUPPLY CURVE TO THE RIGHT, causing a fall in price and rise in quantity supplied. subsidies work better when the demand for a good is elastic.

The money the government gives in subsidies could have been used elsewhere eg healthcare/education (opportunity cost)

state provision: goods and services provided directly by the government. this benefits society as a whole. eg in the UK, healthcare is state provided meaning everyone is able to access it because it’s free (NHS). if it was left to the market, this wouldn’t be the case and the negative externality of disease would rise, leading to less economically active people.

the government may not provide enough to satisfy demand. eg, healthcare may not be able to be provided when demanded causing excess demand (long waiting lines). this increases pressure on the government to increase supply to match demand.

legislation and regulation: rules/laws to control the way people and organisations behave, e.g law: no market for drugs (which is a negative externality), all children must attend school (positive externality).

rules: cannot purchase tobacco and alcohol under 18 years old

laws and rules are effective at reducing consumption of negative externalities and increasing the consumption of positive externalities

danger of unofficial markets or using illegal items. government has to spend more money on policing (opportunity cost on spending in other sectors)

information provision: government supplies information to encourage people and organisations to change their behaviour. eg workshops coming to schools to educate them

Knowt

Knowt