Lecture 4 Debt Valuation

What is debt?

Introduction to Debt

Definition: Debt involves borrowing money to be repaid in the future.

Types of Debt Instruments:

Bill: Short-term debt with principal payments within a year.

Bond: Long-term debt with promised future payments and a maturity date.

Bondholders receive periodic interest payments and principal at maturity.

Default consequences: Failure to pay can lead to bankruptcy.

What are some bond terminologies?

Bond Terminology

Face Value (Par Value): Principal amount borrowed, typically $1000 for corporate bonds.

Maturity: Final repayment date of the bond.

How does coupon payment work?

Bond Terminology Continued

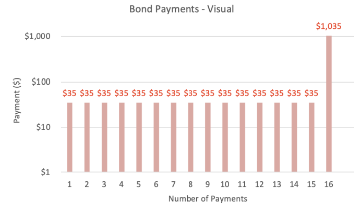

Coupon Payments (CPN): Interest payments on bonds. Pay twice a year.

Coupon Rate: Rate at which coupons are paid, expressed as APR.

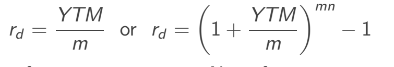

Yield to Maturity (YTM): Market required rate of return for bonds, used as a discount rate. Yield twice a year.

How to calculate present value of bond?

Bond Pricing

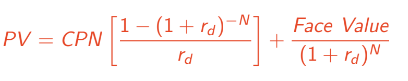

Bond present value = Present value of interest payments + Present value of principal.

Formula:

Where ( rd ) is the yield to maturity, similar to EAR, only use it when the compounding effect is different.

What is a zero-coupon bond?

Zero Coupon Bonds

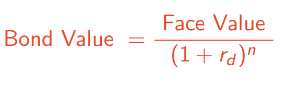

No coupon payments; only one payment at maturity.

Pricing formula:

Typically sold at a discount.

What is bond yield?

Bond Yields

Yield to maturity is the discount rate that equates present value of payments to bond price.

Changes daily with interest rate fluctuations.

What is the relationship between interest rates, bond yields and bond prices?

Bond Price and YTM Relationship

Inverse relationship: As interest rates and bond yields rise, bond prices fall, and vice versa.

What is the relationship of coupon rate and yield to maturity?

Coupon Rate vs. Yields to Maturity

If coupon rate = YTM, bond sells at face value (par bond).

If coupon rate < YTM, bond sells at a discount.

If coupon rate > YTM, bond sells at a premium.

What is the relationship of bond price and face value?

If bond price = face value, bond sells at face value (par bond).

If bond price < face value, bond sells at a discount.

If bond price > face value, bond sells at a premium

How to invest in bonds?

Bond Theorem Applications

If rates are expected to increase, avoid long-term/low coupon bonds.

If rates are expected to decline, consider investing in long-term/low coupon bonds.

What are some risks with bond?

Bond Risk Characteristics: Maturity

Long-term bonds are more sensitive to interest rate changes than short-term bonds.

Interest rate risk increases with maturity.

Bond Risk Characteristics: Coupon Payments

Lower coupon bonds are more sensitive to interest rate changes than higher coupon bonds.

Corporate Bond Yields

Bonds with credit risk yield higher returns than default-free bonds.

Credit Risk in Bonds:

Credit risk refers to the possibility that a bond issuer will default on its debt obligations, failing to make interest payments or repay the principal at maturity.

Default risk is the risk of non-payment, risk that lender may not receive payments as promised.

How to rate bonds?

Investment Grade Bonds

Aaa/AAA: Best quality, lowest risk.

Aa/AA: High quality, lower than Aaa.

A/A: Upper-medium grade.

Baa/BBB: Medium grade, some speculative characteristics.

Speculative Bonds

Ba/BB: Speculative elements, moderate protection.

B/B: Lacks desirable investment characteristics.

Caa/CCC: Poor standing, may be in default.

C/C/D: Extremely poor prospects.