Chapter 8: Bond Valuation and the Structure of Interest Rates

Chapter Overview

Title: Chapter 8: Bond Valuation and the Structure of Interest Rates

Authors: Robert Parrino, Ph.D.; David S. Kidwell, Ph.D.; Thomas W. Bates, Ph.D.; Stuart Gillan, Ph.D.

Edition: Fifth Edition

Copyright: © 2022 John Wiley & Sons, Inc.

Learning Objectives

Describe the market for corporate bonds and three types of corporate bonds.

Explain how to calculate the value of a bond and why bond prices vary negatively with interest rate movements.

Distinguish between a bond’s coupon rate, yield to maturity, and effective annual yield.

Explain why investors in bonds are subject to interest rate risk and why it is important to understand the bond theorems.

Discuss the concept of default risk and know how to compute a default risk premium.

Describe the factors that determine the level and shape of the yield curve.

8.1 Corporate Bonds

Market for Corporate Bonds

Value: As of Q3 2020, the U.S. corporate bonds market is valued at $16.9 trillion.

Key Investors: Life insurance companies, pension funds, and mutual funds.

Transaction Characteristics:

Most transactions occur in large dollar amounts.

Limited daily trading compared to stocks.

Greater volatility due to thin trading.

Types of Corporate Bonds

Fixed-Income Securities:

Pay fixed interest amounts over the contract's life.

Face value typically $1,000.

Coupon rate computed as annual coupon payment divided by face value.

Vanilla Bonds (Debentures):

Typically unsecured, fixed coupon payments, repay principal at maturity.

Zero Coupon Bonds:

No coupon payments, sold at a discount, pays face value at maturity.

Convertible Bonds:

Can be exchanged for shares of the firm's stock, generally priced higher than similar non-convertible bonds.

8.2 Bond Valuation

Bond Valuation Process

Estimate Future Cash Flows: Assess the expected cash inflows from coupons and principal payment.

Determine Required Rate of Return: This reflects the risk associated with the cash flows.

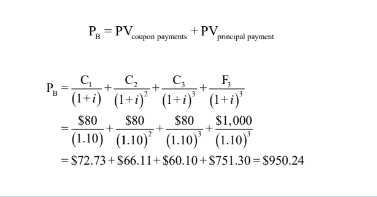

Compute Present Value: Calculate the current worth of future cash flows to determine bond price. [ P_B = PV(Coupon Payments) + PV(Principal Payment) ]

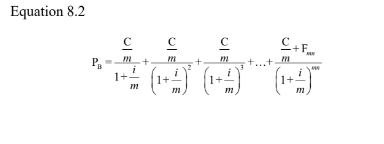

The Bond Valuation Formula

Determine bond price using the present value of expected future cash flows: [ P = PV + PV ]

Where P is the bond price, and components include coupon and principal payments.

Example Calculating Bond Prices: Promised cash flows are discounted to compute the bond's current market price.

Types of Bonds

Par Bond: Price equals face value when coupon rate equals yield.

Premium Bond: Price above face value when coupon rate exceeds yield.

Discount Bond: Price below face value when coupon rate is lower than yield.

8.3 Bond Yields

Understanding Bond Yields

Yield to Maturity (YTM): The discount rate at which the present value of the bond’s cash flows equals its market price.

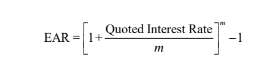

Effective Annual Yield (EAY): A more accurate measure of yield that accounts for compounding.

Realized Yield

Realized Yield: The interest rate that equals the present value of actual cash flows received by the investor.

8.4 Interest Rate Risk

Interest Rate Risk Overview

Definition: Uncertainty regarding future bond values due to fluctuating interest rates.

Bond Theorems: Describe the inverse relationship between bond prices and interest rates.

Longer maturity bonds exhibit greater price sensitivity to interest rate changes, making them riskier.

Implications of Bond Theorems

Investors must adapt their strategies based on interest rate forecasts:

Avoid long-term bonds if higher rates are expected.

Consider zero-coupon bonds if lower rates are anticipated.

8.5 The Determinants of Corporate Borrowing Costs

Key Determinants

Marketability: How easily a bond can be sold without loss in value.

Call Provision: The issuer’s right to redeem the bond early, affecting yield and pricing.

Default Risk: The likelihood of the issuer not meeting payment obligations.

Default Risk Premium (DRP)

DRP: Difference in yield between a security with default risk versus a risk-free rate.

8.6 The Term Structure of Interest Rates

Yield Curves

Factors Influencing Yield Curves: Interest rates, expected inflation, real rates of interest.

Types of Yield Curves:

Ascending/Normal: Indicates higher future rates.

Descending/Inverted: Indicates lower future rates.

Flat: Implies stability in rates.

Economic Impact

Economic conditions influence the real rate of interest, inflation premium, and yield curve slope.