Chapter 7 - Trade Finance

The Law of Negotiable Instruments: Drafts or Bills of Exchange

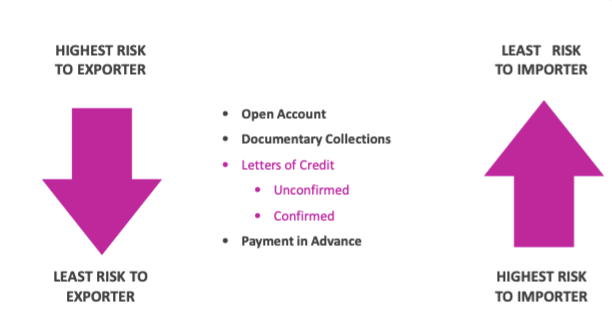

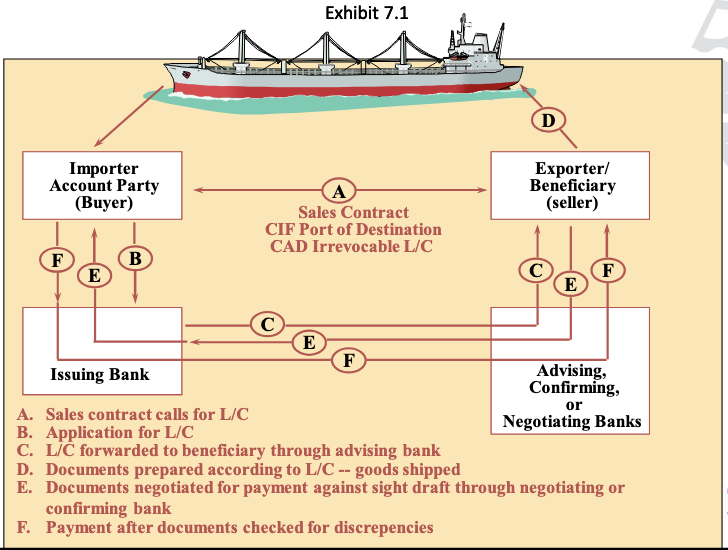

Facilitates payment: Act as a substitute for money (Exhibit 7.1)

Seller (Drawer) orders

Buyer (Drawee) to pay

a specified amount

at a specified time

Sight Draft – when presented

Time Draft – at a specified time

May be “order” or “bearer”

The Law of Negotiable Instruments

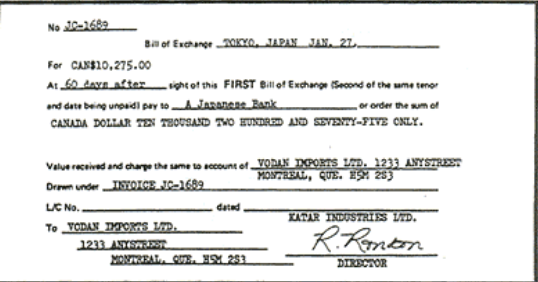

Bill of Exchange or Draft (US term) [Subject to different national laws]

Two purposes:

Substitute for money

Financing/Credit device

Negotiability is a matter of form

UCC Article 3

Instrument must:

Be in writing

Signed

Contain unconditional order or promise to pay

Fixed amount of money

No other undertaking

Payable on demand or specific time

Payable to order of a specific person or to bearer

Types of drafts

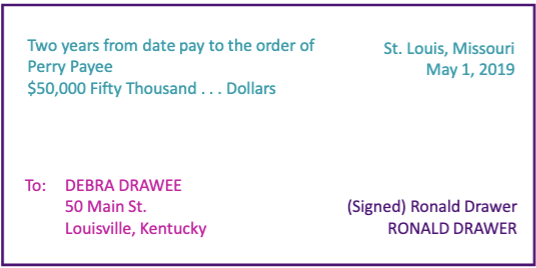

See example Exhibit 7.1

Sight draft – payable upon presentation or demand

Time draft – payable at a specified time

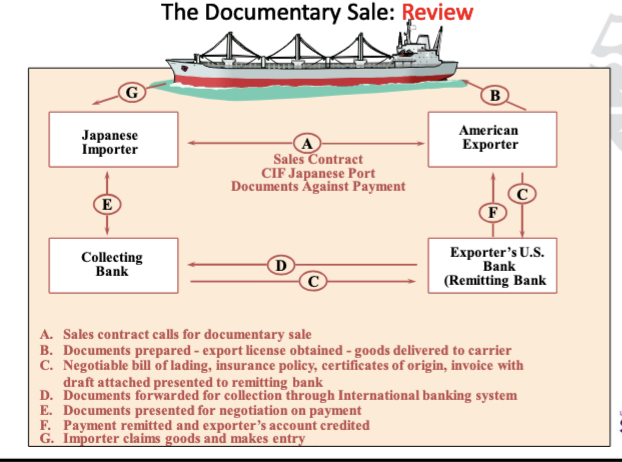

Review documentary collection process –

Draft part of the documents

Seller uses international banks in collection

Buyer [or Bank] pays according to draft when documents presented

Banker’s Acceptance

Subject to Federal law in the US

Substitute a bank’s acceptance for that of a party

This is a term in the Sales Contract

When Bank Accepts, the bank becomes obligated to pay the amount to the holder on the date specified. See example Exhibit 7.1

How do you use drafts as financing device?

Seller gets the Accepted draft & can

Hold until it matures

Sell it at a discount

Contract term

Documents against payment [sight draft]

Documents against acceptance [time draft]

Concept of negotiation and transfer

Negotiability allows draft to be substitute for money

Negotiation = transfer of instrument from one party to a holder (transferee) so that holder gets legal rights

How do you negotiate?

Bearer instrument or

Order instrument

Letters of Credit

Written undertaking (contract) by the Importer’s bank, (Issuing Bank)

On behalf of its customer, the Buyer (Account Party), promising to pay the Seller (Beneficiary) up to a stated sum of money,

Within a prescribed time limit and

Against stipulated documents.

Conditional promise to pay

A Revocable Letter of Credit can be revoked without the consent of the Exporter, meaning that it may be canceled or changed up to the time the documents are presented. Revocable Letters of Credit are very rarely used.

An Irrevocable Letter of Credit cannot be canceled or amended without the consent of all parties including the Exporter. Unless otherwise stipulated, all Letters of Credit are irrevocable.

If payment is to be made at the time that documents are presented, this is referred to as a

SIGHT Letter of Credit.

(used with a sight draft)

If payment is to be made at a future fixed time from the presentation of documents, this is referred to as a

TERM or TIME Letter of Credit

(used with a time draft)

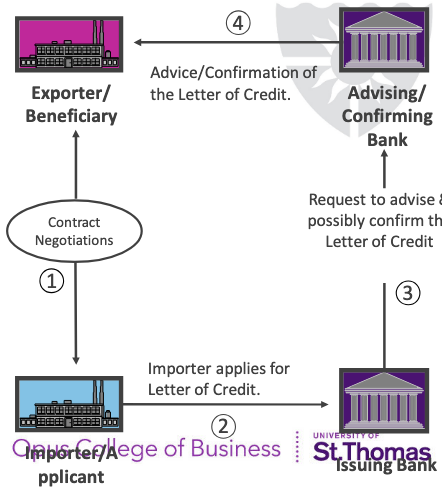

Mechanics: How does a Letter of Credit work?

Three steps

Issuance

Flow of Good

Flow of Documents & Payment

Three relationships

Bank & Buyer

Seller & Buyer

Bank & Beneficiary (Seller)

Letters of Credit: Issuance

Contract for sale of goods payment by Letter of Credit,

Buyer requests that its bank (Issuing Bank) issue a Letter of Credit in favor of the Seller (Beneficiary).

The Issuing Bank sends the LoC to the Advising Bank. Usually located in the country where the Exporter does business and may be the Exporter’s bank, but does not have to be.

The Advising/Confirming Bank verifies the Letter of Credit for authenticity and sends it to the Exporter.

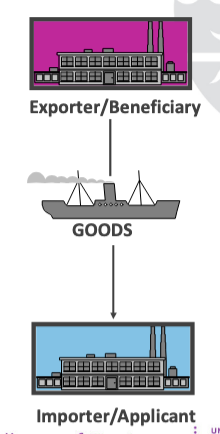

Letters of Credit: Flow of Goods

Exporter reviews LoC to ensure that it corresponds to the terms and conditions in the contract (documents stipulated in the LoC can be produced).

Assuming the Exporter is in agreement with the above, it arranges for shipment of the goods.

Includes the Negotiable Bill of Lading

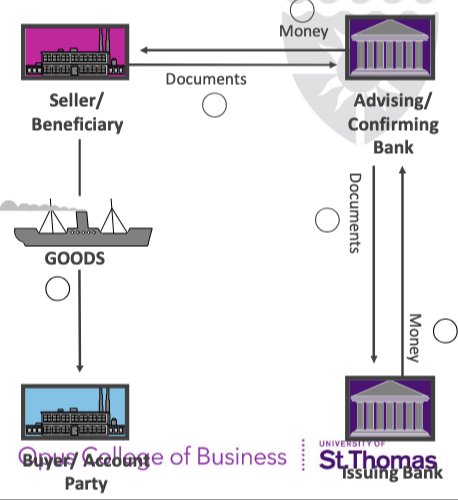

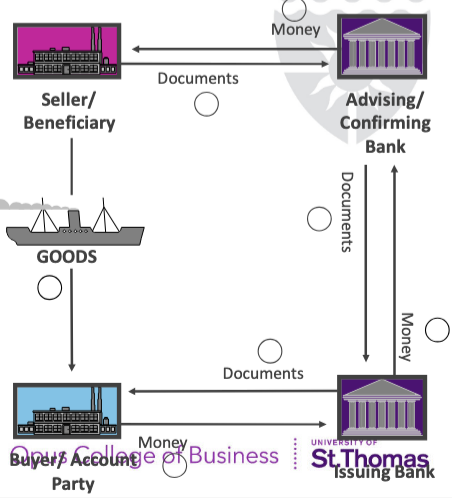

Letters of Credit: Flow of Documents & Payment

After the goods are shipped,

The Exporter presents the documents specified in the LoC to the Advising/ Confirming Bank.

Once the documents are checked and found to comply with the LoC the Advising/ Confirming Bank forwards these documents to the Issuing Bank.

Letters of Credit: Flow of Documents & Payment

In turn, the Issuing Bank examines the documents to ensure they comply with the Letter of Credit.

If the documents are in order, the Issuing Bank will obtain payment from the Importer for payment already made to the Confirming Bank.

Documents are delivered to the Buyer to allow it to take possession of the goods.

Risk Analysis: Letters of Credit

Importer

Advantages:

Importer is assured that, for the Exporter to be paid, all terms and conditions of the Letter of Credit must be met.

Ability to negotiate more favorable trade terms with the Exporter when payment by Letter of Credit is offered.

Disadvantages:

A Letter of Credit assures correct documents but not necessarily correct goods.

Ties up line of credit.

Exporter

Advantages:

An undertaking from the Issuing Bank that you will receive payment under the Letter of Credit provided that you meet all terms and conditions of the Letter of Credit.

Shifts credit risk from the Importer to the Issuing bank.

Not obligated to ship against a Letter of Credit that is not issued as agreed.

Disadvantages:

Documents must be prepared in strict compliance with the requirements stipulated in the Letter of Credit. Non-compliance leaves Exporter exposed to risk of non-payment.

Confirmed Letter of Credit

A bank, called the Confirming Bank, adds its commitment to that of the Issuing Bank to pay the Exporter under the Letter of Credit provided all terms and conditions of the Letter of Credit are met.

An Exporter would request a Confirmed Letter of Credit if it does not consider the financial strength of the Issuing Bank or the country in which it is located to be acceptable risks.

Relationship between the L/C and the Contract for the Sale of Goods

Principle of Independence

Bank is not concerned with whether goods in the underlying sales contract are conforming

Bank is ONLY concerned with whether the correct documents are presented

Examination of the Documents

The Independence Principle

Obligation of issuing bank to honor Beneficiary’s (Seller’s) Draft is conditioned solely on the Beneficiary doing what is required in LoC

UCP Art. 4 – parties deal with documents (not goods, services, other performances)

UCP Art. 14 Bank really only concerned with the appearance of the documents

Comply “on their face”?

Apparent good order

BANK MUST Honor the beneficiary’s draft

(Honor = accept or pay)

If documents not listed in the LoC produced, Bank not required to look at them

Rule of Strict Compliance

Documents presented must STRICTLY CONFORM – or are considered to be a discrepancy

There is no room for documents that are ‘almost the same’

See Exhibit 7.4 for common discrepancies page 195