Firms in Competitive Markets

Competitive Markets Overview

Competitive markets involve firms that are price takers, meaning they accept the market price as given, without influence.

Characteristics of Perfect Competition

Many Buyers and Sellers: Ensures no single firm can influence the market price.

Identical Goods: Products offered by different firms are largely the same, leading to interchangeability.

Free Entry and Exit: Firms can enter or exit the market easily, influencing supply.

Revenue Definitions

Total Revenue (TR): Total income from sales.

Formula: TR=P\cdot Q where P = price and Q = quantity.

Average Revenue (AR): Revenue generated per unit sold.

Formula: AR=\frac{TR}{Q}{}{}=P (In perfect competition, AR equals price).

Marginal Revenue (MR): Change in TR from selling one more unit.

Formula: MR=\frac{\Delta TR}{\Delta Q} or MR = P in competitive markets.

Demand Curve: In a competitive market, the demand curve faced by an individual firm is perfectly elastic, meaning that it can sell any quantity of output at the market price but nothing at a higher price (demand is a horizontal line - very elastic)

each one-unit increase in quantity (Q) causes revenue to rise by PRICE (P) so MR = P

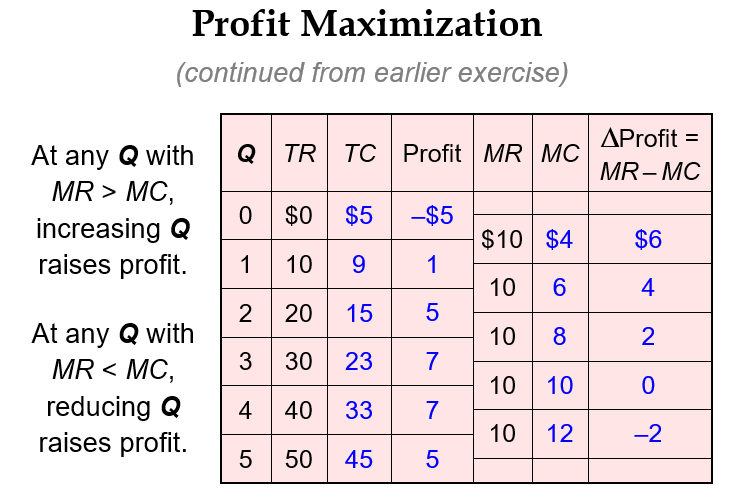

Profit Maximization

To maximize profit, firms must consider marginal changes:

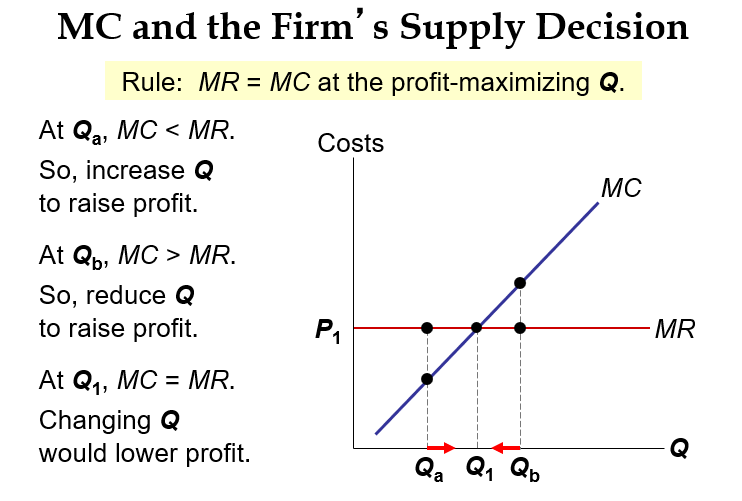

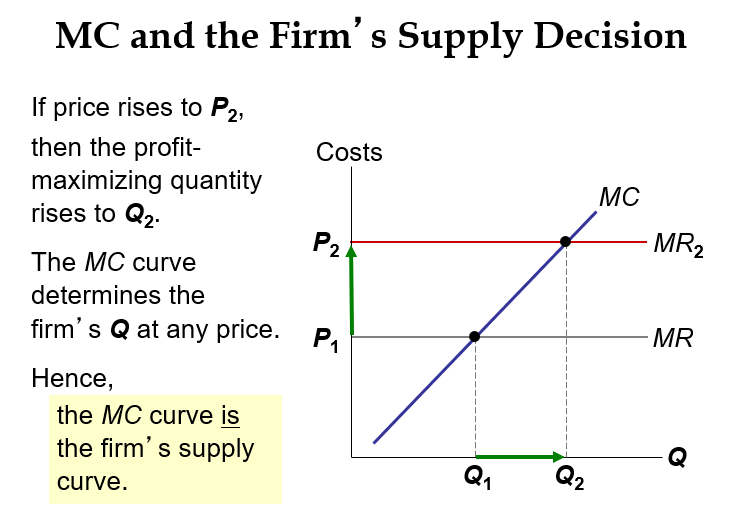

Increase Output: If MR > MC (Marginal Cost), increase quantity.

Decrease Output: If MR < MC , reduce quantity.

The profit-maximizing condition occurs where:

MR = MC

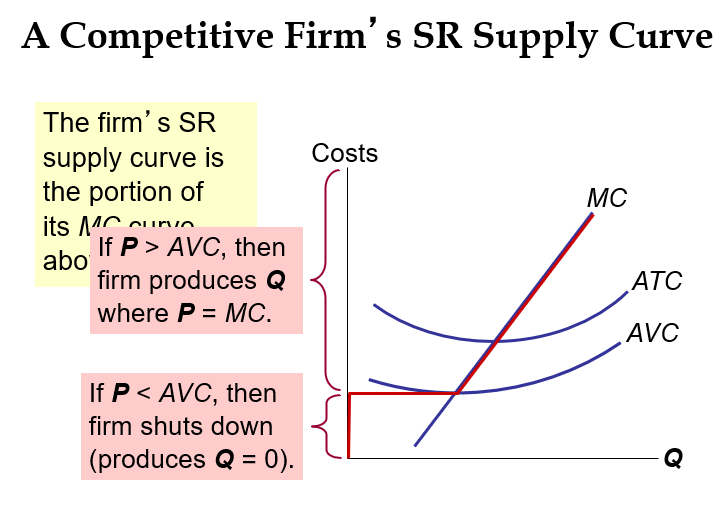

Shutdown vs Exit

Shutdown (Short-run): A decision not to produce, but still responsible for fixed costs (FC).

Condition to shut down: If TR < VC (variable costs).

Alternatively, if price P < AVC (Average Variable Costs), shut down.

Exit (Long-run): A decision to leave the market, with no longer incurring fixed costs.

Condition to exit: If TR < TC (Total Costs).

Alternatively, if price P < ATC (Average Total Costs), exit the market.

Enter: A new firm’s decision to enter the market if profitable to do so.

Condition to enter: If TR > TC

Alternatively, if price P > ATC (Average Total Costs), enter the market

Short-Run and Long-Run Market Supply Curves

Short-Run Supply Curve: The portion of the Marginal Cost (MC) curve above the Average Variable Cost (AVC) curve.

If P > AVC , firms produce where P = MC . If P < AVC , firms shut down (produce zero).

Long-Run Supply Curve: Reflects changes in the number of firms; it may slope upward if firms have different costs or if costs rise with entry.

Long-Run Equilibrium: Achieved when there's no incentive for firms to enter or exit, resulting in zero economic profits (P = ATC).

Market Dynamics and Zero-Profit Conditions

Entry and Exit Thresholds:

Positive economic profit attracts new firms, shifting the supply curve right and reducing prices.

Losses lead firms to exit, shifting the supply curve left and increasing prices.

Zero-Profit Condition: Firms make no economic profit when:

P = ATC and P = MC , ensuring maximum efficiency in resource allocation.

Conclusion: Efficiency of Competitive Markets

In perfect competition, firms optimize output where:

P = MR = MC

The equilibrium in a competitive market ensures total surplus is maximized, reflecting efficiency in consumer and producer welfare.