Ch.11 Understanding Accounting

~11.1 - Accounting + acc. Info~

- Accounting: system for collecting and communicating financial information

- measures business performance and translates findings into information for management decisions

- Bookkeeping: records of taxes paid, income received, and expenses incurred

- Users of accounting information are numerous:

- Business managers use acc. info to set goals, develop plans, and set budgets

- employees and unions use accounting info to get paid and to plan for receive benefits like health care

- investors and creditors: estimate returns to shareholders and to determine tax liabilities of individuals and businesses, ensure amounts are paid on time

- Controller/Chief accounting officer: manages firm’s accounting activities by ensuring that AIS provides reports and statements needed for planning/decision making/other management activities

~Financial vs Managerial accouting~

- can be distinguished by users they serve: those outside the company and those within

~financial accounting~

- accounting system: process in which interested groups are kept informed about financial condition of a firm

- concerned with external users of info like consumer groups, unions, shareholders, and government agencies

- companies prepare + publish income statements and balance sheets at regular intervals

- all documents focus on activities of company as a whole, rather than on individual departments or divisions

~managerial accounting~

- internal procedures that alert managers to problems and aid them in planning and decision making

- serves internal users

- managers at all levels need info to make decisions for their department/ monitor current projects/ plan future events

- to set performance goals:

- salespeople: need data on past sales by geographic regions

- purchasing agents: use info on material costs to negotiate terms with suppliers

~Professional Accountants~

- chartered professional accountant: banner (designation) that is being used to unify the accounting profession in Canada

~Chartered Accountants~

- to achieve designation, must have a uni degree, complete an educational program, and pass national exam

- focus on external financial reporting, so certifying the true financial condition of the firm for various interested parties (shareholders, lenders, etc.)

~Certified General accountants~

to become a CGA

- complete an education program + pass national exam

- must also have an accounting job within a company

Can audit corporate financial statements in most provinces

most work in private companies, but there are a few CGA firms

also, focus on external financial reporting

~Certified Management Accountants~

to get designation

- must have a uni degree, passed two-part entrance exam, completed strategic leadership program while gaining practical experience in management accounting environment

work in organizations of all sizes and focus on applying best management practices in all operations of business

CMAs bring a strong market focus to strategic management and resource deployment

synthesizing and analyzing financial and non-financial info to help organizations maintain competitive advantage

emphasize the role of accountants in the planning and overall strategy of the firm in which they work

~Accounting Services~

~Auditing~

- accountants examine the company’s AIS to ensure it follows prescribed accounting rules

- involves examination of receipts such as shipping documents, cancelled cheques, payroll records, and cash receipt record

- may physically check inventories, equipment, or other assets

- at the end of audit, auditor will certify whether clien’’s financial reports comply with accounting rules

~International accounting standards~

- International financial reporting standards: were developed b/c users of financial information want assurances that accounting procedures are comparable from country to country

- aka: GLOBAL GAAP

- used by more than 140 countries

- IASB financial statements require an income statement, balance sheet, and statement of cash flows

~detecting fraud~

- forensic accountants may be used to track down hidden funds in business firms

- look behind the behind the corporate walls instead of accepting financial records at face value

- may be called upon by law enforcement agencies, insurance companies, law firms, and business firms

- fraud examiners interview high-level executives , pursue tips from employees or outsiders, and search through emails looking for supscious words/phrases

~Tax services~

- helping clients with preparing tax returns and tax planning

~management consulting services~

- range from personal financial planning to planning corporate mergers.

- plant layout and design

- marketing studies

- production scheduling

- computer feasibility studies and design implementation of accounting systems

- some CA firms assist in executive recruitment

~PRIVATE ACCOUNTANTS~

- are salaried employees who deal with company’s day-to-day accounting needs

- large businesses employ specialized accountants in areas such as budgets, financial planning, internal auditing, payroll, and taxation

- work of private accountants varies, depending on nature of specific business and activities needed to make business a success

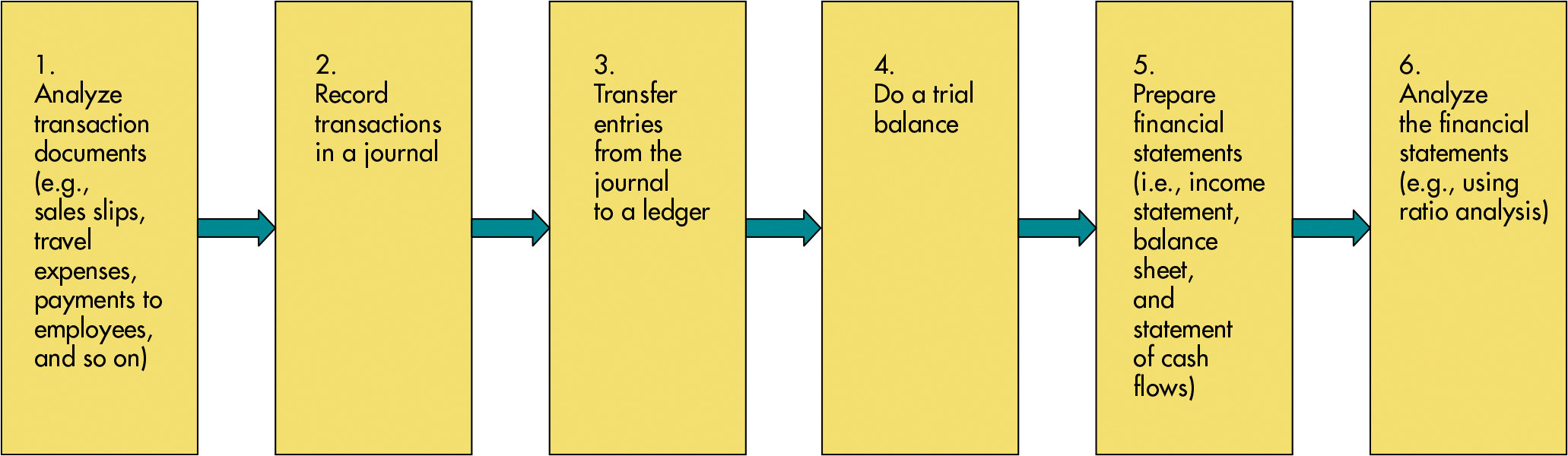

~accouting cycle~

Private accountants use a six-step process to develop and analyze company’s financial reports

- analyze data generated from company’s regular business operations (sales, income tax payments, etc.)

- transactions are recorded in journal

- then transferred into a ledger (shows increase/decrease in various asset, liability, and equity accounts)

- legder amounts for each account are listed in trial balance (assesses accuracy of cash flows)

- financial statements (balance sheet, income statement, and statement of cash flows) are prepared

- analyzing financial statements

`

`

~11.2 Accounting Equation~

- ASSETS = LIABILITIES + OWNER’S EQUITY

- Used to balance the data pertaining financial transactions

~Assets and Liabilities~

- Asset: economic resource that’s expected to benefit firm or individual who owns it

- Liability: debt that the firm owes to an outside party

~Owner’s Equity~

- Owner’s Equity: amount of money received from selling all assets and paying off liabilities

- ASSETS - LIABILITIES = OWNER’S EQUITY

- if company’s assets exceed its liabilities, then the owner’s equity is positive

- if company goes out of business, the owner’s will receive some cah after selling assets and paying off liabilities

- if company’s liabilities exceed its assets, owner’s equity is negative

- assets will not be enough to pay off debt

- Consists of two sources of capital:

- Amount owners originally invested

- profits earned by and reinvested in the company

- when company operates profitably, its assets increase faster than liabilities

- owner’s equity will increase if profits are retained in business instead of paid out as dividends to shareholders

- will increase if owners invest more of their own money to increase assets

~11.3 financial statements~

- if business purchases inventory with cash, then cash decreases but inventory increases

- if business purchases inventory on credit, then inventory increases and amounts payable

- since each transaction affects two accounts, DOUBLE ENTRY ACCOUNTING SYSTEMS are used to record the dual effects of financial transactions

- these transactions are reflected in three important FINANCIAL STATEMENTS

- balance sheets

- income statements

- statements of cash flows

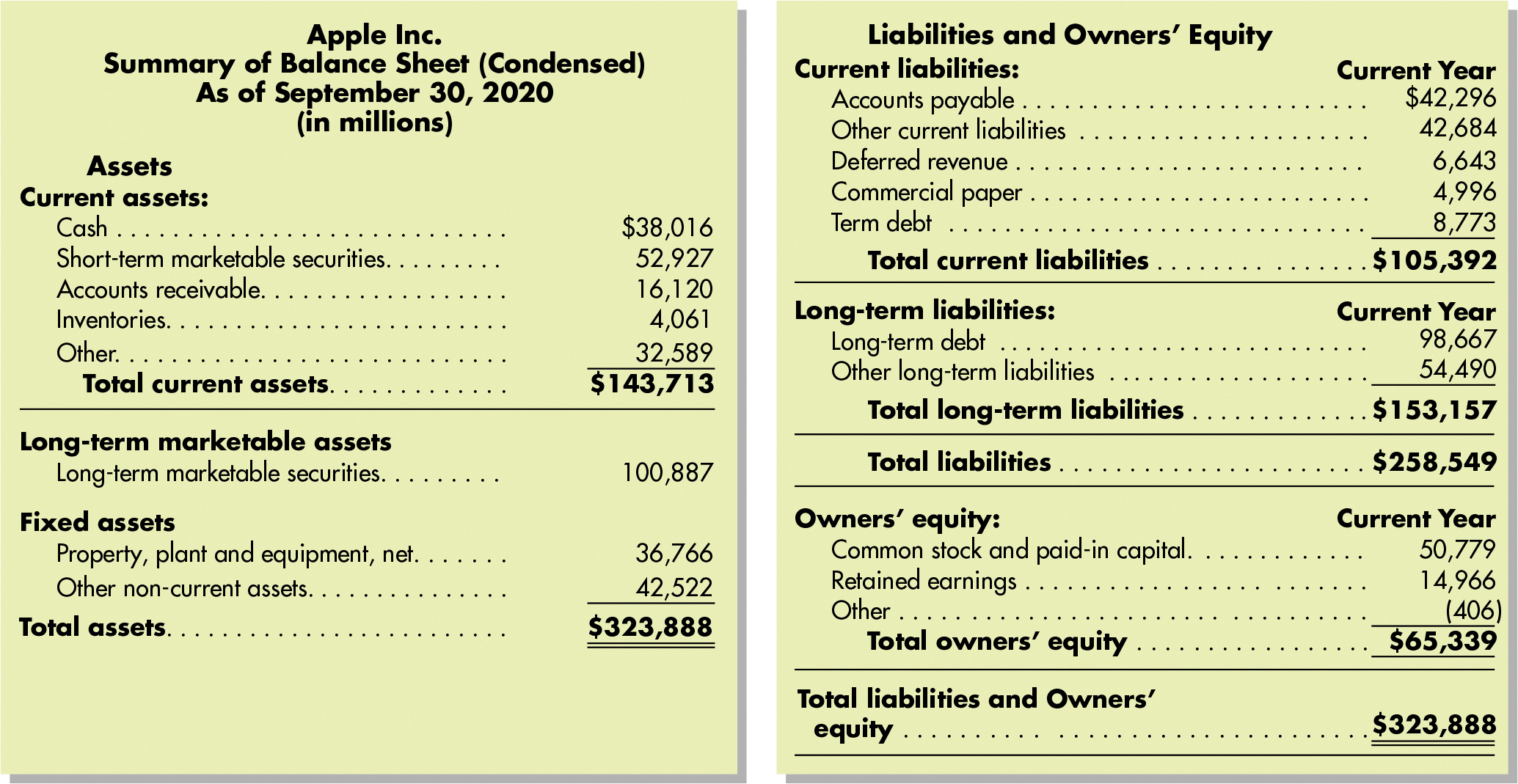

~Balance sheets~

- have detailed info about accounting equation factors: assets, liabilities, and owner’s equity

- shows financial condition at a specific point in time

~assets~

~assets~- three types of assets exist

- current

- fixed

- intangible

~Current assets~

- include cash, money in the bank, and assets that can be converted into cash within a year

- act of converting something into cash is called LIQUIDATING

- assets are listed in order of liquidity

- cash is completely liquid

- Marketable securities: purchased as short-term investments are slightly less liquid but can be sold quickly

- include stocks or bonds of other companies, government securities, and money market certificates

- Non-liquid assets

- Merchandise inventory: is a non-liquid asset, the cost of merchandise that’s been acquired for customers and is still on hand

- Prepaid expenses: supplies on hand and rent paid for the period to come

~Fixed Assets~

have long-term use or value to the firm (land, buildings, equipment)

as buildings/equipment become worn out, their value drops/depreciates

DEPRECIATION: determining an asset’s useful life in years, dividing its worth by that many years, and then subtracting the resulting amount each year

asset’s remaining value, therefore, decreases each year

~Intangible assets~

worth is hard to set, intangible assets have monetary value

usually include cost of obtaining rights or privileges like patents, trademarks, copyright, and franchise fees

GOODWILL: amount paid for an existing business beyond the value of its other assets

~Liabilities~

- CURRENT LIABILITIES: debts that MUST be paid within a year

- include accounts payable (unpaid bills/wages/taxes)

- LONG-TERM LIABILITIES: debts that are not due for at least one year

- represent borrowed funds on which company must pay interest

~Owners’ Equity~

- RETAINED EARNINGS: net profits minus dividend payments to shareholders

- accumulate when profits, which could have been distributed to shareholders, are kept instead for use by the company

~Income Statements~

- aka “profit-and-loss statement”

- REVENUES - EXPENSES = PROFIT/LOSS

- profit or loss (bottom line)

- shows financial results that occurred during a period of time (month, quarter, or year)

- Divided into 3 categories

- REVENUES

- funds that flow into a business from the sale of goods/sevices

- revenue recognition: recording + reporting of revenues in financial statements

- earnings are not reported until reporting cycle has completed

- matching principle: expenses matched with revenues to determine net income for an accounting period

- is important b/c it permits the user of the statement to see how much net gain resulted from assets that had to be given up to generate revenues during period covered in the statement

- COSTS OF GOODS SOLD

- shows the costs of obtaining materials to make products sold during the year

- Gross profit (gross margin): to calculate → subtract cost of goods sold from revenues

- for companies with low gross margins, it probably has low cost of goods sold but high selling and administrative expenses

- OPERATING EXPENSES

- resources that must flow out of a company for it to earn revenues

- **__selling expenses: __**salaries, delivery costs, + advertising expenses

- general/administrative expenses: management salaries, insurance expenses, + maintenance costs

- operating income: compares gross profit from business operations against operating expenses

- __net income: __subtracting income taxes from total operating income before taxes

~STATEMENTS OF CASH FLOWS~

describes a company’s yearly cash receipts and cash payments

- CASH FLOWS FROM OPERATIONS: concerned with firm’s main operating expenses like cash transactions involved in buying and selling goods/services

- reveals how much of year’s profits result from firm’s main line of business (sales of cars)

- CASH FLOWS FROM INVESTING: net cash used in/provided by investing

- cash receipts + payments from buying/selling stocks, bonds, property, equipment, other productive assets

- CASH FLOWS FROM FINANCING: net cash from all financing activites

- cash inflows from borrowing/issuing stock

- outflows for payment of dividends/repayment of borrowed money

~the budget: an internal financial statement~

- BUDGET: detailed report on estimated receipts and expenditures for a future period

~11.4 analyzing financial statements~

statements provide data which can be used to compute solvency, profitability, and activity ratios that are useful in analyzing financial health of a company

ratios are grouped into three major classifications:

- solvency ratios for estimating short-term/long-term risks

- profitability ratios for measuring potential earnings

- activity ratios for evaluating management’s use of assets

~SOLVENCY RATIOS: BORROWER’S ABILITY TO REPAY DEBT~

- measures firm’s ability to meet its debt obligations

~short term solvency ratios~

- measure a company’s liquidity and its ability to pay immediate debts

- current ratio: company’s ability to generate cash to meet obligations by selling inventories and collecting revenues from customers

- calculated by diving current assets by current liabilities

- the higher the ratio, the lower the risk it represents to investor

~long-term solvency~

- stakeholders are concerned with this

- calculated by dividing debt by owners equity

- if debt-to-equity is higher than 1.0, company may be really too much on debt

- sometimes high debt can not only be acceptable, but desirable

- borrowing funds gives firm leverage - ability to make otherwise unaffordable investments

- in leveraged buyouts, firms have sometimes taken on huge debt to get money to buy out other companies

- if owning purchased company generates profits above cost of borrowing purchase price, leveraging makes sense

~PROFITABILITY RATIOS: EARNINGS POWER FOR OWNERS~

- measures firm’s overall financial performance in terms of its likely profits, used by investors to assess their probable returns

~return on equity~

- net income earned by a business for each dollar invested

- calculate: divide net income with total owner’s equity

~return on sales~

- firms want to generate as much profit as they can from each dollar of sales revenue they receive

- calculate: net income divided by sales revenue

~earnings per share~

- calculate: net income divided by number of common shares outstanding

- influences the size of dividend a company can pay its shareholders

- investors use this to figure out whether or not to sell stock

~activity ratios: how efficiently is the firm using its resources~

- measures how efficiently a firm uses its resources; used by investors to assess their probably returns

- important activity ratio: inventory turnover ratio → calculates average number of times that inventory is sold and restocked during the year

- calculation: @@cost of goods sold divided by average inventory (beginning of year + end of year inventory / 2)@@

~11.5 accounting ethics~

- responsibilities as a professional

- serving the public interest

- maintaining integrity

- being objective and independent

- maintaining technical and ethical standards

- professional conduct in providing services