nature of economics

1.1.1 Economics as a Social Science Economists need to make assumptions. A key assumption that is made is assuming that events occur with ceteris paribus. This assumption is that other things are being held equal or constant, so nothing else changes. Economists cannot conduct scientific experiments, like in the natural sciences, so models are devised. Economists then use real-life scenarios to build these models upon, and assumptions are made with the models.

1.1.2 Positive and Normative Statements It is important to be able to distinguish between fact and fiction in current affairs. Positive statements are objective. They can be tested with factual evidence, and can consequently be rejected or accepted. Look for words such as ‘will’, ‘is’. For example, “Raising the tax on alcohol will lead to a fall in the demand of alcohol and a fall in the profits of pub landlords” is a positive statement. “Higher temperatures will lead to an increase in the demand for sun cream” is also a positive statement. The key thing here is that these statements can be tested, the results can be examined and the statement can then be rejected or accepted. Normative statements are based on value judgements. These are subjective and based on opinion rather than factual evidence. Look for words such as ‘should’, and if the statement is suggesting one action is more credible than another. For example, “The free market is the best way to allocate resources” is a normative statement, because it is based on opinion and suggests one method of resource allocation is better than another. “The government should increase the tax on alcohol” is another normative statement. Value judgements can influence economic decision making and policy. Different economists may make different judgements from the same statistic. For example, the rate of inflation can give rise to different conclusions

1.1.3 The Economic Problem The basic economic problem is scarcity. Wants are unlimited and resources are finite, so choices have to be made. Resources have to be used and distributed optimally. For example, if you only have £1 and you go to a shop, you can buy either the chocolate bar or the packet of crisps. The scarcity of the resource (the money) means a choice has to be made between the chocolate and the crisps. This gives rise to opportunity cost. The opportunity cost of a choice is the value of the next best alternative forgone. In the above example, the opportunity cost of choosing the crisps is the chocolate bar. If a car was bought for £15,000 and after 5 years the value depreciates by £5,000, the opportunity cost of keeping the car is £5,000 (which could have been gained by selling the car), regardless of the starting price. Opportunity cost is important to economic agents, such as consumers, producers and governments. For example, producers might have to choose between hiring extra staff and investing in a new machine. The government might have to choose between spending more on the NHS and spending more on education. They cannot do both because of finite resources, so a choice has to be made for where resources are best spent. The factors of production land, labour, capital and enterprise These factors of production are inputs, and they produce outputs in the form of goods and services. This forms the economy. Renewable and non-renewable resources: Renewable resources can be replenished, so the stock level of the resources can be maintained over a period of time. For example, commodities such as oxygen, fish, or solar power are renewable assuming the rate of consumption of the resource is less than the rate of replenishment. If the resource is consumed faster than it is renewed, the stock of the resource will decline over time. This is important in environmental economics, and can be managed by preventing or limiting deforestation, or imposing fishing quotas. Renewable resources are sustainable. However, currently, resources are being consumed faster than the planet can replace them. The Worldwide Fund for Nature claims that two planets will be required to meet global demand by 2050 if this continues. Non-renewable resources cannot be renewed. For example, things produced from fossil fuels such as coal, oil and natural gas are non-renewable. The stock level decreases over time as it is consumed. Methods such as recycling and finding substitutes, such as wind farms, can reduce the rate of decline of the resource.

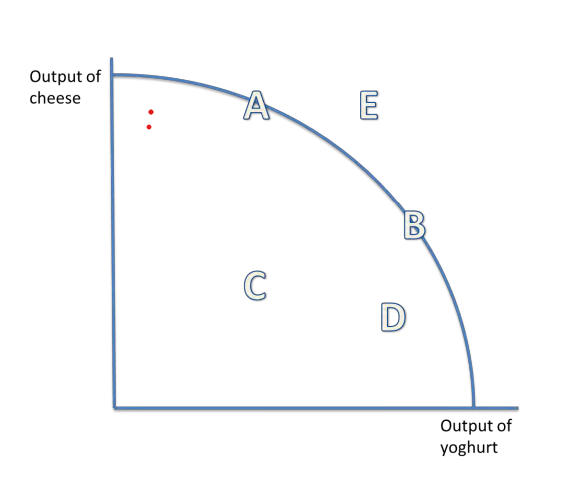

1.1.4 PPF Production possibility frontiers (PPFs) depict the maximum productive potential of an economy, using a combination of two goods or services, when resources are fully and efficiently employed. PPF curves can show the opportunity cost of using the scarce resources. For example, if the scare resource is milk, there is a trade-off between producing more cheese or more yoghurt from the milk. The PPF can show this:

The PPF can also depict economic growth or decline. Only production under and on the PPF is attainable. Production outside of the PPF is not obtainable. However, only production on the PPF uses resources efficiently (A and B). It is inefficient to produce below the PPF (point C).

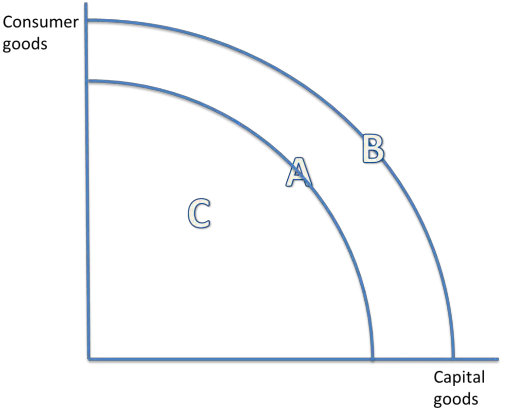

Economic growth can be shown by an outward shift in the PPF, from the curve with point A on it, to the curve with point B on it. A decline in the economy would be depicted by an inward shift. The original curve is drawn assuming:

A fixed amount of resources are used

There is a constant state of technology

An increase in the quantity or quality of resources shifts the PPF curve outwards, so the productive potential of the economy increases, and there is economic growth. This can be achieved with the use of supply side policies. A PPF curve may shift inwards as a result of a decrease in the quality or quantity of resources in an economy. A country may see their PPF curve shift inwards if they are affected by natural disasters, such as flooding, or if there is brain drain. Moving along the PPF is different to shifting the PPF. Moving along the PPF uses the same number and state of resources, and shifts production from fewer consumer goods to more capital goods, for instance. This incurs an opportunity cost. Shifting the PPF curve outwards, for example, uses either more resources or resources of a greater quality. This reduces the opportunity cost of producing either capital or consumer goods, since more goods can be produced overall. Capital goods are goods which can be used to produce other goods, such as machinery. Consumer goods are goods which cannot be used to produce other goods, such as clothing

1.1.5 Specialisation and the Division of Labour

Specialisation occurs when each worker is completes a specific task in a production process. The concept was famously stated by Adam Smith, who showed how, through the division of labour, worker productivity can increase. Firms can then take advantage of increased efficiency and lower average costs of production.

Advantages:

Higher output and potentially higher quality, since production focusses on what people and businesses are best at.

There could be a greater variety of goods and services produced.

There are more opportunities for economies of scale, so the size of the market increases.

There is more competition and this gives an incentive for firms to lower their costs, which helps to keep prices down.

disadvantages:

Work becomes repetitive, which could lower the motivation of workers, potentially affecting quality and productivity. Workers could become dissatisfied.

There could be more structural unemployment, since skills might not be transferable, especially because workers have focussed on one task for so long.

By producing a lot of one type of good through specialisation, variety could in fact decrease for consumers.

There could be higher worker turnover for firms, which means employees become dissatisfied with their jobs and leave regularly

The functions of money:

A medium of exchange: without money, transactions were conducted through bartering. Goods and services were traded with other goods and services, but people did not always get exactly what they wanted or needed. The goods and services exchanged were not always of the same value, which also posed a problem. Exchange could only take place if there was a double coincidence of wants, i.e. both parties have to want the good the other party offer. Using money eliminates this problem.

A measure of value (unit of account): Money provides a means to measure the relative values of different goods and services. For example, a piece of jewellery might be considered more valuable than a table because of the relative price, measured by money. Money also puts a value on labour.

A store of value: Money has to hold its value to be used for payment. It can be kept for a long time without expiring. However, the quantity of goods and services that can be bought with money fluctuates slightly with the forces of supply and demand.

A method of deferred payment: Money can allow for debts to be created. People can therefore pay for things without having money in the present, and can pay for it later. This relies on money storing its value.

Free Market Economies, Mixed Economy and Command Economy

Free market economies: Also known as laissez-faire economies, where governments leave markets to their own devices, so the market forces of supply and demand allocate scarce resources.

Economic decisions are taken by private individuals and firms, and private individuals own everything. There is no government intervention

In reality, governments usually intervene by implementing laws and public services, such as property rights and national defence.

Adam Smith and Friedrich Hayek were famous free market economists. Adam Smith’s famous theory of the invisible hand of the market can be applied to free market economies and the price mechanism, which describes how prices are determined by the ‘spending votes’ of consumers and businesses. Smith recognised some of the issues with monopoly power that could arise from a free market, however. Hayek argued that government intervention makes the market worse. For example, shortly after the 1930s crash, he argued that the Fed caused the crash by keeping interest rates low, and encouraging investments which were not economically worthwhile: ‘malinvestments’.

What to produce: determined by what the consumer prefers o How to produce it: producers seek profits

For whom to produce it: whoever has the greatest purchasing power in the economy, and is therefore able to buy the good

Advantages:

Firms are likely to be efficient because they have to provide goods and services demanded by consumers. They are also likely to lower their average costs and make better use of scarce resources. Therefore, overall output of the economy increases.

The bureaucracy from government intervention is avoided

. Some economists might argue the freedom gained from having a free economy leads to more personal freedom

Disadvantages:

The free market ignores inequality, and tends to benefit those who hold most of the wealth. There are no social security payments for those on low incomes.

There could be monopolies, which could exploit the market by charging higher prices.

There could be the overconsumption of demerit goods, which have large negative externalities, such as tobacco

Public goods are not provided in a free market, such as national defence. Merit goods, such as education, are underprovided.

Command economy:

This is where the government allocates all of the scarce resources in an economy to where they think there is a greater need. It is also referred to as central planning.

Karl Marx saw the free market as unstable. He saw profits created in the free market as coming from the exploitation of labour, and by not paying workers to cover the value of their work. He argued for the “common ownership of the means of production”.

What to produce: determined by what the government prefers

How to produce it: governments and their employees

For whom to produce it: who the government prefers

Advantages:

It might be easier to coordinate resources in times of crises, such as wars.

The government can compensate for market failure, by reallocating resources. They might ensure everyone can access basic necessities.

Inequality in society could be reduced, and society might maximise welfare rather than profit.

The abuse of monopoly power could be prevented.

Disadvantages:

Governments fail, as do markets, and they may not be fully informed for what to produce.

They may not necessarily meet consumer preferences.

It limits democracy and personal freedom.

Mixed economy:

This has features of both command and free economies and is the most common economic system today. There are different balances between command and free economies in reality, though. The UK is generally considered quite central, whilst the US is slightly more free (although the government spends around 35% of GDP) and Cuba is more centrally planned.

The market is controlled by both the government and the forces of supply and demand.

Governments often provide public goods such as street lights, roads and the police, and merit goods, such as healthcare and education.

What to produce: determined by both consumer and government preferences

How to produce it: determined by producers making profits and the government

For whom to produce it: both who the government prefers and the purchasing power of private individuals.

Knowt

Knowt