Ch 17 - Monetary Policy

(Macroeconomics)

@@Monetary Policy@@

- ^^Monetary Policy:^^ are changes in the money supply to fight recessions or inflations. The Fed’s goals for monetary policy: 1) maximise employment and 2) keep the price level steady and 3) promote economic growth

- If the economy is mired in recession, the money supply should be increased.

@@Monetary Policy in Theory@@

An increase in the money supply promotes maximum employment and can remedy a recession. The main idea is:

- ↑Money supply → ↓ interest rates → ↑borrowing & spending → ↑ Aggregate Demand

^^Expansionary Monetary policy^^: is increasing the money supply to promote maximum employment and remedy a recession

- During inflationary times, a decrease in the money supply is warranted. This increases nominal interest rates and borrowing costs. As borrowing and spending decreases, there is a decreases in aggregate demand.

^^Contractionary Monetary policy:^^ is decreasing the money supply to lower the price level and remedy inflation

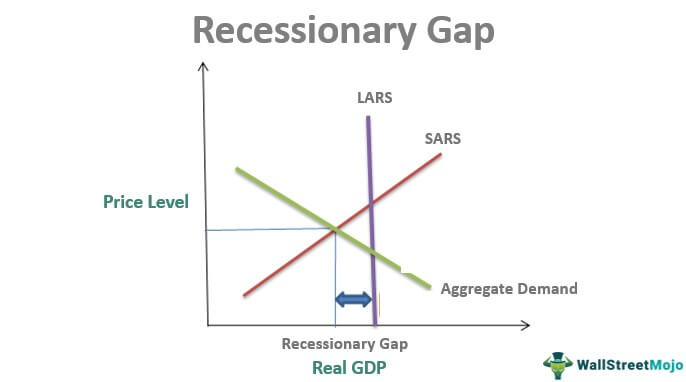

^^A recessionary gap^^ occurs when a country’s real GDP is lower than its GDP at full employment, which is the distance between LRAS and price level.

- In economic terms, we can say that the economy is producing inside its production possibilities frontier. In the short run equilibrium, the economy will adjust so that all three curves cross in the long run.

- The recession leaves many resources, including some labour, to be idle

In the long run, the price level falls and the recession is over with an increase in output. It could take time for resource prices and wages to fall, while minimum wage laws and government price supports for some resources that prohibit wages and resource prices from falling.

- Expansionary monetary policy can be applied during a recession rather than waiting for wages and input prices to fall in the long run. The Fed increases the money supply, which lowers interest rates. When there is more money in circulation, it can be borrowed at a lower rate.

- Lower interest rates stimulate borrowing and spending, this causes shifts in the AD to the right.

When Expansionary monetary policy aims to close the recessionary gap, the prices will increase along the price level, while incomes increase proportionally in the long run. The rise in the price level implies some amount of inflation in the short run and inflation has its costs.

- Expansionary monetary policy promotes full employment during a recession but causes inflation

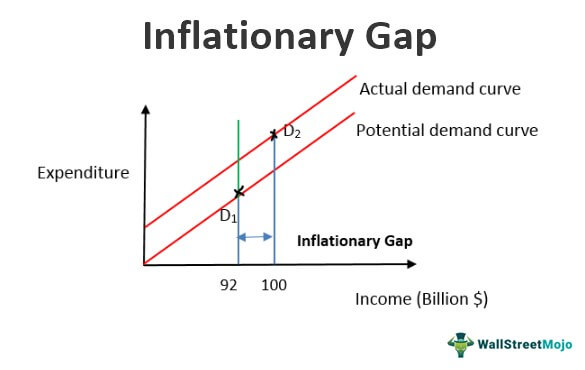

^^Inflationary gap:^^ Is the difference between the current real GDP and the GDP of an economy operating at full employment. The current real GDP must be higher than the potential GDP for the gap to be considered inflationary.

- In economic terms, the economy is producing outside its production possibilities frontier.

The short run equilibrium and the economy will adjust so that all three curves cross in the long run. High production level strains resources. So, labor works overtime and resources deplete at a rapid rate. Workers and resource owners demand higher wages and prices which induces firms to lower production, and shifts SRAS to the left.

- In the long run adjustment to the inflationary gap results in price levels increasing in inflation and the Fed has a mandate to fight price stability. The fed decreases money supply, which raises interest rates. The higher rates discourage borrowers and spending. This results in AD shifting to the left.

The contractionary Monetary policy ends up closing inflationary gap

@@Monetary Policy in Practice@@

- In real life, the recessionary and inflationary gaps need to be detected, then, the exact amount of the increase or decrease in the money supply must be determined.

- Once this gap is detected, the Fed determines the exact amount of money supply which should be changed by focusing on interest rates. The money supply will affect the macroeconomy through interest rates.

- In order to stimulate the economy, the Fed would increase the money supply (through open markets) to lower the federal funds rate to the desired level. This help to determine how much the money supply should be changed to close the recessionary or inflationary gap.

- ^^Federal Funds Rate:^^ the interest rate on short-term loans between depository institutions

- ^^Liquidity Trap:^^ When interest rates are near zero

@@The Phillips Curve@@

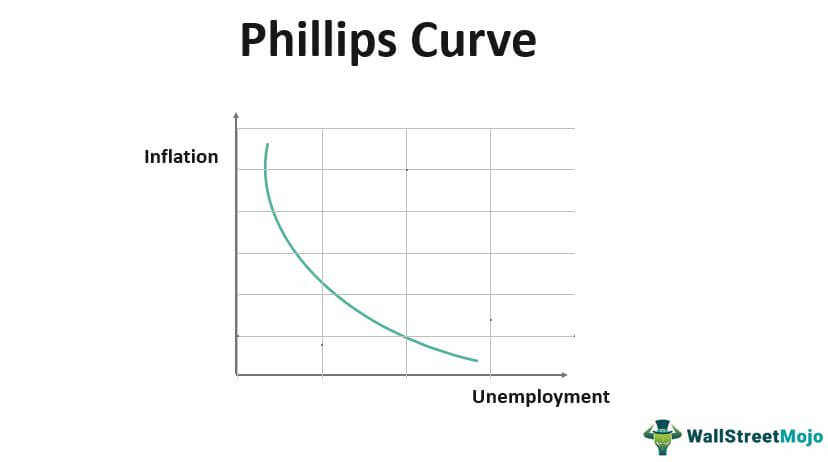

Contractionary monetary policy will fight the inflation caused by expansionary monetary policy, which causes real GDP to decrease and that means more unemployment.

^^The phillips curve^^ states that inflation and unemployment will have an inverse relationship. This is also known as the phillips tradeoff.

When aggregate demand shifts to the left, it results in the price level falling (lower inflation) and the quantity of output falling (higher unemployment).

When aggregate demand shifts to the right, inflation rises and unemployment decreases.

- When the short run aggregate supply curve shifts, the entire phillips curve shifts in the opposite direction

The Phillips tradeoff only holds in the short run. The short-run aggregate supply curve must remain stable or the tradeoff breaks down.

Important points:

- If aggregate demand shifts to the right, the economy slides up the phillips curve

- If aggregate demand shifts to the left, the economy slides down the phillips curve

- If either aggregate supply curve shifts to the left, the phillips curve shifts to the right

- If either aggregate supply curve shifts to the right, the phillips curve shifts to the left

- The long-run phillips curve is a vertical line