Chapter 6: Demand, Supply, Market Equilibrium, and Welfare Analysis

Demand

- Simple concept- people purchase less when prices are high and vice versa

Law of Demand

- Ceteris paribus means holding everything else constant

- There is an inverse relationship between quantity demanded and prices

| ]]Price per cup($)]] | ]]Quantity Demanded]] |

|---|---|

| .25 | 120 |

| .50 | 100 |

| .75 | 80 |

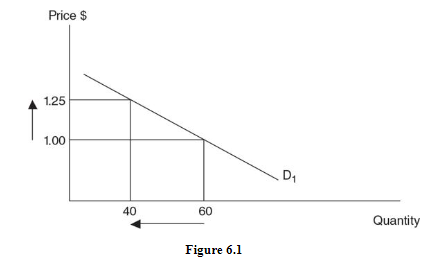

| 1.00 | 60 |

| 1.25 | 40 |

- For simplification of the demand model, we assume all other things as constant

Reasons for the Law of Demand (why people buy less when price increases)

Income effect: when prices are low, people are easily able to afford it since their budget would allow it

- Imagine having a budget of $10, and you are able to buy a limited quantity of apples

- Now if your income increases, your budget increases by more than 10, which allows you to buy more of the apples

Substitution effect: when products price increase, they tend to increase in relative to other products

- 2 products exist in the market A and B, where B is a substitute product for A

- If product A were to become expensive, product B would most likely be cheaper than A

- Due to the existence of substitutes, customers immediately leave product A for B

Diminishing marginal utility: As more units of a product are consumed, the satisfaction/utility it provides tends to decline

- Apple users would purchase at maximum, a limited phones-they wouldn’t purchase a new iPhone every month since that extra phone would offer them no utility or not as much

Quantity Demanded vs. Change in Demand

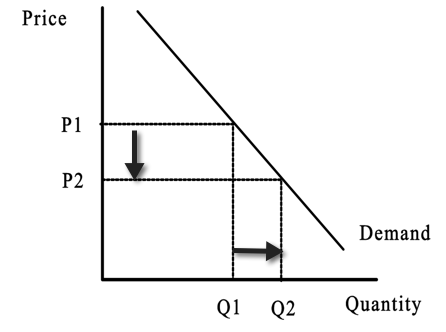

Change is the quantity demanded only occurs due to change in price of a product

If product X would become expensive (1.00 to 1.25), the quantity demanded would fall (60 to 40)

Change in demand occurs when the entire demand curve shifts upwards or downwards due to specific factors

Change in demand occurs irrespective of price changes of the product

Determinants of Demand

- Consumer income

- Price of substitutes

- The price of a complementary good

- Consumer tastes and preferences

- Consumer expectations about future prices

- Number of buyers in the market

1. Consumer income

- Goods are usually categorized into 2 types, inferior and normal

- Demand tends to decline (shift downwards) for inferior goods with an increase in consumer income

- Demand for normal goods increases (shifts upwards) with an increase in consumer income

- A good example of this would be how college students purchase used furniture (higher demand) at the beginning of their semesters

- The same students however go for the purchase of new furniture once they graduate/ or are employed

2. Price of substitute goods

Substitutes goods are products that a consumer can use as alternates to satisfy the same essential function, yielding the same degree of happiness (utility)

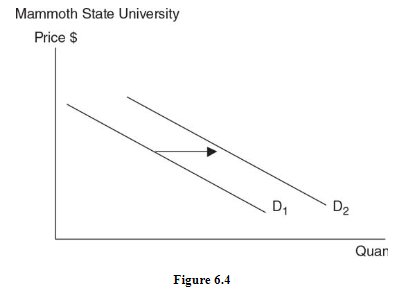

2 goods would be considered substitutes if an increase in the price of one good causes an increase in demand for the other good

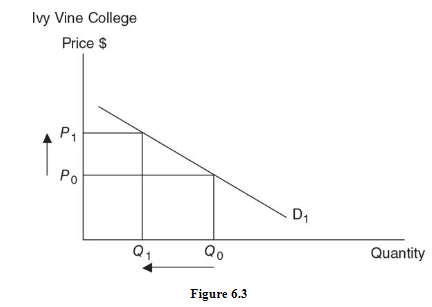

Assuming 2 institutes only exist in the market: Mammoth State University (MSU) and Ivy Vine College (IVC)

In an effort to generate more revenue, IVC raises fee per student which in turn leads to counter effects (see below)

Automatically, IVC faces a decline in demand while MSU faces increase in demand

3. Price of Complementary Goods

- Complementary goods are those which are purchased separately but used together

- The consumer receives more utility from consuming them together than consuming each separately

- The relation here is inverse of that of substitute goods

- If 2 products are complements, an increase in the price of one good causes demand for the other good to decline as well

- A good example would be of tortilla chips and the nacho sauce

- Both products are purchased together, and not individually

4. Tastes and Preferences

- This is the consumer’s taste for a product at any point

- If consumers like a product, the demand curve for that product shifts upwards and vice versa if they dislike it

- A good example is when the trend of vegetarianism hit the public, the consumption of plant-based food drastically increased

5. Future Expectations

- Consumer expectation plays a major role in the determination of the price

- if consumers expect that the price of something would increase in the future, they would buy the product at a larger scale leading to the demand curve shifting upwards

- A good example would be when consumers assume that gasoline prices may raise tomorrow by a certain percentage

- This would result in them filling up more gasoline in the day prior to overcome future trouble

- Demand can also be influenced by future expectations of income changes

6. Number of Buyers

- Increase in the number of buyers leads to an increase in demand (keeping everything else constant)

- This is usually due to demographic changes or increasing availability in more markets

- A good example would be after the abolishment of communism in USSR, many US based companies entered into Russia with their products, hence a new market with new consumer base

Supply

- The market supply shows the quantity a supplier is willing and able to offer at various prices at a given time

Law of Supply

- Law of supply states that when prices increase, the supply increases (while holding everything else constant)

- This proves a direct relationship between price and supply

Behind the scenes of the law of supply

Increasing Marginal Costs

- As suppliers increase the number of units supplied, they face increasing marginal cost

- In conclusion, they would only supply up to the quantity which allows them to at least cover their high marginal cost

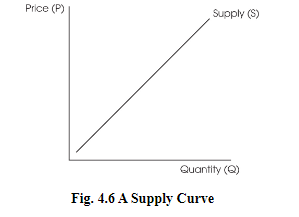

The Supply Curve

- The table above is sometime referred to as supply schedule

| ]]Price per cup ($)]] | ]]Quantity supplied]] |

|---|---|

| .25 | 40 |

| .50 | 60 |

| .75 | 80 |

| 1.00 | 100 |

| 1.25 | 120 |

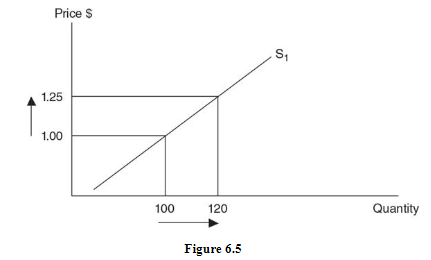

Quantity Supplied Versus Supply

- Change is the quantity supplied only occurs due to a change in the price of a product, holding all other factors constant

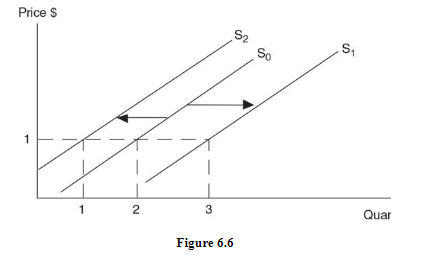

- Change in supply occurs when the entire supply curve shifts upwards or downwards due to specific factors

- Increase in supply is viewed as a rightward shift in the supply curve and vice versa

- Change in supply occurs irrespective of price changes of the product

Determinants of Supply

- The cost of an input to be used in the production

- Technology and productivity used to produce

- Taxes or subsidies

- Producer expectations about future prices

- The price of other goods that could be produced

- The number of producers in the industry

1. Cost of Inputs

The cost of production (land, labor, capital) has an inverse impact on the supply

When the cost of these increases, the supplier decides to produce less of the products since he is unable to afford the production cost

2. Technology or Productivity

- Newer technology causes the cost of production (reduces the marginal cost) to decline and helps improve the efficiency of the supplier

- This allows the supplier to produce more, shifting the supply curve outwards(towards the right)

- Flow production techniques, where similar products are produced in one go are preferred by suppliers as the marginal cost is reduced and supply can be increased

3. Taxes and Subsidies

- Taxes are added up to the unit cost of production, thus making it more expensive

- Due to this, heavily taxed products are produced in less quantity by suppliers(supply curve shifts towards the left)

- Subsidies are the opposite of taxes and help reduce price per unit

- This allows suppliers to produce more of the product(supply curve shifts towards right)

4. Price Expectations

- Producers’ willingness to supply depends greatly on future prices as well

- If a juice producer assumes that heat waves tomorrow would reduce the number of people coming out of their houses, he would hold back some of his supply

- If the same producer is aware that a marathon would be taking place on a particular date, he would supply more on that particular day at an inflated price

5. Price of Other Outputs

- Suppliers can use the same resources for production of 2 goods

- If the demand for let’s say milkshake rises, the supplier would reduce his supply of ice cream and shift towards selling more of milkshake

6. Number of Suppliers

- As the number of sellers increases in the market, the supply automatically increases

- This allows consumers more choices at a lower price due to an increase in competition

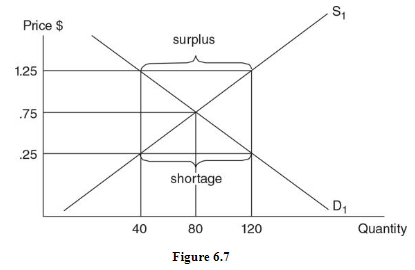

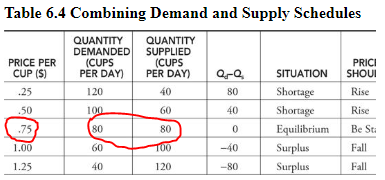

Market Equilibrium

- Consumers prefer lower prices whereas suppliers prefer higher prices

- Market is in a state of equilibrium when the quantity supplied equals the quantity demanded at a given price

- It is where the price expected by consumers is equal to the price required by suppliers

| Price per cup ($) | Quantity demanded | Quantity supplied | Qd-Qs | Situation | Price should |

|---|---|---|---|---|---|

| .25 | 120 | 40 | 80 | Shortage | rise |

| .50 | 100 | 60 | 40 | shortage | rise |

| {{.75{{ | {{80{{ | {{80{{ | 0 | equilibrim | Same |

| 1.00 | 60 | 100 | -40 | surplus | fall |

| 1.25 | 40 | 120 | -80 | surplus | fall |

Shortage

- A shortage exists at a market price when the quantity demanded exceeds the quantity supplied

- At prices of 25 cents and 50 cents per cup, you can see the shortage in the figure above

- Suppliers don’t prefer lower prices and therefore decrease their quantity supplied.

- At prices below 75 cents per cup, lemonade buyers and sellers are in a state of disequilibrium

- With a shortage in the market, consumers become willing to pay slightly more which in turn allows suppliers to produce more

- Hence the shortage is eliminated at a price of 75 cents per cup

Surplus

- A surplus exists at a market price when the quantity supplied exceeds the quantity demanded

- At prices of $1 and $1.25 per cup, you can see the surplus in the figure above

- Consumers don’t wish to purchase more lemonade but suppliers are willing to supply more

- Hence the market is in disequilibrium state

- To overcome this, suppliers begin offering discounted prices which helps them overcome the problem

- Hence the surplus would be eliminated at a price of 75 cents per cup

- {{Note: Shortages and surpluses are relatively short-lived in a free market as prices rise or fall until the quantity demanded again equals the quantity supplied{{

Changes in Demand

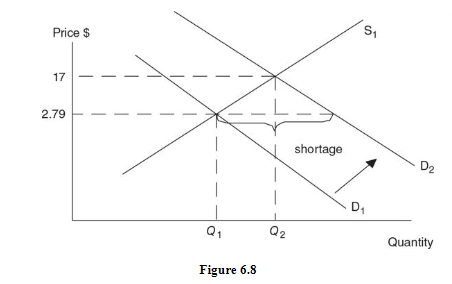

Increase in Demand

- As demand increases from D1 to D2 but supply stays constant, a shortage is created in the market

- Take an example the government suddenly announces that gasoline prices would drop greatly

- This would result in huge influx of demand, giving limited time for suppliers to cope with

- This creates shortage in the market with high gasoline demand but not enough supplied

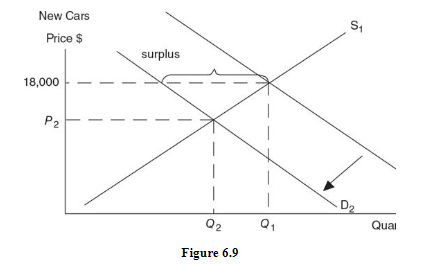

Decrease in Demand

- As demand decreases from D1 to D2 but supply stays constant, a surplus is created in the market

- Take an example that fruit prices hike up greatly in an economy

- This would drop the quantity demanded for the fruits greatly, rendering most of the fruit stored to be useless

- This creates excess in the market with great quantity of fruits supplied but not enough demand

- When demand increases, equilibrium price and quantity both increase

- When demand decreases, equilibrium price and quantity both decrease

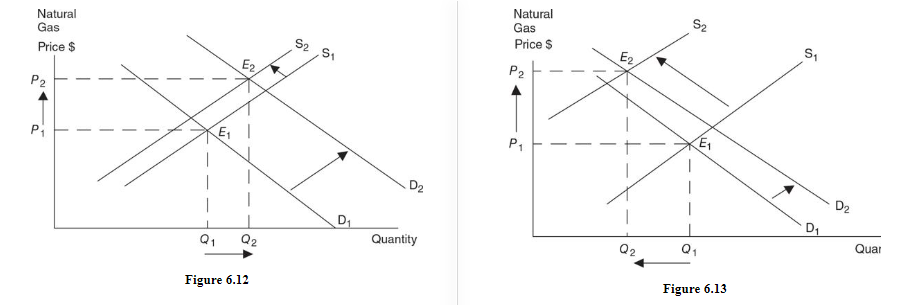

Changes in Supply

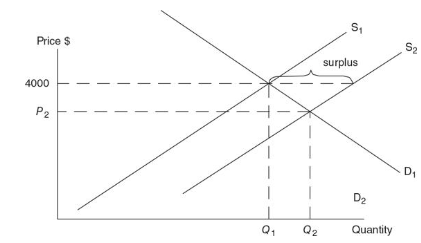

Increase in Supply

Advancements in computer technology and production methods increases supply greatly

At equilibrium price of $4,000, there is now a surplus

To eliminate the surplus, the market price must fall to P2 and the equilibrium quantity must rise to Q2

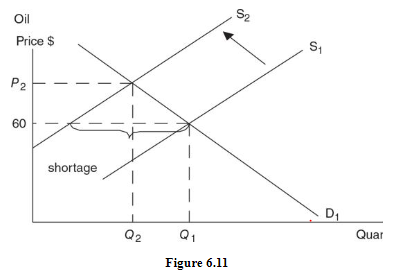

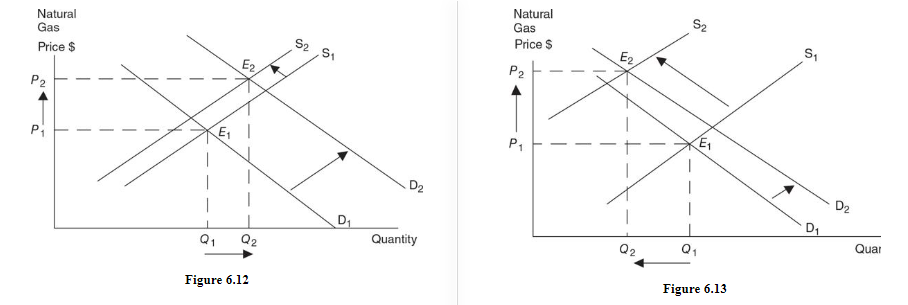

Decrease in Supply

- Assume a decrease in the global supply of oil

- At equilibrium price of $60 per barrel, there is now a shortage of crude oil

- The market eliminates this shortage through higher prices temporarily and the equilibrium quantity of crude oil falls

- When supply increases, equilibrium price decreases and quantity increases

- When supply decreases, equilibrium price increases and quantity decreases

Simultaneous changes in Demand and Supply

When both demand and supply are changing, one of the equilibrium outcomes (price or quantity) is predictable and one is unpredictable

Before combining the two shifting curves, predict changes in price and quantity for each shift, by itself

The variable that is rising in one case and falling in the other case is your ambiguous prediction

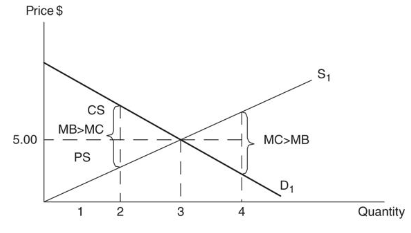

Welfare Analysis

- Total Welfare

- Total welfare= consumer surplus + producer surplus

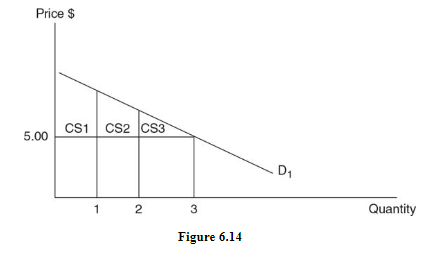

- Consumer Surplus

consumer surplus, the difference between the price consumers are willing to pay and the price you actually pay for a product

At a price of $5, three units of the good are purchased.

First 2 units receive consumer surplus as the price being willingly paid for exceeds $5.

The third unit pays a price exactly equal to his willingness to pay so he earns no consumer surplus.

Total consumer surplus is the total amount earned by these three consumer together

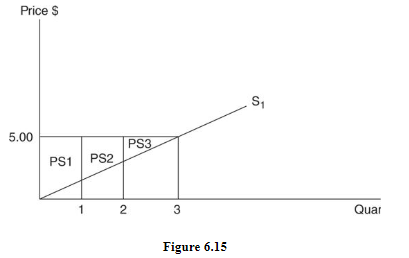

Producer Surplus

It is the difference between the price received and the marginal cost of producing the good

The first two units earn producer surplus because $5 is above the marginal cost

The third unit earns no additional producer surplus, since the marginal cost is exactly equal to the price received by supplier

Total producer surplus is the total amount earned by these three producers.

The area under the demand curve and above the market price is equal to total consumer surplus

The area above the supply curve and below the market price is equal to total producer surplus

Welfare would be maximized at equilibrium level

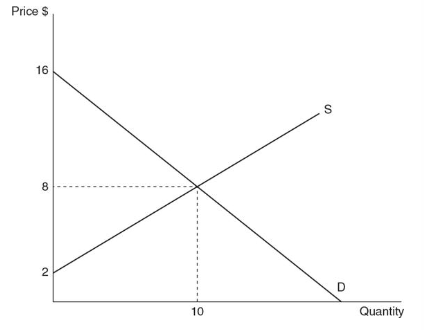

Use area of triangle (1/2 x base x height) to calculate producer and consumer surplus

- Consumer surplus: ½ x 10 units wide x 8 units long = $40 surplus

- Producer surplus: ½ x 10 units wide x 6 units long = $30 surplus