tutorial 1 - cash management

key information:

company - barrow plc.

objective - improve cash management strategy

annual cash requirement [to pay obligations] - £15,000,000

fixed transaction cost per cash raise - £700

opportunity cost of holding cash - 10% per annum

preferred buffer cash balance - £10,000

daily variance of cash balance - £9,000,000

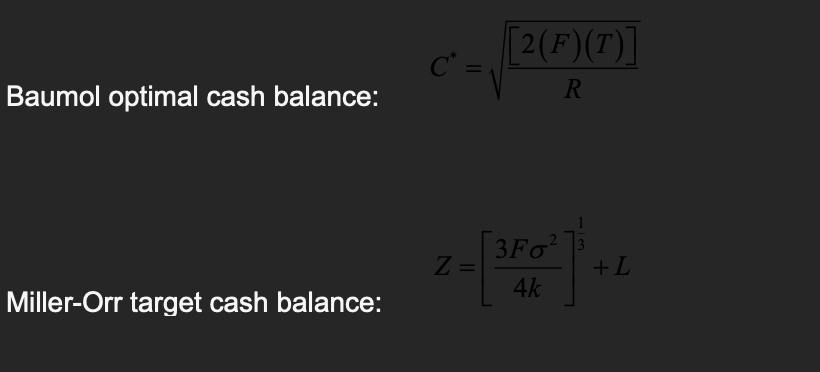

formula sheet:

a. applying the Baumol model to manage cash balances

the Baumol model is similar to the economic order quantity [EOQ] model but applied to cash management. it helps determine how much cash a company should withdraw at a time to minimise transaction and opportunity costs

given data:

total cash requirement per yr [T] = 15,000,000

fixed cost per transaction [F] = 700

opportunity cost per rate [R] = 10%

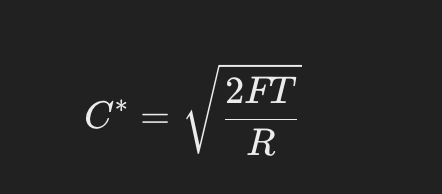

formula for optimal order quantity [i.e. the amount of cash withdrawn each time]:

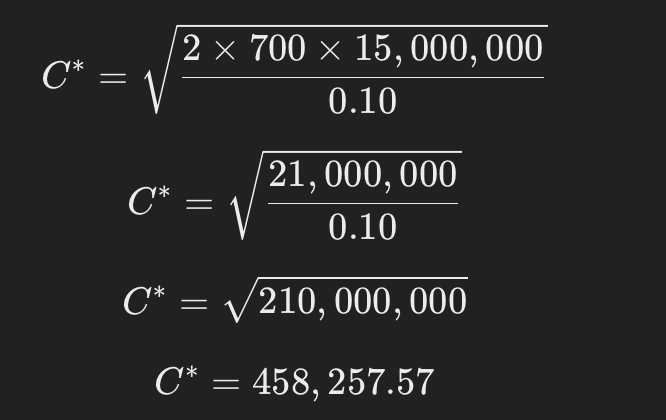

a. i. compute optimal order quantity

substituting the given values:

this means barrow plc. should withdraw £458,257.57 each time they need cash

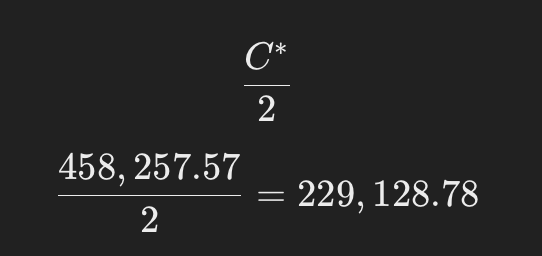

a. ii. compute the average cash balance

since cash is withdrawn in fixed amounts and spent over time, the average cash balance is simply:

so, the company will, on average, hold £229,128.78 in cash

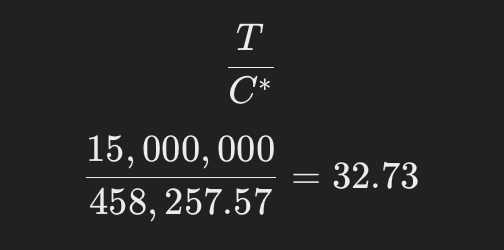

a. iii. compute the no. of transaction per yr

the no. of times the company needs to withdraw cash annually is:

this means barrow plc. will need to withdraw cash about 33 times a yr

a. iv. compute the trading costs and opportunity costs

total trading costs:

= fixed cost per transaction x no. of transactions

= 700 × 32.73 = 22,912.88

total opportunity costs:

= average cash balance x opportunity cost rate

= 229,128.78 × 0.10 = 22,912.88

total cost:

= trading costs + opportunity costs

= 22,912.88 + 22,912.88 = 45,825.76

so, the total cost of managing cash using the baumol model is £45,825.76 per yr

b. applying the Miller-Orr model

the miller-orr model is useful when cash inflows and outflows are uncertain. it sets upper and lower limits for cash balances and determines a target balance

given data:

lower limit [L] = 10,000

fixed cost per transaction [F] = 700

opportunity cost rate [R] = 10%

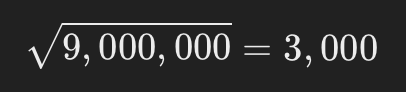

variance of daily cash flows = 9,000,000

so, standard deviation of daily cash flows:

constant K for miller-orr formula:

[1 + K]^365 = 1 + R

as R = 10%, when rearranged, K = 0.000261

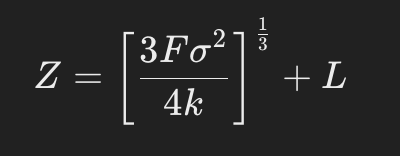

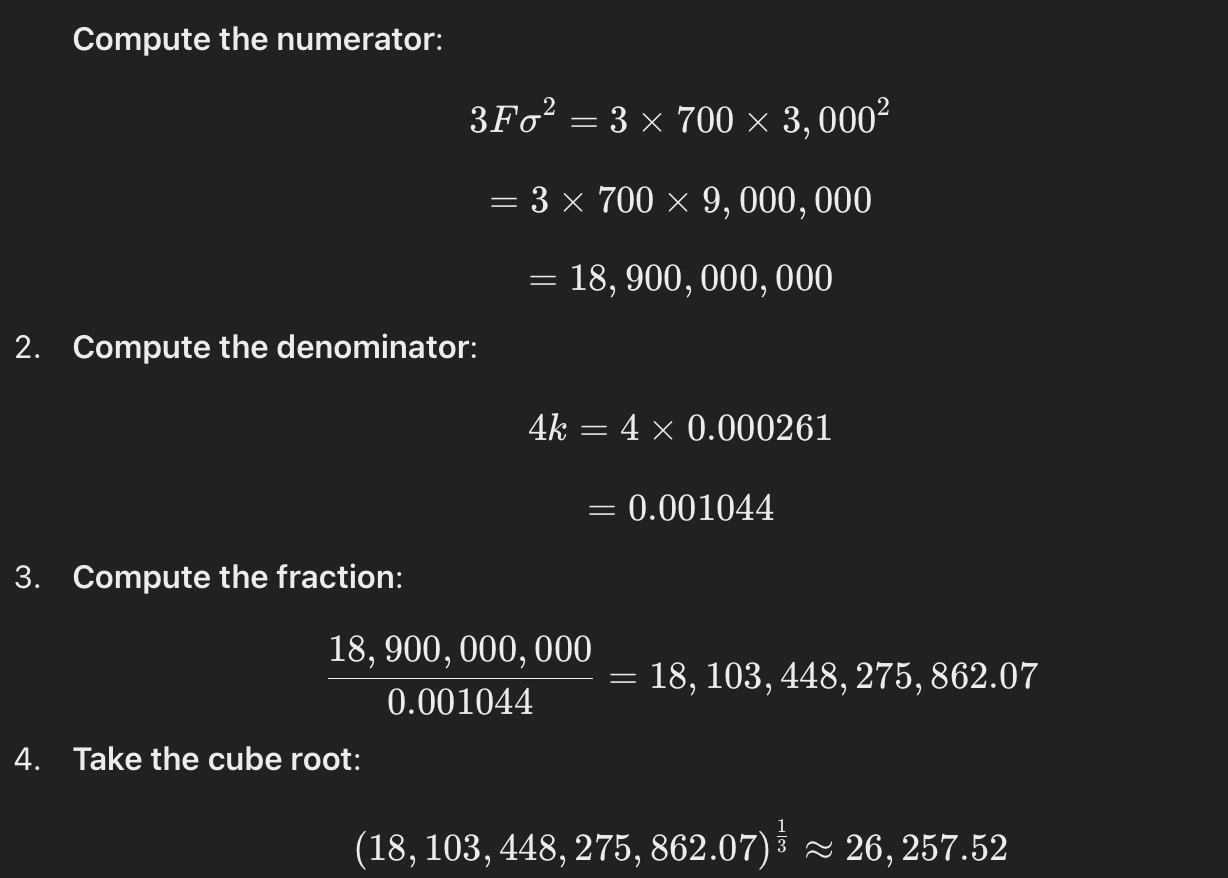

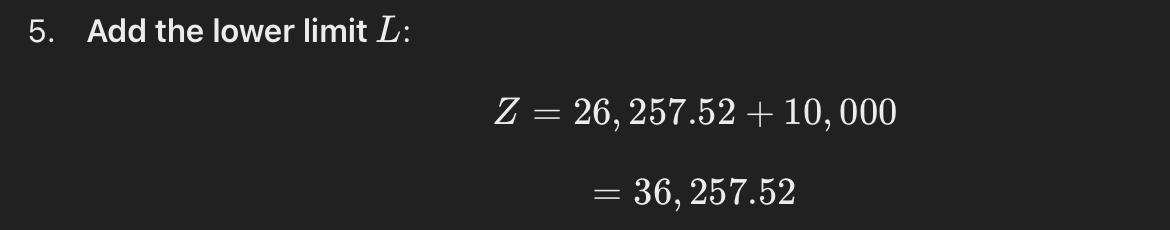

b. i. compute target cash balance

the miller-orr target cash balance formula:

substituting the values:

so the target cash balance is £36,257.23

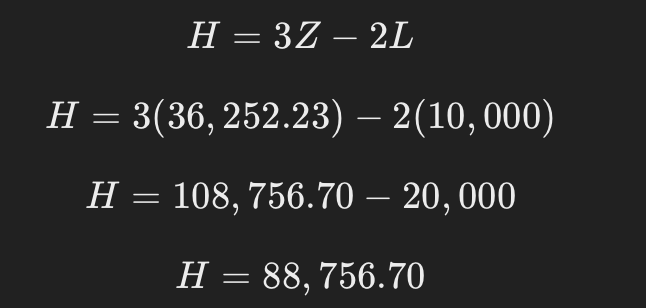

b. ii. compute the upper limit

the upper limit is given by:

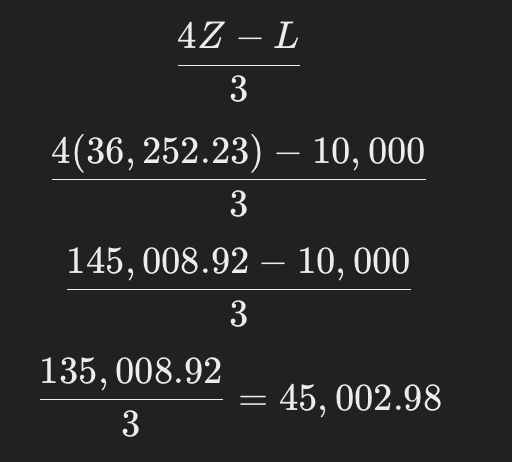

b. iii. compute the average cash balance

the miller-orr average cash balance is:

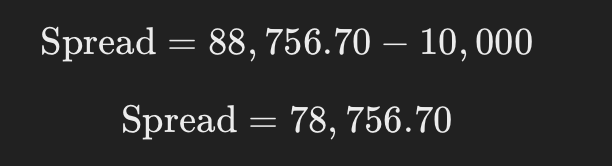

b. iv. compute the spread

the spread in the miller-orr model is the difference between the upper limit and the lower limit, which is:

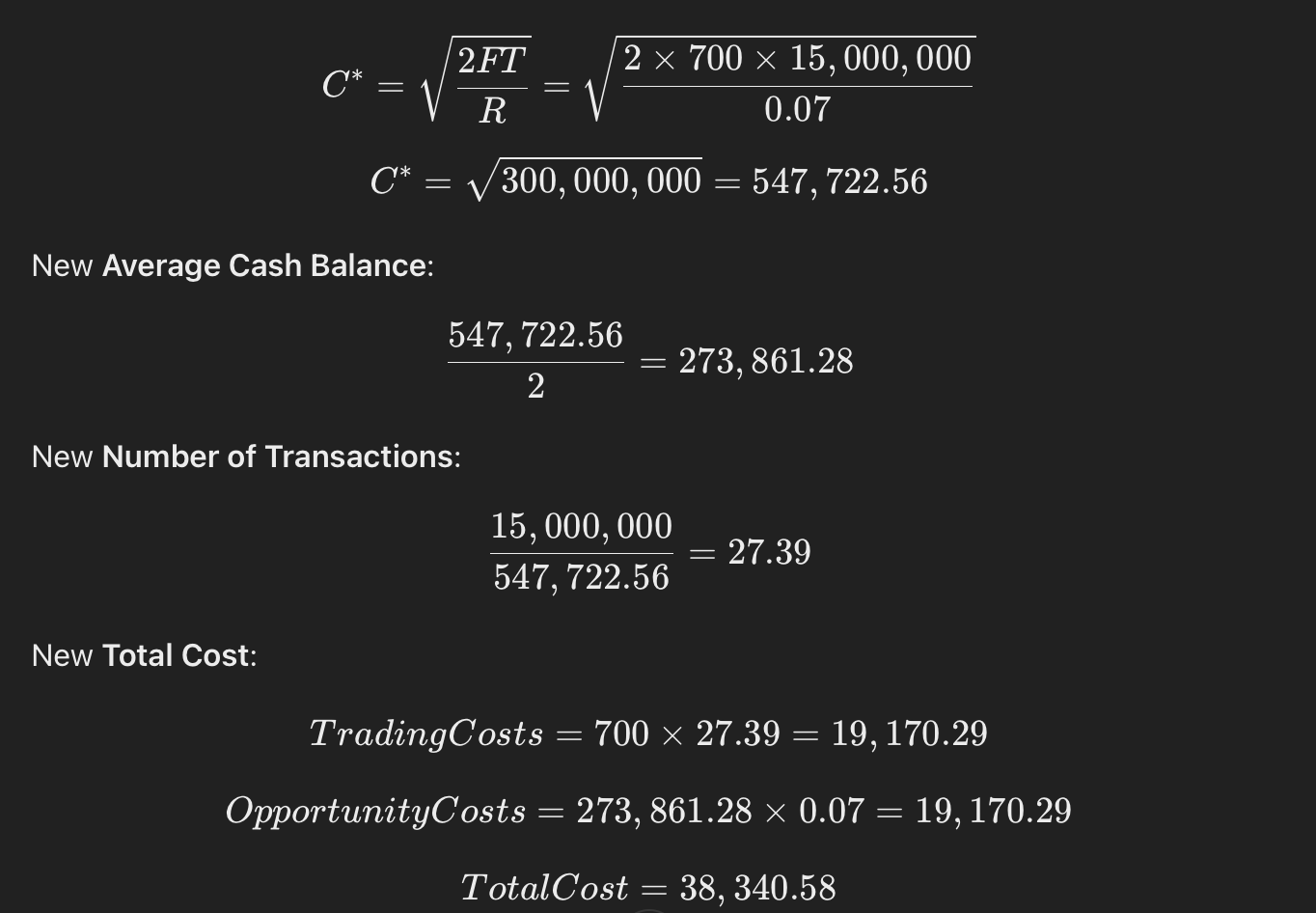

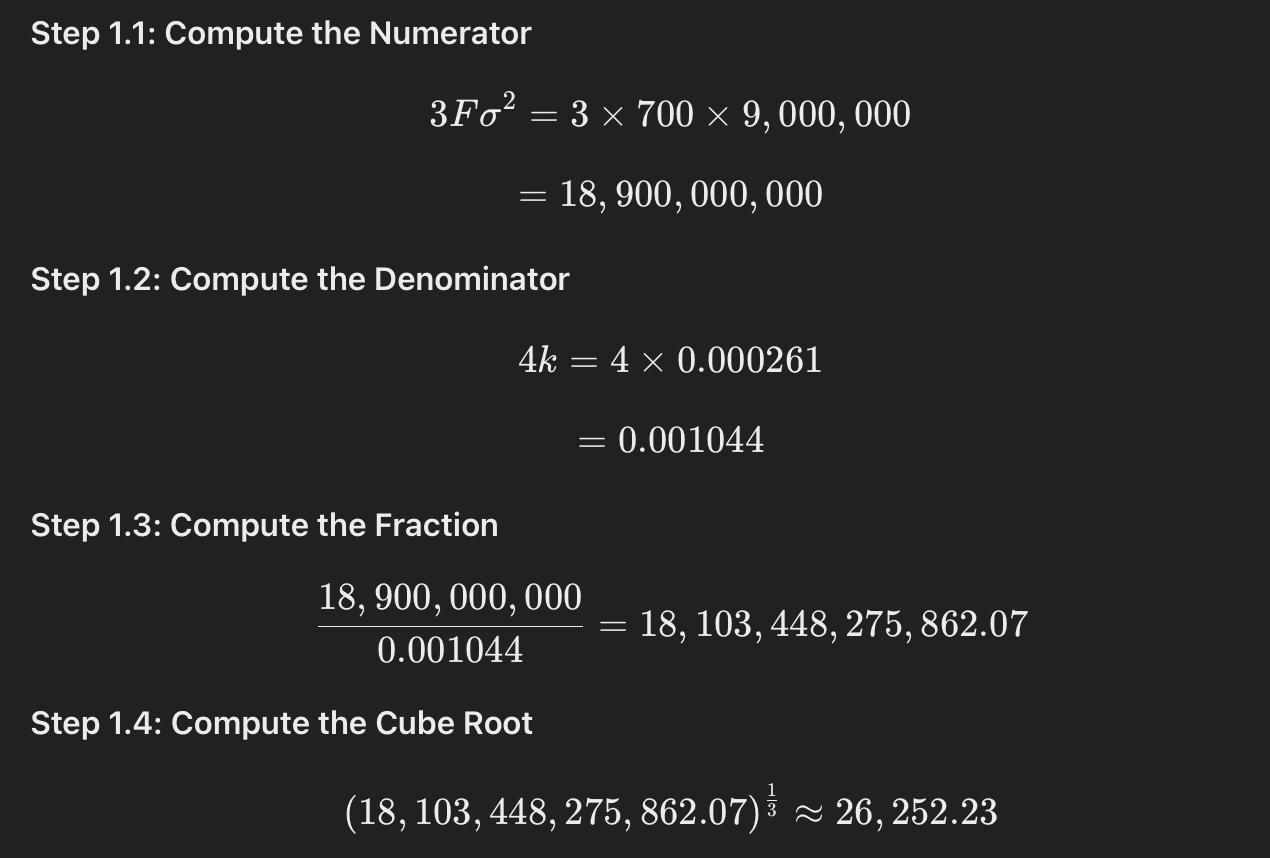

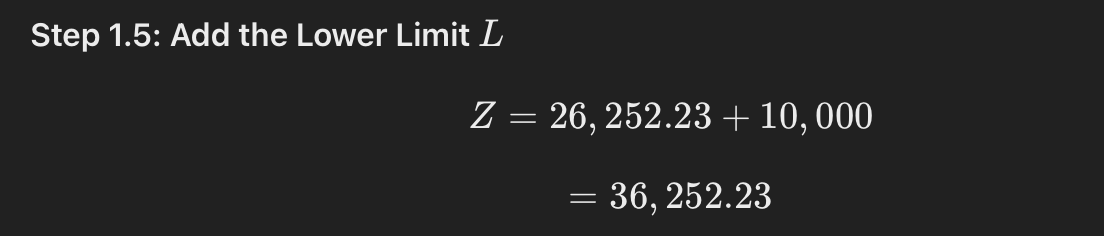

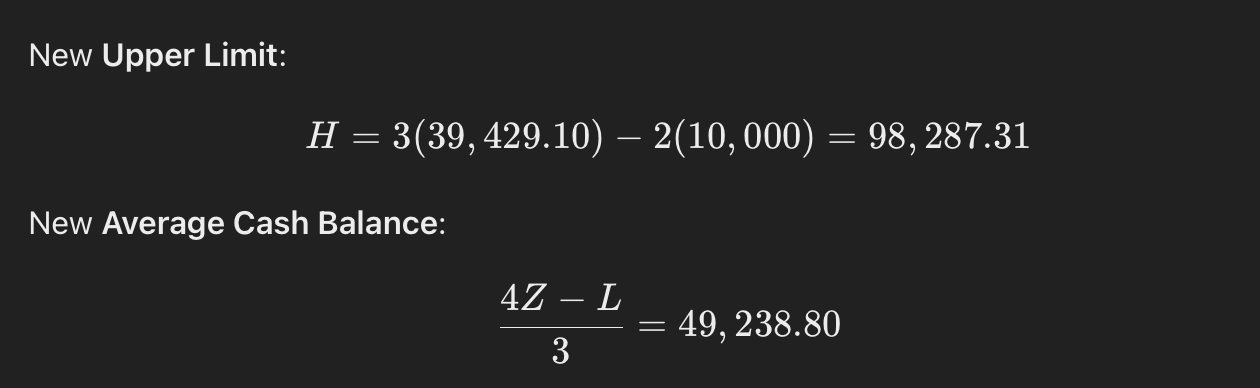

c. effect of a decrease in opportunity cost to 7%

if the opportunity cost of holding cash decreases to 7%, it impacts both models:

baumol model adjustments

miller orr model adjustments

new target cash balance:

d. evaluation of the usefulness of baumol and miller orr models

baumol model

strengths

simply to apply and understand, making it easy for financial managers

helps minimise transaction and opportunity costs by determining an optimal cash withdrawal amount

suitable for firms with predictable and steady cash flows

limitations

assumes constant cash outflows, which is unrealistic for a business with fluctuating cash needs

requires regular and schedules withdrawals, which may not be practical for barrow plc.

doesn’t account for uncertainty in cash flows, making it less useful in volatile environments

applicability to barrow plc:

since barrow plc. likely has uncertain cash needs, the baumol model may not be the most effective choice

it works well for planned cash management but lacks flexibility in real-world conditions

miller orr model

strengths

designed to handle uncertain cash flows, making it more realistic for barrow plc.

establishes upper and lower cash limits, allowing automatic decisions on cash transfers

reduces unnecessary cash holdings while keeping a buffer for unexpected expenses

helps balance transaction costs with the opportunity cost of holding excess cash

limitations

more complex than the baumol model, requiring estimates of variance in cash flows

requires constant monitoring to ensure cash stays within limits

assumes a normal distribution of cash movements, which may not always be accurate

applicability to barrow plc:

since barrows plc’s cash balance varies daily [variance = £9 mil.], the miller orr model is more suitable

it allows barrow plc to adjust its cash balance dynamically based on inflows and outflows

final recommendation

miller orr model is the better choice for barrow plc. due to its adaptability to fluctuating cash flows

the baumol model may still be useful for forecasting and basic cash planning but lacks the flexibility required for real world conditions

a combined approach [using baumol model for planning and miller ott for daily management] may be an effective strategy

Knowt

Knowt