Note

0.0(0)

Explore Top Notes Note

Note Studied by 178 people

Studied by 178 people Note

Note Studied by 25 people

Studied by 25 people Note

Note Studied by 41 people

Studied by 41 people Note

Note Studied by 19 people

Studied by 19 people Note

Note Studied by 24 people

Studied by 24 people Note

Note Studied by 3 people

Studied by 3 people

AP World History Full Guide

5.0(1)

Chapter 17 - Human resource policies & practices

4.5(2)

States of Matter!

5.0(2)

Chapter 14: Reactivity Series

5.0(1)

Honors Biology Midterm Cram Sheet!!

5.0(2)

I-V Characteristics

5.0(1)

International Trade - chapter 17

17.1. Comparative Advantage

- Comparative advantage is the ability to produce a good or service at a lower opportunity cost than others can

- Absolute advantage is the ability to produce more of a good than others can with a given amount of resources

- It is comparative advantage, rather than absolute advantage, that determines which goods for trade

- The most efficient economic arrangement is one in which each country specializes in the good for which it has a comparative advantage and trades with others

- Characteristics such as climate, natural resources, factor endowment, and technology determine which goods and services a country will have a comparative advantage at producing

- Because features like climate, population, and technology aren’t uniform throughout an entire country, incomplete specialization, in which a country produces some of many different kinds of goods, can also be efficient

17.2. And 17.3. Becoming a Net Importer

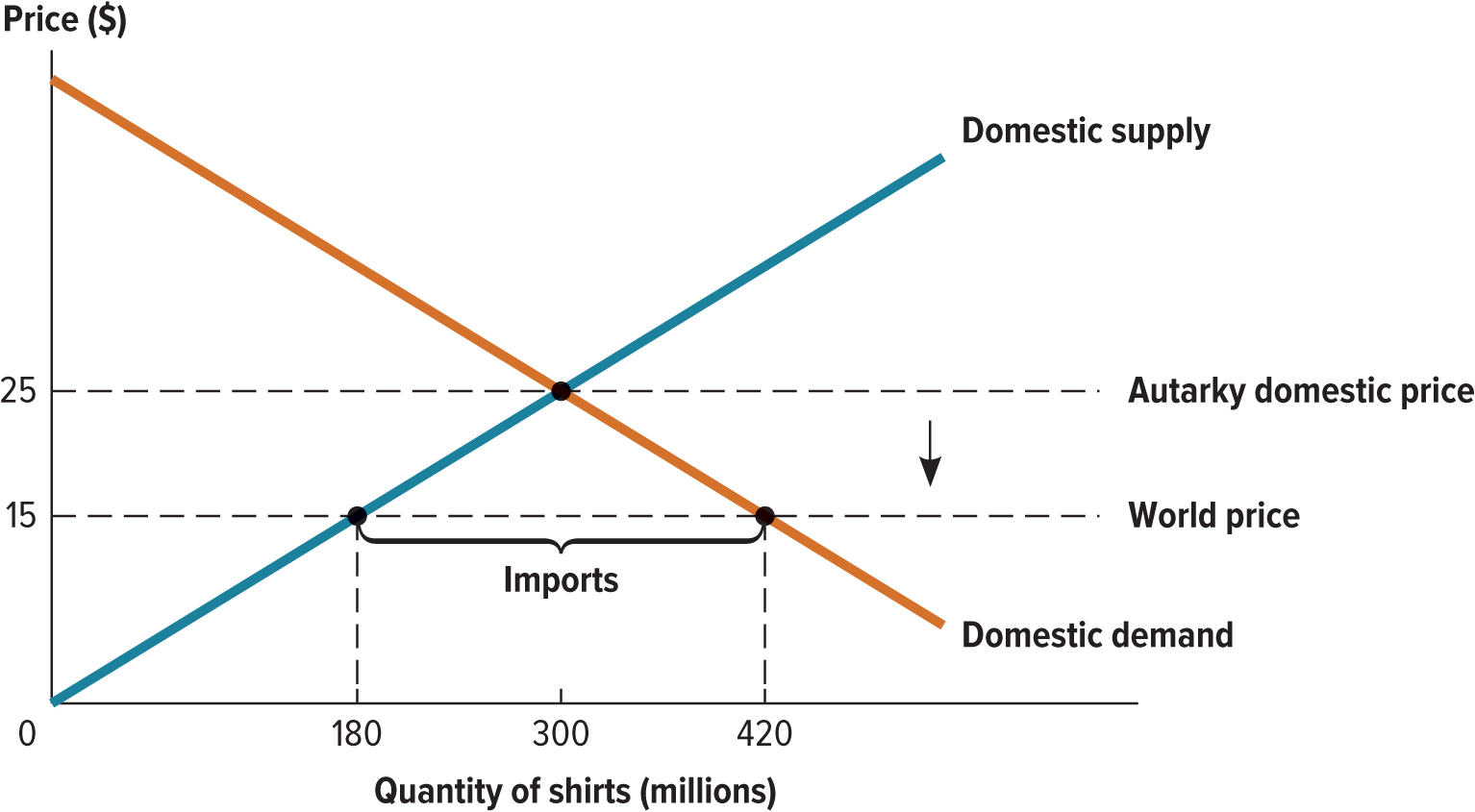

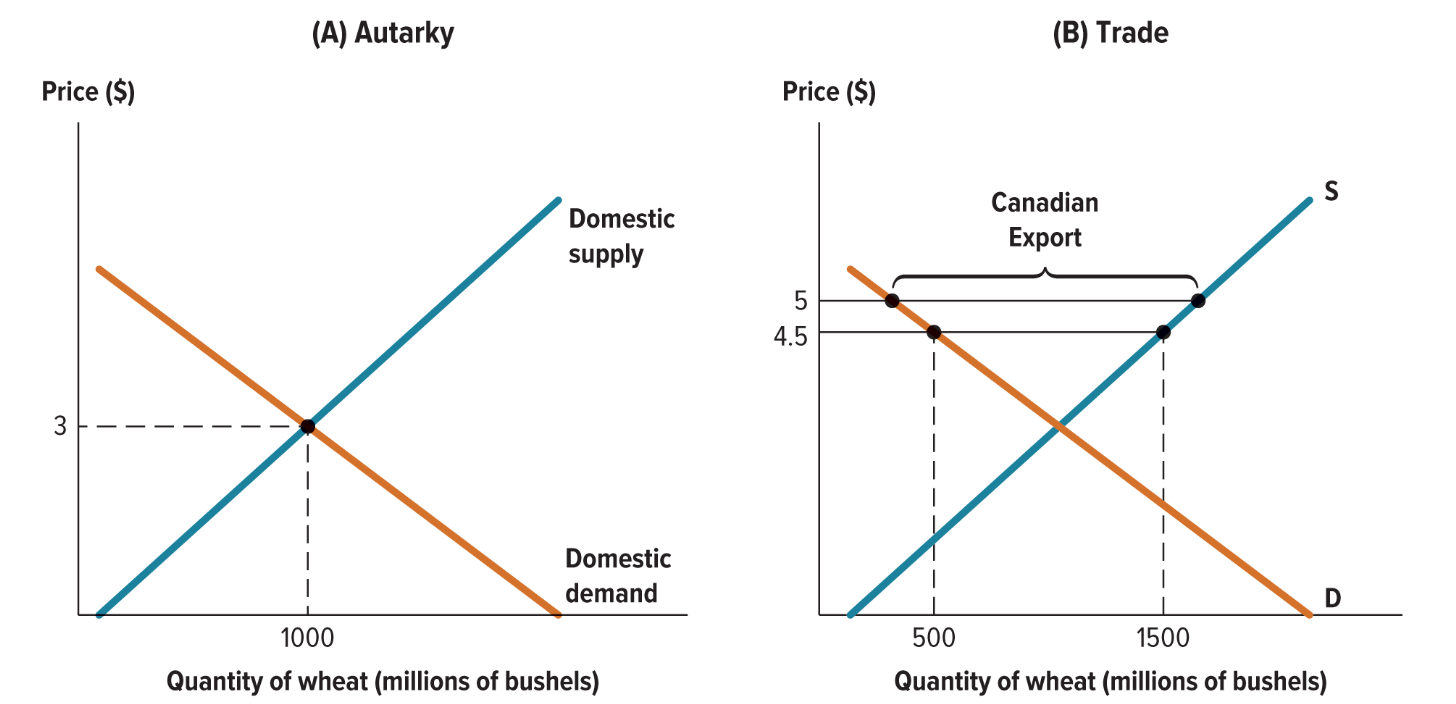

- When a country moves from autarky to trade, the difference between the world price and the domestic price of a good determines whether the country becomes a net importer or net exporter

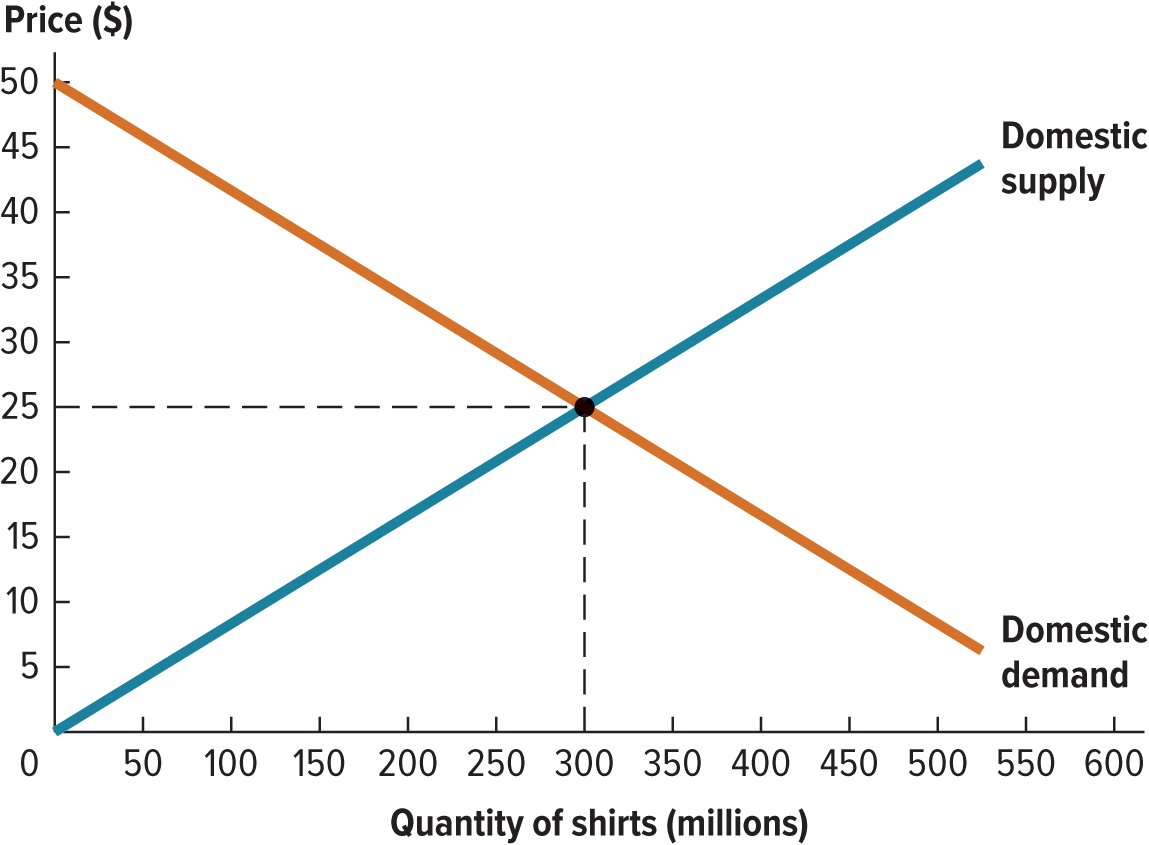

- Autarky: an economy that is self-contained and does not engage in trade with outsiders

- If the world price is lower than the domestic price, the domestic price will drop when the country opens to trade

- In that case, domestic supply will no longer be sufficient to meet domestic demands at the lower price

- Imported goodwill make up the difference, and the country will become a net importer

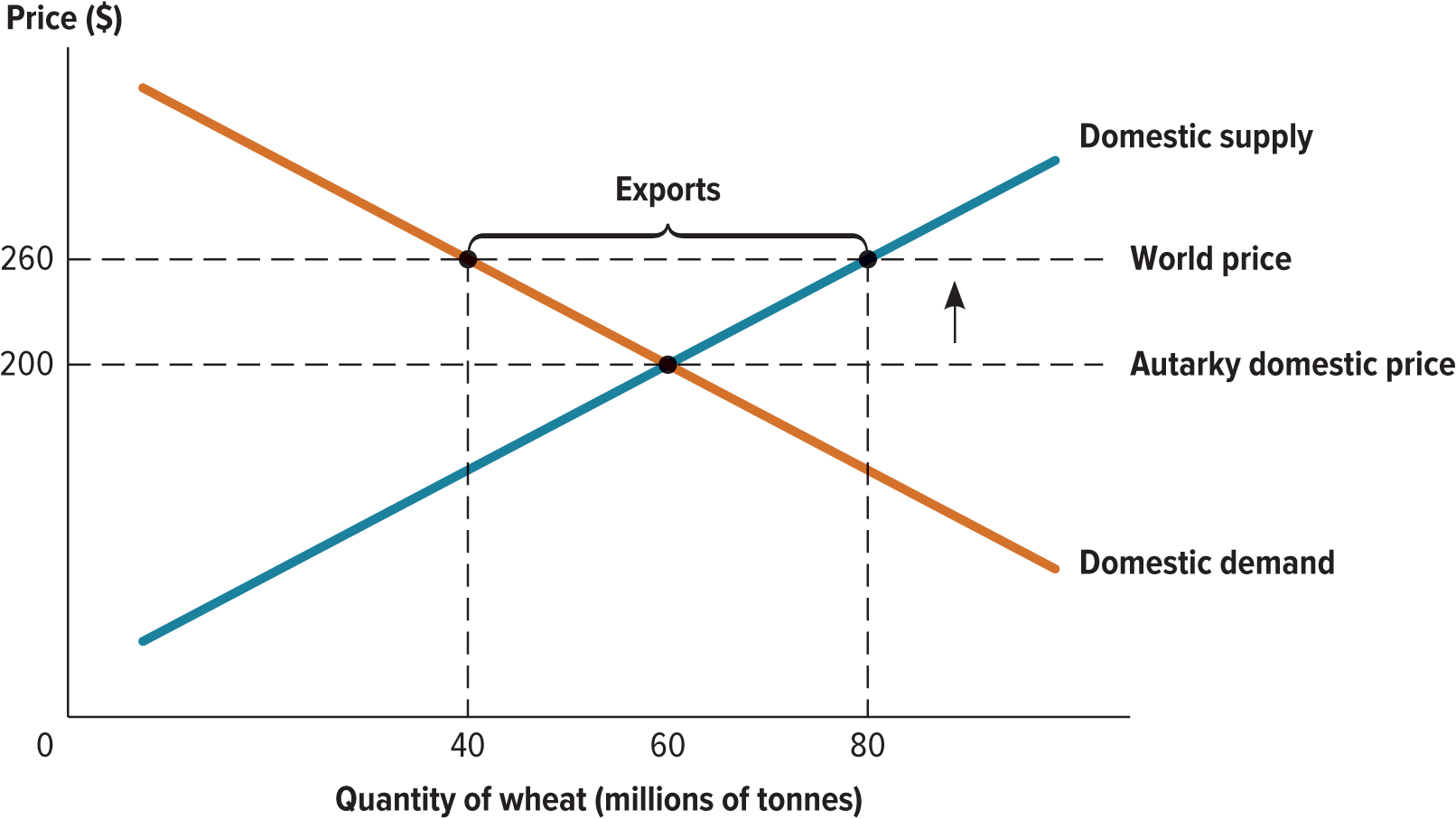

- If the world price is higher than the domestic price, the domestic price will rise when the country opens up to trade

- Domestic supply will outstrip domestic demand at the higher piece, and the country will export the excess supply, becoming a net exporter

- Imports: goods and services that are produced in other countries and consumed domestically

- Exports: goods and services that are produced domestically and consumed in other countries

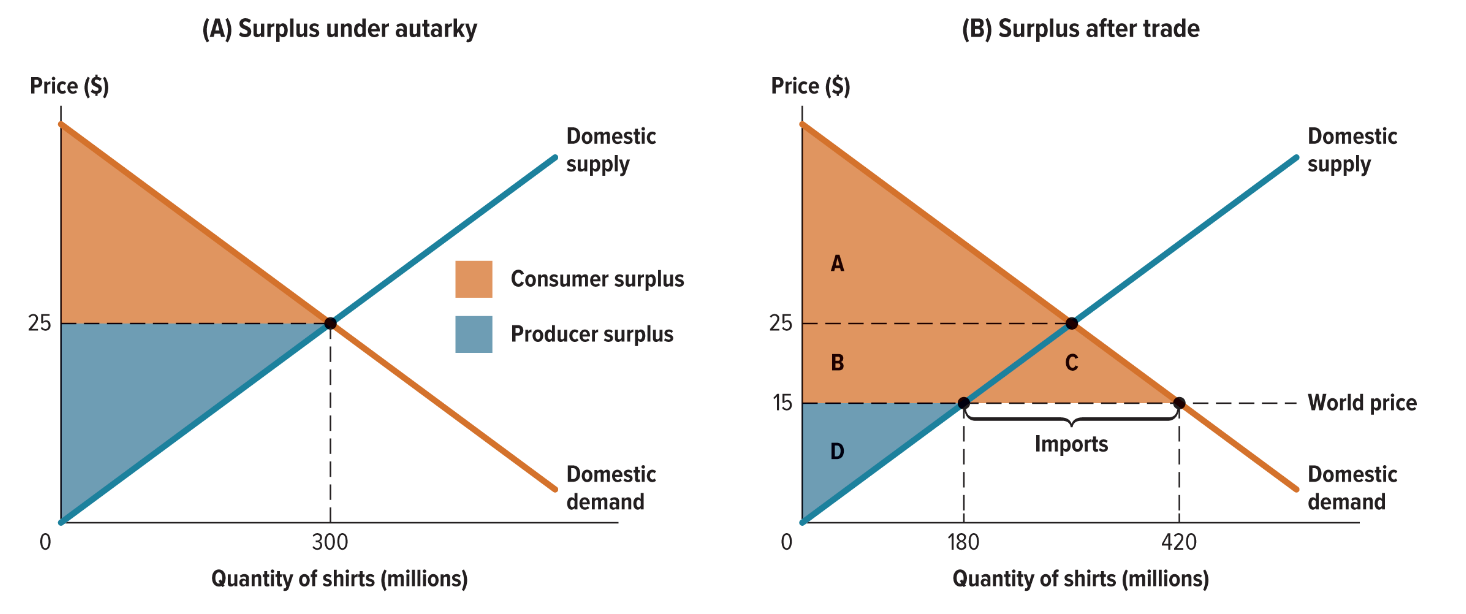

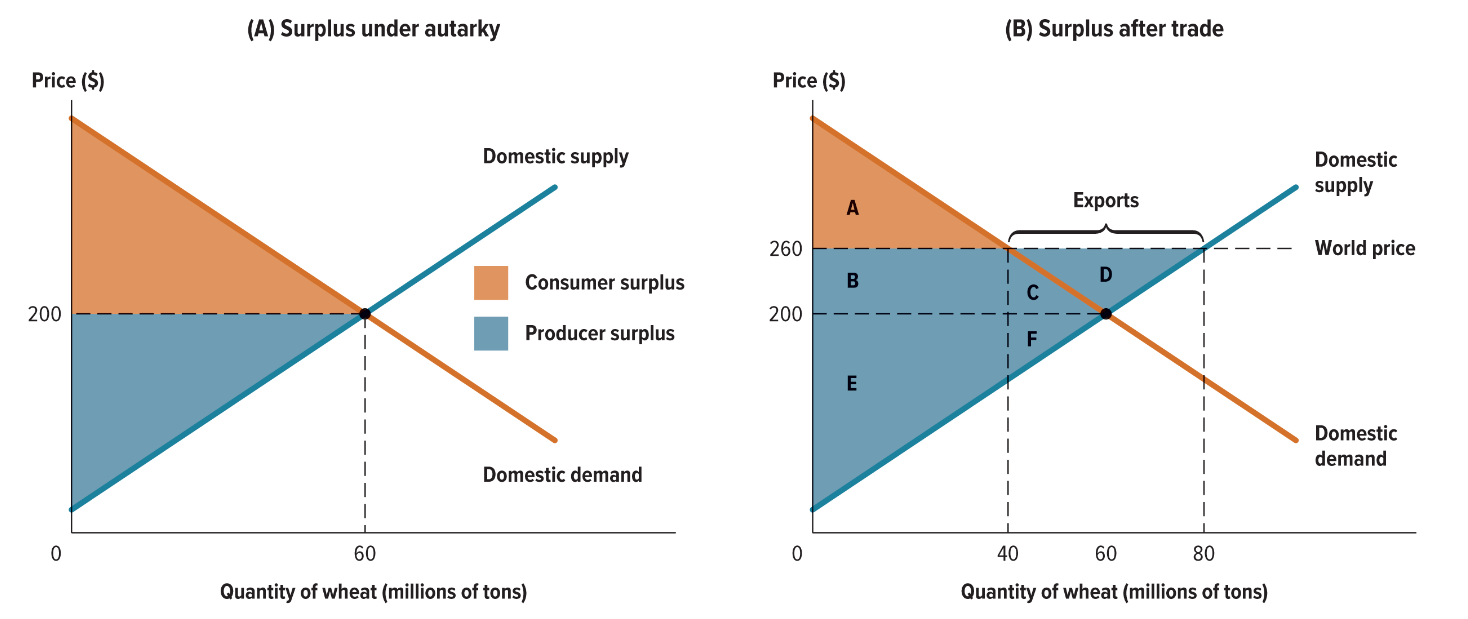

- When markets function well, total surplus increases when a country opens up to rade

- The domestic distribution of surplus depends on whether the country becomes a net importer or net exporter of the good being traded

- In net importing countries, consumers gain surplus from buying a larger quantity at a lower price; producers lose surplus from selling less at a lower price

- When a country becomes a net exporter, consumers lose surplus from buying a smaller quantity at a higher price; producers gain surplus

- In both cases, total surplus increases, making trade more efficient than autarky

17.4. Big Economy, Small Economy

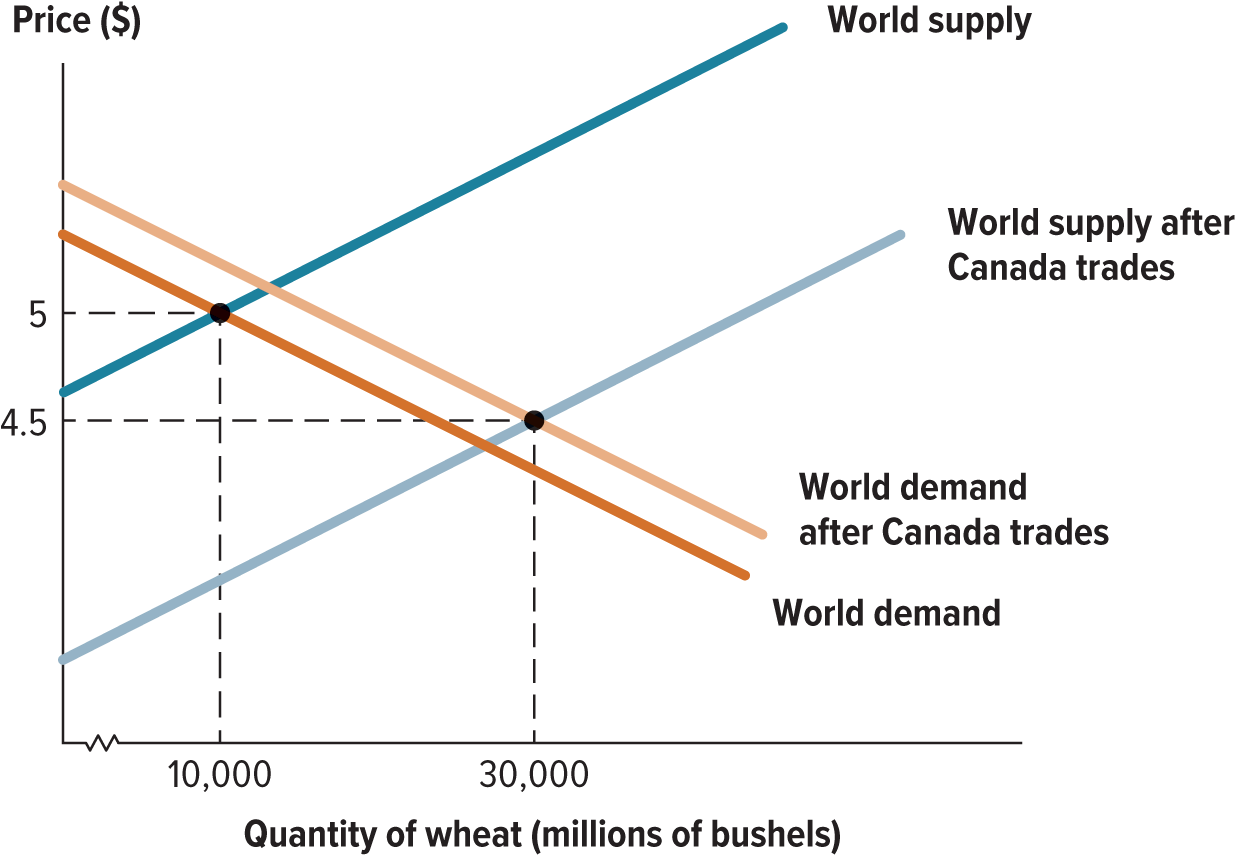

- Our previous examples hold only if the economy in question us a price taker

- The decisions of its citizens about what quantity to produce or consume have no effect on the world price

- If we are dealing with a “big” economy, its decisions would affect the world price

- The economy’s move from autarky to free trade would

- shift the world demand curve to the right because more consumers have entered the world market

- shift the world supply curve to the right because more producers have entered the world market

- Protectionism: a preference for policies that limit trade

- trade liberalization: policies and actions that reduce trade restrictions

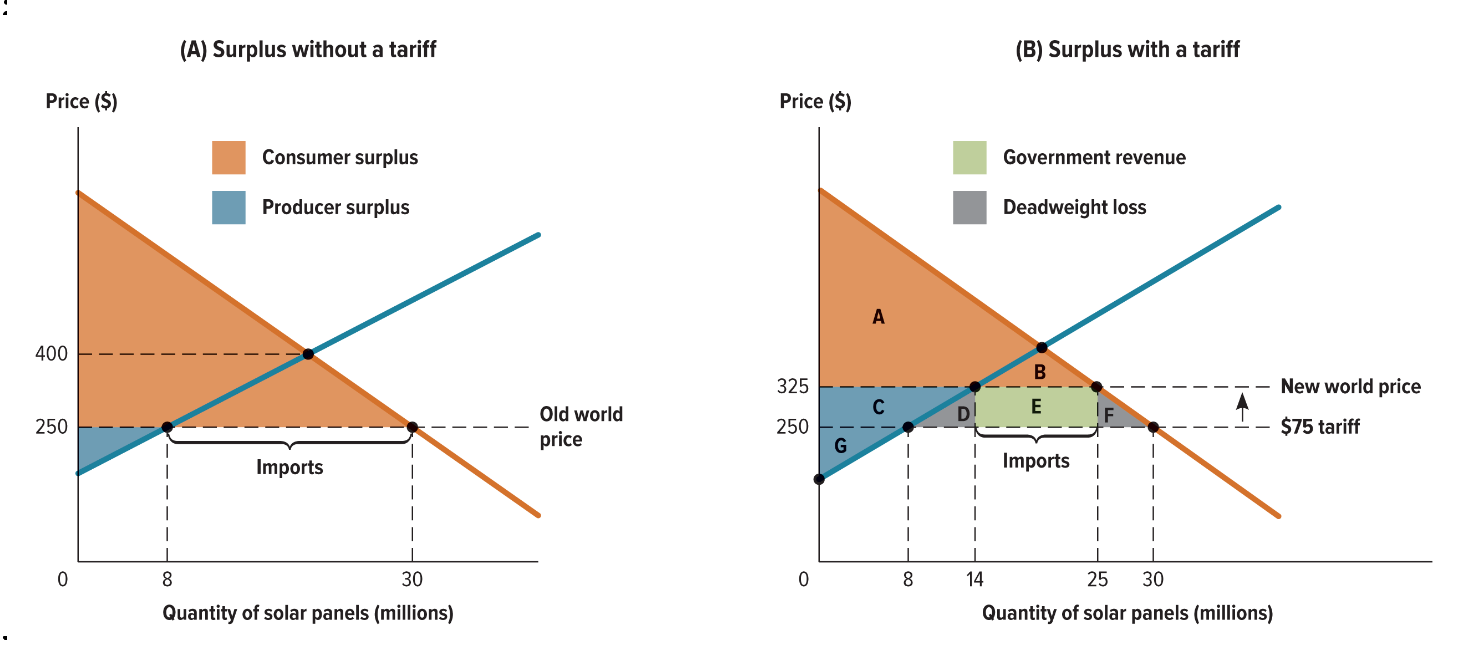

17.5. Tariffs

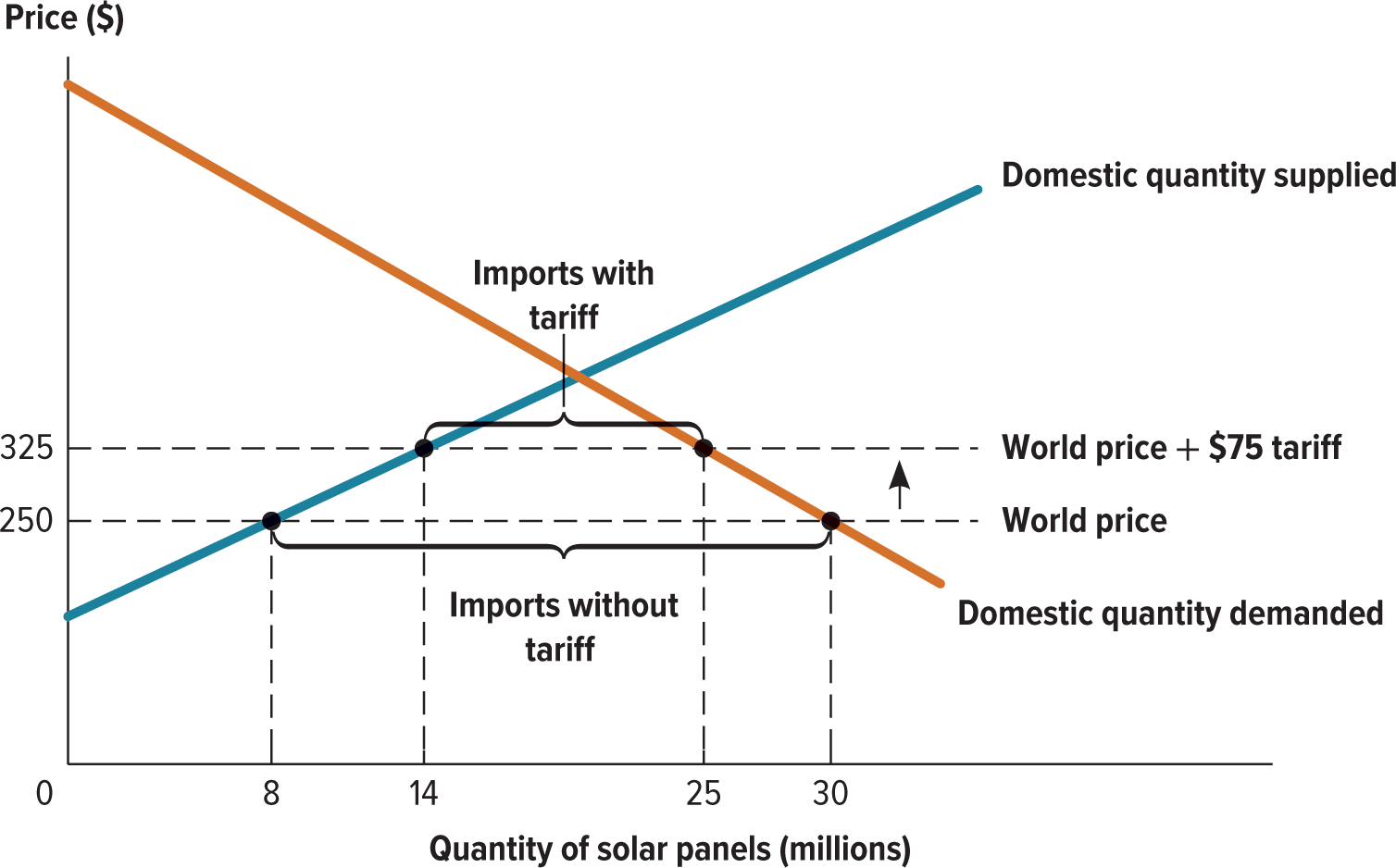

- In order to raise public funds and redistribute surplus toward domestic producers, governments use import tariffs

- Tariff: a tax on imported goods which causes inefficiency and deadweight loss

- A tariff raises the domestic price of a good, causing a reduction in the quantity demanded, an increase in the quantity supplied domestically, and a reduction in the quantity imported

- Domestic producers will enjoy an increase in surplus as a result of selling more at a higher price, and government will receive tax revenue

- Domestic consumers lose surplus as a result of buying less at a higher price, and total surplus decreases

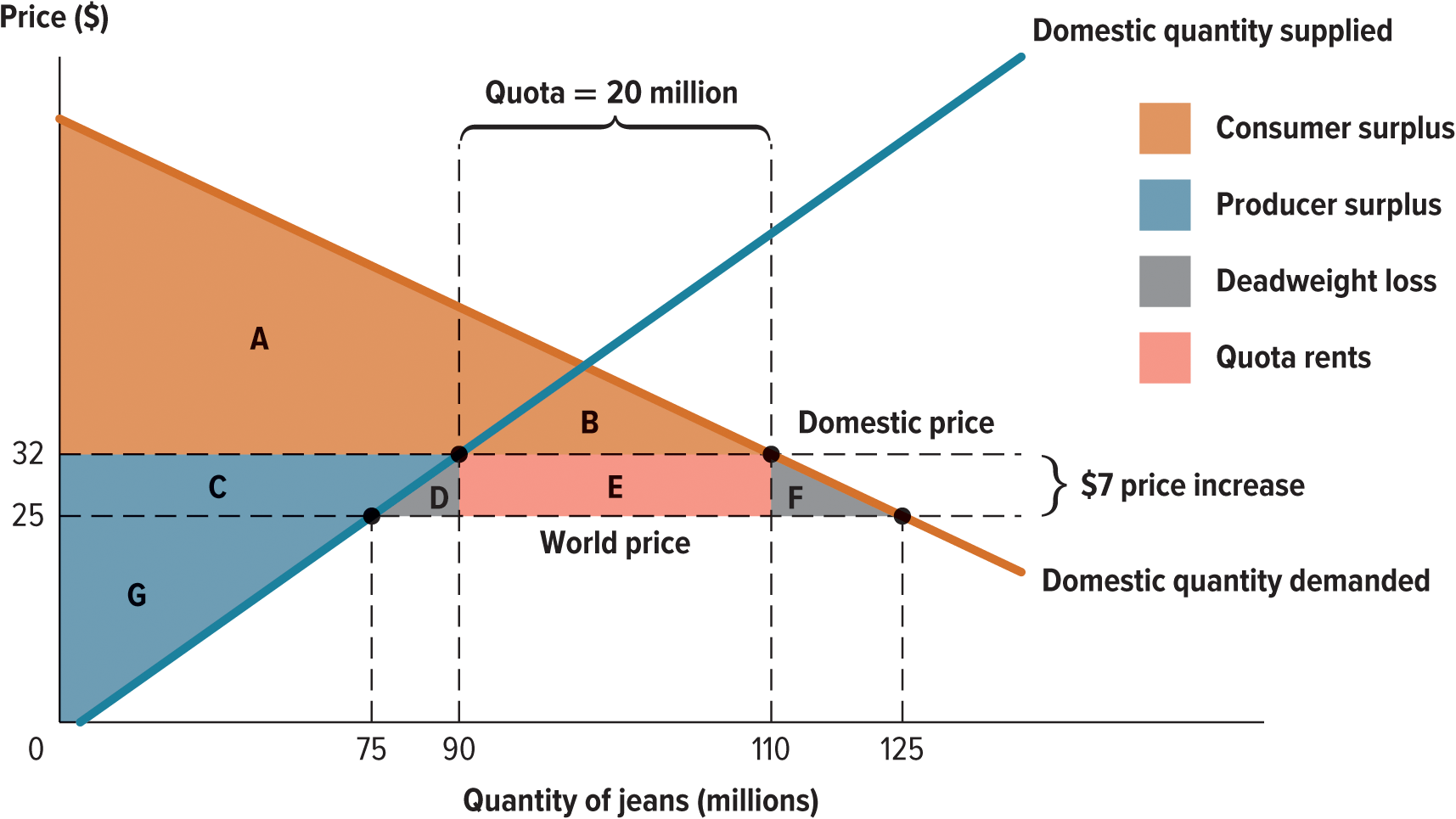

17.6. Quotas

- import quota: a limit on the amount of a particular good that can be imported

- The effect of a quota on domestic price and quantity is similar to the effect of a tariff: domestic price increases, quantity imported decreases

- Domestic producers gain surplus from selling at a higher price; domestic consumers lose surplus from buying a lower quantity at a higher price

- quota rents: the profits earned by the holders of import rights under a quota

17.7. International Labour and Capital

- International trade equalizes the supply and demand factors of production across countries

- In general, trade increases demand for factors that are domestically abundant, and it increases the supply of factors that are domestically scarce

- The price of domestically scarce factors will typically drop due to increased foreign competition, and the owners of these factors lose surplus

- In contrast, the price of domestically abundant factors increases due to increased demand, and owners will gains surplus

- World Trade Organization (WTO): an international organization designed to monitor and enforce trade agreements, while also promoting free trade

- Embargo: a restriction or prohibition of trade in order to put political pressure on a country

17.8. Labour and Environmental Standards

- Each country has its own set of laws and policies governing the economy

- These regulations vary among countries, which can be a source of friction when economic activity takes place across national boundaries

- Policymakers and consumers approach the problem of inconsistent standards in several ways, ranging from explicit laws about imports to voluntary purchasing decisions by consumers

Note

0.0(0)

Explore Top Notes Note

Note Studied by 178 people

Studied by 178 people Note

Note Studied by 25 people

Studied by 25 people Note

Note Studied by 41 people

Studied by 41 people Note

Note Studied by 19 people

Studied by 19 people Note

Note Studied by 24 people

Studied by 24 people Note

Note Studied by 3 people

Studied by 3 people

AP World History Full Guide

5.0(1)

Chapter 17 - Human resource policies & practices

4.5(2)

States of Matter!

5.0(2)

Chapter 14: Reactivity Series

5.0(1)

Honors Biology Midterm Cram Sheet!!

5.0(2)

I-V Characteristics

5.0(1)