Chapter 11: Monopolistic Competition and Oligopoly

Monopolistic competition - Relatively large number of sellers, differentiated products, easy entry/exit

Relatively large # of sellers

- Small market shares

- No collusion - The presence of a relatively large number of firms ensures that collusion by a group of firms to restrict output and set prices is unlikely

- Independent action - Each firm can determine its own pricing policy without considering the possible reactions of rival firms

Product differentiation - Variations of particular product

- Product attributes

- Service

- Location

- Brand names + packaging

- Some control over product prices

Easy entry + exit

- Few economies of scale

- Low capital requirements

Non-price competition - Product differentiation + advertising

Four firm concentration ratio - Ratio of the output (sales) of the four largest firms in an industry relative to total industry sales

- Very low in purely competitive industries

Herfindahl index - Sum of the squared percentage market shares of all firms in the industry

- Important to assess oligopolistic industries

- Lower index → Greater chance of being competitive

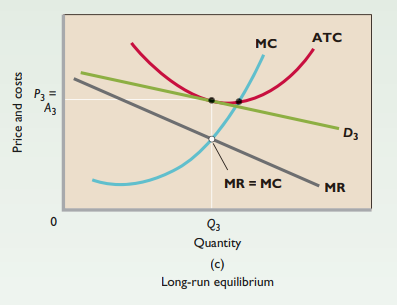

Monopolistic competition’s demand curve

- Highly elastic

- No perfect product substitutes

- Price elasticity depends on # of rivals + degree of product differentiation

Short run

- Produces where MR = MC

- May incur loss in short run

Long run

- Only normal profit (break even)

- Economic profits → Firms enter industry → Quantity increases → Economic profit decreases

- Economic losses → Firms leave industry → Quantity decreases → Economic profit increases

- Complications

- Product differentiation can prevent duplication

- In reality, entry is not as free

Efficiency

- Neither productive nor allocative efficiency

- Average total cost slightly higher than optimal

- P > MC → Underallocation of resources

Excess capacity - Plant and equipment that are underused because firms are producing less than the minimum-ATC output

Product differentiation

- Stay ahead of competitors

- Provides more range to consumers

- Trade-off b/w consumer choice + productive efficiency

Oligopoly - Market dominated by a few large producers of a homogeneous or differentiated product

- 3-5 firms

Homogeneous oligopoly - Standardized products

Differentiated oligopoly - Differentiated products

Strategic behavior - Self-interested behavior that takes into account reactions of others

Mutual interdependence - A situation in which each firm’s profit depends not entirely on its own price and sales strategies but also on those of the other firms

Entry barriers

- Economies of scale

- Large capital expenditures

- Ownership + control of raw resources

Merge 2 competing firms → Increase market share + achieve greater economies of scale + greater monopoly power

Shortcomings of concentration ratios

- Localized markets

- Interindustry competition - Competition b/w 2 products associated w/ different industries

- Import competition - Competition b/w foreign products

Game theory - Study of how people behave in strategic situations

- Payoff matrix shows payoff to each firm resulting from different combinations of strategies

- Collusion - Cooperation w/ rivals rather than work competitively/independently

- Incentive to cheat - Cheating on collusive agreement to increase own profit

3 oligopoly models

- (1) the kinked-demand curve, (2) collusive pricing, and (3) price leadership

- Why isn’t there only a single model?

- Diversity of oligopolies - Oligopoly encompasses a greater range and diversity of market situations than do other market structures

- Complications of interdependence - The mutual interdependence of oligopolistic firms complicates matters significantly

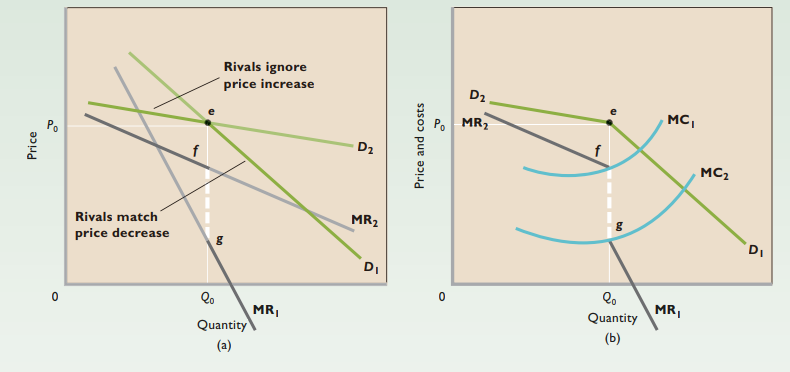

Kinked demand curve - Demand is highly elastic above the going price P0 but much less elastic or even inelastic below that price

- Rivals can either match price changes or ignore price changes

- Prices stable in non-collusive oligopolistic industries

- Even if costs change significantly, may not need to change price

- Price war - Successive and continuous rounds of price cuts by rivals as they attempt to maintain their market shares

Cartels + other collusion

- Cartel - A group of producers that typically creates a formal written agreement specifying how much each member will produce and charge

- Obstacles to collusion

- Demand + cost differences - When oligopolists face different costs and demand curves, it is difficult for them to agree on a price

- Number of firms - Other things equal, the larger the number of firms, the more difficult it is to create a cartel or some other form of price collusion

- Cheating - Collusive oligopolists are tempted to engage in secret price cutting to increase sales and profit

- Long-lasting recession - Slumping markets increase average total cost

- Potential entry of new firms - The greater prices and profits that result from collusion may attract new entrants, including foreign firms

- Anti-trust law - U.S. antitrust laws prohibit cartels and price-fixing collusion

Price leadership - The dominant firm initiates price changes and all other firms more or less automatically follow the leader

- Infrequent price changes

- Communications of price changes

- Limit pricing

Oligopoly + advertising

- Product development + advertising less easily duplicated than price cuts

- Positive effects

- Diminishes monopoly power

- Lowers consumers’ search costs

- More economic efficiency

- Negative effects

- No info about price or quality

- Based on misleading claims

- Establishes brand loyalty + monopoly power

Oligopoly + efficiency

- Neither productive nor allocative efficiency

- No regulation of loophole monopoly power