Negative externalities of consumption

Externalities - external costs or benefits for third parties that are caused by the consumption or production of a product.

Negative externalities — external costs for third parties that are caused by the consumption or production of a product.

Negative externalities of consumption- external costs for third parties that are caused by the consumption of a product.

Examples;

The consumption of cigarettes leads to health problems. Cost for healthcare providers

The consumption of sugary drinks leads to obesity and hence health problems. Cost for healthcare providers.

The consumption of petrol emits pollution, which leads to unclean air and respiratory problems. Cost for healthcare providers.

The consumption of cars leads to congestion on roads, adding to journey times to work and reducing productivity. Cost for employers/ the economy.

Demerit good - goods that society usually wants less of. They cause a negative externality of consumption.

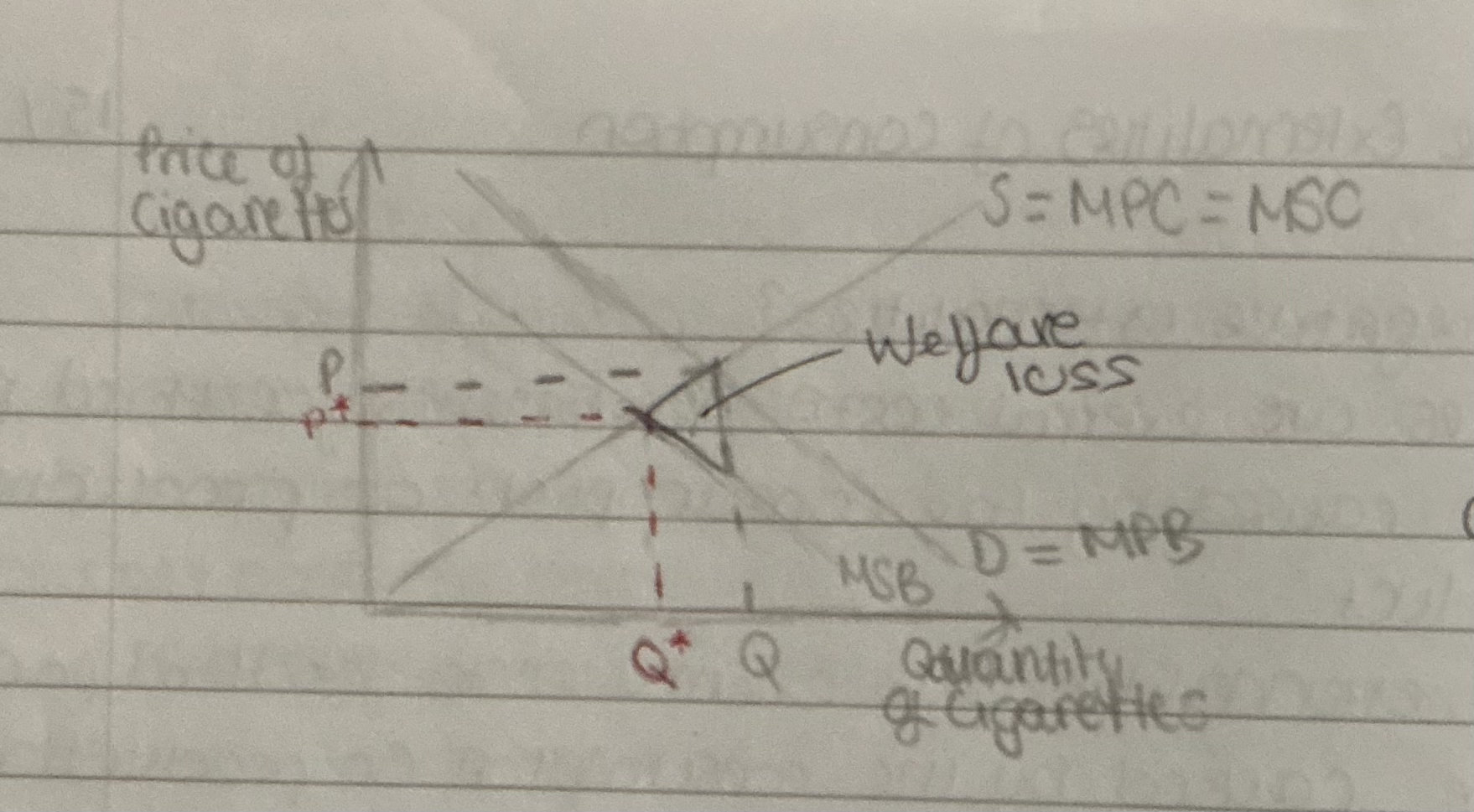

The problem is caused by the consumption of cigarettes, so it must be a benefit curve (MSB). When the cigarettes are consumed society benefits less than the private consumer. MSB is less than MPB. If there are two benefit curves, there must only be one cost curve : MPC=MSC The free market position is where MPB=MPC (D=S) at quantity Q. The allocative efficient position is where MSB=MSC at quantity Q*. Q>Q* There is an over-consumption of cigarettes. Too many are being consumed from society’s point of view. Between Q and Q* the costs to society (MSC) are bigger than the benefits to society (MSB). We are losing social surplus. We call this welfare loss.

The problem is caused by the consumption of cigarettes, so it must be a benefit curve (MSB). When the cigarettes are consumed society benefits less than the private consumer. MSB is less than MPB. If there are two benefit curves, there must only be one cost curve : MPC=MSC The free market position is where MPB=MPC (D=S) at quantity Q. The allocative efficient position is where MSB=MSC at quantity Q*. Q>Q* There is an over-consumption of cigarettes. Too many are being consumed from society’s point of view. Between Q and Q* the costs to society (MSC) are bigger than the benefits to society (MSB). We are losing social surplus. We call this welfare loss.

Figure 1 shows a negative externality of cigarettes consumption, with price on the y axis and quantity on the x-axis. The free market equilibrium is where MPC=MPB (S=D) and quantity Q of cigarettes is bought and sold at price P. When cigarettes are consumed, they cause health problems that impose external costs on healthcare providers. Therefore, MSB is below MPB. Allocative efficiency occurs where MSC=MSB, and quantity Q*. Of cigarettes is bought and sold at price P*. As Q>Q* there is an overconsumption of cigarettes and a welfare loss in the market. This is market failure.

SOLUTION 1: INDIRECT TAXES

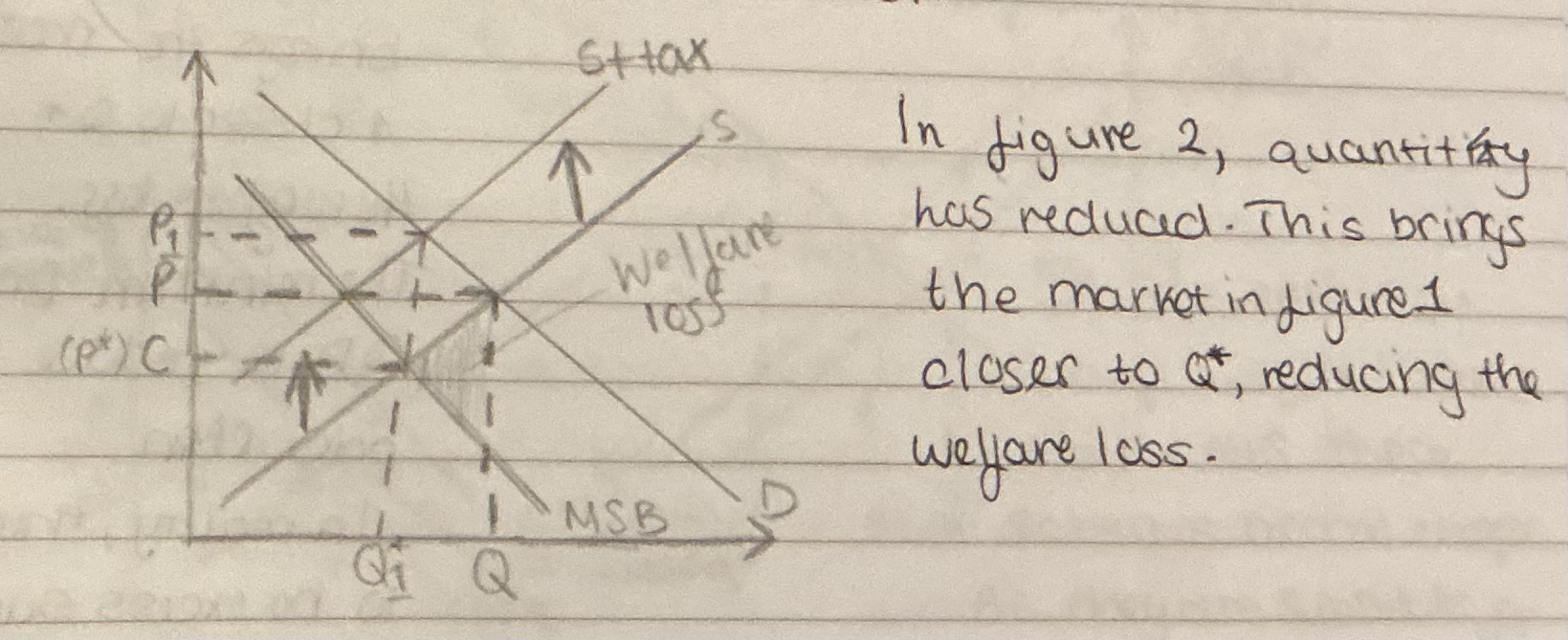

The tax raises costs for firms, shifting S=MPC up to (S=MPC) + tax. The market reaches a new equilibrium where S + tax = D (or MPC + tax = MPB) and Q* cigarettes are bought and sold at price P1. The socially efficient quantity has been reached so the market failure is solved and externality is internalised.

The tax raises costs for firms, shifting S=MPC up to (S=MPC) + tax. The market reaches a new equilibrium where S + tax = D (or MPC + tax = MPB) and Q* cigarettes are bought and sold at price P1. The socially efficient quantity has been reached so the market failure is solved and externality is internalised.

Consumers: higher price means they lose real income (especially low income consumers), but some may be healthier from the reduced quantity.

Producers: loss revenue (‘P X Q’ to ‘P* X Q*’), unless they pass the tax burden onto consumers or reformulate the product to avoid the tax.

Government: tax revenue can be spent on negative advertising or subsidising alternative products like nicotine patches to further reduce demand for cigarettes.

Society: closer to Q* more social surplus.

Depends on PED for how much Q will decrease. But even with cigarettes, there is lots of tax revenue, so it depends on whether government allocates revenue to further bring market towards Q*.

SOLUTION 2: MINIMUM PRICE

In figure 2, QD has decreased. This brings the market in figure 1 closer to Q* reducing the welfare loss. This minimum price causes QD to reduce to Q* at price Pmin. In reality there is unlikely to be excess supply as films that are unable to sell alcoholic drinks will reduce their supply. The socially efficient Q has been reached so the market failure is solved.

Consumers: increase in P means they lose real income but some may be healthier from decreased quantity.

Producers: may gain revenue if PED is inelastic (‘PXQ’ to ‘Pmin X Q*’)

Government: may have been better to use a tax so that revenue could go to the government rather than to the industry?!

Society: closer to Q* more social surplus

But how much will reduce, depends on PED. Parallel markets. Good thing is that a per-unit minimum price which means that the cheapest, strongest drinks, will see the biggest price increases. The policy directly targets the main cause of the externality.

SOLUTION 3: SUBSIDISE SUBSTITUTE PRODUCTS

Quantity has decreased. This brings the market in figure 1 closer to Q*, reducing the welfare loss.

The government subsidies ‘help to quit’ schemes via the NHS. These schemes become cheaper. As they are substitutes for cigarettes this reduces the demand for cigarettes, shifting D left to D1. The market reaches a new equilibrium where D1=S with Q1 cigarettes bought and sold at price P1. The Q is now closer to Q* so the welfare loss has reduced.

Government: it costs the govt money. Could this be better spent elsewhere? On education campaigns to reduce demand?

Government: maybe could have raised the money by taxing cigarettes?

Society: do consumers see ‘help to quit’ schemes and cigarettes as close subs? They might choose not to swap.

SOLUTION 4: COMMAND AND CONTROL

For goods that cause very big negative externalities (class A drugs) more market based solutions may not be enough. This is why the government tries to eliminate the market altogether by naming certain products.

… or partially banning products:

Alcohol/ tobacco consumption banned for under-18s in the UK.

Smoking banned in indoor public places in the UK.

Diagram: shifts D left (partial bans); no diagram (total ban)

Evaluation:

Opportunity cost of policing this ban? And of punishing offenders?

Parallel markets with no tax revenue and an unregulated product.

Generally only used for markets that cause significant negative externalities

SOLUTION 5: NUDGES

Display bans (so people cannot be influenced by product location)

Packaging legislation (so people cannot be influenced by attractive colours and are reminded constantly of key info)

Negative advertising ( to remind consumers of info more constantly)

Make healthy school meals the default option (default bias means most people stick)

No junk food advertising before 9pm (Malaysia - reduce influence of colours)

Diagram: shifts D left

Evaluation:

Should be transparent and justified to consumers

Good that consumers have freedom of choice - it does not punish people who are addicted as they can still get the product

Will these cause a big enough impact on their own? May need to be part of a range of policies if there are big problems that need solving

Knowt

Knowt