Note

5.0(1)

Explore Top Notes Note

Note Studied by 22 people

Studied by 22 people Note

Note Studied by 48 people

Studied by 48 people Note

Note Studied by 6 people

Studied by 6 people Note

Note Studied by 18 people

Studied by 18 people Note

Note Studied by 112 people

Studied by 112 people Note

Note Studied by 34 people

Studied by 34 people

Refraction of Light

4.5(2)

Chapter 9: Molecular Geometry and Bonding Theories

5.0(1)

AB Level 1.5: Possessions, Nicknames & Asking for Time

5.0(1)

Chapter 13: Wage Determination

5.0(1)

DNA: History and Functions

5.0(4)

Chapter 10: Serology Concepts

5.0(2)

Chapter 4: Adjustments, Financial Statements, and Financial Results

Objective 4.1: Explain why adjustments are needed.

Why Adjustments Are Needed

- Accounting systems records daily transactions. Sometimes cash does not come in or paid immediately.

- Cash may not be paid or received in period related to revenues or expenses.

- For adjusting journal entries, there is ^^no cash involved^^.

- Adjustments are made ^^at the end^^ of the accounting period.

- Adjusting entries always have one balance sheet account and one income statement account.

- The purpose of adjustments at the end of the period is to state the following at appropriate amounts:

- Assets are reported at amounts representing the economic benefits that remain at the end of the accounting period.

- Liabilities are reported as amounts owed at the end of the accounting period.

- Revenues are recorded after service or sale is provided (revenue recognition principle).

- Expenses are recorded in the same period that we needed the expense to earn revenue (expense recognition/”matching” principle).

- ^^There are two categories for adjustments^^:

- Deferrals

- Accruals

Deferral Adjustments

- Defer means to postpone until later.

- Deferral adjustments arise because a cash transaction happened first.

- ^^There are two things to considered regarding deferral adjustments^^:

- Deferral adjustments are used to DECREASE balance sheet accounts and INCREASE corresponding income statement accounts.

- Each deferral adjustment involves:

- One asset and one expenses account OR

- One liability and one revenue account.

- Regarding expenses:

- Assets such as supplies or prepaid rent are reported on the balance sheet.

- Once these assets are used, they move over to the income statement as “supplies expense” or “rent expense”.

- Regarding revenues:

- A liability, specifically “deferred revenue”, is reported on the balance sheet.

- Once a service or sale is provided, the deferred revenue is moved onto the income statement as “sales revenue” or “service revenue”.

Accrual Adjustments

- Accrual adjustments are needed when a company has earned revenue or incurred an expense in the current period but has not recorded it because cash will be paid later.

- ^^There are two things to consider regarding accrual adjustments^^:

- These adjustments are used to record revenues or expenses when they occur prior to receiving or paying cash, and to adjust corresponding balance sheet accounts.

- Each accrual adjustment involves:

- One asset and one revenue account OR

- One liability and one expense account.

- ^^Cash is never in an accrual adjustment^^ because cash is paid or received AFTER.

- Regarding revenues:

- Assets on the balance sheet will be followed by the word “receivable” (ex: rent receivable, interest receivable), meaning the right to collect later.

- Once collected, the asset moves to the income statement as rent or interest revenue.

- Regarding expenses:

- Liabilities are reported on the balance sheet and will be followed by the word “payable” (wages payable, interest payable), meaning they will have to pay later.

- Once the liability is paid, it moves to the income statement as an expense (wages expense, interest expense).

Deferral vs Accrual Accounting

- For deferral adjustments, assets are paired with expenses and liabilities are paired with revenues.

- For accrual adjustments, assets are paired with revenues and liabilities are paired with expenses.

Objective 4.2: Prepare adjustments needed at the end of the period.

Adjustment Analysis, Recording, and Summarizing

- ^^Adjustments are not made daily^^ because it is more efficient for them to be made at the end of the accounting period.

- The first step is to find the current unadjusted balances.

- Next, the desired adjustments should be identified.

- Make the adjustments and create the adjusted trial balance to ensure debits still equal credits.

- If debits do equal credits and there are no further adjustments, the final financial statement can be made.

Depreciation

- Depreciation is the process of allocating the cost of buildings, vehicles, and equipment (tangible assets) to the accounting periods in which they are used.

- The expense recognition principle says that when equipment is used to generate revenue, part of the cost is becomes an expense.

- With depreciation, an account on the income statement called Depreciation Expense records the cost of equipment at the time.

- On the balance sheet, we use the contra account Accumulated Depreciation to record the reduced value of the equipment.

- ^^The journal entry^^:

- Debit Depreciation Expense

- Credit Accumulated Depreciation

- A contra account is an account that is an offset to, or reduction of, another account.

- It can never be alone, it must be attached to another account.

- Its purpose is to bring down the value of the account its “stuck” to.

- The contra account’s normal balance is the opposite of the account its stuck to.

Amortization

- Amortization is the corollary to depreciation and relates to intangible assets.

- An amortization expense is an expense on the income statement.

- Accumulated amortization:

- Found on the balance sheet.

- Attaches itself to advertisements, patents, software etc.

- It brings the value down for the assets.

- It has a normal credit balance.

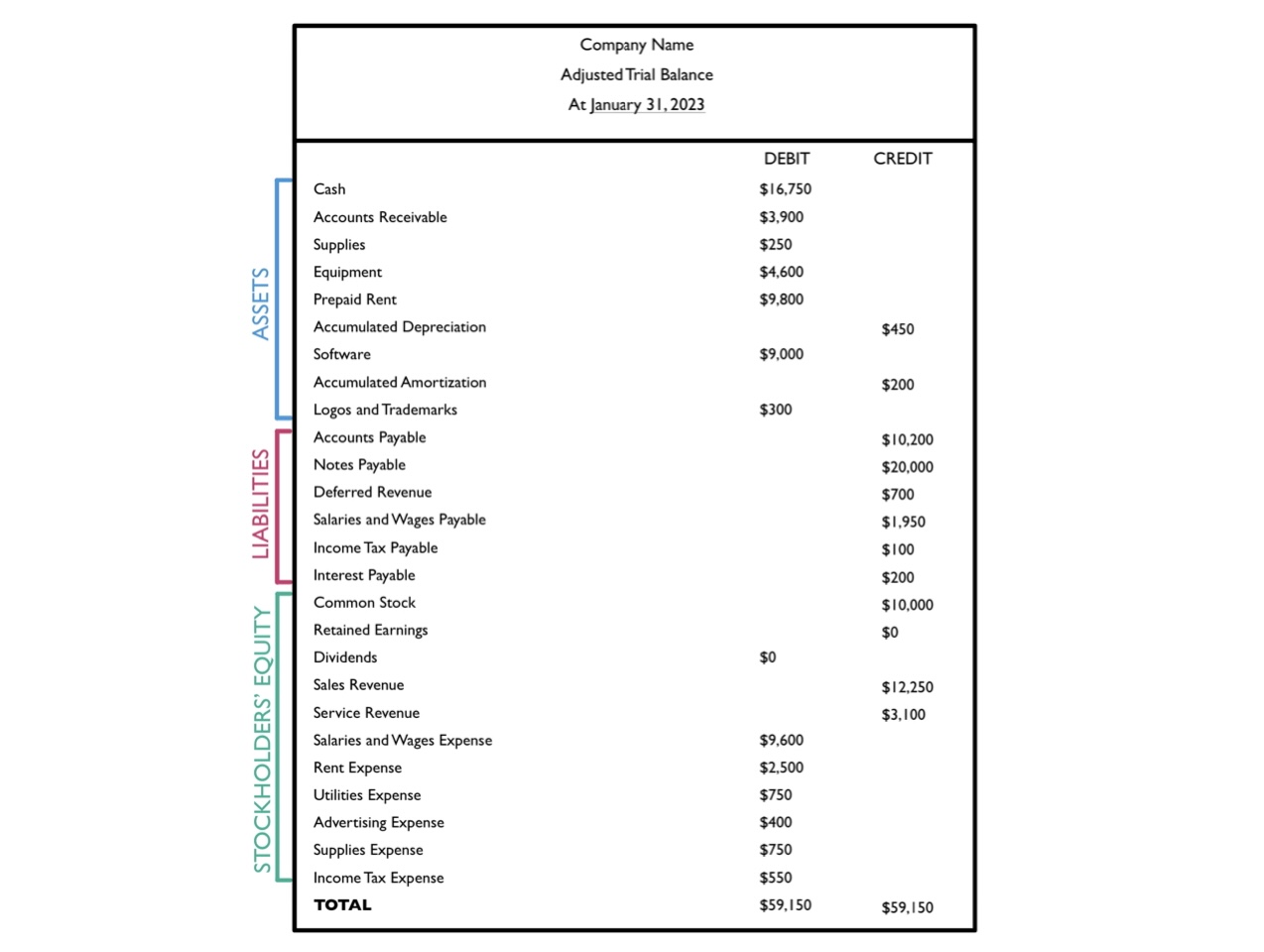

Objective 4.3: Prepare an adjusted trial balance.

Adjusted Trial Balance

The adjusted trial balance ensures that debits still equal credits.

Adjusted t-accounts balances are transferred into debit and credit columns.

Accumulated Depreciation and Accumulated Amortization belong with assets.

The trial balance lists accounts in the order they will appear in the balance sheet, statement of retained earnings, and income statement.

Objective 4.4: Prepare financial statements.

Financial Statements

- Account balances from the adjusted trial balances are in the Statement of Retained Earnings.

- The total of Retained Earnings and Dividends from the adjusted trial balance equal beginning Retained Earnings on the Statement of Retained Earnings.

- Retained Earnings should be from the Statement of Retained Earnings and not the adjusted trial balance.

Objective 4.5: Explain the closing process.

Closing Accounts

- The closing process is done at the end of the year.

- Accounting records are prepped to be tracked in the following year.

- Accounts that are ^^tracked for a limited period of time^^ and closed at the end of the year are called temporary accounts, which consists of revenues, expenses, and dividends.

- Net income or loss and dividends are moved into the Retained Earnings account (subcategory of stockholders’ equity).

- Accounts that are not closed and ^^carry into the next year^^ are called permanent accounts, which consists of assets, liabilities, and stockholders’ equity.

- Retained earnings for the end of the year becomes the beginning balance for the next year.

- ^^2 journal entries for closing accounts are needed^^:

- Entry 1.) Debit revenue accounts, credit expense accounts, then debit or credit the difference to Retained Earnings.

| DEBIT | CREDIT | ||

|---|---|---|---|

| Sales Revenue | $$$ | ||

| Service Revenue | $$$ | ||

| Salaries and Wages Expense | $$$ | ||

| Rent Expense | $$$ | ||

| Utilities Expense | $$$ | ||

| Advertising Expense | $$$ | ||

| Depreciation Expense | $$$ | ||

| Supplies Expense | $$$ | ||

| Amortization Expenses | $$$ | ||

| Interest Expense | $$$ | ||

| Income Tax Expense | $$$ | ||

| Retained Earnings | $$$ |

- Entry 2.) Debit Retained Earnings and credit Dividends

| DEBIT | CREDIT | ||

|---|---|---|---|

| Retained Earnings | $$$ | ||

| Dividends | $$$ |

Post Closing Trial Balance

- Post closing entries are the last step in the accounting process and will ensure all income statement accounts and the dividend account have a zero balance.

- The post closing trial balance is the last step to check:

- If debits are still equal to credits.

- If all temporary accounts are closed.

- The post closing trial balance will only have the balances of permanent accounts, ^^temporary accounts should be zero^^. It should look like:

| REVENUES | EXPENSES | DEBIT | CREDIT |

|---|---|---|---|

| Sales Revenue | 0 | ||

| Service Revenue | 0 | ||

| Salaries and Wages Expense | 0 | ||

| Rent Expense | 0 | ||

| Utilities Expense | 0 | ||

| Advertising Expense | 0 | ||

| Supplies Expense | 0 | ||

| Income Tax Expense | 0 |

Objective 4.6: Explain how adjustments affect financial results.

Adjusted Financial Results

- Adjustments show that revenues (earned) and expenses (incurred) are reported properly.

- If there were no adjustments, a company’s performance would have an inaccurate portrayal.

\

Note

5.0(1)

Explore Top Notes Note

Note Studied by 22 people

Studied by 22 people Note

Note Studied by 48 people

Studied by 48 people Note

Note Studied by 6 people

Studied by 6 people Note

Note Studied by 18 people

Studied by 18 people Note

Note Studied by 112 people

Studied by 112 people Note

Note Studied by 34 people

Studied by 34 people

Refraction of Light

4.5(2)

Chapter 9: Molecular Geometry and Bonding Theories

5.0(1)

AB Level 1.5: Possessions, Nicknames & Asking for Time

5.0(1)

Chapter 13: Wage Determination

5.0(1)

DNA: History and Functions

5.0(4)

Chapter 10: Serology Concepts

5.0(2)