Business

1 - Business Activity

The economic problem

A want is a good or service which is not essential for living.

A need is a good or service which is essential for living.

The economic problem is that there are unlimited wants but limited resources to fulfill those wants, which leads to scarcity.

Scarcity is the lack of resources to fulfill the wants of the population.

Businesses are organizations that combine the four factors of production to create goods and services that satisfy people’s wants. They combine scarce factors of production, to produce goods and services and employ workers and pay them wages to allow them to consume products by other people.

The four factors of production

The four factors of production are resources needed to satisfy the wants of the population.

Land - Natural resources

Labor - Workers, number of people available to make products

Capital - Finance, machinery and equipment

Enterprise - Skill and risk-taking ability of the entrepreneur

These factors of production are very limited. Limited resources + unlimited wants = scarcity

Capital can also mean the money invested into a business by the owners.

Limited resources and opportunity cost

Opportunity cost is the next best alternative forgone by choosing another option.

Scarcity → Choice → Opportunity cost.

Specialization

Specialization is when people and business concentrate on what they are best at.

Specialization is common because:

Specialized technology is widely available

Increasing competition means that costs have to be low

Higher living standards can result from being specialized.

Advantages and disadvantages of specialization

Advantages

Workers are trained and specialized in one task, increasing efficiency

Less time is wasted from moving workspaces

Quicker and cheaper to train as there are less tasks

Disadvantages

Workers can become bored from repetition

If a worker is absent, production may be stopped

Division of labor

Division of labor is when production is split up into different tasks and each worker performs one of the tasks. It is a form of specialization.

Added value

Added value is the difference between the selling price of a product and the cost of the materials.

All businesses attempt to add value. Without it, no profit will be made and costs cannot be paid for.

Added value is important because when it is larger than the cost of materials bought in, other costs such as wages can be paid for, and the owner may be able to make a profit.

Main ways to increase added value

Increase selling price

Reduce cost of bought-in materials

2 - Classification of Businesses

Stages of economic activity

Primary sector, extracting the natural resources of the planet

Secondary sector, the manufacture of goods using the raw materials

Tertiary sector, provides services

Importance is usually measured by:

Percentage of the country’s total number of workers employed in each sector

Value of output of goods and services provided by the sector and the proportion of total national output.

Changes in sector importance

Industrialization is the rise of importance in the secondary sector.

De-industrialization is the decline of importance in the secondary sector.

Mixed economy

Nearly every country in the world has a mixed economy which includes private and public sectors:

Private sector - Businesses not owned by the government

Public sector - Businesses owned by the government

The public sector usually controls the following industries:

Health

Education

Defense

Public transport

Water supply

Electricity supply

Privatization is when government-owned business are sold to private sector business

Nationalization is when private sector businesses are sold to the government

3 - Enterprise, business growth and size

An entrepreneur is a person who organizes, operates and takes the risk for a new business venture.

Advantages and disadvantages of being an entrepreneur

Advantages:

Independence - you can make your own decisions

Can use your own ideas

May become famous and successful if the business grows

May be profitable

Can make use of own skills

Disadvantages

Risk

Capital - you have to put your own money into the business

Lack of knowledge and experience

Opportunity cost - You lost income by not working for another business

Characteristics of successful entrepreneurs

Hardworking - Long hours and short holidays lead to successful businesses

Risk taker - Making decisions to produce goods or services

Creative - Businesses need new ideas

Optimistic - If you think only of failure, you will fail.

Self-confident - Being self-confident is important to convince other people of your skills and so banks can lend you money.

Innovative - Putting new ideas in interesting and different ways is important

Independent - Entrepreneurs often have to work on their own before they can afford to employ. They must be well-motivated and able to work alone.

Effective communicator - Talking clearly and confidently to banks, lenders, customers etc. will raise the profile of the business.

Business plans

Banks will almost always ask for a business plan before lending money. Without it, they will be reluctant to lend money. Business plans make the entrepreneur think ahead and plan carefully for the first few years. Some key points to think about are:

What products or services do I provide?

What is my target market?

What are my main costs and will I sell enough products to cover them?

Where will the firm be located?

What equipment do I need and how many people do I need to hire?

The contents of a business plan usually include:

Description of the business - Brief history, summary and objectives of the business.

Products and services - Describes what the business sells or delivers, and the strategy to improve development in the future to remain in the market and grow as a business.

Target market - Describes the market the business is targeting. Should include:

Target market

Total market size

Predicted market growth

Predicted future changes in the market

Predicted sales revenue from the product

Analysis of competitors

Marketing strategy

Business location - Describes the physical location, website, etc.

Organization structure - Describes the organizational structure, management and details of employees required.

Financial information - Should include:

Projected future financial statements for several years or more

Sources of capital

Predicted costs

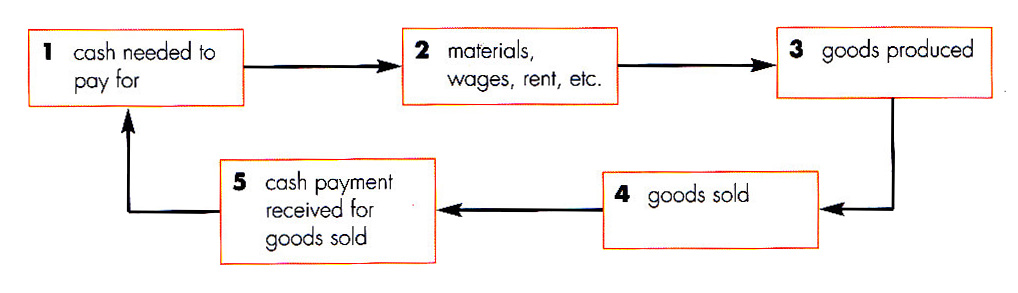

Forecast cash flow and working capital

Projections of profitability ratios.

Business strategy - Explains how the business intends to satisfy customer needs and wants and gain loyalty.

A summary should be included to bring together all the points from above and demonstrate the business’ future success.

Why governments support business start-ups

Most governments offer support to entrepreneurs to encourage them to set up new businesses, some of the reasons include:

To reduce unemployment

To increase competition

To increase output

To benefit society

Can grow further

What business start-ups need and how the government can support the business

Business ideas and help - The government can organize training for entrepreneurs that gives and support sessions offered by experienced entrepreneurs

Premises - Enterprise zones which provide low-cost premises for start-up businesses

Finance - Loans for small business with low interest rates

Labor - Grants to small business to train employees

Research - Encouraging universities to open their research facilities to new business entrepreneurs

Business size

Businesses can vary in size, from one person to a multi-million dollar company run by many people with thousands of workers. Who would find it useful to compare business sizes and why?

Investors - Before deciding which business to invest in

Governments - Often there are different tax rates depending on business size

Competitors - To compare size and importance with their own and other firms.

Workers - To know how many people they may be working with.

Banks - To decide how much they should loan a business, if at all.

Ways business size can be measured and their problems

Number of people employed - Some firms use production method that are efficient but require little employees, such as automated factories.

Value of output - Value of output will not be useful if the output is not sold.

Value of sales - This could be misleading when comparing the size of businesses that sell different products, such as luxury handbags vs. cheap toys.

Value of capital employed - A company employing many workers may use methods that require more employees than equipment, therefore requiring less capital equipment.

Capital employed is the total value of capital used in the business.

No method to measure business size is truly perfect. It is common to use multiple methods and compare results obtained.

Expanding businesses

Owners of businesses often wait to expand their business. But why?

Advantages of large businesses

Possibility of higher profit

More status and prestige for the owners and managers

Lower average costs

Larger share of its market

Disadvantages of a large business (and how to overcome them)

Larger businesses are difficult to control - Operate the business in small units

Larger businesses will lead to poor communication - Operate the business in small units or use latest technology and equipment (which can still cause problems)

Expansions costs so much the business may be short of finance - Expand more slowly, use profits from slowly expanding business to pay for further growth, ensure long-term finance is available (by saving up money and such)

Integrating with another business is more difficult than expected - Introducing a different style of management needs good communication with employees and managers as they will need to understand the reasons for the change

Different ways a business can grow

Internal growth is when businesses grow from the inside using their own profit, employees etc.

External growth is when businesses perform a takeover or merger with another business.

A takeover is when one business buys out the owners of another business, which becomes part of the first business.

A merger is when the owners of two business join their businesses together to make one business.

Types of external growth

Horizontal integration (or horizontal merger) is when one firm takes over or merges with another one in the same industry and same sector of production (primary, secondary, tertiary)

Vertical integration (or vertical merger) is when one business merges with or takes over another one in the same industry but a different sector of production. This can be forward - integrating with a business at a later stage of production - or backward - integrating with a stage at an earlier stage of production.

Conglomerate integration (or conglomerate merger) is when one business merges with or takes over another one in a completely different industry (example: a house business buys out a clothing brand)

Benefits of horizontal integration

Reduces the number of competitors in the industry.

The combined business will have a bigger market share than either business before the integration.

Benefits of forward vertical integration (example: secondary takes over tertiary)

Provides an assured outlet for products

The profit margin of the supplier is absorbed by the new expanded business.

The retailer could be prevented from selling competing products.

Information about consumer preferences can now be obtained directly instead of having to buy it from the retailer (since now you own the retailer!)

Benefits of backward vertical integration (example: secondary takes over primary)

Provides an assured supply of important materials

The profit margin of the supplier is absorbed by the new expanded business

The supplier could be prevented from supplying competing manufacturers

Costs of supplies can now be controlled

Benefits of conglomerate integration

The business now has activities in more than one industry.

There might be a transfer of ideas between the sections of the business (example, a car business buys an advertising business, the car business could benefit from better promotion of its cars)

Why some businesses stay small

Not all businesses grow. Some like to stay small and here are some reasons:

The type of industry the business operates in - Example, services like window cleaning or hairdressing give you a close and personal experience. If they were to grow larger, that close and personal service would be hard to recreate.

Market size - if the market (total number of customers) is small, then the business will likely stay small.

Owner’s objectives - Some business owners just prefer to keep their businesses small. They could be more interested in having a small business where you know all your staff and customers, rather than running a larger business. They also sometimes wish to avoid the stress that comes from running larger business.

Causes of a business failure

Of course, not all businesses are successful. The main reasons why some businesses fail include the following:

Lack of management skills and experience - This can lead to bad decisions.

Changes in the business environment - If the environment of a business changes, (e.g. a powerful new competitor has very advanced new technology) then the business will fail if they don’t respond to the situation effectively.

Poor financial management - shortage of cash means costs (wages, rent etc.) cannot be paid for. Failure to predict or plan for cash flows is a major cause of businesses of all sizes failing.

Over-expansion - As mentioned, when a business expands too quickly it can lead to big problems, which if not solved can lead to the whole business shutting down.

Why new businesses are at greater risk of failing

Newer businesses tend to fail due to a multitude of reasons, including:

Lack of finance and other resources

Poor planning

Inadequate research

Lack of experience and decision-making skills

4 - Types of business organization

There are many main forms of business organizations in the private sector. These are:

Sole trader

It is the most common form. This is because there are so few legal regulations to set it up:

The owner must register with, and send annual accounts to, the Government Tax Office.

The name of the business is important. In some countries it must be registered with the Registrar of Business Names, but in others you can just put the name on all the business’ documents and put a notice in the main office stating who owns the business (that’s you)

Sole trader must observe laws such as health and safety laws or obtaining a license

Disadvantages to being a sole trader

No one to discuss business with

No limited liability (business is not a separate legal unit). This means you are fully responsible for the debts your business has, and if you cannot pay them, your creditors (the people you owe) can force you to sell your possessions to pay them using that money instead.

Sources of finance are limited to the owner’s savings, profits and small bank loans.

Business is likely to remain small.

If owner is ill or similar, no one can take control of the business for them. There is no continuity of the business after the death of the owner.

Limited liability means that the liability of owners in a company is limited to only the amount they invested. Basically, they’re only responsible for what they put into the business, not what others invested.

Unlimited liability means that the owners of a business can be held responsible for the debts of the business they own. Their liability is not limited to just what they put into the business.

Partnerships

A partnership is a form of business in which two or more people agree to jointly own a business. In some countries this is limited to 20 people.

Setting up a partnership can be as simple as a verbal agreement, but a partnership agreement is advised as it is the written and legal agreement between business partners.

A unincorporated business is one that does not have a separate legal entity.

Advantages of a partnership

More capital can be invested into the business

The responsibilities are now shared

All partners motivated to work hard as they would both benefit from profits.

Risks are shared

Disadvantages of a partnership

No limited liability

No separate legal identity. If one of the partners died, the business would be over.

Partners can disagree on business decisions.

If one of the partners is inefficient or dishonest, then the other partners would suffer by losing money in the business.

Most countries limit the number of partners to 20 and this means capital was limited to the amount that 20 people could invest.

Limited partnerships

In some countries it is possible to create a Limited Liability Partnership (LLP). It offers limited liability but shares cannot be bought or sold. This type of partnership is a separate legal unit, so if one of the partners died it would continue.

A share is a percentage of ownership of a business. Selling shares means you’re selling bits of ownership of your business to other people - selling too many will lead to you losing control since now others own it more than you do!

Private limited partnerships

A private limited company is a business owned by shareholders but they cannot sell shares to the public.

Advantages of a private limited business

(these are just general advantages, not compared to any other business type)

Shares can be sold to family or friends

All shareholders have limited liability

The people who started the company are able to keep control of it as long as they don’t sell too many shares to other people.

Disadvantages of a private limited business

There are many legal matters which have to be dealt with before it can be formed.

The shares cannot be sold to anyone without the agreement of all shareholders.

The company cannot offer its shares to the general public. Therefore it will not be possible to raise really large sums of capital to invest back into the business.

There is one major difference between a company and an unincorporated business, such as a sole trader or a partnership. A company is a separate legal unit from it’s owners - it is an incorporated business. This means:

A company exists separately from the owners and will continue to exist if one should die

A company can make contracts

Company accounts are kept separate from the accounts of the owners.

Companies are jointly owned by people who invested in the business. These people buy shares in the company and are therefore called shareholders. They appoint directors to run the business. In a private limited company, the directors are usually the most important or majority shareholders.

Public limited companies

Public limited companies are businesses owned by shareholders but they can sell shares to the public. Most large, well-known businesses are public limited companies as they have been able to raise the capital to expand nationally or even internationally. Common mistakes made in these are:

Public limited companies are not in the public sector of industry, despite what the name might suggest.

The title can cause confusion. Is the UK, public limited companies are given the title ‘plc’, but in other countries the title ‘Limited’ is used. This must not be confused with the UK use of ‘Limited’ which refers only to private limited companies. This table should help.

Private limited companies | Public limited companies | |

|---|---|---|

UK | Limited or Ltd | plc |

South Africa and some other countries | Proprietary Limited or (Pty) Ltd | Limited |

Advantages of a public limited company

Offers limited liability

Incorporated business, so it has a separate legal identity. It accounts are kept separately and there is continuity if an owner dies.

No limit to the number of shareholders a public limited company can have.

No restriction of buying, selling or transferring shares.

Disadvantages of a public limited company

Legal formalities are quite complicated

Many more regulations and controls

Selling shares to the public is expensive

Although the original owners of the business might become rich by selling shares in their business, they may lose control over it when it ‘goes public’.

In sole trader businesses and partnerships the owners have control over their business. They take all the decisions. This is also the case in most private limited companies with relatively little shareholders. The directors are often the majority shareholders so their decisions are usually passed at all meetings. However, with a public limited company there are thousands of shareholders. They cannot all make decisions. They can only elect professional managers as company directors, who are given the responsibility of running the business. The directors cannot control everything by themselves so they appoint managers. So the shareholders own, but the directors and managers control.

I know that was difficult, so here’s a summary of

Risk, ownership and limited liability

Business organization | Risk | Ownership | Limited liability |

|---|---|---|---|

Sole trader | Carried by sole owner | One person | No |

Partnership | Carried between all partners | Several partners | No |

Private limited company | Shareholders up to their original investment | Shareholders - shares cannot be sold to the public | Yes |

Public limited company | Shareholders up to their original investment | Shareholders - shares can be sold to the public so may be thousands (even millions) | Yes |

Franchising

A franchise is a business based upon the use of the brand names, promotional logos and trading methods of an existing successful business. A franchisor is a business with a product or service idea that it does not want to sell directly. Instead it appoints franchisees to use the idea or product and sell it under its name.

To the franchisor | To the franchisee | |

|---|---|---|

Advantages | • Franchisee buys a license from the franchisor to use the brand name• Expansion of the franchised business is much faster than if the franchisor had to pay for all new outlets• The franchisee has the responsibility of the outlets• All products sold must be obtained from the franchisor. | • Chances of a business failure are much reduced because a well-known product is being sold• Franchisor pays for advertising• All supplies are obtained from the franchisor• There are fewer decisions to make - prices, store layout and products are decided by the franchisor• Training is provided by the franchisor• Banks are often willing to lend to franchisees due to low risk |

Disadvantages | • Poor management of one franchised outlet could lead to a bad reputation for the whole business• Franchisee keeps profits from the outlet | • Less independence•Unable to make decisions that would suit the local area• License fee must be paid to the franchisor and possibly a part of the annual turnover |

Joint ventures

A joint venture is when two or more businesses agree to start a new project together, sharing the capital, risks and profit. This is not the same as a merger, as they are still separate businesses, just starting a new project together (similar to a collaboration).

Advantages of joint ventures | Disadvantages of joint ventures |

|---|---|

Sharing of costs | Sharing of profits |

Local knowledge when joint venture company is already based in the country | Disagreements may occur |

Risks are shared | Businesses may have different ways of running a business - different cultures |

Public corporations

These are wholly owned by the state or central government. They are usually business which have been nationalized. This means (as mentioned in Chapter 2) that they were once owned by private individuals, but were purchased by the government. Public corporations are owned by the government but it does not directly operate the businesses. Ministers appoints a Broad of Directors who have the responsibility to manage the business. The government will make clear what the objectives of the business should be.

Advantages of public corporations

Some industries are so important that government ownership is essentials

If an important business is failing the government can nationalize it to keep it open and secure jobs.

Important public services are often in the public sector.

Disadvantages of public corporations

No private shareholders to insist on high profits so the motivation might not be as powerful

Managers will always think the government will help them if the business makes a loss due to subsidies

No close competition to public corporations, so lack of incentive to increase efficiency

Governments can use businesses for political reasons

5 - Business objectives and stakeholder objectives

An objective is an aim or goal to work towards. All businesses should have them. They have many benefits:

Give workers and managers a clear target to work towards and this motivates them

Taking decisions will be focused on “Will it help reach our objectives?”

Clear objectives will help unite the whole business work towards the same goal

Business managers can compare how the business has performed with their objectives to see if they have been successful or not.

The most common objectives are:

Profit

Business survival

Returns to shareholders

Growth of the business

Market share

Service to the community

Let’s look deeper.

Profit

When a business is owned by private individuals it usually wants to make a profit. The owners each take a share. Profits are needed to:

Pay a return to the owners of the business

Provide finance for further investment in the business.

Without profit, the owners will probably close the business.

Survival

When a business is new, or the economy is moving into recession (a significant decline in economic activity), the business will be very concerned with survival. The business could lower its prices in order to survive.

Returns to shareholders

Shareholders own limited companies. The managers will often set the objective of ‘increasing returns to shareholders.’ This discourages shareholders from selling their shares and the managers keep their job. Returns to shareholders are increased in two ways:

Increasing profit and the share of profit paid to shareholders

Increasing share price

Growth

Owners usually aim for growth in order to:

Make jobs more secure if the business is larger

Increase the salaries and status of managers

Open up new possibilities by moving into new products and new markets

Spread the risks by moving into new products and new markets

Obtain a higher market share

Growth will only be achieved if the customers are pleased with the products or services.

Market share

Here is where math is involved. If the total value of shoes sold is a 100 million dollars in a year and Nike sold 20 million dollars’ worth of shoes, then Nike’s market share is 20%.

Market share % = (Company sales ÷ Total market sales) x 100

Increased market share gives a business:

Good publicity since it could say it’s becoming the ‘most popular’

Increased influence over suppliers as they will be very keen to sell to a business that is larger than others

Increased influence over customers (like in setting prices)

Providing a service to the community (and social enterprises while we’re at it)

Social enterprises are operated by private individuals - they are in the private sector - but do not have just profit as an objective. They often set three objectives for their business:

Social: To provide jobs and support for disadvantaged groups or minorities, such as the disabled or homeless.

Environmental: To protect the environment.

Financial: To make a profit to invest back into the business and expand its social work

Why business objectives could change

No business has the same objective forever! Here are some situations where a business might change its objective:

A business set up recently has survived for three years and the owner now wants to work towards more profit.

A business has a higher market share and now the owner wants to earn higher returns for shareholders.

A profit-driven business operates in a country facing economic recession so now has the short-term objective of survival.

The main internal and external stakeholders groups and their objectives

A stakeholder is any person or group with a direct interest in the performance and activities of a business.

The following groups of people are involved in business activity in one way or another, or are affected by it:

Owners

Workers

Managers

Consumers

Government

The whole community

Banks

These groups called the stakeholders of the business as they have an interest in how it is run. Some are internal - they work for it or own it - and some are external - they are groups outside the business.

Here’s a big table with a bunch of information. Good luck.

Stakeholder group | Main features | Most likely objectives for the stakeholder group |

|---|---|---|

Owners (internal) | They put capital in to set up and expand the businessThey take a share of profits. If the business does not attract customers, they may lose the money they invested.They take risks. | share of the profitsgrowth of the business |

Workers (internal) | They are employed by the business.They have to follow the instructions of managersThey may need trainingThe may be employed full-time, part-time, temporarily or permanently.If there is not enough work for all workers, some may be made redundant and told to leave the business. | regular paymentcontract of employmentjob securityjob that gives satisfaction |

Managers (internal) | They are employed by the business.They take important decisions.Successful decisions = business expandsPoor decisions = business fails | high salaries because of their important workjob securitygrowth of the business so they can have more status and power |

Customers (external) | They are important to every business. They buy the products or services. Without enough customers, a business will eventually fail.The most successful businesses often find out what customers want before making goods or providing services - this is called market research. | safe and reliable productsvalue for moneywell-designed products of good qualityreliability of service and maintenance |

Government (external) | It is responsible for the economy of the country. It passes laws to protect workers and customers. | wants businesses to succeed in its country to employ workers and pay taxesexpects all firms to stay within the law |

The whole community (external) | The community is greatly affected by business activity (example, dangerous products might harm the population)Business create jobs and allow workers to raise their living standards. | jobs for the working populationproduct that is safe for the environmentsafe products that are socially responsible |

Banks (external) | They provide finance for the business’ operations | expect the business to be able to pay interest and repay capital lent (past tense of lend) |

Objectives of public sector businesses

Reminder, governments own public sector businesses. What are their likely objectives for these businesses?

Financial: Meet profit targets set by government - sometimes the profit is reinvested back in the business, sometimes it’s handed back to the government - the owner.

Service: Provide a service to the public.

Social: Protect or create employment in certain areas

Conflict of stakeholders’ objectives

We mentioned that businesses could set one objective and aim for it. However, life isn’t that simple. Most businesses are trying to satisfy the objectives of more than one group - since they can conflict.

Refer to the table above for the objectives.

Cheap method of production may increase profit (owner wants this) but cause pollution (community doesn’t want this)

Expanding an oil factory for example is business growth (managers want this) but leads to a noisier, dirtier local environment (community doesn’t want this)

Introducing new machines could lead to higher profits (owner wants this) but reduces the jobs (government doesn’t want this)

Expansion (managers want this) could be expensive, reducing payments and short term profits to owners (owner doesn’t want this)

So managers have to compromise and try to satisfy the most important groups or as many as they can.

6 - Motivating employees

Motivation is the reason why employees would want to work hard and effectively for a business.

Some benefits of a well-motivated workplace:

High output per worker

Willingness to accept change

Two-way communication with management

Low labor turnover

Loyal workforce

Low rates of absenteeism

Low rates of strike action

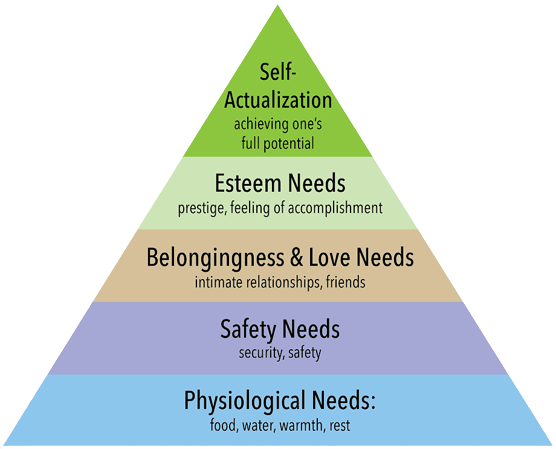

Maslow

This is Maslow’s hierarchy of needs. Maslow studied motivation.

If employees are going to be motivated to work effectively, then higher levels in the hierarchy must be available to them. Money alone is not the only route to productivity.

Each level in the hierarchy must be achieved before an employee can be motivated by the next level (Example, you need safety needs before you can be motivated by belongingness & love needs).

Some problems in some levels don’t appear to exist for some people, while some rewards appear to fit into more than one level. For example, money allows the basic/physiological needs to be purchased, but a high pay can also by a status symbol (esteem needs).

When you work for yourself, you can work hard and effectively since you’re following your own beliefs and methods. However, when you work for somebody else, you might not be as effective. Since one of the jobs of managers is to motivate employees, many studies have been carried out to find out what makes employees work effectively. Here are some.

F.W. Taylor

Taylor conducted experiments into how labor productivity could be increased. He based his ideas assuming that all individuals are motivated by personal gain, so if they are paid more, they will work more effectively.

An idea of his was looking at factory workers. He would set a goal and if they produced this target output, they would be paid more money. He saw them as machines - When they worked hard, they would be more productive and therefore the labor costs would be low for each unit produced. However, there are downsides.

Take:

His ideas were too simplistic - people can be motivated by a lot of things, not just money.

Even after paying an employee more money, if they are unfulfilled by their work in some way, there will be no increase in productivity/effectiveness.

Problems will arise if you cannot easily measure an employee’s output.

Herzberg

According to Frederick Herzberg, humans have two sets of needs; one is for the basic needs (which he called hygiene factors/needs) and one is for a human being growing psychologically (which he called motivational needs or motivators).

Here are some.

Motivators:

Achievement

Recognition

Personal growth / Development

Advancement / Promotion

Work itself

Hygiene factors:

Status

Security

Work conditions

Company policies and administration

Relationship with supervisor

Relationship with subordinates

Salary

According to Herzberg, hygiene factors must be satisfied or they can act as demotivators. However they are not motivators as once satisfied their effects quickly wear off. On the other hand, true motivators will motivate employees.

People often say that money is the main motivator. It may not be. There are other methods, but let’s explore both anyway.

Methods of motivation - financial rewards

Here are five of the most frequently used financial methods of motivation that give employees incentives to encourage them to work harder.

Wage

Salary

Bonus

Commission

Profit sharing

Wages

Wages are often paid every week.

Advantages

Worker gets paid regularly and does not have to wait long. Wages are usually paid to manual workers like those in a warehouse or factory.

Employees that work longer than their normal hours can usually be paid overtime. This is an incentive to work additional hours when required by the business.

Disadvantages

Since wages are paid weekly they have to be calculated every week which takes time and money

People called “wages clerks” are often employed to perform this task

Time rate

Time rate is payment by the hour (or a period of time). For example if you are paid $10 per hour and work 20 hours, you will be paid $200.

Advantages

This makes it easy to calculate wages

The worker knows exactly how much they will be paid

Disadvantages

The hours are often recorded on a time-sheet which must be filled in and calculated by the Accounts department, which takes time.

Good and bad workers will get paid the same.

Often supervisors are needed to make sure the workers keep working and are producing high-quality products, which is more expensive because more supervisors are needed.

A clocking-in system is needed to determine how many hours employees work.

Time rate is often used where it is difficult to measure the output of the worker, for example a bus driver.

Piece rate

Piece rate is where the workers are paid depending on the quantity of the products made. The more they make, the more they get paid. Usually, they are paid a basic rate with additional money according to how many products have been produced.

Advantages:

Encourages workers to work faster and produce more goods.

Disadvantages:

Workers will focus on making a lot of products and ignore quality, which will require a quality control system (this is expensive). If poor quality goods are produced, they could damage the reputation of the business.

Workers who are careful in their work will earn less than those who rush, which will be seen as unfair. Friction/arguments/fights between employees may be caused as some will earn more than others.

If the machinery breaks down, employees will earn less. Because of this, workers are often paid a guaranteed minimum.

Salaries

Salaries are paid monthly, normally straight into a bank account. They are not paid in cash.

Advantages:

A salary is calculated as an amount of money per year, but it is divided into 12 monthly amounts. This means it is easy to calculate salary costs for the business.

The employer has the money in their bank account for longer than if they were paying their workers’ wages as salaries are paid only once a month.

The payment only has to be calculated once a month, which is cheaper than wages’ at least four times a month.

Disadvantages:

Workers may prefer to be paid weekly.

No payment for extra time worked - workers may be reluctant to work longer.

Bonuses

A bonus is a lump sum paid to workers who have worked well. It can be paid at the end of the year or at intervals during the year.

Advantages:

Bonuses are optional.

They are paid in addition to the standard wage or salary.

They can have a positive motivating effect. Workers will consider themselves ‘special’ if they are paid a bonus.

Disadvantages:

Bonuses can become expected every year and if they are not paid, employee disappointment can be difficult to manage.

If a small number workers are paid a bonus, then other workers will resent this and question why they did not receive one.

Commission

Additional payments for sales staff. The more sales they make the more they are paid. Similar to piece rate but only for sales staff. They are paid in addition to existing wages or salary.

Disadvantages:

If the sales staff are very persuasive and encourage people to buy goods they don’t really want, the business may see an increase in sales only in the short term then fall again as it gets a bad reputation.

It can be very stressful for sales staff as if they have a bad month their pay will fall.

There might be too much competition between sales staff.

Profit sharing

Employees receive a share of the profits in addition to the wages or salary.

Disadvantages:

If a business makes low profits or even a loss, no profit share will be possible leading to employee disappointment.

The profit share is usually calculated on the basis of an addition percentage of a worker’s existing wage or salary - so higher paid workers will receive a higher profit share. This could cause disappointment among lower paid workers who would consider that they worked just as hard!

Fringe benefits

In addition to these financial rewards, businesses may give other benefits to employees.

Examples include:

Company vehicle

Discount on products

Healthcare paid for

Children’s education fees paid

Shares given to employees

Generous expense accounts

Pension paid for by the business[

Free trips abroad/holidays

Motivating factors - non-financial methods

Workers can be motivated by things other than money. Many of these are focused on increasing job satisfaction - the enjoyment from doing a job.

Some of the motivation theories emphasize that the important aspects of jobs are that they should give recognition, responsibility and satisfaction and allow the employee to feel a sense of achievement.

Job rotation

This involves the workers swapping round and doing each specific task for only a limited time and then changing around again. This increases the variety in the work and also makes it easier for managers to move workers around if people are ill and their jobs need covering.

Job enrichment

This involves looking at jobs and adding tasks that require more skill or responsibility. Addition training may be necessary for employees to take on extra tasks.

Autonomous work groups or teamworking

This involves a group of workers being given responsibility for a particular process. They can decide as a group how to complete the task or organize the jobs. This makes them more involved in the decision making and they can take responsibility for this process. This gives them a feeling of control therefore increasing job satisfaction.

Training

Improving a worker’s level of skills can motivate them. First, they can feel a great sense of achievement if they successfully gain and apply new work-based skills. Second, they could now be given more challenging and rewarding work to perform, and this is an important element of job enrichment!

Workers can also feel as if they have been selected for training courses, giving them a feeling that their good work has been recognized.

Opportunities for promotion

Many businesses prefer to fill posts of responsibility from within the existing workforce. This internal recruitment offers opportunities for advancement to existing workers. Not only does the business benefit from promoting workers who already know how the business runs, but it also gains from better motivated workers. The employees will feel recognized, have a higher status and be given more challenging work to perform.

7 - Organization and management

Organizational structure refers to the levels of management and division of responsibilities within an organization. This structure is often presented on an organizational chart with several levels of hierarchy.

An organizational chart refers to a diagram that outlines the management structure of a business.

Hierarchy refers to the levels of management in an organization, from the highest to the lowest.

A level of hierarchy refers to managers/supervisors/other employees who are given a similar level of responsibility in an organization.

Organization charts

Main features of an organizational chart:

It is a hierarchy, meaning there are different levels in the organization, each with a different degree of authority.

It is organized into departments.

There is a chain of command. This is how power and authority are passed down from the top to the lower levels in the organization.

Advantages:

The chart shows how everybody is linked together in the organization. All members are aware of which communication channel is used to reach them with messages and instructions

Every individual can see their own position in the organization. They can identify who they have authority over and who has authority over them.

It shows the links and relationship between different departments.

Everyone is in a department and this gives a sense of belonging.

Chain of command and span of control

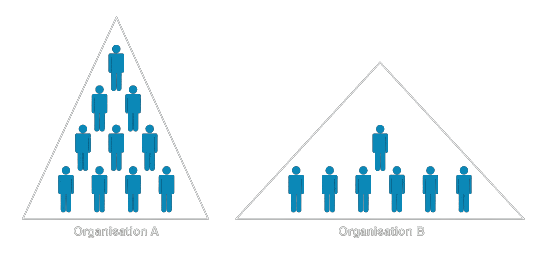

As you can see, Business A has a tall structure and a long chain of command. Business B has a wide structure and a short chain of command. The span of control (the number of subordinates working directly under a manager) is wider in Business B than in A. However, the chain of command is longer in Business A than in B. The longer the chain of command, the shorter the span of control.

Advantages of a short chain of command:

Communication is quicker and accurate.

Top managers are less remote from the lower level of the hierarchy. This means they can be more in touch with the lower levels.

Spans of control will be wider. This is an advantage because if superiors have more people to manage, it will encourage managers to delegate more (delegation will be explained soon). There will also be less direct control of each worker and they will feel more trusted.

Shorts chains of command come with wider spans of control, which could lead to managers losing control of what their subordinates are doing since there are a lot. The subordinates could make many mistakes.

The role and functions of management

All organizations have managers. They may have different titles, leader, director, headteacher, but they are managers. They also have tasks and functions:

Planning

Planning for the future of the organization involves setting aims or targets. These will give the organization a sense of purpose and direction. In addition to the aims, a manager must also plan for the resources needed by the business.

Organizing

A manager can’t do everything. Tasks must be delegated to others in the organization. It is the manager’s responsibility to organize people and resources effectively.

Coordinating

Coordinating means ‘bringing together’. A manager may be good at planning and organizing but may have failed at bringing the the people in the organization together. This is a danger. If different departments only work in their own area without making contact with other departments, issues will arise.

Commanding

Managers have to guide and tell people what to do, setting deadlines and tasks.

Controlling

Managers must try to measure the work of all employees to make sure they are on target.

Without managers a business will lack:

A sense of control and direction

Coordination between departments leading to wastage of effort

Control of employees

Organization of resources

Delegation

Delegation means giving a subordinate the authority and permission to perform particular tasks.

Advantages of delegation for the manager:

Managers cannot do everything themselves. By delegating, they can focus on other important things.

Managers are less likely to make mistakes if some of the tasks are performed by their subordinates.

Managers can measure the success of staff easily. They can see how well they have done in performing their delegated tasks.

Advantages of delegation for the subordinate:

The work becomes more interesting and rewarding.

The employee feels more important and trusted.

Delegation helps to train workers.

Some managers are reluctant to delegate. Some reasons are:

The subordinate might fail.

The subordinate might do better than the manager making them very insecure

Delegation reduces control by supervisors.

Traits of a good manager

A good manager should:

Motivate employees

Give guidance and advice to employees

Inspire employee

Manage resources effectively

Increase business profitability

Leadership

Studies on motivation emphasized the importance of good management and the need for leadership.

Styles of leadership

Autocratic leadership

Democratic leadership

Laissez-faire leadership

Autocratic leadership

Autocratic leadership is where the manager expects to be in charge of the business and to have their orders followed. They make basically all the decisions and only tell the employees what they need to know, separating themselves from the rest of the employees. Communication in the business is mainly one way (that is, downward or top-down). Workers have little say or opportunity to comment on anything.

Advantages:

Decisions can be made quickly when needed

Disadvantages:

No opportunity for employee input into key decisions, which can be demotivating.

Democratic leadership

Democratic leadership is when other employees are involved in making decisions and information is openly discussed before a final decision is made. Communication is both ways.

Advantages:

Better decisions could result from consulting employees

Employees will feel more motivated and heard

Disadvantages

Unpopular decisions, such as firing workers, could not be made using this style of leadership.

Laissez-faire leadership

Laissez-faire leadership is when the business tells the employees it’s objectives, then the employees are left to make their own decisions and do their own work. The leader has a very limited role to play.

Advantages:

Encourages employees to be responsible and creative.

Disadvantages:

Not appropriate in organizations where consistent and clear decision-making structure is needed.

A good manager will adopt the style of leadership that best suits each situation.

Trade unions

A trade union is a group of employees who have joined together to ensure their interests are protected. When a person starts work, they may be asked by someone who represents a trade union if they want to join. Upon joining, they will pay a yearly fee.

Advantages of a trade union for an employee:

Strength in numbers when negotiating with employees

Improved employment conditions like rates of pay and holidays

Improved environment where people work such as noise or heating

Improved benefits for members who are not working because they are sick, retired or have been made redundant.

Improved job satisfaction by encouraging training.

Advice or financial support if a member thinks they have been unfairly dismissed or mistreated.

Benefits such as discounts in certain shops

More secure employment where there is a closed shop.

A closed shop is when all employees must be a member of the same trade union.

Disadvantages of a trade union for an employee:

It costs money to be a member.

Workers may be required to take action even if they don’t agree with something.

Advantages of a trade union for an employer:

Improved communication between workers and management

Wage agreements will be easier to negotiate.

Disadvantages of a trade union for an employer:

Trade unions can organize strikes if they do not receive the pay or work conditions they demand

Wages are likely to be higher when many employees are trade union members.

8 - Recruitment, selection and training of employees

Recruitment is the process of identifying that the business needs to employ someone up to the point at which applications have arrived at the business.

Employee selection is the process of evaluating candidates and selecting an individual for employment.

These two are the most familiar roles of the HR department but there are several others. This chapter studies them in detail.

Recruitment and selection

Businesses need to start recruitment and selection when:

an employee leaves and has to be replaced

it is a new business starting up and needs employees

it wants to expand by employing more people

The recruitment process gives the business an opportunity to assess employees. This job is usually taken by the Human Resources department. Small businesses don’t recruit enough people to make having a Human Resources department worth it.

The recruitment process is summarized in this list.

vacancy arises

job analysis

job description

job specification

job advertised in appropriate media

application forms and shortlisting

interviews and selection

vacancy filled

The recruitment process

Job analysis and description

The first stage is carrying out a job analysis. A job analysis identifies and records the responsibilities and tasks relating to a job to see who will fit it best. Once this is done, a job description will be produced, which has several functions:

It is given to the applicants for the job so they know what the job entails.

It will allow for a job specification to be drawn up to see if the applicants match up to the job so that the people with the right skills will be employed.

Once someone has been employed, if they are doing poorly and a dispute occurs about the employee’s tasks, the job specification can be referred to in order to settle these questions.

Job descriptions usually entail the main purpose of the job, main duties, occasional duties, training that will be offered, etc.

Job specification

This list has desirable and essential requirements and qualifications for a job. They usually include:

The level of educational qualifications

The amount and type of experience

Special skills

Personal characteristics like personality

Internal and external recruitment

There are different kinds of recruitment.

Internal recruitment

When a vacancy is filled from someone who is an existing employee of the business.

Advantages:

It is quicker and cheaper than external recruitment

The person is already known to the business so their potential and reliability is known.

The person already knows how the organization works

It will motivate employees to see their co workers being promoted as they may be promoted as well.

Disadvantages:

No new ideas or experience come into the business

There may be rivalry and jealousy towards who gets the promotion

The quality of internal candidates may be low.

External recruitment

This involves advertising the vacancy beyond the business itself. This can be done in several ways:

Local newspapers

National newspapers

Specialist magazines

Online recruitment sites

Recruitment agencies

Job centers run by the government

Job advertisements for external recruitment

The business will need to ask itself these questions:

What should be included in the ad?

Where should the ad be placed?

How much will the advertising cost and is it withing the budget of the HR department?

Methods of application

A job will ask for a CV (curriculum vitae) or résumé. It is a summary of a person’s qualifications and qualities and should contain:

Name

Address

Telephone number

Email address

Nationality

Education and qualifications

Work experience

Positions of responsibility

Interests

Names and addresses of referees

The letter of application should also outline why the applicant wants the job and why they feel they would be suitable.

Methods of selection

The referees mentioned in the CV will be asked to provide an opinion on the applicant’s character, honesty, and suitability for the job. Referees can range from a school to a former employer. These can be brought up in interviews. The main purposes of an interview are to assess in the shortest possible time:

ability to do the job

any personal qualities that are an advantage or disadvantage

the general character and personality of the applicant.

Some businesses include tests in their selection process, for example:

Skills tests aim to show the ability of the candidate to carry out certain tasks

Aptitude tests aim to show the candidate’s potential to gain addition skills.

Personality tests are used if a particular type of person is required for the job.

Group situation tests give tasks to applicants to complete in group situations under observation.

Recommending which workers to employ

The final decision depends on several factors:

Work experience

Education and other qualifications

Age

Applicant having a good understanding of how the business operates (if internal)

Applicant having new experience and skills gained from outside the business (if external)

Rejecting unsuccessful applicants

Unsuccessful applicants should be informed that they did not get the job and thanked for applying.

Part-time and full-time employees

A part-time employee is someone who works less hours than a full-time employee. There is no specific number of hours, but a full-time employee usually works 35+ hours a week. The contract of employment will show the number of hours and whether it is a part-time or a full-time job.

Advantages to a business of part-time employees:

More flexible in hours of work

Easier to ask employees just to work at busy times

Easier to extend business opening/operating hours by working evenings or at weekends

Employee is willing to accept lower pay

Reduces business costs compared to employing and paying a full-time employee

In some countries it is easier to make part-time workers redundant

Disadvantages to a business of part-time employees:

Less likely to seek training since the employee may see the job as temporary

Takes longer to recruit two part-time workers than one full-time employee

Part-time employees can be less committed to the job

May be more likely to leave for another job

More difficult to communicate with part-time employees when they are not in work.

The advantages and disadvantages of full time employees are the opposite to part time employees, so just switch them around.

The importance and methods of training

Training is very important. It may be used to:

Introduce a new process or equipment

Improve efficiency

Provide training for unskilled workers to make them more valuable to the company

Decrease supervision needed

Improve opportunity for internal promotion

Decrease chances of accidents

Training is usually trying to achieve one or more of the following:

Increase skills

Increase knowledge

Improve employees’ attitudes to encourage them to accept change and raise awareness.

There are 3 main types of training:

induction training

off the job training

on the job training

Induction training

This is carried out when an employee is new to the job. It involves showing the employee around, introducing them to their coworkers and supervisors and told about their tasks. They are also usually given a list of things to expect like the environment, a schedule etc.

Advantages of induction training:

Settles new employees into their job quickly

May be a legal requirement to give health and safety training at the start of a job

Means workers are less likely to make mistakes

Disadvantages of induction training:

Is time-consuming

Means wages are paid but no work is being done by the worker

Delays the start of the employee commencing their job

On the job training

Where a person is trained by watching a more experienced worker doing the job. They are shown what to do.

The advantages of on-the-job training:

Individual tuition is given and it is in the workplace so the employee does not need to be sent away

It ensures there is some production from the worker while they are training

Costs less than off-the-job training

It is training tailored to the specific needs of the business

The disadvantages of on-the-job training:

The trainer will not be as productive as usual

The trainer may pass on bad habits to the trainee

It may not lead to training qualifications recognized outside the business

Off-the-job training

This is where the workers goes away from the place they work. It could be a different building, a different room, a training center etc., and there are techniques used to train the employee.

Advantages of off-the-job training:

A broad range of skills can be taught using these techniques

If these courses are taught in the evening after work, they are cheaper for the business since the employee will still carry out their normal duties during the day

The business will only need to pay for the course and it will also not lose the output of the employee

Employees may be taught a variety of skills

Uses expert trainers

Disadvantages of off-the-job training:

Costs are high

It means wages are paid but no work is being done by the worker

Additional qualifications means it allows employee to easily leave and find another job.

Why reducing the size of the workforce might be necessary

Workforce planning is where a business decides on the type and number of employees needed in the future. Often businesses will need more employees when expanding, but sometimes they need to downsize the workforce. This can be because of:

Introduction of automation (machines)

Falling demand for their goods or services

Factory/shop/office closure

Relocating their factory abroad

A business has merged or been taken over and some jobs have become surplus to requirements.

The human resources department plans how this will be achieved by:

Finding out the skills of all the present employees

Not including anyone who will be leaving soon, for example, due to retirement

Consulting with existing staff as to who could and would want to retrain to fill the new jobs

Preparing a recruitment plan to show how many new staff will be needed and how they should be recruited (internally/externally).

A business can reduce the number of employees in 2 ways, redundancy and dismissal. Workers may also leave a job because they retire (are getting older and want to stop working), or resign (have found another job).

Dismissal

Where a worker is told to leave their job because their work or behavior is unsatisfactory, for example being late too many times or unable to complete tasks.

Redundancy

When a number of employees will no longer be needed, but it’s not their fault, for example during a period of falling sales.

The following factors help a business to decide which workers to make redundant and which to keep:

Some workers may volunteer and be happy to be made redundant - because they may have another job or want to retire early etc.

Length of time employed by the business - workers who have worked for the business for a long time will usually be kept due to their experience.

Workers with essential skills that are needed by the business are often kept.

Employment history of the worker - if they have a good attendance and record.

Which departments of the business need to lose workers and which need to keep workers.

Legal controls over employment issues

Many countries have passed laws that affect the relationship between employers and employees. The most important issues affected by legal controls are:

Employment contracts

Unfair dismissal

Discrimination

Health & safety

Legal minimum wage

Contract of employment

In many countries it is a legal requirement for employers to provide new employees with a contract of employment to sign which sets out the terms of the relationship between the employee and employer. It usually includes:

name of employer and name of employee

job title

date when employment is to begin

hours to be worked

rate of pay

when payment will be made

holiday entitlement

amount of notice that the employer or employee must give to end the employment

Impact of employment contracts on employers and employees

Both know what is expected of them.

Provides some security of employment to employee.

If employee does not meet conditions, legal dismissal is allowed.

Unfair dismissal

This occurs when an employer ends a worker’s contract of employment for a reason not covered by that contract. This is illegal in many countries and the worker has the right either to compensation or to be offered their previous job back by taking the case to an industrial tribunal, a type of law court.

Impact of unfair dismissal on employer and employee

Employer must keep very accurate records of a worker’s performance if they want to claim the employee has broken the contract before dismissing them.

Employees have security of employment as long as they fulfil their contract.

Allows employees to take their employer to an industrial tribunal if they feel they have been treated unfairly.

Makes a business less likely to unfairly treat employees as they know they may be taken to an industrial tribunal and may have to pay compensation or give the employee their job back.

Protection against discrimination

Discrimination at work is when employers make unfair decisions based on unfair reasons. The main examples are when workers are treated differently because they:

are of a different race or color

belong to a different religion

are of a different gender

are considered too old/young for the job

are disabled or differently abled in some way.

In most countries this is illegal.

Impact of discrimination on employers and employees:

Employees should be treated equally in the workplace.

By following these laws carefully, businesses should recruit and promote staff on merit alone and this should help increase motivation at work.

Healthy and safety at work

In our modern world most employers care for their workers’ safety. One reason for this is because there are laws about it. In most countries there are now laws which make sure that all employers:

protect workers from dangerous machinery

provide safety equipment

maintain reasonable workplace temperatures

provide hygienic conditions and washing facilities

do not insist on excessively long shifts and provide breaks

Impact of health & safety on employers and employees:

Cost to employer of meeting the health & safety regulations, for example better safety equipment

Time needs to be found to train workers in health and safety precautions.

Workers feel safer and more motivated.

Reduces accident rate and the cost of paying for workers injured at work.

Some managers provide working conditions of a high safety standard even when not required in the country. The managers have taken an ethical decision. An ethical decision is a decision taken by a manager or a company because of the moral code observed by the firm.

Legal minimum wage

Workers have a right to be paid. There should be a written agreement between employees and employers which contains details of:

hours of work

nature of the job

wage rate to be paid

how frequently wages will be paid

what deductions will be made from wages like tax

In some countries employers can pay whatever they want, but others have a minimum.

Impact of legal minimum wage on employers and employees

It should prevent strong employers from exploiting unskilled workers who cannot find other work easily.

It will encourage employers to train unskilled workers since they have to be paid higher

It will encourage more people to seek work

Low-paid workers will earn more.

Increases business costs, forcing them to raise prices.

Some employers will not be able to afford wage rates and make workers redundant instead.

Other workers may be jealous of workers with higher wages.

9 - Internal and external communication

Communication is the transferring of a message from a sender to a receiver.

Internal communication

Internal communication is between members of the same organization. Here are some examples:

A paper on a table saying “please do not smoke here”

A manager asking a worker “how many hours did you work last week?”

A notice on a board saying “there will be a fire drill at 11 today”

A telephone call

An email

A voice message

There are more, but these are basic examples.

External communication

External communication is between the organization and outside the organization. Some main examples are:

Orders for goods from supplies

Sending information to customers about prices

Advertising goods or services

Asking customers to pay bills on time.

Internal and external communication are both as important.

Why external communication is important

It is very important, because imagine if a business didn’t have these examples:

A manager writes a letter to the tax office asking how much tax must be paid this year.

A sales manager records a customer order taken online.

A business must contact thousands of customers who have bought a product which turned out to be dangerous.

The process of effective communication

Effective communication involves the following four features:

A sender of the message

A medium of communication or a method for sending the message, e.g. a message, a notice board, an email etc.

A receiver of the message

Feedback, where the receiver confirms that the message has been received and responds to it.

One way and two-way communication

One-way communication involves a message which does not call for or require a response.

Two-way communication is when the receiver gives a response to the message and there is a discussion about it.

Advantages of two-way communication:

It should become clear to the sender whether or not the receiver has understood and acted upon the message.

Both people are now involved in the communication process, which can motivate the receiver.

Communication methods

Verbal methods involving the sender speaking to the receiver

Written methods such as letters, posters and emails

Visual methods including diagrams, charts and videos

Choosing the appropriate method

There are several factors. Here are some to help choose:

Speed - is it important that the receiver gets the message quickly, e.g. right before a flight?

Cost - is it important to keep costs down?

Message details - how detailed is the message? If it contains graphs, then visual methods are probably required.

Leadership style - is the leadership style democratic? if it is, then two-way verbal communication is needed.

The receiver - Who is the target receiver(s)? If they are in the next office, then one-to-one conversation will be effective.

Verbal communication methods

Face-to-face

Video conferencing

Meetings and team briefings

Telephone conversations

Advantages of verbal communication

Information can be given out quickly

There is opportunity for immediate feedback

The message is often reinforced by facial expressions and body language

Disadvantages of verbal communication

In a big meeting, there is no way of telling whether everybody is listening or not.

It can take longer to use verbal methods when feedback occurs than to use a written form of communication.

When an accurate and permanent record of the message is needed, such as a warning to a worker, a verbal method is inappropriate.

Written communication methods including those based on information technology

Written methods can include the following:

Business letters

Memos

Reports

Text messages

Email

Advantages of written communication

There is hard evidence of the message which can be referred to in the future

It is essential for certain messages involving complicated details.

A written message can be copied and pasted.

Electronic communication is quick and cheap.

Disadvantages of written communication

Direct feedback is not always possible

It is not easy to check that the message has been received and acted upon

The language used can be difficult for some receivers to understand.

There is no opportunity for body language to be used.

Visual communication methods

Visual methods can include the following:

Films, videos and PowerPoints

Posters

Charts and diagrams

Photographs and cartoons

Advantages of visual communication:

These methods can present information in an appealing and attractive way

They can be used to make a written message clearer by adding a chart or diagram.

Disadvantages of visual communication:

There is no feedback and the sender may need other methods to check if the message has been received.

Charts and graphs are difficult for some people to interpret.

Formal and informal communication

Formal communication is when messages are sent through established channels using professional language.

Informal communication is when information is sent and received casually using everyday language.

Directions of communications

Downward or top-down communication is when messages are sent from managers to subordinates.

Upward or down-top communication is when messages are sent from subordinates to managers.

Horizontal communication is when people at the same level communicate with each other.

Communication barriers

Communication barriers are factors that stop effective communication of messages. Here’s a big table.

Communication barrier | Description | How it can be reduced or removed |

|---|---|---|

Problems with the sender | Language which is too difficult is used.The sender speaks too quickly. The sender communicates the wrong message or sends it to the wrong receiver The message is too long and this prevents the main point from being understood. | Sender could use understandable language. The sender should make the message as clear as possible. The sender must make sure that the right person is receiving the right message. The message should be as brief as possible. |

Problems with the medium | The message may be lost so the receiver does not see it. The wrong channel has been used If the message is sent down a long chain of command, the original meaning could be lost or distorted. No feedback is received | It is important to insist on feedback. The sender must select the appropriate channel. The shortest possible channel should be used to avoid this problem. This could be because a letter was sent instead of a meeting. |

Problems with the receiver | They may not be listening. The receiver may not like or trust the sender and be unwilling to act upon their message | The importance of the message should be emphasized. There should be trust between the sender and receiver or effective communication is unlikely. |

Problems with feedback | There is no feedback. It is received too slowly or is distorted. | Ask for feedback. Direct lines of communication between subordinates and managers must be available. |

10 - Marketing, competition and the customer

The Marketing department

Most businesses will have a Marketing department.

Marketing - identifying customer wants and satisfying them profitably.

18 - Production of goods and services

Managing resources effectively to produce goods and services

Production is the provision of a product or a service to satisfy consumer wants and needs. The process of production adds value to the raw materials and bought-in components. (this is a direct reference to added value, which we talked about in Chapter 1).

In business, we combine the four factors of production, ‘inputs’, to produce more valuable ‘outputs’ (the final good or service), to satisfy consumer wants or needs. However, these factors of production, also called economic resources, can be combined in different proportions to the production process.

For a business to be competitive it should combine these inputs of resources efficiently so that it makes the best use of resources at its disposal to keep costs low and increase profits.

22 - Financial information and financial decisions