Chapter 26: Business Cycles, Unemployment, and Inflation

Business cycles - Alternating rises and declines in the level of economic activity, sometime over several years

- Peak - Business activity has reached a temporary maximum. Here the economy is near or at full employment and the level of real output is at or very close to the economy’s capacity. The price level is likely to rise during this phase.

- Recession - Period of decline in total output, income, and employment. This downturn, which lasts 6 months or more, is marked by the widespread contraction of business activity in many sectors of the economy. Along with declines in real GDP, significant increases in unemployment occur.

- Trough - Output and employment “bottom out” at their lowest levels

- Expansion - Period in which real GDP, income, and employment rise. At some point, the economy again approaches full employment.

What causes business cycles?

- Fluctuations driven by shocks

- Shocks to productivity are major cause of business cycles

- Immediate cause of the large majority of cyclical changes in the levels of real output and employment is unexpected changes in the level of total spending

Cyclical impact

- Firms + industries affected most by business cycle

- Recession → Capital goods + purchases of consumer goods decrease

- Service industries + non-durable consumer good industries insulated from effects of recession

Unemployment

- Labor force - People who are able and willing to work

- Unemployment - Percent of labor force unemployed

- Data skews

- Part-time employment

- Discouraged workers - Unemployed individual who is not actively seeking employment is classified as “not in the labor force”

Types of unemployment

- Frictional unemployment - Workers who are either searching for jobs or waiting to take jobs in the near future

- Structural unemployment - Workers find it hard to obtain new jobs without retraining, gaining additional education, or relocating

- Cyclical unemployment - Caused by decline in total spending + begins in recession phase of business cycle

Natural rate of unemployment (NRU) - Economists say that the economy is “fully employed” when it is experiencing only frictional and structural unemployment. That is, full employment occurs when there is no cyclical unemployment.

- Potential output - Real GDP that occurs when the economy is “fully employed”

- NRU varies over time

Economic cost of unemployment

- Forgone output

- GDP gap - Difference between actual and potential GDP

- Higher unemployment rate → Higher GDP gap

- Okun’s law - For every 1 percentage point by which the actual unemployment rate exceeds the natural rate, a negative GDP gap of about 2 percent occurs

- Workers in lower-skilled occupations have higher unemployment rates

- Less-educated workers have higher unemployment rates

Non-economic costs of unemployment

- Loss of skills, loss of self-respect, plummeting morale, family disintegration, and sociopolitical unrest

- Increases poverty, heightens racial and ethnic tensions, and reduces hope for material advancement

Inflation - Rise in the general level of prices

Consumer Price Index (CPI) - Main measure of inflation

Reports the price of a “market basket” of some 300 consumer goods and services that are purchased by a typical urban consumer

Rate of inflation = Percent growth of CPI b/w years

Types of inflation

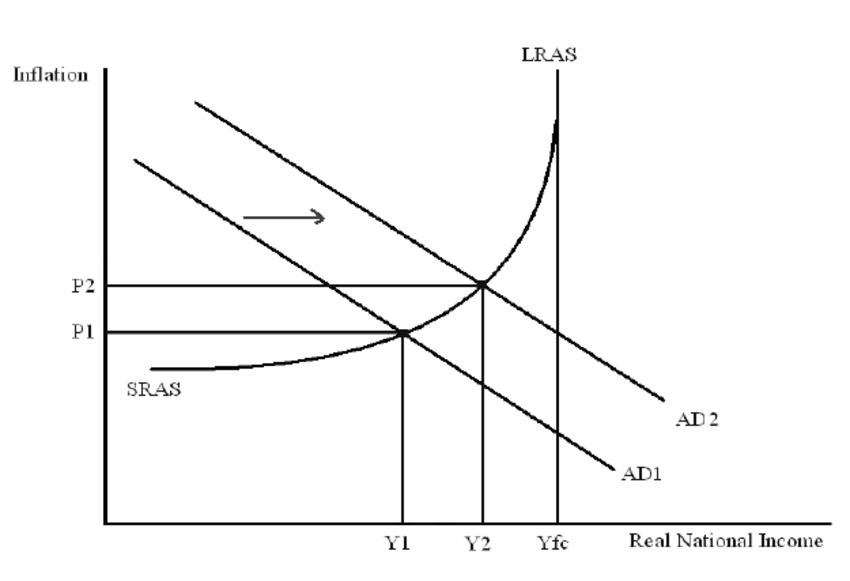

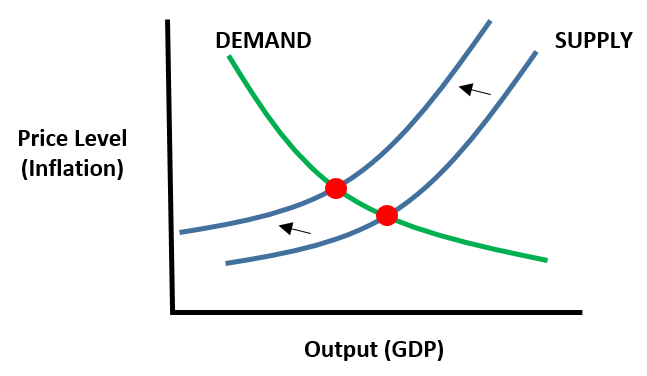

Demand-pull inflation - Excess of spending beyond economy’s capacity to produce

Cost-push inflation - Output and employment were both declining (evidence that total spending was not excessive) while the general price level was rising

- Per-unit production cost - Average cost of a particular level of output

- Difficult to distinguish b/w demand pull + cost push

Redistribution effects of inflation

- Nominal income - Number of dollars received as wages, rent, interest, or profits

- Real income - Measure of the amount of goods and services nominal income can buy; it is the purchasing power of nominal income, or income adjusted for inflation

- Unanticipated inflation - Unexpected inflation

Who is hurt by inflation?

- Fixed-income receivers - People whose incomes are fixed see their real incomes fall when inflation occurs

- Savers - As prices rise, the real value, or purchasing power, of an accumulation of savings deteriorates

- Creditors - Borrowers pay back less valuable dollars than those received from the lender, so the lenders suffer a loss of real income

Who is unaffected/helped by inflation?

- Flexible income receivers - The strong product demand and labor shortages implied by rapid demand-pull inflation may cause some nominal incomes to spurt ahead of the price level, thereby enhancing real incomes

- Cost of living adjustments (COLAs) - Adjustments to pay when CPI rises

- Debtors - Borrowers borrow real dollars, but, because of inflation, pay back the principal and interest with “cheap” dollars whose purchasing power has been eroded by inflation

Anticipated inflation

- Redistribution effects of inflation are less severe or are eliminated altogether if people anticipate inflation and can adjust their nominal incomes to reflect the expected price-level rises

- Real interest rate - Percentage increase in purchasing power that the borrower pays the lender

- Nominal interest rate - Percentage increase in money that the borrower pays the lender

Other redistribution effects of inflation

- Deflation - Declines in price level

- Mixed effects - A person who is simultaneously an income earner, a holder of financial assets, and a debtor will probably find that the redistribution impact of unanticipated inflation is cushioned

- Arbitrariness - Inflation lacks a social conscience and takes from some and gives to others, whether they are rich, poor, young, or old

Does inflation affect output?

- Inflation can reduce real output

- Inflation diverts time and effort toward activities designed to hedge against inflation

Hyperinflation - Extraordinarily rapid inflation

- Disrupts normal economic relationships

- Money becomes almost worthless

- Economic collapse