Lecture 12 Efficient Market Hypothesis and Behavioral Finance

Key Market Participants

Share Trading Parties: Individuals and institutions (e.g., fund managers, banks) involved in buying and selling shares.

Stockbrokers: Entities providing trading services, functioning either as agents for clients or conducting trades on their own account through agency or principal trading.

Agency trading: business transacted on behalf of clients

Principal trading: business transacted on the broker’s own account

Securities Exchanges: Platforms facilitating share trading, acting as self-regulatory bodies.

Fund Managers: Organizations investing funds for clients, adopting either:

a passive investment strategy (mirroring market indices for a similar return, safer)

an active strategy (aiming to outperform the market, riskier).

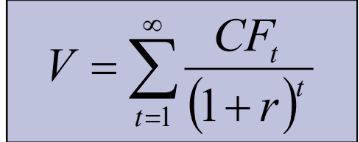

Asset Valuation

The value of an asset is calculated based on the present value of expected future cash flows, which is influenced by the information market participants have and expect.

Prices fluctuate as new information modifies these expectations.

The valuation formula involves discounting future cash flows.

—> We can have expected value for the cashflow and cost of equity as trader ‘expected’ changes, to be updated regularly.

Efficient Market Hypothesis (EMH)

According to Nobel Laureate Eugene Fama, the EMH posits that “in efficient markets, security prices fully reflect all available information”. EMH comprises two essential components:

Informational Efficiency: This pertains to the type of information reflected in prices and the speed at which new information affects prices.

Market Rationality: The assumption that all market participants act rationally when making trading decisions, aiming for higher returns.

Types of Information in Markets

Market efficiency relies on various types of information:

Historical Trading Data: Past prices and volumes.

Public Information: Accessible data such as financial statements and news announcements.

Private Information: Includes analysts’ insights and inside information not yet released publicly.

CEO and CFO has the most insider information.

Mechanisms of Market Efficiency

Investor analysis and information discovery drive market efficiency. The trading of informed investors leads to profits for early traders and aligns prices with the underlying information. This interaction ensures security prices reflect newly acquired data quickly.

When there is a new about a company, as an investor you should:

assess the probability of something bad/good happen.

how the dividend being reflected by these changes?

How is the stock price changes due to the news?

When there isn’t news about company, news about central bank and risk free rate can effect stock as well:

increase in risk-free rate makes cost of equity high thus drop stock price and vice versa.

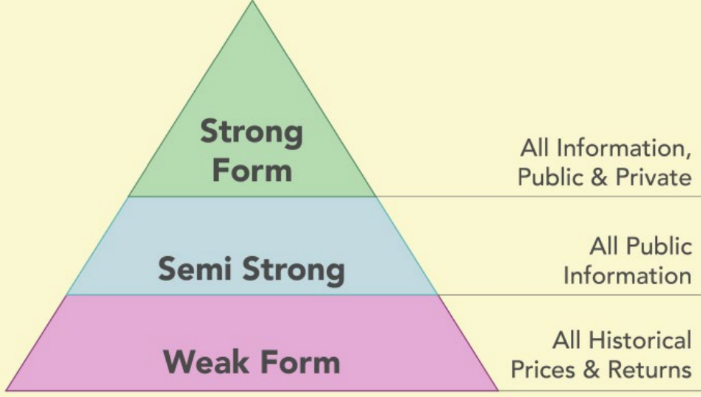

Forms of Market Efficiency

Fama (1970) delineated three levels of efficiency based on the information incorporated in prices:

Weak Form Efficiency: Prices reflect all past trading data, suggesting that technical analysis cannot provide systematic profits.

Semi-Strong Form Efficiency: Prices adjust rapidly to reflect all publicly available information, making fundamental analysis unprofitable if markets are semi-strong efficient.

Strong Form Efficiency: All information, including private insider data, is reflected in prices, indicating that even insider trading would not yield abnormal returns.

Testing Market Efficiency

Various tests measure market efficiency:

Weak Form: Assesses the profitability of trading rules based on past data; findings suggest that the ASX (Australian Securities Exchange) is weak-form efficient.

Semi-Strong Form: Event studies analyze how quickly prices adjust to new information; evidence typically supports those major markets, like the U.S., are semi-strong efficient.

Strong Form: Examines if insider trading can yield consistent profits. Studies indicate that if the market is strong form efficient, insiders cannot achieve consistent outperformance.

Will any of these analysis profitable in any of these form? | Past (Technical) | Present (Fundamental) | Private |

Weak | No | Yes | Yes |

Semi-strong | No | No | Yes |

Strong | No | No | No |

If past prices reflected by any of these types, meaning the future can’t used these to reflect. For example, if stock trading volume increasing for the past duration, meaning the technical analysis has been reflected into these past price, the future price can not be reflected using technical analysis again.

Technical Analysis

Technical analysis involves evaluating securities by analyzing statistics generated by market activity, such as past prices and trading volume. It aims to forecast future price movements based on historical patterns, assuming that past trading data can provide insights into future performance.

A market that is at least weak form efficiency, technical analysis will not be profitable and there shouldn’t be any trading rules in this market.

Fundamental Analysis

A practice using financial statements, announcements and other publicly available info about firms to pick stocks.

Not profitable in a market that is at least semi-strong form efficient, because stock prices will quickly react to publicly information.

Technical analysis wouldn’t be profitable too.

Semi-strong efficient market must also be in weak form too since historic prices and volumes are public information.

Private Information

A strong form efficient market must also be semi-strong and weak form since public information as well as historic prices and volume are all subset of all available information.

basically, everything will struggle to outperform the market: technical, fundamental, private.

Insider trading (Illegal) will not yield any abnormal returns as private information would already be reflected in share prices:

fund managers or individuals are unable to consistently outperform.

corporate insiders are unable to consistently make trading profits.

Market Anomalies

Despite evidence of market efficiency, various anomalies challenge the EMH:

January Effect: Stocks typically see higher returns in January (weak form efficiency).

Day-of-the-Week Effect: Stocks often yield lower returns on Mondays.

Size Effect: Smaller stocks outperform larger ones.

Book-to-market effect: buy stocks with small B/M ratio and sell stocks with large B/M ratio.

Momentum Effect: Buying recent winners and selling recent losers may be profitable.

Note: these anomalies disappear if you look at recent 10 years data.

EMH and passive investing

Efficient Market Hypothesis (EMH): market prices reflect all available information; it is difficult to make systematic trading profits using information to “beat the market” in the long term.

EMH supports passive investing approach: investors should hold a well-diversified market portfolio based on the portfolio and CAPM theory.

Index funds are passively-manages funds that track and invest in a particular benchmark index.

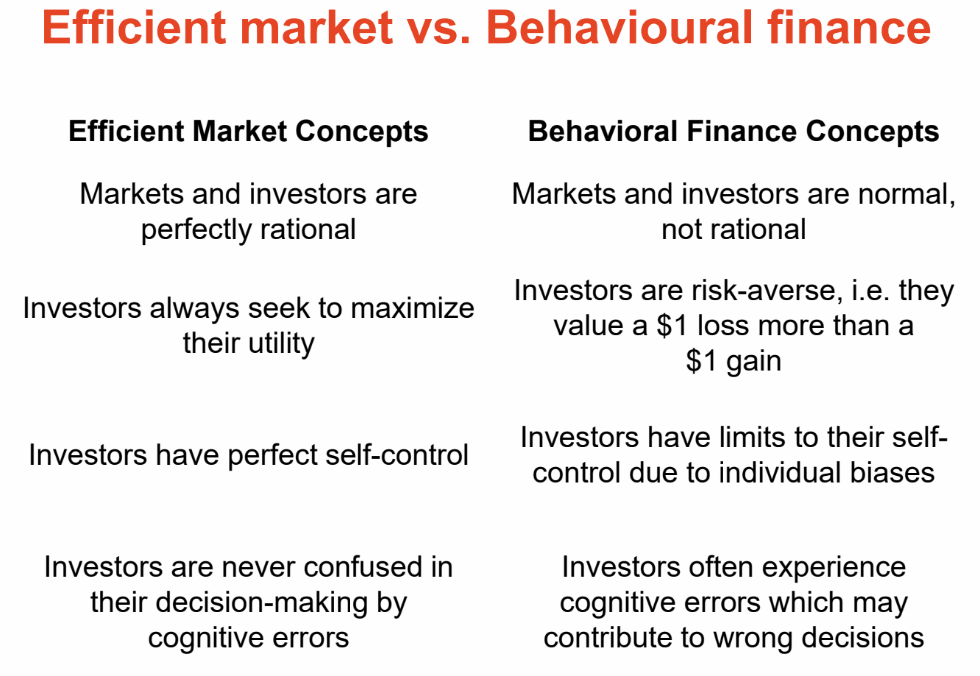

Behavioral Finance

Behavioral finance explores how psychological factors influence investor behavior, leading to market discrepancies. Observed phenomena include:

Herding: Investors often follow the crowd, FOMO, like during the GameStop frenzy, spurred by social media.

Cognitive Errors: Investors may undervalue risks or overestimate their decision-making capabilities, leading to market inefficiencies.

Investors do not always process information correctly; this results in market prices differ from fundamental values.

overconfidence bias and overestimate their abilities to identify successful investment.

some investors see investment risk as loss probability instead of standard deviation of returns.

Knowt

Knowt