Ch 18 - Fiscal Policy

(Macroeconomics)

@@Fiscal Policy Defined@@

- ^^Fiscal policy:^^ is changing the level of government spending or tax revenues to achieve economic stability. Official governmental positions such as congress and the president are able to control the federal budget in the US.

- ^^Expansionary Fiscal Policy:^^ is increasing government spending and/or decreasing tax collections in order to stimulate the macroeconomy.

- ^^Deficit Spending^^: when federal government expenditures exceed tax revenues. The government borrows money to finance the spending increase or shortfall in tax collections

- ^^Contractionary fiscal policy:^^ is decreasing government spending and/or increasing tax collections in order to cool off the economy and lower the price level.

- The federal government runs a surplus when tax revenues exceed government expenditures

@@Fiscal Policy in Theory@@

The appropriate way to remedy recession is by using expansionary fiscal policy.

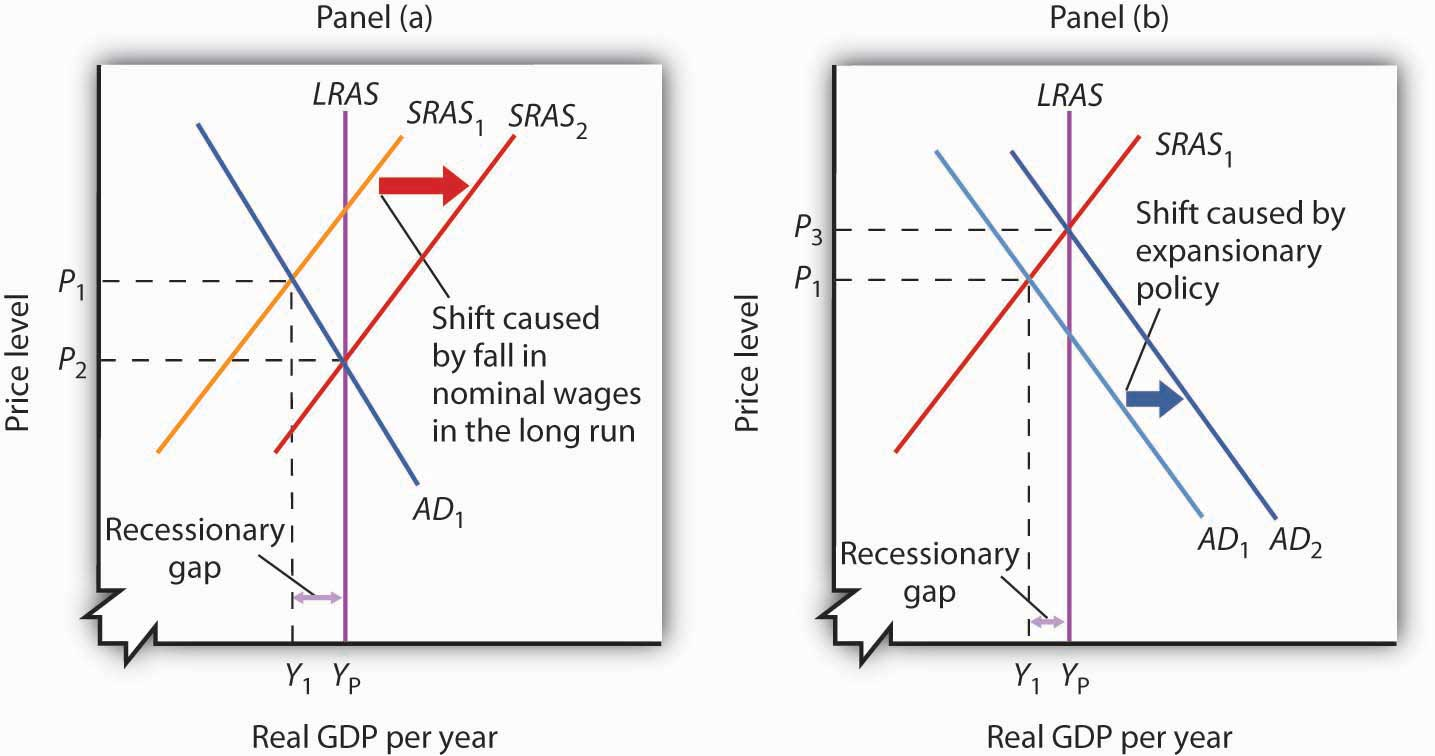

- In the Long-run adjustment to a recessionary gap, the Aggregate demand and Aggregate supply curves convey an economy where the market is producing below its potential. Resources, along with factors of production such as labor are not fully employed.

The shortfall of real GDP from its full employment potential is known as the recessionary gap, which is shown in panel A from Y1 to Yp.

- To attain long run equilibrium, wages and other resource prices must fall. This could occur since unemployed workers and idle resource put downward pressure on wages and other production costs. When resource prices fall, firms are encouraged to increase production since costs are lower. Supply increases, leading to a shift in the short run aggregate supply to the right.

- When the price level falls, the economy is producing at optimum potential. The recessionary gap is closed and the economy is in long-run equilibrium.

- The federal government increases spending or reduced tax collections, which increases aggregate demand.

- If income taxes are cut, households are left with more funds in their budgets and they spend and save more.

- If corporate taxes are cut, the owners of corporations have more income and spending increases.

A downside of expansionary policy is ^^budget deficits^^; If there are no surplus funds to draw on, then the government will be in negative territory. Increasing spending or cutting taxes, the government will be spending more and taking in less revenue

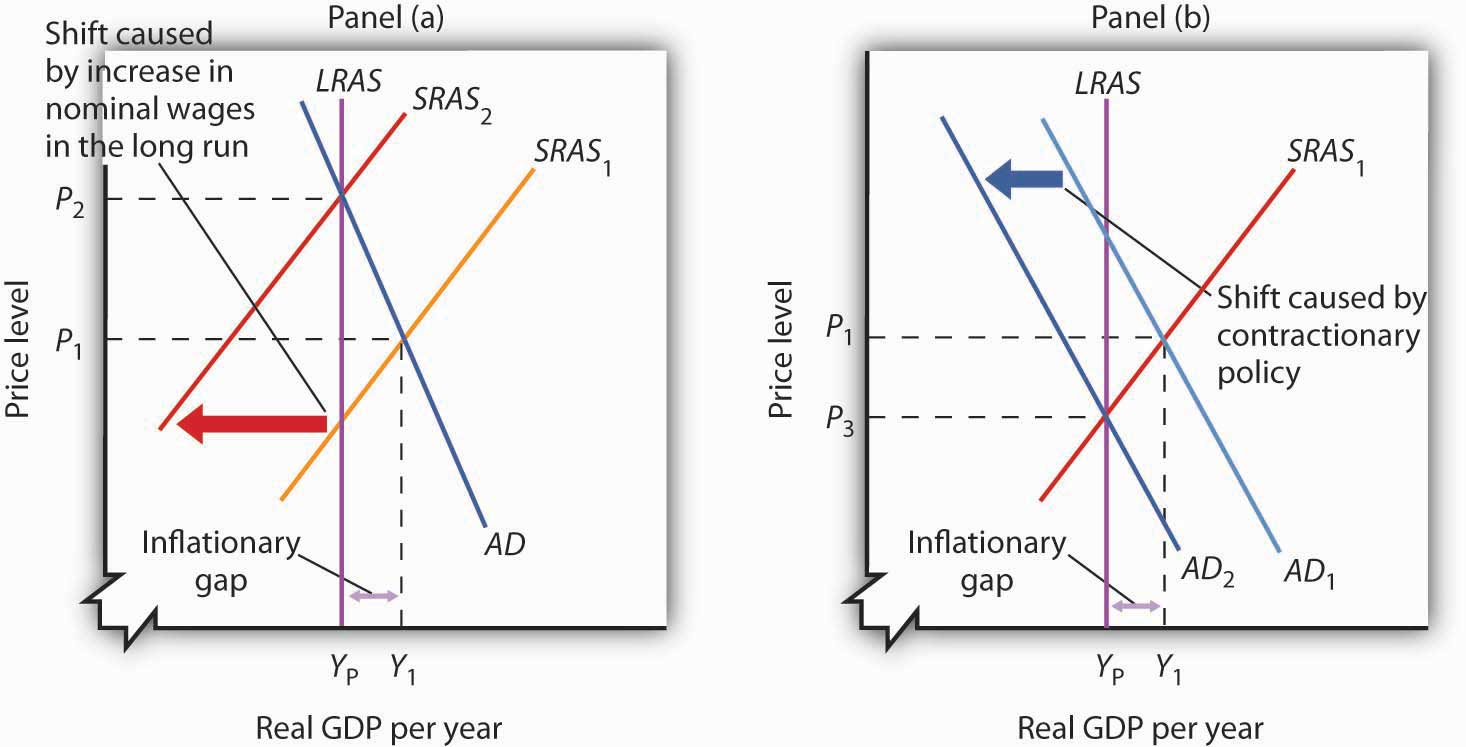

- Contractionary Fiscal Policy is the appropriate method to remedy inflation.

\n

In panel A, the economy is producing above potential, where resources and labor are more than fully employed. The unemployment rate is low. The distance between Yp and T1 is the inflationary gap.

- ^^Inflationary gap:^^ the surefit of real GDP over its full-employment potential. In economic terms, the economy is producing outside its production possibilities.

In panel B, the short run equilibrium and the economy will adjust so that all three curves cross in the long run. High production level strains resources. Workers and resource owners demand higher wages and prices and this induced firms to let workers go and production falls.

In this case, Contractionary fiscal policy can be applied to fix it. The government spending decreases and/or increases taxes, this increases aggregate demand as a result.

@@Fiscal Policy in Practice@@

- Recessionary and inflationary gaps need to be detected. Congress has the authority to influence fiscal policy. They then must agree on the details of change in spending.

- If the policy is expansionary, then the government has to decide what programs there are needed to be expanded. They need to decide which programs must be developed. Also, they must decide which taxes need to be reduced and by how much. Before initiating a fiscal policy, one has to answer all these questions first.

@@Crowding Out@@

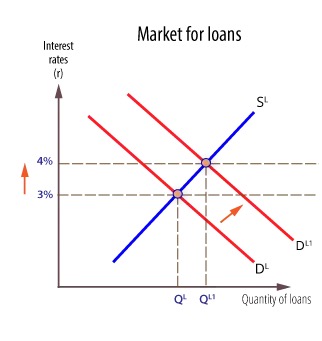

^^Crowding out:^^ is the increase in interest rates and subsequent decline in spending that occur when government borrows money to finance a deficit

- If the government borrows a large portion of the funds for lending, then interest rates would rise. One of the largest demanders for loanable funds is the US Federal Government. When the federal government deficit spends in order to stimulate the economy, the demand for loanable funds shifts to the right. This leads to higher equilibrium real interest rates.

- Higher interest rates discourage borrowing and spending, more specifically for investment. The decrease in investment spending by businesses can offset the government’s expansionary fiscal policy

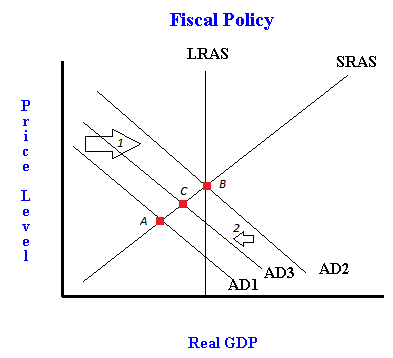

Crowding out is reflected in an aggregate demand curve that shifts back to the left after a fiscal policy has just shifted to the right.

Sometimes, crowding out will not be an issue, and other times, the government borrowing raises interest rates, which chokes off consumer and business spending. The decline in consumer and business spending offset the increase in government spending and fiscal policy is ineffective.

@@Government Spending and Tax Multipliers@@

- ^^Marginal Propensity to Consume (MPC):^^ given an extra dollar, how much of it will be spent

- Formula: MPC = Change in spending / Change in income

- ^^Marginal Propensity to Save (MPS):^^ given an extra dollar, how much of it is saved.

- Government spending leads to extra income for firms. (The total change in spending is also called total change in national income)

- Formula: Multiplier = 1/(1 - MPC)

- Total change in aggregate demand = Multiplier * Initial change in spending

@@The Balanced-Budget Multiplier@@

- ^^Balanced budget move^^: when a government’s budget remains balanced with spending and tax collections, if spending increases, taxes increase as well.

- An increase in government spending of any amount, matched by a tax increase of the same amount, creates an increase in aggregate demand of that amount. A decrease in government spending of any amount, matched by a tax decrease, creates a decrease in aggregate demand of that amount. These results hold regardless of the value of the MPC. That means that the balanced-budget multiplier is equal to one.

@@Automatic Stabilizers@@

- ^^Automatic Stabilizers:^^ are government policies already in place that promote deficit spending during recessions and surplus budgets during expansions.

- They promote correct fiscal policies over the course of the business cycle. These policies prevent recessions from becoming depressions. They also keep inflations from turning into hyperinflations.

- The more money a household makes, the more it owes in taxes, and vise versa. Income taxes are affected as the economy falls into a recession. This happens since more and more people become unemployed or make less income as the recession progresses.

- Higher taxes are the appropriate fiscal policy to fight inflation. Cuts in government spending are the appropriate fiscal policy to fight inflation.

@@The National Debt and Deficits@@

^^Federal Surplus^^: occurs when tax revenues exceed government spending

- The surplus tax revenue could be used to pay back the funds borrowed during recessionary times.

^^Federal Deficit^^: occurs when government spending exceeds tax revenues.

- The government borrows funds to deficit spend, federal deficits are appropriate during recessionary times.

^^Federal Debt:^^ When national government spending exceeds tax revenues

^^Treasury Security^^: a financial instrument that allows the federal government to borrow funds

- ^^Treasury Bill:^^ a loan which has the duration of a year or less

- ^^Treasury Note:^^ a loan which has the duration of 1-5 years

- ^^Treasury Bond^^: a loan which has the duration of 6-30 years