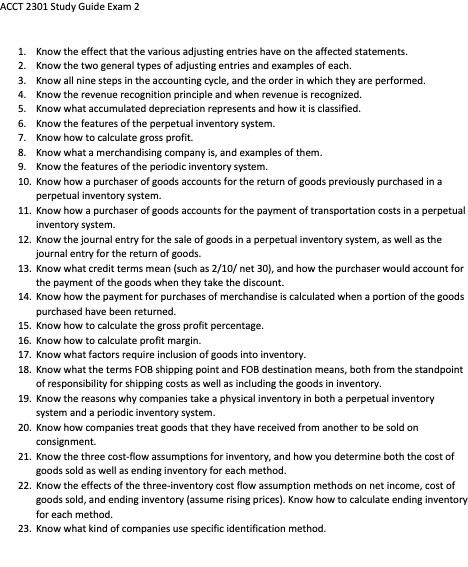

ACCT 2301 Study Guide Exam 2

1. Know the effect that the various adjusting entries have on the affected statements.

2. Know the two general types of adjusting entries and examples of each.

3. Know all nine steps in the accounting cycle, and the order in which they are performed.

4. Know the revenue recognition principle and when revenue is recognized.

5. Know what accumulated depreciation represents and how it is classified.

6. Know the features of the perpetual inventory system.

7. Know how to calculate gross profit.

8. Know what a merchandising company is, and examples of them.

9. Know the features of the periodic inventory system.

10. Know how a purchaser of goods accounts for the return of goods previously purchased in a perpetual inventory system.

11. Know how a purchaser of goods accounts for the payment of transportation costs in a perpetual inventory system.

12. Know the journal entry for the sale of goods in a perpetual inventory system, as well as the journal entry for the return of goods.

13. Know what credit terms mean (such as 2/10/ net 30), and how the purchaser would account for the payment of the goods when they take the discount.

14. Know how the payment for purchases of merchandise is calculated when a portion of the goods purchased have been returned.

15. Know how to calculate the gross profit percentage.

16. Know how to calculate profit margin.

17. Know what factors require inclusion of goods into inventory.

18. Know what the terms FOB shipping point and FOB destination means, both from the standpoint of responsibility for shipping costs as well as including the goods in inventory.

19. Know the reasons why companies take a physical inventory in both a perpetual inventory system and a periodic inventory system.

20. Know how companies treat goods that they have received from another to be sold on consignment.

21. Know the three cost-flow assumptions for inventory, and how you determine both the cost of goods sold as well as ending inventory for each method.

22. Know the effects of the three-inventory cost flow assumption methods on net income, cost of goods sold, and ending inventory (assume rising prices). Know how to calculate ending inventory for each method.

23. Know what kind of companies use specific identification method.