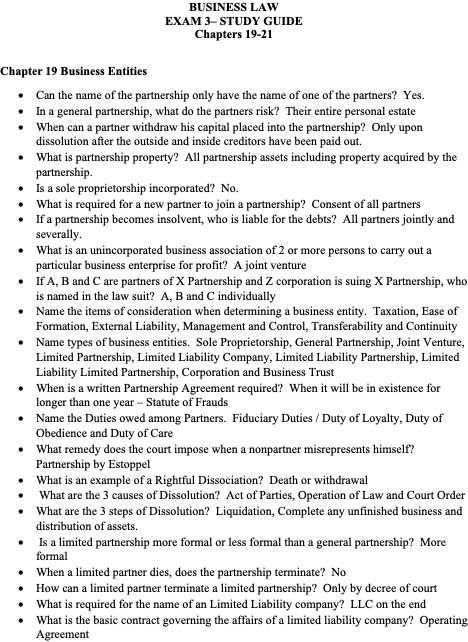

Business law Test 3

Chapter 19 Business Entities

· Can the name of the partnership only have the name of one of the partners? Yes.

· In a general partnership, what do the partners risk? Their entire personal estate

· When can a partner withdraw his capital placed into the partnership? Only upon dissolution after the outside and inside creditors have been paid out.

· What is partnership property? All partnership assets including property acquired by the partnership.

· Is a sole proprietorship incorporated? No.

· What is required for a new partner to join a partnership? Consent of all partners

· If a partnership becomes insolvent, who is liable for the debts? All partners jointly and severally.

· What is an unincorporated business association of 2 or more persons to carry out a particular business enterprise for profit? A joint venture

· If A, B and C are partners of X Partnership and Z corporation is suing X Partnership, who is named in the law suit? A, B and C individually

· Name the items of consideration when determining a business entity. Taxation, Ease of Formation, External Liability, Management and Control, Transferability and Continuity

· Name types of business entities. Sole Proprietorship, General Partnership, Joint Venture, Limited Partnership, Limited Liability Company, Limited Liability Partnership, Limited Liability Limited Partnership, Corporation and Business Trust

· When is a written Partnership Agreement required? When it will be in existence for longer than one year – Statute of Frauds

· Name the Duties owed among Partners. Fiduciary Duties / Duty of Loyalty, Duty of Obedience and Duty of Care

· What remedy does the court impose when a nonpartner misrepresents himself? Partnership by Estoppel

· What is an example of a Rightful Dissociation? Death or withdrawal

· What are the 3 causes of Dissolution? Act of Parties, Operation of Law and Court Order

· What are the 3 steps of Dissolution? Liquidation, Complete any unfinished business and distribution of assets.

· Is a limited partnership more formal or less formal than a general partnership? More formal

· When a limited partner dies, does the partnership terminate? No

· How can a limited partner terminate a limited partnership? Only by decree of court

· What is required for the name of an Limited Liability company? LLC on the end

· What is the basic contract governing the affairs of a limited liability company? Operating Agreement

· Does a limited liability company require approval from the State? Yes

· What state department governs the affairs or LPs and LLCs? Secretary of State

· What is a foreign LLC? One in any state other than which it was formed

· What are the 2 types of management of LLCs? Member managed and manager managed

Chapters 20 & 21 Corporations / Corporate Governance

· How long is a corporation in existence? Perpetual

· A city in which is incorporated is an example of what kind of corporation? Public

· Name the benefits of a corporation? Limited liability etc

· Name one negative point of a corporation. Taxation

· In a nonprofit corporation, what must the profits be used for? Charitable, educational, or scientific purposes for which it was formed.

· The name of the person who solicits capital. Promoter

· The promoter owes fiduciary duties to whom? Other promoters and initial shareholders

· What does the incorporators do? Sign the Articles of Incorporation

· A court can disregard the corporate structure and hold an officer directly liable under what principal? Piercing the corporate veil

· What are preemptive rights? When new shares are issues, you have the right to purchase the amount of shares required to keep your same % as before.

· Typically, how many votes do each shareholder get? One vote per share

· How many meetings per year are required for shareholders? One annual meeting

· What is required on the notice of shareholder meeting? Date place and time

· What is the minimum number necessary to be present at a meeting in order to transact business called? A Quorum

· The name of the people who agree to purchase stock in the corporation before it is formed. Subscribers

· Who removes a member of the board of directors? Shareholders can remove with or without cause

· The authorization to vote another’s shares at a meeting – generally must be in writing is called a ______________? Proxy

· Name the corporate attributes. Legal entity, limited liability, free transferability of corporate shares, perpetual existence, Centralized management, a person, a citizen

· A lawsuit brought by the shareholder against the corporation is called ________. A direct suit.

· A lawsuit brought by a shareholder on behalf of a corporation is called ________. A derivative suit.

· Name 3 functions of the board of directors. Selecting and removing officers, Determining the corporation’s capital structure, Initiating fundamental changes, Declaring dividends and Setting management compensation

· What are the 2 requirements to action to be taken without a meeting? Must be written and unanimous.

· Who are responsible for the day to day functions of a corporation? Officers.

· What duties do the directors and officers have in a corporation? Fiduciary duties, duty of diligence, duty of obedience and duty of loyalty

· What precludes imposing liability on directors and officers for honest mistakes in judgment if they act with due care, in good faith and reasonably believed to be in the best interest of the corporation? Business Judgment Rule

· Name Fundamental changes in a corporation? Amendment to Articles of Incorporation (Charter), purchase or sale of substantially all of its assets, Merger, Consolidation, Dissolution

· What is the combination of assets of 2 or more corporations into one corporation? Merger

· What is the combination of 2 or more corporations into a new corporation? Consolidation

· What is the most common debt security? Bond

· Who can involuntarily dissolve a corporation? Shareholder, Creditors and the Attorney General

· A bond that can be exchanged for other securities of the corporation? Convertible Bond

· The Source of capital creating an ownership interest in the corporation is called ____? Equity

· How many shares can be issued by a corporation? only issue shares authorized in the articles of incorporation

· The amount set by the Board of Directors or shareholders for the price of one share of stock is called ______________? Par Value

· Shares a corporation buys back after issuing them is called _______? Treasury Stock

· Special contract rights superior to common stock are _______? Preferred Stock

· Who declares Dividends of a Corporation? Board of Directors

Essay Questions:

Select what type of corporation : for example closely held, nonprofit, publicly traded, public (like city of Springfield), domestic, foreign, etc.

Know how to pay out partnership (including limited partnerships and LLC’s taxed as a partnership) upon dissolution. Outside creditors, inside creditors, repay capital contributions then profits.

Knowt

Knowt