Lecture 11 Capital Budgeting II

FINC2011 Topic Eleven: Capital Budgeting - Fundamentals

Types of projects - Page 3

Types of Projects

Replacement projects for cost reduction.

Expansion projects.

New product or market development.

Mandatory projects (e.g., governmental safety-related).

Other types.

Use CF, not accounting income - Page 4

Use Cash Flows, Not Accounting Income

NPV relies on free cash flows, not accounting income.

Accounting income is influenced by arbitrary revenue and expense recognition.

NPV requires cash flow recognition at the time it occurs.

Relevant CF - Page 5

Relevant Cash Flows

Include only cash flows that occur if the project is accepted. If in part, we should include the part that occurs

aka incremental cash flows, the amount by which the firm’s earnings are expected to change as a result of the investment decision.

Use the stand-alone principle to analyze projects in isolation.

Also only include the cashflow if it assists the project even if the project is canceled.

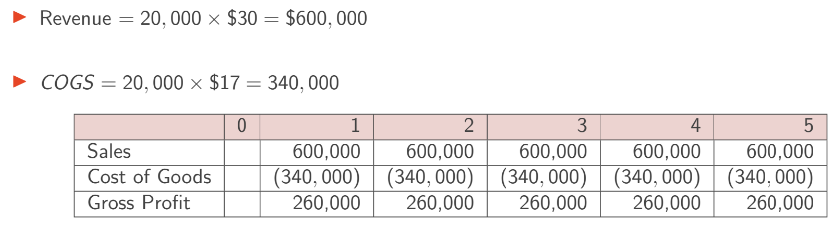

Example: ABC Ltd.

New toy introduction with a feasibility study cost of $300,000.

Expected sales volume: 20,000 toys/year for 5 years.

Cost of producing is 17$ and revenue receive per unit is $30.

$300k expense for study is not included in the timeline because regardless of if the investment is forward or not, it is a sunk cost.

Sunk cost - Page 7

Sunk Costs

Sunk costs are incurred regardless of the investment decision.

Should not be included in incremental earnings analysis.

Examples:

fixed overhead expenses (static cost that remains for long period of time and do not change, e.g. rent)

past expenses

feasibility study costs (e.g. research).

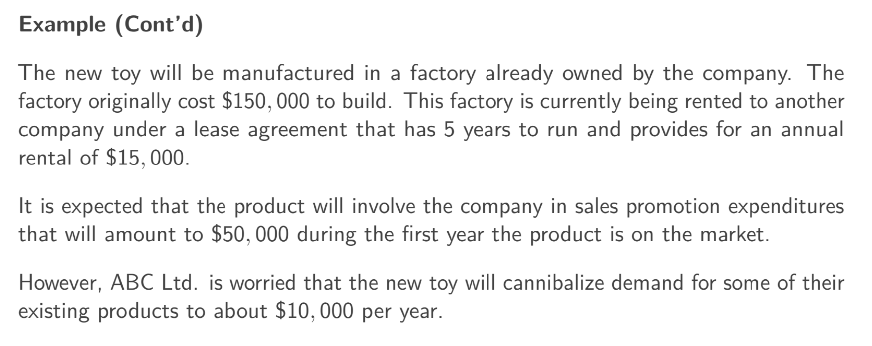

Other Costs (Benefits) Example

Existing factory used for production.

Rental income lost due to factory use.

Sales promotion costs and cannibalization effects on existing products.

Opportunity cost - Page 9

Opportunity Cost

Opportunity costs represent the value of the best alternative use of resources.

Must be included as cash outflows in NPV calculations because it is consumed in undertaking the project.

Example: rental income from the factory is counted as opportunity cost.

Project externalities - Page 10

Project Externalities (Side Effects)

Side effects can be positive or negative cash flows related to other business aspects.

Cannibalization of existing product sales must be included in calculations.

Cannibalization is when sales of a new product displace sales of an existing product

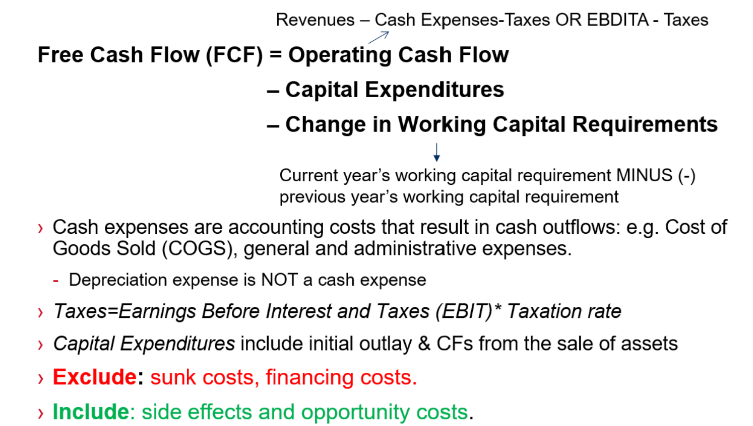

Using everything - Page 11

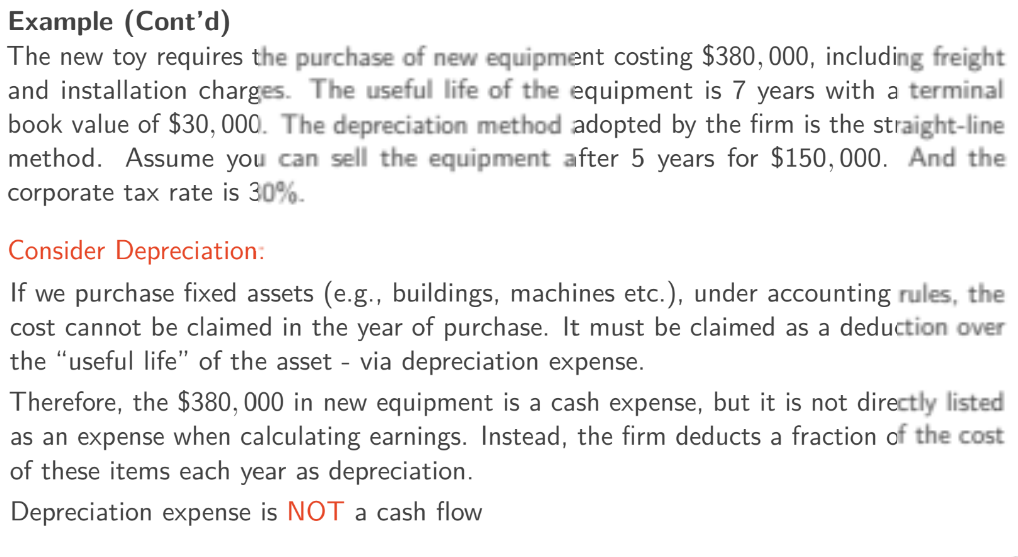

Cash Flow Summary

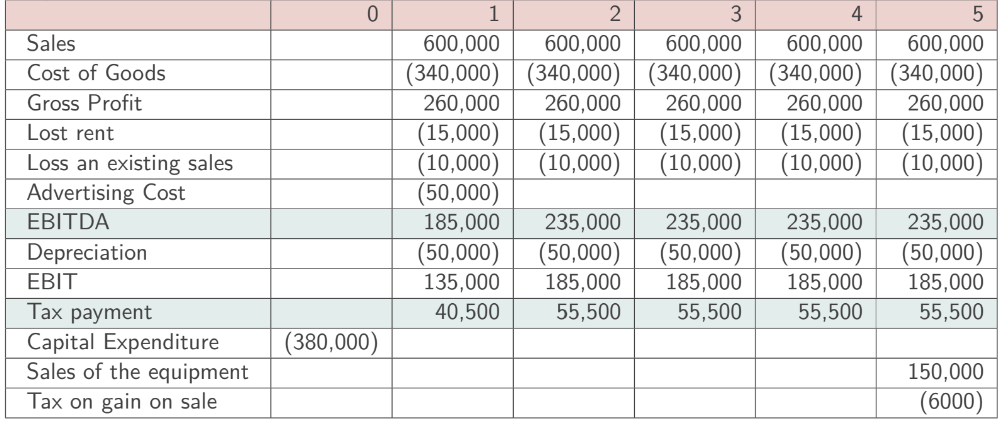

Detailed cash flow calculations for the new toy project, including sales, costs, and EBITDA.

Opportunity cost: rent, existing sales

Project externality: existing sales

Normal cost: advertising

EBITDA can be used for analyzing performance of a company.

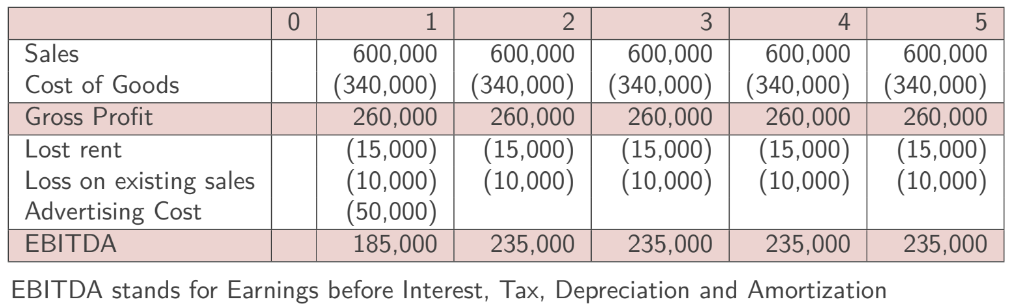

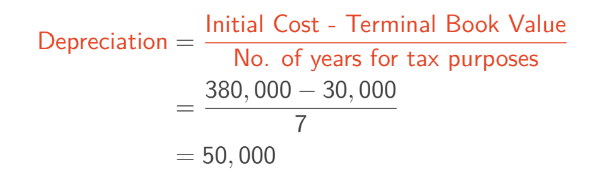

Depreciation - Page 13

Depreciation

Depreciation reduces taxable income but is not a cash flow.

Acts as a tax shield.

Depreciation can be calculated in several ways:

straight line depreciation (aka prime cost method): the asset’s cost to be divided equally over its life.

depreciated at a pre-determined rate: the asset’s cost to be multiplied by the depreciation rate.

Note: the depreciation value remain the same at each intervals.

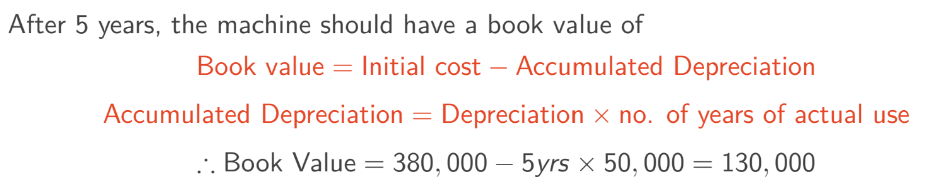

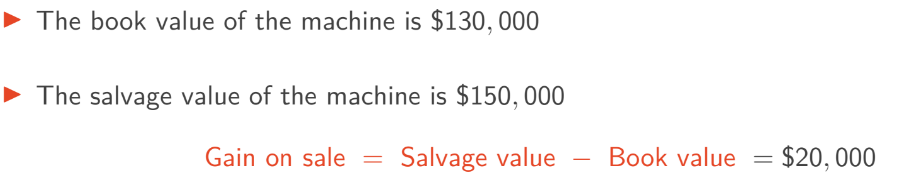

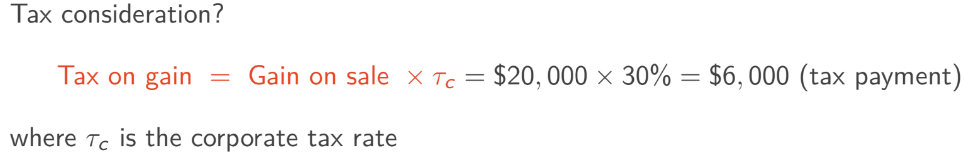

Salvage value and gain on sale - Page 14

Salvage Value and Gain on Sale

Once the project canceled or over, firms would want to sell the asset (the asset might be less than the useful life):

The value of asset sold at the end of its useful life is called salvage value, which generates cash flow in the last year.

It will also generate a gain on sale which is taxable.

After-tax profit of selling depreciation asset should be $14k

If the loss from the gain on sale, you’ll received a tax refund (aka reduction on tax liability). In this example, it should equal to |-30k| * 30% = 9000$ if the salvage value is 100k

Using everything + depreciation + tax - Page 16

Final Cash Flow Summary

Comprehensive cash flow table including sales, costs, EBITDA, and tax payments.

Interest expense - Page 17

Interest Expense

Interest expense is typically excluded from capital budgeting decisions.

The rationale is that the project should be judged on its own, not on how it will be financed.

—> don’t account for anything interest, finance, incremental outflow due to financing

Taxation - Page 18

Taxation

Taxation is a cash outflow and must be included in calculations.

After-tax cash flows should be discounted using an after-tax required rate of return.

Tax can influence project in 3 ways:

corporate income tax affects after-tax income

Depreciation —> tax deduction = tax shield

liquidation or salvage value —> tax on gain or loss

NWC - Page 19

Net Working Capital (NWC)

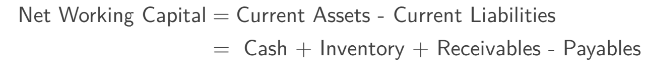

NWC is the difference between current assets and current liabilities.

Sales be recorded on the income statement when made, not when cash is received.

Sales and COGS in financial statements are not cashflows:

Adjustments needed to recognize actual cash flows.

NWC is something you prepare for next year, build up inventory for future sale.

Change in NWC - Page 20

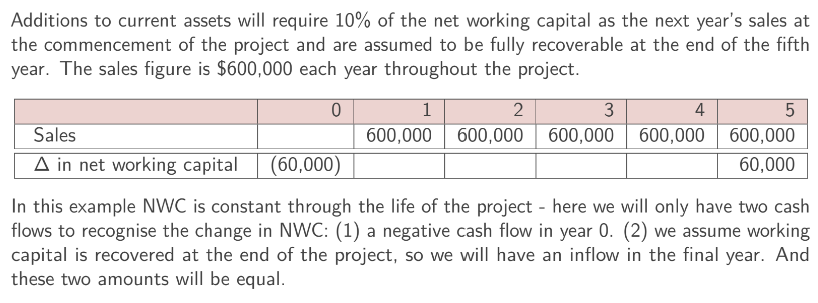

Change in Net Working Capital

Changes in NWC must be included in cash flow tables.

Cash flows related to NWC changes should be recognized. Don’t forget to include cash received when working capital is released at the end of the project

Change in NWC from year 1 to 4 here is 0, using NWC from forward year - NWC last year.

At year 5, we clear everything, that’s why we have a positive $60k.

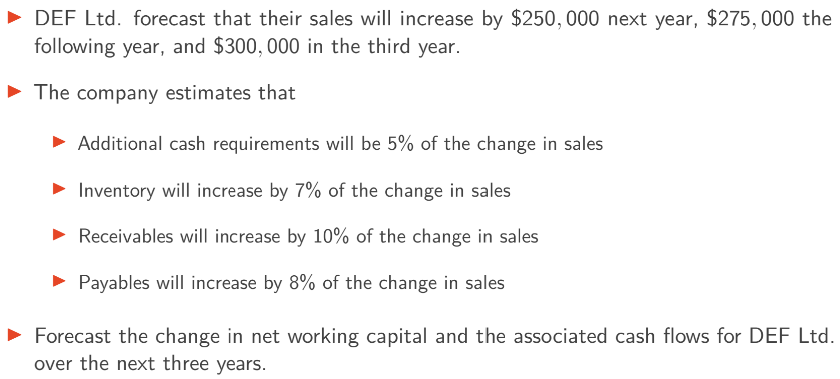

Non-constant NWC problem - Page 22

Complicated NWC Example

DEF Ltd. forecast with detailed calculations for NWC changes over three years.

NWC consideration - Page 24

NWC Considerations

Importance of recognizing changes in NWC for cash flow calculations.

we are interested in changes in NWC only, this reflects modifications to take account of accounts payable.

Increase in NWC means an increase in receivables relative to payables, decrease our CF.

Assumes that working capital is recovered at the end of the project. In the final year, the CF of everything is equal to the ending balance of NWC.

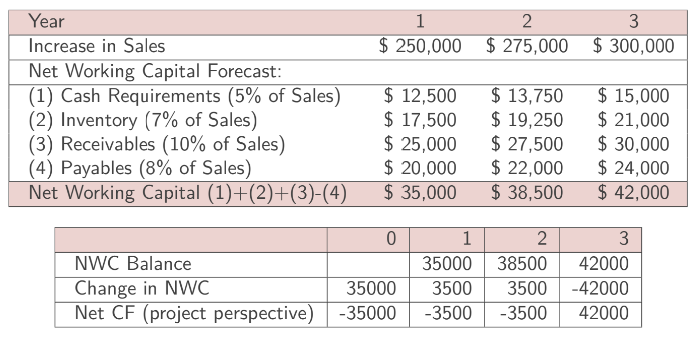

Free cash flow - Page 25

Free Cash Flow (FCF) Formula

FCF calculation explained, including components and exclusions.

Using everything + change in NWC - Page 26

Full Cash Flow Table

Detailed cash flow table for the ABC Ltd. project.

To summaries, know how to divide cash flow into different sections:

Operation cash flows

Capital flows

NWC

Side effect

Proper CF to calculate for NPV - Page 27

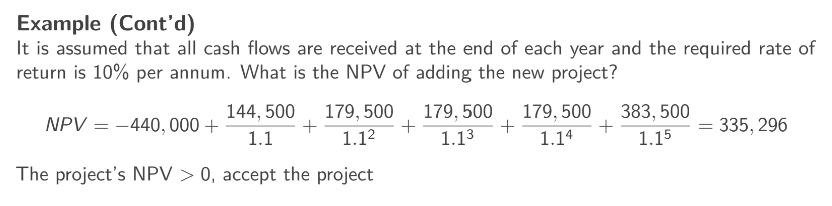

Net Present Value (NPV) Calculation

NPV calculation for the project with a required rate of return of 10%.

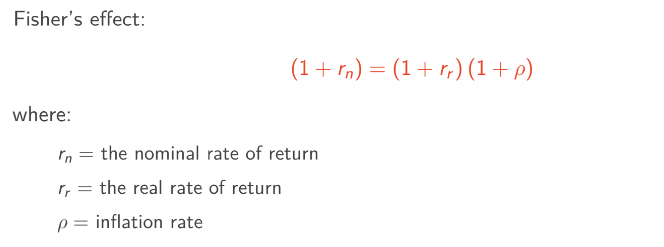

Inflation consideration - Page 28

Inflation Considerations

Inflation impacts on future cash flows and project profitability, especially long-term project.

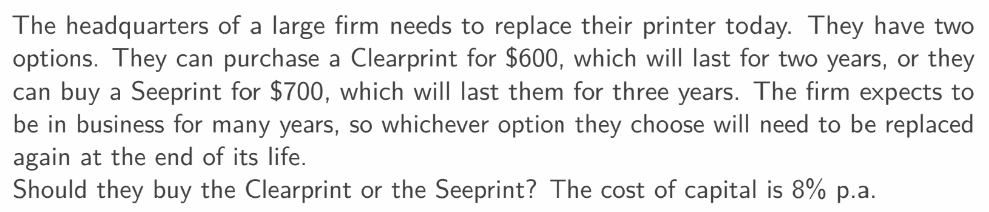

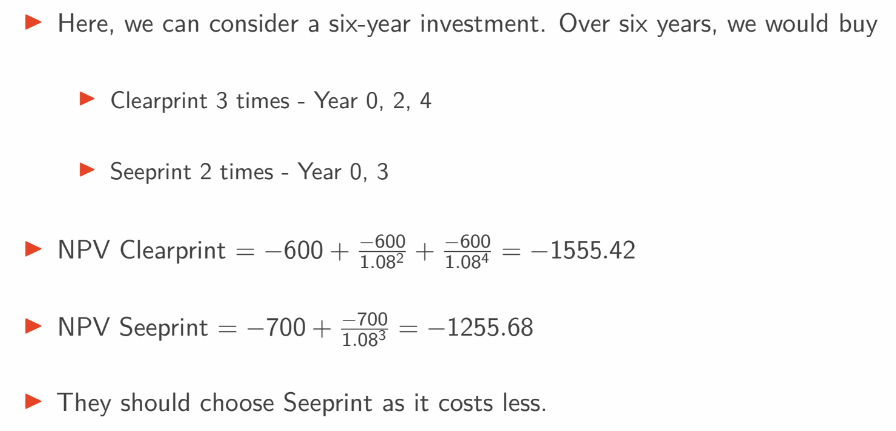

Projects with different lives

Projects with Different Lives

Challenges in comparing projects with different lifespans.

When there are projects with different lifespan, we can’t use NPV for direct comparison.

You can do this by assuming repeated investments over an identical period and then comparing the NPVs of their cost.

Alternatively, standardise the project to a 1-year period for comparision.

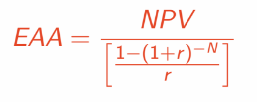

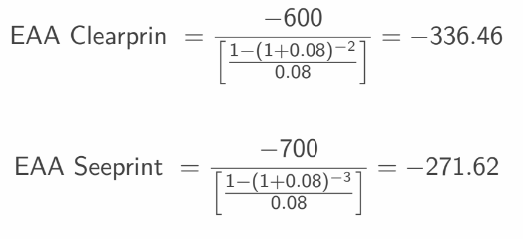

Equivalent annual annuity

Equivalent Annual Annuity (EAA) Approach

EAA formula and application to the printer example.

Calculating cost on annual basis

Page 32

Replacement Project Analysis

occurs when a firm decides whether to replace an existing asset with a new or better one.

Do not need to wait until a lifespan of an asset runs out.