2.7 - management control systems in inter-organisational relationships

learning objectives

discuss the concept of inter-organisational relationships

explain the main drivers behind the development and increased importance of inter - organisational relationships

discuss the interrelation between risk, trust and control at an inter-organisational context

discuss the implications for management control systems at an inter-organisational context

lecture outline

the concept of inter-organisational relationships:

types

importance, popularity

notable examples

inter-organisational relationships are a risky business

failure change

the concept of risk

risk x trust x control

inter-organisational management control systems

are internal MCSs sufficient?

IO management control techniques

the concept of inter-organisational relationships

inter-organisational relationships

various forms of cooperation between independent organisations

the significance of IORs makes it necessary for managers to extend management control beyond the company’s boarders

very popular in both manufacturing and service industry

inter-organisational relationships - alliances

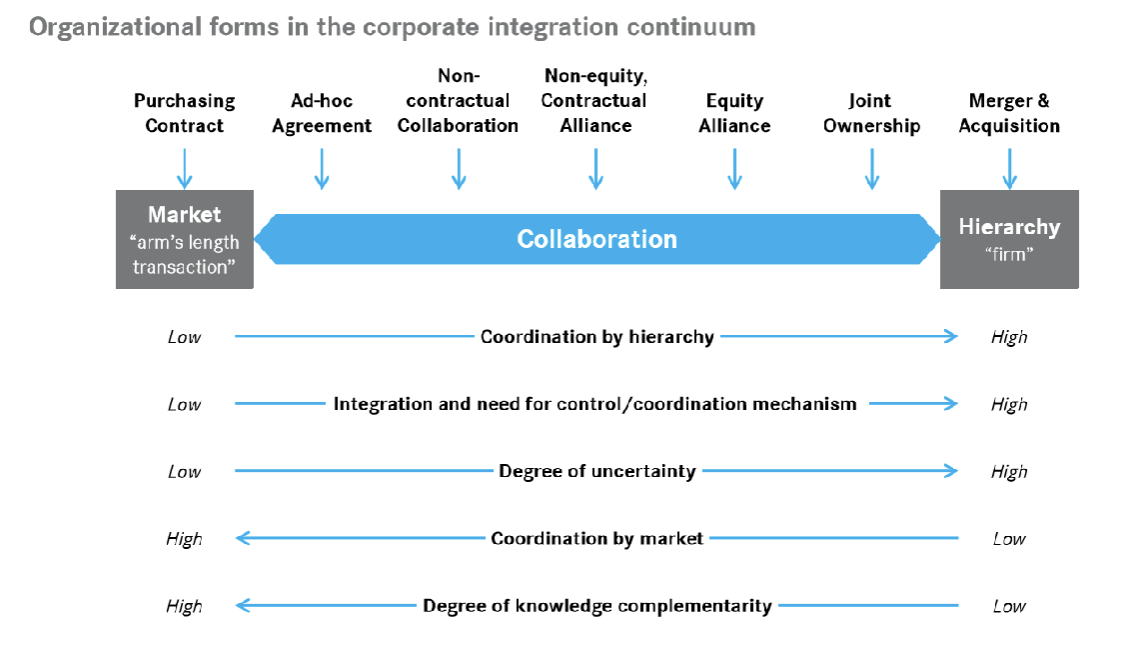

the term refers to a wide range of cooperative relationships that represent the middle ground between market and hierarchy forms of governance, the hybrid

environmental conditions

globalisation

rapid technological transformation

increased technical complexity of products and services

trends

closer business relationships

i.e. early supplier engagement; joint designs

increased informations sharing

CRM very useful

outsourcing

parts/components or other departments

cost reduction - focus on core competencies - improve product development - suppliers exercise

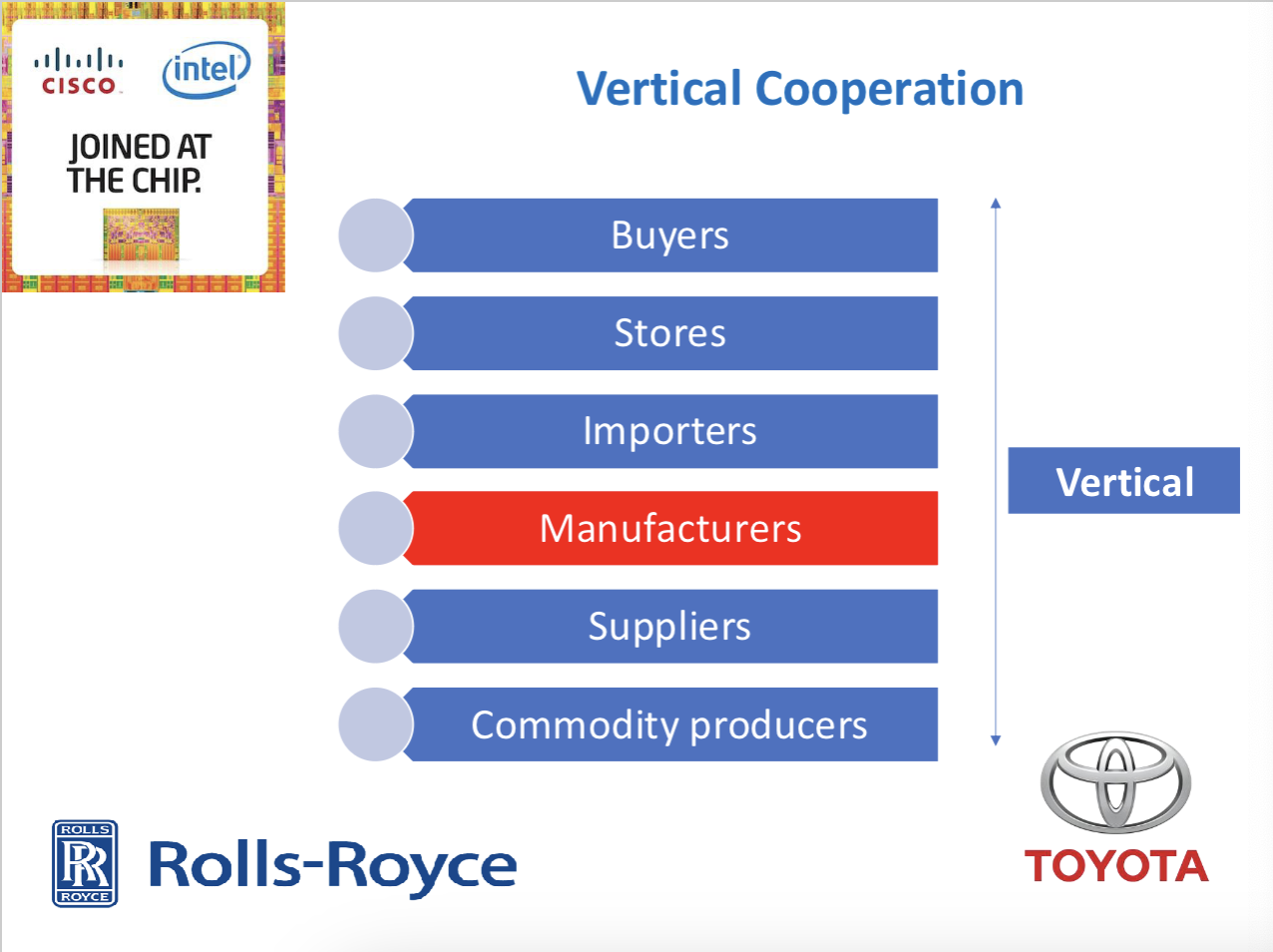

rolls royce

restructuring of supply chain for turbines blades to improve efficiency

before the restructuring process, the SC compromised approximately 5000 arm’s length relationships and 3JVs

after restructuring, approximately 40 arms length relationships and much closer collaborations with those remaining in the supply chain

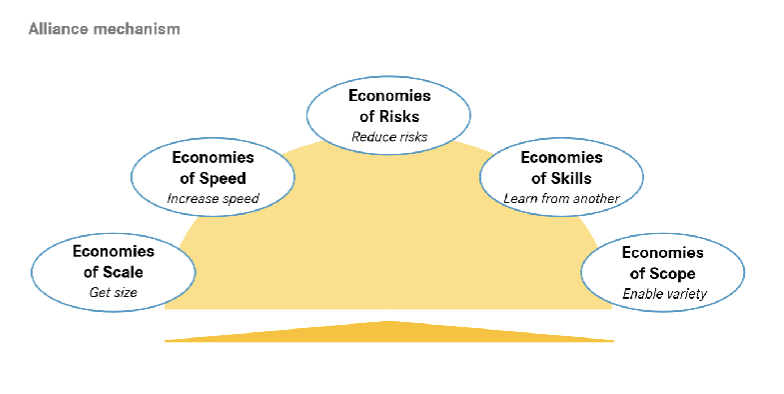

IORs motives

alliances are used to achieve specific outcomes [glaister and brickley, 1996]

setting of relationships

dyadic relationships

relationships can be distinguised taking the industry and the level on the value chain of the partners into consideration

vertical

horizontal

diagonal

networks

simultaneously handling of a set of interconnected relationships

horizontal IORs

2012 - qantas and emirates entered an alliance for the next 10 yrs.

the deal involves coordinated pricing, sales and scheduling, shared airport lounges and integrated frequent flyer programs

2018 - increase bargaining power when dealing with global suppliers and share own brand products - 3 yr alliance

diagonal cooperation

firms of different industries work together

in 1993, starbucks formed a partnership with barnes and noble, placing is coffee outlets inside the bookstores

2014 - apple formed alliances with mastercard and visa to create apple pay

2019 - apple card - new alliance between apple, goldman sachs, and mastercard

2017 - formed an alliance to build data driven products, initially focused in healthcare, life sciences, retail and transport

any standard factors of success?

goal compatibility

synergy - matching culture

collaborative environment

a certain amount of equality

IORs are a risky business

issues with IORs

loss of proprietary information

management complexities

financial and organisational risks

risk of becoming dependent

loss of decision autonomy

loss of flexibility

long term viability

failed friendships - over 60% of IORs fail

in 2009 - volkswagen acquired 19.9% of suzuki for 1.7 bil and sign an agreement to share technologies and global distribution networks

2011 - suzuki claimed VW had breached its contract, in failing to hand over the hybrid technology. VW said suzuki didn’t honour the alliance, complaining that suzuki was buying engines from european rival fiat instead of VW

clash of personalities - distrust between the companies undermined the entire relationship

inadequate MCS are often blamed for the failure

it is typically linked to the risks associated with collaborative organisational forms: risks associated not only with the lack of cooperation among partner firms, but also with performance failure despite full cooperations [das and teng, 1996, 2000, 2001]

control problems

control structures and related control practices do not suffice

because fundamental uncertainty and bounded rationality it is impossible for individual actors to foresee all potential opportunism and thus to fully align interests in advance

formal control and contracts are necessarily incomplete - there is a control structure deficit

the risk of opportunistic behaviour and the related appropriation concerns are particularly high when there is asset specificity

do intra-firm management control frameworks fit inter-organisational relationships?

why might they not fit?

separate [but overlapping] profit functions of partners

absence of once central figure who provides conscious governance

the potential role of courts and third party arbitrators in settling disputes

challenges

MCS, cost accounting systems and performance management systems are adapting to address:

relationship risk and decision making under uncertainty

performance of the value chain

aligned incentives of all partners

risk [das and teng, 2001]

relational risk

the probability and consequences of not having satisfactory cooperation

opportunistic behaviour, conflicts

performance risk

the probability and consequences that alliance’s objectives are not achieved

risk is different from a condition of uncertainty as it related to the estimated probabilities

risk and perceived risk

perceived risk and objective risk

perceived risk is determined by trust and control

both trust and control reduce the perceived risk and impact of undesirable outcomes

trust entails a positive expectation - hence unpleasant outcomes are less likely - leads to perception of lowered risk in a relationship

control does not always reduce objective risk - “illusion of control“

the concept of trust

“the willingness of one party to relate with another in the belief that the others actions will be beneficial rather than detrimental to the first party“ - child and faulkner, 1998

positive expectation:

sako [1992]:

contractual trust

competence trust

goodwill trust

trust and risk [das and teng, 2001]

a firms goodwill trust in its partner firm will reduce its perceived relational risk in an alliance, but not its perceived performance risk

a firms competence trust in its partner firm will reduce its perceived performance risk in an alliance, but not its perceived relational risk

trust and control nexus

trust is seen as a substitute for control

control and trust should be seen as complements [cite]

control can damage established trust

the relationship between trust and control can shift over time as the supply chain matures

inter-organisational MCS

dual role of inter-organisational MCS

types of controls:

outcome/results controls

behaviour/actions controls

social cultural controls

monitoring [controlling]

measurement and performance assessment

intended to reduce opportunism and promote goal congruence

coordination [enabling]

of activties across legal boundaries, information sharing

intended to assist learning

outcome/results control

use of integrated information systems

target costing

inter-organisational cost management

rank based rewards

value chain analysis

open book accounting

perceived performance risk in an IOR will be reduced more effectively by output control than by behaviour control

open book accounting

the exchange of internal information and accounting data between the supplier and the buyer in order to achieve benefits for both partners

reduces information asymmetry - confidential information is shared both upstream and downstream

collaborative efforts create additional opportunities for cost reduction

it requires high degree of cooperation and trust

unfortunately - one-side OBA

behaviour/action controls

focus on how the parties should act and whether these specifications have

been followedpolicy documents, procedures, structures for regulating employment and

trainingfrequent meetings to develop and discuss guidelines joint projects

focus on communication – cross organisational teams; boards

perceived relational risk will be reduced more effectively behaviour control

than by output control (Das and Teng, 2001)

social/cultural controls

values, norms and culture that influence thevehabiour of the people in the companies

cross organisational teams are governed by social controls

selections of partner - “matching culture“

rolls royce developed jointly with its partners

a supplier strategy

the relationship profile tool

trust

social control will reduce both perceived relational and perceived performance risk [das and teng, 2001]

inter organisational management control

changes of a company’s internal management control system

the joint development of inter organisational management control with key customers and/or suppliers

changes of a company’s internal MCS

overlapping responsibilities

an inter organisational perspective on target costing

functionality price quality trade offs

inter organisational cost investigations

concurrent cost management

rank based rewards

an inter organisational perspective on working capital management

internal management control systems that account for network effects

value flow charts

profitability analysis of customer relationships

the joint development of inter organisational management control

inter organisational performance measures

mix of financial and non financial measures

joint reward system

inter organisational behaviour controls

policy documents, procedures

joint meetings

alliance board

inter organisational cost management

coordination of activties seek to reduce their shared costs

open book accounting

jointly developed target costing

value chain analysis

social control techniques and establishment and development of trust

summary

main types of IORs - well known examples

reasons of popularity

benefits and issues

risk and trust and control framework

implications to MCS