Chapter 9: Reporting and Analyzing Long-Lived Assets

Explain the accounting for plant assets expenditures?

The cost of plant assets includes all expenditures necessary to acquire the asset and make it ready for its intended use. Once cost is established, a compny uses that amount a s the basis of accounting for the plant asset over its useful life

Apply depreciation methods to planet assets.

Depreciation

Add to expense the cost of a plant asset over its useful (service) life in a rational and systematic manner

Usefulness and revenue producing ability decreases from wear and tear

Formula for straight line depreciation:

Depreciable cost x depreciation rate x 9/12 of a year

Straight line depreciation is: Cost - Salvage Value/Useful life (in years)

Declining balance depreciaton: Book value at beginning of beginning of year x Declining balance rate = Depreciation expense

Units of activity:

Depreciable cost/Total units of activity = Depreciation cost per unit

Depreciation cost per unit x Units of activity during year = Depreciation expense

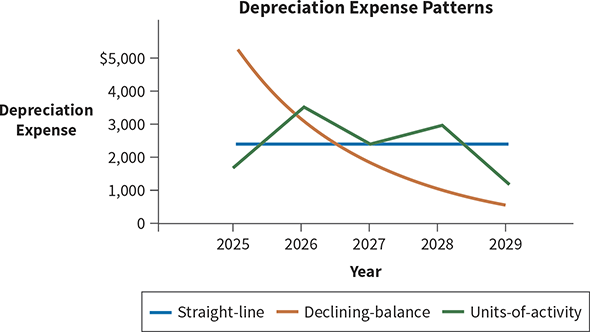

The expense patterns of the three depreciation methods are as follows.

Method | Annual Depreciation Pattern

Straight-line | Constant amount

Declining-balance | Decreasing amount

Units-of-activity | Varying amount

Explain how to account for the disposal of plant assets?

a) Eliminate the book value of the planet asset at the date of disposal

b) Record cash proceeds

c) account for the difference betweent eh book value and the cash proceeds as a gain or a loss on disposal

Identify the basic issues related to reporting intangible assets

Intangible assets reported at their cost - amoutns amortized

Limited intangible asset life costs should be allocated over its useful life

Intangible assets ith indefintie lives should not be amortized

Discuss how long-lived assets are reported and analyzed

Planet assets “Property, plant and equipment”

Intangibles “Intangible Assets”

IN statement of cash flows, under indirect method, depreciation and amorization expense are added back to net income to determine net cash prvided by operating activities. The investing section reports cash paid or received to purchase or sell property plant and equipment

Plant assets may be analyzed using return on assets and asset turnover. Return on assets consists of two components: asset turnover and profit margin.

compute periodic depreciation using the declining-balance method and the units of activity method

Declining balance

Book value at beginning of year x Declining balance rate = Depreciation expense

Units-of-activity

Depreciable cost/Total units of activity = Depreciation cost per unit

Depreciation cost x Units of activity during year = Depreciation expense

Comparing Depreciation Methods

Patterns of depreciation

Book Value

Book Value

Cost of the plant asset - Accumulated depreciation to date

Goodwill

Recorded only when a business is purchased

Research and development (R&D)

Costs are exxpensed when incurred regardless of whether the research and development expenditures result in a successful patent or not

Asset turnover

Indicates how efficiently a company is employing its assets

Current ratio

Indicator of liquidity and the company’s ability to pay its obligations when they come due

Profit margin

An indicator of how profitable a company is

Debt to assets ratio

Indicates the proportion of assets that are financed by debt rather than by equity

Amortization

The process of allocating to expense the cost of an intangible asset

Declining-balance method

A depreciation method that applies a constant rate to the declining book value of the asset and produces a decreasing annual depreciation expense over the asset’s useful life

Depreciable cost

Cost of a plant asset less its salvage value

Depreciation

Process of allocating to expense the cost of a plant asset over its useful life ina rational and systematic manner

Good will

The value of all favorable attributes that relate to a ocmpany that are not attributahble to any other specific asset

Research and development costs

Expenditures that may lead to patents, copyrights, new processes, and new products; must be expensed as incurred.

Straight line method

A depreciation method in which companies expense an equal amount of depreciation for each year of the asset’s useful life.

Units of Activity Method

A depreciation method in which useful life is expressed in terms of the total units of production or use expected from the asset.

Knowt

Knowt