Econ Unit 1

Chapter 1

3 Basic Economic Questions:

- What and how much will be produced?

- ex. 2 pairs of airpods

- How will items be produced?

- ex. mechanized factory

- For whom will items be produced?

- ex. how is the product split between a number of people?

3 Types of Economic Systems

- Centralized Command and Control Economic System

- central gov answers economic questions

- Price System

- individuals/families own all resources

- they choose how resources are used to produce goods

- labor used to make stuff owned and managed by workers

- factories owned by companies

- workers determine how much will be produced

- %%prices of resources and goods produced impact decision of individuals/families%%

- Mixed Economic System

- most common

- either centralized system or individuals/families can answer economic questions

^^acting rational^^ - acting in one’s own self-interest and not taking decisions that would make one worse off

^^positive analysis^^ - identifies objective truths; describes how the world is; utilize economic models in this one

^^normative analysis^^ - imposes ethical/moral beliefs; describes how world should be

^^bounded rationality^^ - people are all nearly rational so cannot examine every possible choice so use simple rules of thumb to sort among alternatives

Chapter 2

Graphing:

- points inside line = inefficient

- points outside line = not feasible

^^absolute advantage^^ - when one party can produce more of a certain service than the other

^^comparative advantage^^ - when one party can produce a service at a lower opportunity cost

- find which party has fewer slope

^^opportunity cost^^ - the value of what is being given up

Chapter 3

%%law of demand%% - price up = buyers less; price down = buyers more

^^demand^^ - the schedule of all purchase plans for each possible price of the good

- change in demand = shifting entire demand curve

- increase in demand = rightward shift

- decrease in demand = leftward shift

- ^^normal goods^^ - income up = demand rises

- ^^inferior goods^^ - income up = demand falls

- change in demand depends on income, preferences, prices of related goods, expectations of future prices/incomes, market size

^^quantity demanded^^ - how many units consumers would plan to purchase at a particular price

- represented by a single point on demand curve

- change in quantity demanded = movement from one point to another point on the curve

- change depends on change in price of its own good/service

%%law of supply%% - high price = high quantity; low price = low quantity

^^supply^^ - the schedule of all supply plans for each possible price of the good

- change in supply = shifting entire supply curve

^^quantity supplied^^ - how many units suppliers plan to offer at a particular price

- single point on the supply curve

- change in quantity supplied = movement from one point to another point on the curve

- change depends on its own price changes and willingness of suppliers to produce a good/service

^^relative price^^ - a commodity’s price in terms of another commodity

^^money price^^ - the price you pay at any point in time

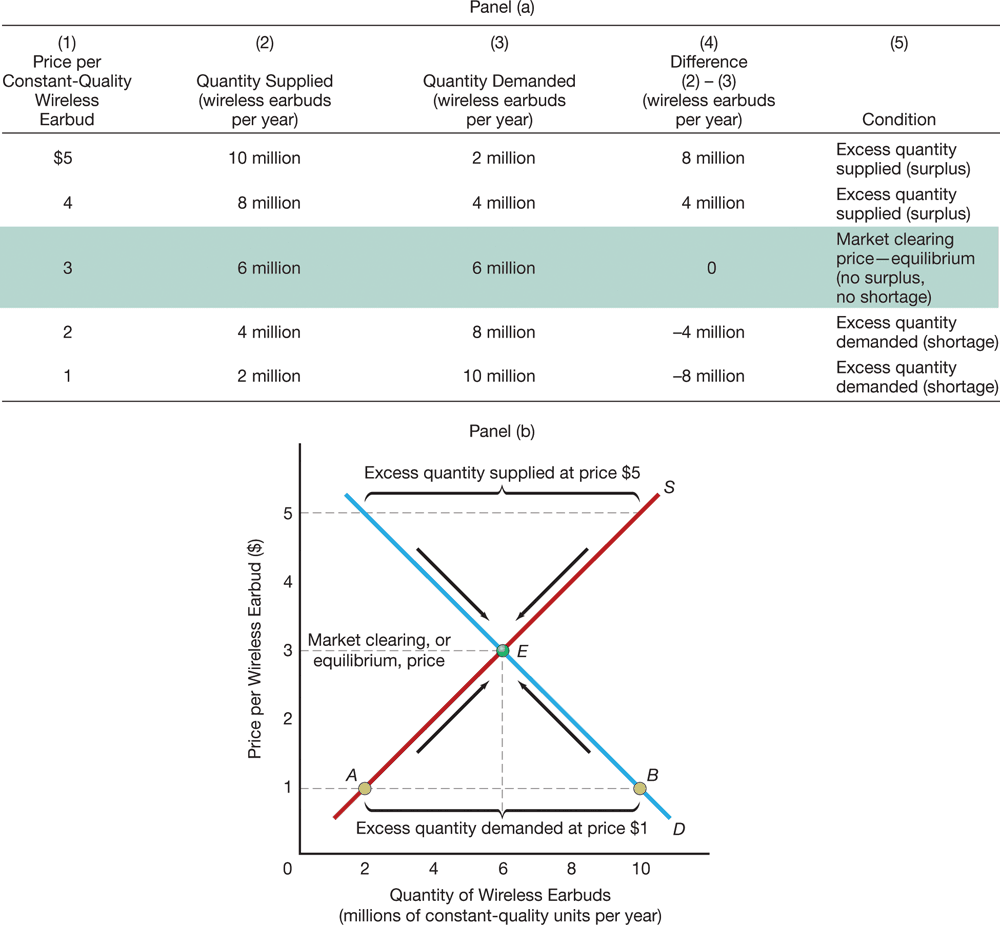

^^market clearing price^^ - price that has no surplus or shortage (equilibrium)

^^shortage^^ - quantity demand > quantity supply

^^surplus^^ - quantity demand < quantity supply

^^complements^^ - price of smtg inversely affects demand of another

Chapter 4

Price Controls:

%%price ceiling%% - the max price allowed in an exchange

- price ceiling below equilibrium = shortage

- rental rates held below equilibrium = property owners cannot recover maintenance costs

%%price floor%% - the min price below which a good/service may not be sold

- price floor above equilibrium = surplus

- gov has to buy surplus

- guarantees earnings for low-income farmers

Rent Controls:

- discourage construction of new rentals

- goal is to keep rent below levels usually observed

Minimum Wage Effects:

- higher minimum wage = unemployment increases

Chapter 5

Advantages of a Price System:

- economic efficiency

- allows all resource to become high valued via voluntary exchange

- consumers have freedom to purchase whatever

- protects sellers from coercion by one consumer

^^market failures^^ - where too few or too many resources go to specific economic activities

- prevent price system from reaching economic efficiency

^^externality^^ - a consequence of economic activity that spills over and affects third parties

- ex. benefits of vaccinations spill over and benefit others who interact with the vaccinated patient

- ex. cost or harm of vaping spill over and harm those who experience second hand smoke

- %%how can gov fix negative externalities?%%

- special taxes

- effluent/pollution tax: makes price = cost to society

- regulation

- max rate of pollution enforced

- negative externalities = market yields too much at too low of a price

- %%how can gov fix positive externalities?%%

- gov financing/production

- if externality is big, gov can finance additional production facilities so “right“ amount is produced

- regulation

- gov requires by law individuals must take a certain action

- subsidies

- a negative tax/reimbursement

- positive externalities = market under produces and under prices the good

Economic Functions of Government:

- correcting externalities

- providing a legal system

- promoting competition

- ^^antitrust legislation^^ - laws that restrict the formation of monopolies and regulate certain anticompetitive business practices

- ^^monopoly^^ - firm that can determine the market place of the goods they sell

- providing public goods

- %%rival goods%% - a good where if one person consumes it the amount available for consumption by others is reduced

- %%excludable goods%% - when suppliers can design a system to exclude non-payers

- ^^private goods^^ are goods that are both rival and excludable

- ^^public goods^^ - are goods that are neither rival nor excludable; can be consumed by multitudes of ppl

- provision of these in market is problematic

- no additional opportunity cost

- %%free-rider problem%% - some ppl take advantage of the fact that others will assume the burden of paying for public goods

- ex. if ppl taxed by how much they value national defense, ppl who say they don’t value are free riders

- ensuring economywide stability

- full employment, price stability, econ growth

Political Functions of Government

- gov-sponsored and gov-inhibited goods

- %%gov sponsored goods%% - any good gov deemed worthy of public support

- ex. sport stadiums, museums, ballets, etc

- %%gov inhibited goods%% - goods deemed by gov as undesirable for human consumption

- ex. heroin, gambling, cigs

- income redistribution

- ^^transfer payment^^ - payments made to ppl for which no services or good are rendered in return

- ex. disability benefits, unemployment insurance benefits, etc

- ^^transfer in kind^^ - payments in the form of actual goods and services

- ex. food stamps

Healthcare Subsidies:

- patients pay deductible while gov pays the subsidies

- health-related spending is significant portion of total gov expenditures

- %%Medicare%% - provides subsidies to 65+ ppl’s hospital bills

- upsurge in doctor incomes, med school applications, private for profit hospitals, proliferation of new med tests and procedures

- medicare spending is growing faster than total employer/employee contributions → future spending guarantees outstrip the taxes collected to pay for the system

- %%Medicaid%% - provides subsidies for those who have lower incomes

Public Education:

- public schools provide services at price below market price with funds from taxpayers

- public spending on education has increased, while student performance has remained constant/declined

Markets and Collective Decision-Making:

%%collective decision making%% - area of econ that focuses on this is public choice; how politic decisions influence nonmarket decisions'

Similarities in market and public-sector decision

- opportunity cost

- every gov action has an opportunity cost

- competition

- similarity of individuals

- gov ppl face diff incentive structure

Differences in market and public-sector decision

- gov goods/services at zero price

- ^^gov/political goods^^ - goods provided by the public sector

- use of force

- expropriation

- voting vs. spending

- private = dollar voting system

- political system = majority rule

- market system = proportional rule

Chapter 19

Price Elasticity of Demand:

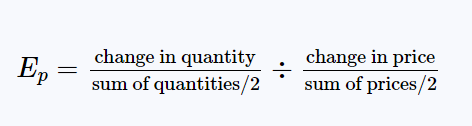

%%price elasticity of demand (Ep)%% - measures the responsiveness of the quantity demanded to changes in the price of a good/service

tells us the relative amount by which the quantity demanded will change in response to a change in the price of a particular good

equation: % change in quantity demanded / % change in price

^^elastic^^ - >1 percent change in quantity demanded; consumers are relatively responsive to price changes; inverse relationship between total revenue and market price

^^unitary elastic^^ - =1 percent change in quantity demanded; consumers are relatively unresponsive to price changes; total revenue never changes

^^inelastic^^ - <1 percent change in quantity demanded; doesn’t mean totally unresponsive; direct relationship

Extreme Elasticities:

%%perfectly inelastic demand/zero elasticity%% - 0 responsiveness to price changes; no matter the price quantity demanded remains the same

- graph is just vertical line

%%perfectly elastic demand/infinite elasticity%% - even a slight increase in price leads to 0 quantity demanded

- graph is horizontal line

Elasticity vs. Total Revenue:

- multiply price and quantity demanded to find total revenue

- use revenue to find elasticity

- using that data, find at what happens to the total revenue when price increases and declines

Determinants of the Price Elasticity of Demand:

- existence and number of substitutes

- more substitutes = greater price elasticity of demand

- perfect substitute = infinity elasticity of demand

- share of a consumer’s total budget devoted to purchases of that commodity

- greater part of budget spent on smtg = greater price elasticity of demand

- the length of time allowed for adjustment to changes in the price of commodity

- longer price change persists = greater elasticity of demand

- greater in long run

Cross Price Elasticity of Demand:

%%cross price elasticity of demand%% - responsiveness of the amount of an item demanded to the prices of related goods

equation:

- utilized to see if 2 products are substitutes or complements

- if substitute then positive

- if complement then negative

- if goods are unrelated than 0

Income Elasticity of Demand:

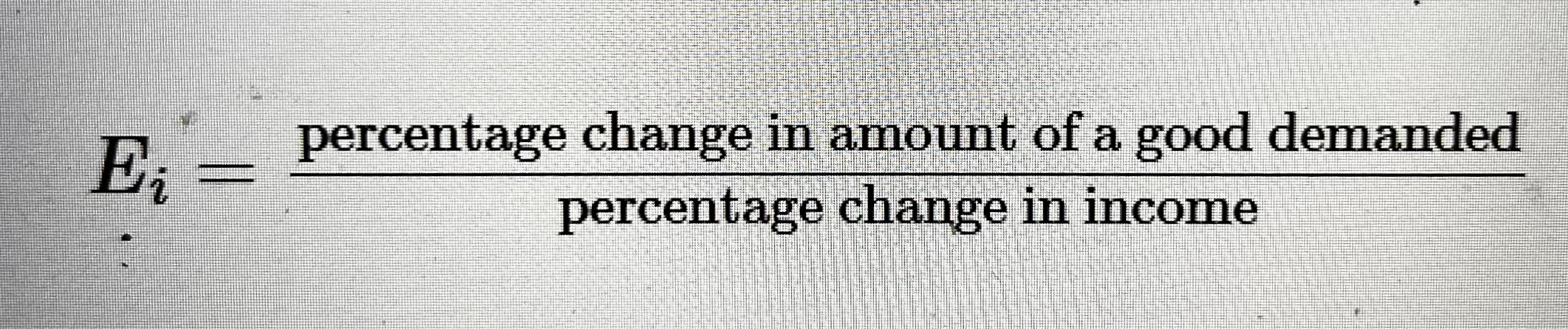

%%income elasticity of demand%% - the responsiveness of the amount of a good demanded to a change income

equation:

Price Elasticity of Supply:

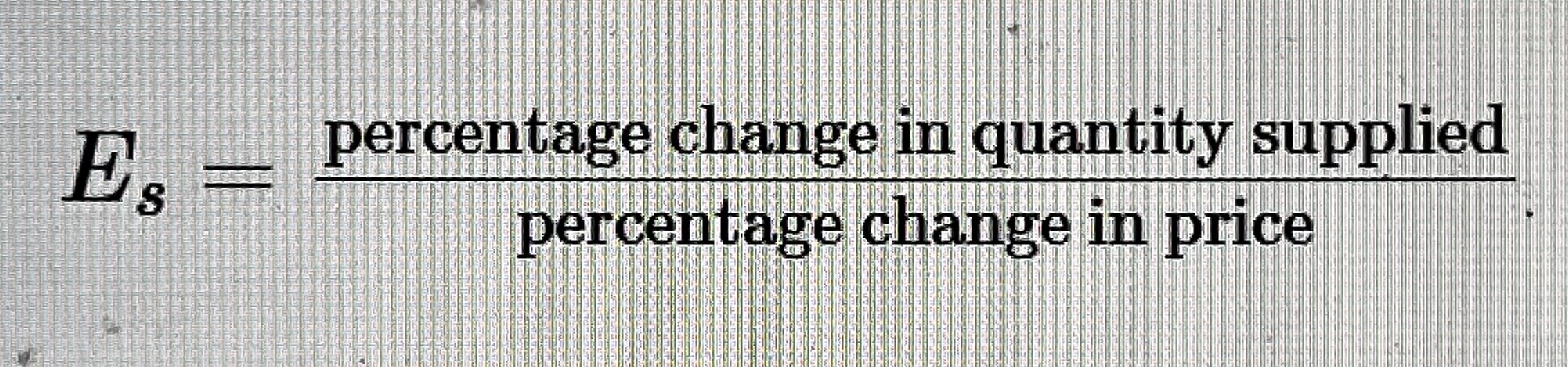

%%price elasticity of supply%% - generally positive; the responsiveness of the quantity supplied of a product to a change in its price

equation:

Types of Supply Elastics:

- %%perfectly elastic supply%% - >1 percent increase; slight decrease in price = quantity supplied to 0

- %%perfectly inelastic supply%% - <1 percent increase; quantity supplied always remains the same

- %%unit-elastic supply%% - % change in quantity supplied = % change in price

longer time for adjustment = more elastic supply curve

Chapter 20

^^utility^^ - satisfaction \n ^^utility analysis^^ - analysis of consumer decision making based on utility maximization

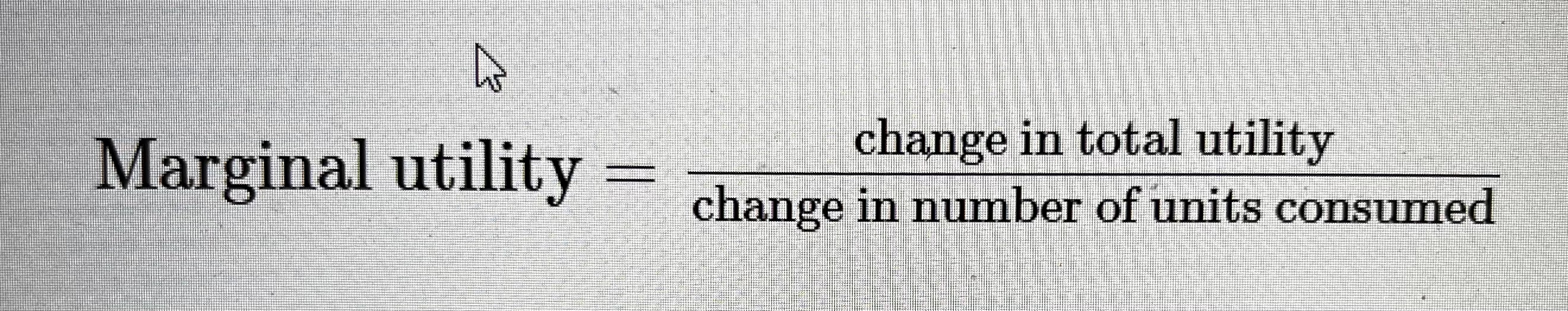

%%marginal utility%% - change in total utility due to a change in the quantity of a good/service consumed

equation:

%%diminishing marginal utility%% - as additional units of a good/service are consumed, the extra benefit of each additional unit eventually declines after originally satisfaction increased

- ^^how to calculate marginal utility per $^^

- marginal utility/price

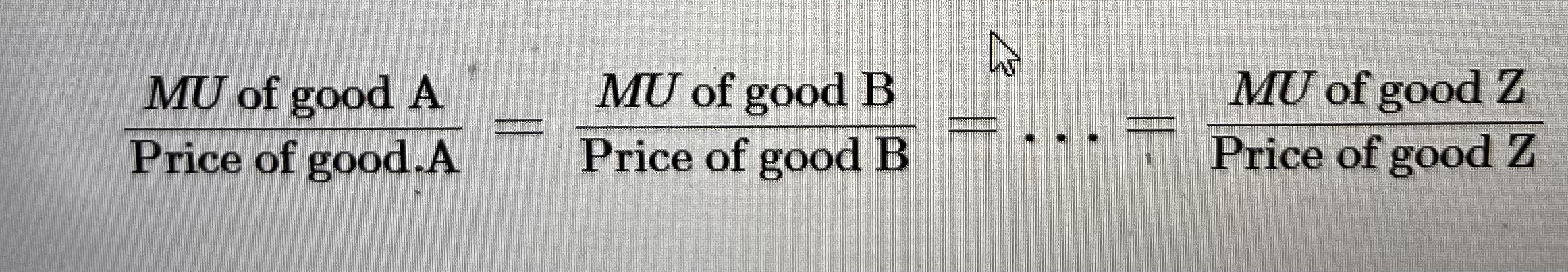

%%consumer optimum%% - the choice of a set of goods/services that maximizes the level of satisfaction for the consumer subject to their limited income

- can only reach when set marginal utility per dollar spent on all goods/services equal

- if prices of 2 items consumed are 0 = individuals will consume each as long as marginal utility is positive

- individual with unlimited income will continue to consume goods until the marginal utility of each is equal to 0

- no constraint on consumption

How to Attain the Consumer Optimum:

- consumer’s money income should be allocated so that the last dollar spent on each good purchased yields the same amount of marginal utility

equation:

Price Changes’ Influence on Consumer Optimum:

- amount purchased inverse to price

- if price decreases → ppl consume more

- %%substitution effect%% - tendency for ppl to substitute cheaper commodities for expensive ones

- %%principle of substitution%% - consumers shift away from goods that are higher priced and shift towards goods priced lower

- ^^purchasing power^^ - the value of money for buying goods

- income same, price increased → purchase power falls

- income same, price decreased → purchase power rises

- aka ^^real income effect^^

Diamond Water Paradox

^^marginal utility^^ determines what ppl are willing to pay for a unit of a certain good

- total utility of water > total utility of diamonds

- marginal utility of diamonds > marginal utility of water

- diamonds sell at a higher price than mouth

Why Utility Analysis?

- belief that ppl behave rationally to put them better off supports utility analysis

- makes clear predictions abt how ppl adjust their consumption based of prices and incomes

- people claim “bounded rationality” supports utility theory better

Chapter 21

%%economic rent%% - a payment for the use of any resource over and above its opportunity cost; minimum payment needed to call forth production of a resource

Land Rent:

- supply of land is completely inelastic

- quantity supplied = always the same

Allocation of Resources:

- economic rent allocated resources to their highest-valued use

Firms and Profits:

- ^^firm^^ - an organization that brings together factors of production (labor, land, physical capital, human capital, and entrepreneurial skill) to produce a product it hopes to sell at a profit

Organization of Firms -

%%proprietorship%%

- makes up 2/3 of all firms in US

- owned by single individual

- usually small businesses

- account for 4% of all business revenue

- advantages

- easy to form and dissolve

- all decision-making power resides with proprietor

- profit only taxed once

- disadvantages

- ^^unlimited liability^^ - where the personal assets of the owner of a firm can be deuces to pay off the firm’s debts

- limited ability to raise funds

- ends with death of proprietor leaving uncertainty for employees

%%partnership%%

- business owned by 2 or more joint owners

- less than 10% of all businesses

- can earn 20x more revenue than proprietors

- advantages

- easy to form

- limits cost of monitoring job performance

- permits more effective specialization

- subject only to personal taxation

- disadvantages

- unlimited liability

- decision making = more costly

- dissolution of partnership occurs when one leaves/dies → uncertain future

%%corporations%%

- owners are shareholders

- ^^limited liability^^ - personal property is shielded from claims by the firm’s creditors; shareholders have this

- < 20% of all US firms

- responsible for 80% of all business ventures in US

- advantage

- limited liability

- corporation doesn’t cease to exist after owners cease to be owners

- can raise large sums of financial capital

- disadvantages

- double taxation

- after tax profits distributed to shareholders as dividends

- ^^dividends^^ - payments that are treated as personal income and subject to personal taxation

- problems with separation of ownership and control

%%limited liability company%% - (LLC) offers limited liability of a corporation and tax advantages of a partnership

profit calculated by: total revenues - total cost

- ^^accounting profits^^ - total revenue - total explicit costs

- ^^economic profits^^ - total revenue - total explicit and implicit costs

Interest Rates’ Determinants:

- length of loan

- risk

- more risky ppl pay more

- creditworthy and collateral providers pay less

- cost of handling the loan

- resources + time needed to provide loan

How to Find Present Value of a Future Payment:

Equation: PresentVt = FutureVt / (1+interest)^t