Week 2 Risk and the Cost of Capital-1

Company Cost of Capital 1.1

Definition: The opportunity cost of capital for an investment in all the firm’s assets, typically used as a benchmark discount rate for new investments.

Cost of capital depends on the use to which capital is put.

Applicability: Correct only for new investments with the same risk as the company’s overall business (average-risk projects).

Firms that have their company’s cost of capital should only accept project with the same amount of risk (average), should not be higher (requires higher cost of capital), or lower (requires lower cost of capital).

Risk Adjustments:

For riskier projects than the overall business, the discount rate should be greater than the company cost of capital.

For safer projects, the discount rate should be less than the company cost of capital.

Company versus Project Cost of Capital

Principle: Each investment project should be evaluated at its own opportunity cost of capital, reflecting its unique risk level.

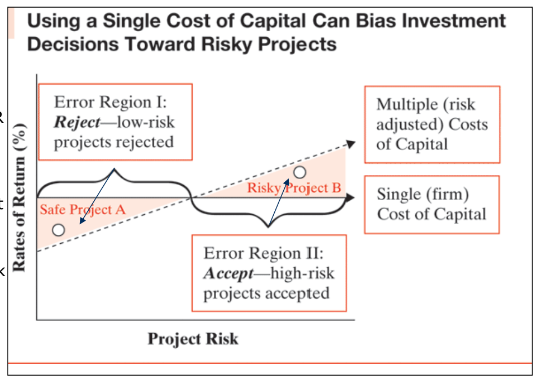

Risks and Decision Bias: Using a single discount rate for diverse risk levels may bias decisions towards risky projects (favoring risky investments over safer alternatives).

Risk Measurement: The risk of each project is quantified through its beta.

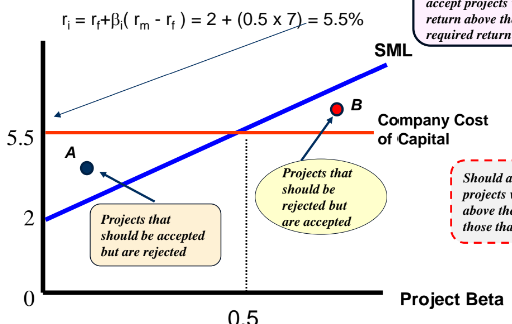

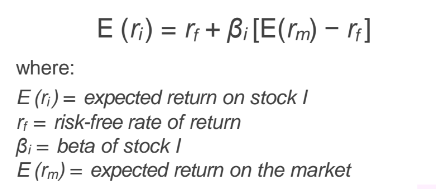

CAPM Required Return and SML

Calculation: If a project's beta is known, it can be compared to the company's cost of capital using the Capital Asset Pricing Model (CAPM) to determine whether to accept or reject investments based on their returns relative to the Security Market Line (SML).

Acceptance Criterion: Firm should only accept projects that have returns above the SML and reject those that are below the SML.

The correct discount rate should increase as project beta increases.

SML shows the relationship between return and risk. CAPM uses Beta as a proxy for risk. Beta is the slope of SML. Regression analysis can be used to find Beta.

Implications of Discount Rate Selection

Decision Outcomes: Using a single discount rate (firm COC) leads to accepting high-risk investments with attractive IRRs while potentially passing up safer projects.

Risk Bias Consequence: Over time, this bias towards high-risk investments increases the firm's overall risk profile, since firm prefers riskier project for higher return.

Benefits of Estimating Company Cost of Capital

Usefulness: It provides a benchmark for discount rates for projects that are unusually risky or safe.

Practicality: Business intuition helps in adjusting the company cost of capital rather than estimating from scratch for every project.

Company Cost of Capital 1.2

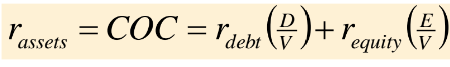

Comprised of the rates of return expected by debt and equity holders; a blended figure representing the opportunity cost involved in investing in the company's existing assets.

Ownership Understanding: Holding a portfolio consisting of both the firm's debt and equity means claiming full rights to its assets and cash flows.

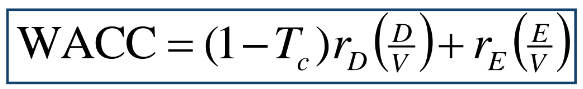

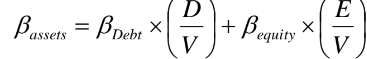

Weighted Average Cost of Capital (WACC)

Formula:

where:

(E) = market value of equity

(D) = market value of debt

(V) = total market value of firm (E + D)

rd = debt cost of capital

re = equity cost of capital

Equity versus Debt: Equity is riskier; its claim follows after debt in priority for claims on income and assets.

After-Tax WACC

Adjustment: The cost of debt must be adjusted for tax benefits because interest payments on debt are tax-deductible. Each dollar paid in interest can be deducted from the firm’s taxable income.

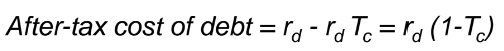

After-tax Formula:

Example: If (r_d = 7.5%) and (T_c = 35%), the after-tax cost of debt equals (7.5%(1 - 0.35) = 4.87%).

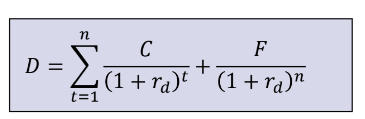

Cost of Debt Capital

Definition: Minimum return rate demanded by creditors when lending money to the company.

Calculation: Can be derived using a present value expression based on market value of debt, its cash flows, and the time to maturity.

D = market value of debt

n = the time to maturity of the debt

C = dollar interest paid on the debt

F = face value of the debt

rd = discount rate or YTM or cost of debt.

Challenges: Actual market values of corporate debt can be difficult to obtain due to infrequency of trading.

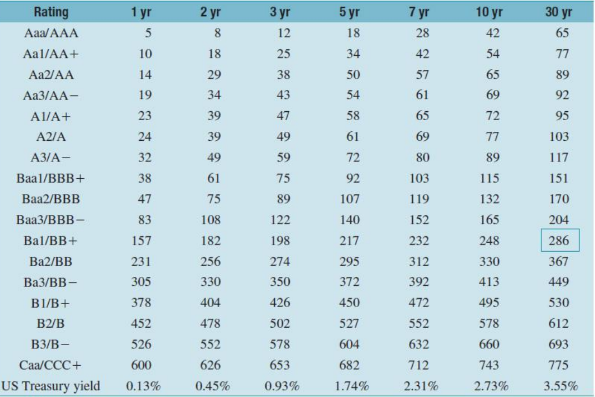

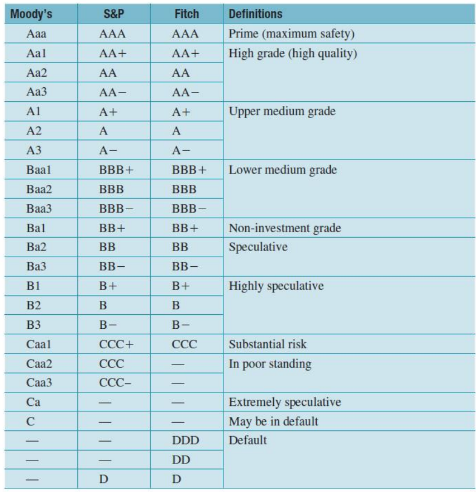

Estimating Cost of Debt

Methods:

Use government bond yields as proxies (risk-free rate). rd = rf.

Add credit risk premium to the bond yield/risk-free rate proxy. rd = rf + credit risk premium.

Credit risk premium for bond is usually associate with the credit spread from various credit ratings.

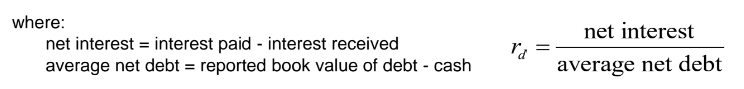

Calculate using net interest and average net debt.

Utilize the CAPM framework adjusted for debt beta, acknowledging the infrequency of trading in corporate bonds.

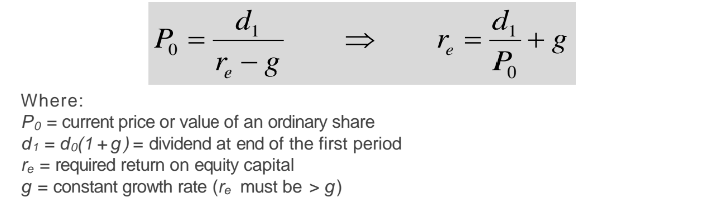

Dividend growth model and rate of return on equity

This model assumes that companies pay dividends that grow at a constant rate in the long run. This estimate might be flawed:

The shares could be overpriced or underpriced.

Constant dividend assumption might be inappropriate.

The cost of equity is the minimum rate of return required by a company’s shareholders. There is an alternative way to estimate cost of equity is the CAPM:

Estimating Betas

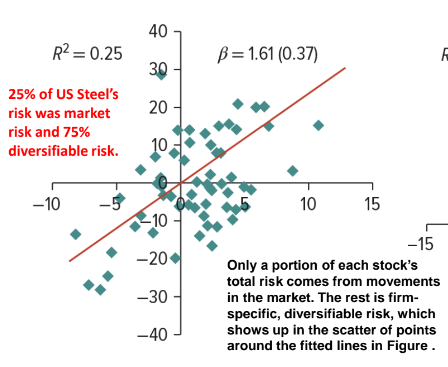

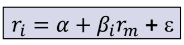

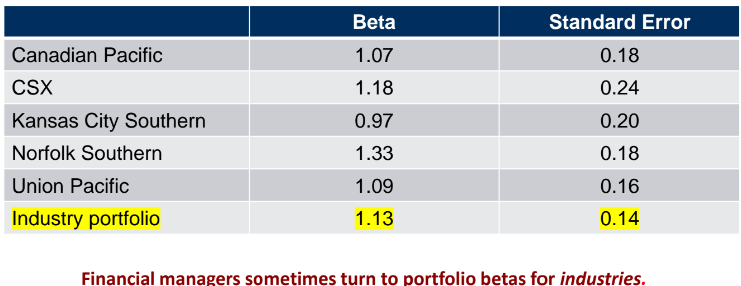

Beta Measurement: Reflects variation in stock returns relative to market movements. Beta is measured using past information, so there is no future expectation and volatitlies included.

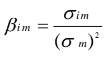

Security beta = covariance with asset I’s returns with market / variance of market.

Statistical Approach: Employ regression analysis to determine beta from historical stock and market data. Using OLD line of best fit through scatter plot of points.

Slope of line = beta of the security.

“a” measure the historical performance of the security relative to the expected return predicted by the SML.

Interpretation: A higher R-squared (R²) indicates a higher proportion of systematic risk attributed to market movements (market risk).

Specific/Systematic risk = 1 - market risk.

Market risk = R2.

R2, line of best fit, is the percentage of variance that can be explained through the independent variables. We prefer a higher R2, meaning more variation is explained thus better results and prediction.

Company Cost of Capital and Capital Structures

Estimating COC: Calculate firm-wide asset beta and substitute into the CAPM to derive the company cost of capital.

Asset Structure: Corporate structure viewed as a portfolio encompassing debt and equity—calculating asset beta reflects this composition.

Company CoC is based on the average beta of the assets. The average beta of the assets is based on the % of funds in each asset.

New ventures viewed as high-risk projects.

Expansion of the existing business viewed as average risk project.

Improving plant efficiency viewed as low-risk project.

Determinants of Asset Betas

Determinants of asset betas:

Cyclicality: variability of firm’s earnings or cash flow (earnings beta of cash-flow beta). Higher beta, or high-beta firm, means firms whose revenue & earnings are strongly dependent on business cycle.

Higher rate or return from investment whose performance is strongly tied to the performance of the economy.

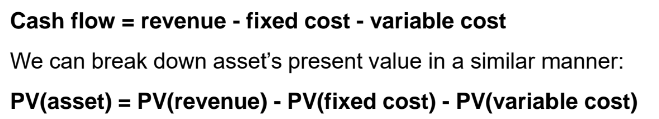

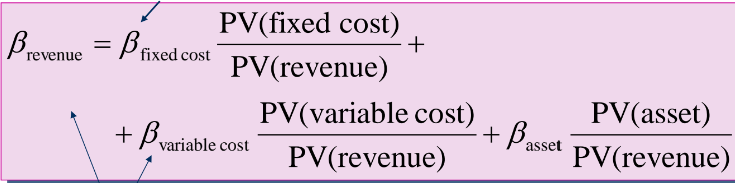

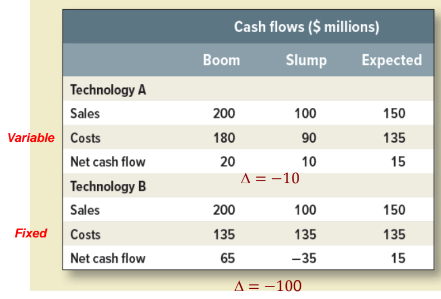

Operating leverage: ratio of firm’s fixed costs relative to its variable costs.

High fixed costs imply high operating leverage imply high betas.

High operating leverage implies a high asset beta.

→ Asset betas useful when one cannot calculate the equity beta.

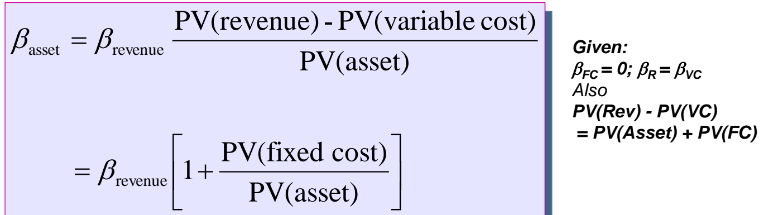

Cash flows generated by asset can be broken down into:

Beta of revenue

beta of revenue is simply weighted average of its component’s parts.

beta of fixed cost is 0 by definition, whoever incurs fixed costs does not experience variability in those costs with changes in revenue, meaning it does not contribute to the overall risk profile of the asset.

beta of revenue and variable cost are approximately the same.

Operating leverage and risk

Given example for two Technologies, both with same level of sales, however, one has fluctuated cost and the other has fixed cost. Since fixed cash flows are hit harder by economic downturns, thus having a higher beta and higher risk. For boom time, it would leverage the best profit.

Discount rate changes and durations of project’s cash flows can impact beta:

For example, long-term cash flows are more exposed to shifts in the discount rate than short-term. The project would have higher beta even though it may not have high operating leverage or cyclicality.

Diversifiable risks do not increase cost of capital, increasing discount rates to offset diversifiable risks will not be effective.

e.g. stock price fluctuation.

Do not offset uncertainty of a project’s by adding up the discount rate, it should have been incorporated into the expected future cash flows. (fudge factor)

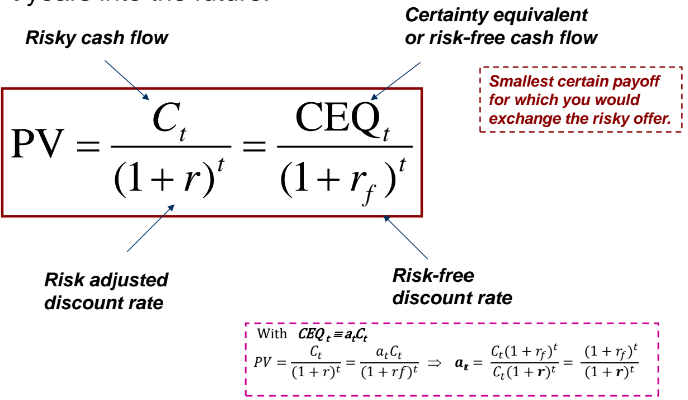

Risk, DCF, and Certainty Equivalents

Valuation Methods:

Discount risky cash flows at a risk-adjusted rate.

Find the certainty-equivalent cash flow and discount it at the risk-free rate.

Present Value Calculation: The equivalence of cash flows must be appropriately discounted to derive present value accurately.

→ CEQ is guarantee return that reflects the risk-free rate without taking higher risk, allowing for a clear comparison with the risky cash flows. Risk-adjusted.

The NPV would be the same if certainty equivalents discounted by the risk-free rate are used instead.