Untitled Flashcards Set

1.4.3 Factors Contributing to Business Failure

Reference: Business Studies in Action p138-144

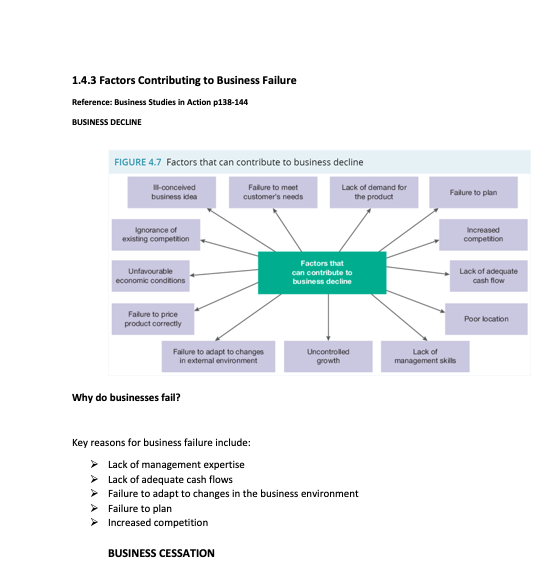

BUSINESS DECLINE

Why do businesses fail?

Key reasons for business failure include:

Ø Lack of management expertise

Ø Lack of adequate cash flows

Ø Failure to adapt to changes in the business environment

Ø Failure to plan

Ø Increased competition

BUSINESS CESSATION

1.4.4 Cessation of Business

Voluntary cessation

To prevent this accumulation of debt, the owner will need to cease operating the business of their own accord — that is, undergo voluntary cessation.

Involuntary cessation

Many businesses, however, finish involuntarily. The owner is forced to cease trading by the creditors of the business; that is, undergo involuntary cessation.

Note: Creditors: are those people or businesses who are owed money

Legal Structure and Business Cessation

Bankruptcy - Sole Traders or Partnerships

Bankruptcy is a declaration that a business, or person, is unable to pay his or her debts.

Bankruptcy can be either voluntary or involuntary,

The process of bankruptcy involves either the business owner or a creditor applying to a court for a bankruptcy order to be made

The process of converting a business’s assets into cash is known as realisation.

Voluntary Administration - Private and Public Companies

Voluntary Administration

When a company is unable to pay its debts it becomes insolvent.

If a company is insolvent, they can be placed into voluntary administration. Voluntary administration occurs when occurs when an independent administrator is appointed to operate the business in the hope of trading out of the present financial problems.

The administrator’s main tasks are to bring the business and its creditors together, and examine the financial affairs of the business.

Liquidation

If a company is unable to pay its debts, the shareholders, creditors, or the court may place the company into liquidation

When a company is being liquidated because it is insolvent, the liquidator’s prime responsibility is to the company’s creditors.

Liquidation, also known as winding up a company, occurs when (commonly referred to as winding up a company an independent and suitably qualified person — the liquidator — is appointed to take control of the business with the intention of selling all the company’s assets in an orderly and fair way to pay the creditors.

A company in liquidation can also be in receivership. Receivership is where a business has a receiver appointed by creditors or the courts to take charge of the affairs of the business.

Unlike liquidation, though, the business may not necessarily be wound up.

The main features of liquidation are:

Ø can be regarded as the equivalent of bankruptcy for a company (corporation)

Ø results in the life of a company coming to an end

Ø normally occurs because the company is unable to pay its debts as and when they fall due – it has become insolvent.

The liquidator’s main functions are to:

Ø take possession of and realise – convert into cash – the company’s assets

Ø investigate and report to creditors about the company’s financial and related business affairs

Ø determine debts owed by the company and pay the company’s creditors

Ø scrutinise the reasons for the company failure

Ø report possible offences by people involved with the company to ASIC

Ø deregister or dissolve the company.

Knowt

Knowt