Chapter 2 Microeconomics

Economic Systems Overview

Economic systems are the frameworks a society uses to answer the perennial questions “what goods & services should be produced, how should they be produced, and how should they be distributed?” They are fundamentally institutional arrangements—that is, bundles of legal, cultural, and organizational rules that allocate scarce resources.

Key dimensions of difference

Ownership of the factors of production (land, labor, capital, entrepreneurial ability).

Method of motivation, coordination, and direction of economic activity (markets vs. central plans).

These two dimensions give rise to the two polar prototypes—command and market systems—plus a wide spectrum of hybrids.

The Command System (Socialism / Communism)

• Ownership: Government owns virtually all property and productive resources.

• Decision-making: A central planning board sets output targets, allocates inputs, and dictates prices.

• Contemporary examples: North Korea, Myanmar (Burma), Iran.

Practical challenges

Coordination problem – Planners must set accurate targets for thousands of goods; mis-queues ripple through the economy.

Incentive problem – Because prices cannot rise to clear surpluses/shortages and managers face no profit motive, chronic excesses and deficits occur.

Advantages:

Reduced Inequality and Unemployment:

Centralized control can ensure everyone has a job and that income is distributed more evenly, potentially reducing poverty and social unrest.

Rapid Industrialization and Resource Mobilization:

A command economy can quickly mobilize resources to achieve specific goals like industrialization or infrastructure development.

Potential for Social Welfare:

Prioritizing social welfare over profit can lead to universal access to essential services like healthcare and education.

Stability:

Centralized control can theoretically prevent the boom-and-bust cycles of market economies, leading to more stable economic conditions.

Alignment with National Goals:

A command economy can focus resources on achieving specific national objectives, such as national defense or technological advancement.

Disadvantages:

Lack of Competition and Innovation:

Without the pressure of competition, businesses may lack the incentive to innovate or improve efficiency, potentially leading to stagnation and low-quality goods.

Inefficiency and Bureaucracy:

Large bureaucracies are often needed to manage a command economy, which can lead to inefficiencies, delays, and misallocation of resources.

Disregard for Consumer Preferences:

Central planners may not accurately predict or respond to consumer demands, leading to shortages or surpluses of goods.

Limited Individual Freedom and Entrepreneurship:

Individuals have limited freedom to make economic decisions or start businesses, potentially stifling innovation and economic growth.

Potential for Corruption:

Centralized power can create opportunities for corruption, especially at the highest levels of government.

Difficulty Adapting to Change:

Command economies may struggle to adapt to changing technologies or global market conditions, potentially falling behind in innovation and economic development.

The Market System (Capitalism)

• Ownership: Resources are privately owned; property rights are strongly protected.

• Decision-making: Millions of individual buyers and sellers interact in markets. Prices, profits and losses guide activity.

• Representative nations: Australia, Switzerland, United Kingdom.

Core Characteristics of a Market System

Private Property – Owners have the right to control, employ, and dispose of resources. This underpins investment, innovation, and growth.

Freedom of Enterprise and Choice – Firms may enter/exit industries; consumers can purchase any bundle their income permits.

Self-Interest – Each economic actor pursues objectives that are personally rewarding, yet collectively promote social welfare.

Competition – Large numbers of independently acting buyers & sellers, plus freedom to enter or leave markets, keep power diffused and prices honest.

Markets and Prices – A vast network of markets transmits information (prices) and provides incentives.

Advantages:

Efficiency and Innovation:

Competition among businesses drives them to produce goods and services efficiently and at lower costs, leading to innovation and better quality products.

Consumer Choice:

Consumers have a wide variety of products and services to choose from, catering to diverse preferences.

Economic Growth:

The profit motive encourages investment and entrepreneurship, fostering economic growth.

Reduced Bureaucracy:

Market economies often feature less government intervention, leading to streamlined processes for businesses.

Disadvantages:

Income Inequality:

The market system can exacerbate income inequality, as those with more resources can accumulate more wealth.

Market Failures:

Externalities (like pollution) and the potential for monopolies can lead to inefficient resource allocation.

Exploitation of Labor:

In the pursuit of profit, businesses may exploit workers through low wages or poor working conditions.

Economic Instability:

Market economies are susceptible to business cycles, leading to potential periods of recession and unemployment.

Environmental Degradation:

The focus on profit can incentivize unsustainable practices, leading to environmental problems like pollution and resource depletion, according to a study finance blog.

Public Goods:

Some essential public goods and services (like national defense or clean air) might not be provided adequately by the market

Global Perspective on Economic Freedom

The Heritage Foundation’s index classifies nations from “Free” to “Repressed.” Illustrative rankings:

Free: Hong Kong (#1), Australia (#3), Switzerland (#5).

Mostly Free: United States (#9), Japan (#20).

Mostly Unfree: Nigeria (#111), Vietnam (#139), Russia (#143).

Repressed: Iran (#171), Burma (#174), North Korea (#179).

These rankings correlate strongly with income per capita, investment inflows, and political liberties.

Technology, Capital Goods, and Specialization

A market system actively encourages the adoption of advanced technology and the accumulation of capital goods because:

Owners receive the rewards of efficiency (higher profits).

Competition penalizes obsolete methods.

Specialization increases productivity via:

Division of Labor – Workers concentrate on a narrow task, hone skills, save time, and facilitate mechanization.

Geographic Specialization – Regions/nations exploit natural or acquired advantages (e.g., Silicon Valley software, OPEC oil).

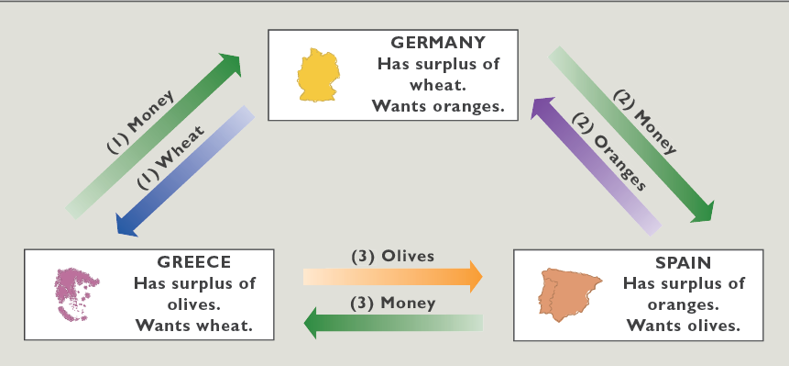

Money and the Elimination of Barter

Money acts as a universally accepted medium of exchange, solving the double-coincidence-of-wants problem inherent in barter.

Example flow among three countries:

Greece trades olives \Rightarrow receives money.

Spain trades oranges \Rightarrow receives money.

Germany trades wheat \Rightarrow receives money.

Because each party accepts money, three‐way barter cycles (olives \rightarrow wheat \rightarrow oranges \rightarrow olives) are unnecessary; trade volume and complexity expand.

Active but Limited Government

Even in laissez-faire capitalism, government may intervene to:

Correct market failures (externalities, public goods, asymmetric information).

Promote competition (antitrust laws).

Provide a legal framework (contracts, property rights).

The ideal is to raise overall efficiency without stifling the price mechanism.

The Five Fundamental Questions

1. What Goods and Services Will Be Produced?

• Profit Test (Supply Side) – Firms supply items whose expected revenue exceeds cost; i.e., they anticipate \text{profit} > 0.

• “Money Votes” (Demand Side) – Every dollar spent is a ballot. Products receiving more ballots survive; others exit.

2. How Will Goods and Services Be Produced?

• Firms pick the least-cost technique, balancing available technology and input prices.

Illustration: Three Techniques for $\$15$ of Bar Soap

Resource | Price/Unit | Technique 1 | Cost | Technique 2 | Cost | Technique 3 | Cost |

|---|---|---|---|---|---|---|---|

Labor | \$2 | 4 | \$8 | 2 | \$4 | 1 | \$2 |

Land | \$1 | 1 | \$1 | 3 | \$3 | 4 | \$4 |

Capital | \$3 | 1 | \$3 | 1 | \$3 | 2 | \$6 |

Entrepreneur | \$3 | 1 | \$3 | 1 | \$3 | 1 | \$3 |

Total | \$15 | \$13 | \$15 |

Technique 2 is chosen because \$13 < \$15, yielding a \$2 cost advantage.

3. Who Will Get the Output?

• Consumers with both willingness and ability to pay obtain the good. Income distribution thus matters.

4. How Will the System Accommodate Change?

• Tastes shift \Rightarrow demand curves move \Rightarrow prices/profits change \Rightarrow resources reallocate.

• Technology improves \Rightarrow lower costs \Rightarrow old firms/adaptations exit.

• Resource Prices vary (e.g., oil shock) \Rightarrow producers substitute other inputs.

5. How Will the System Promote Progress?

• Technological Advance – Innovation raises productivity.

• Capital Accumulation – Profits finance new plants and equipment.

• Disruptive Technologies/innovation – new products/techniques obliterate old ones (e.g., smartphones vs. flip phones).

The Invisible Hand

Coined by Adam Smith (1776, Wealth of Nations), the invisible hand doctrine states that, under competition and property rights, individuals pursuing self-interest inadvertently promote the social good.

Virtues

Efficiency – Resources gravitate to their highest-valued use.

Incentives – Profit motive spurs innovation and effort.

Freedom – Decentralized decision-making preserves personal liberty.

Demise of Historical Command Economies

The Soviet Union, Eastern Europe, and pre-reform China exhibited chronic shortages/surpluses and low growth. Without price signals, planners misallocated resources; without a profit motive, managers had no reason to innovate.

Key lessons:

Flexible prices are essential for coordination.

Incentives matter — they channel human creativity or lethargy.

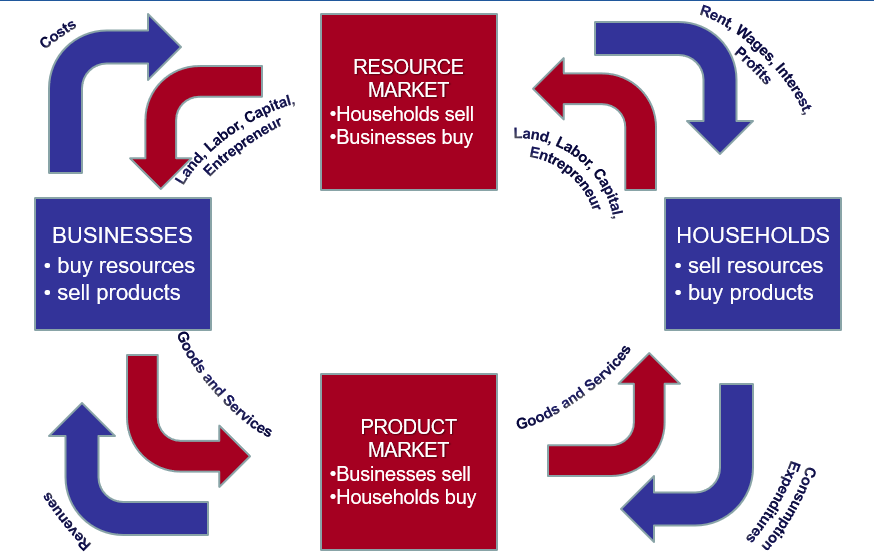

The Circular Flow Model

A simplified closed economy with no government or foreign sector illustrates continuous, reciprocal flows.

Resource Market

Households sell land, labor, capital, entrepreneurial ability.

Businesses buy these inputs, paying wages, rent, interest, profit.

Product Market

Businesses sell finished goods/services.

Households buy them with income earned from the resource market.

Money flows (income, expenditures) move clockwise; Real flows (resources, goods) move counter-clockwise.

Business Forms

Sole Proprietorship – Single owner, unlimited liability.

Partnership – Two or more owners share profits & liability.

Corporation – Separate legal entity; owners (shareholders) enjoy limited liability; can raise capital via stock issuance.

Ethical, Philosophical, and Practical Implications

• Equity vs. Efficiency – A pure market might maximize pie size but not its distribution; societies often temper markets with taxes, transfers, or regulation.

• Freedom vs. Security – Markets emphasize choice; command systems promise stability. Actual outcomes show higher living standards where freedom is prioritized.

• Dynamic vs. Static Efficiency – Profit signals in markets reward not just current efficiency but also long-run innovation (dynamic); command systems struggle here.

Connections and Real-World Relevance

• 2008-09 financial crisis highlighted market failure (systemic risk) and reignited debate on government’s proper scope.

• Ongoing shift toward mixed economies – even “market” nations operate social safety nets; formerly command nations (e.g., China, Vietnam) integrate market mechanisms.

• Technological revolutions—AI, green energy—echo creative destruction: firms that adapt prosper; laggards disappear.

Key Numerical & Mathematical References

• Total cost comparison in bar-soap example: \$15 vs. \$13.

• Economic freedom ranks (selected): 1 \leq \text{Rank} \leq 179, lower = freer.

• Circular flow: household income \Rightarrow product spending \Rightarrow business revenue \Rightarrow factor payments \Rightarrow household income (a closed loop).