Chapter 14: Rent, Interest, and Profit

Economic rent - The price paid for the use of land and other natural resources that are completely fixed in total supply

- Demand for resource derived from demand for product being produced

- Supply of resource is perfectly inelastic in short + long run

- Productivity of land + prices of other resources combined w/ land determine demand

- Free good - Demand much weaker than supply → Excess supply even if market price is zero

Incentive function - A high price provides an incentive to offer more of the resource, whereas a low price prompts resource suppliers to offer less

Single-tax movement - Henry George; economic rent could be heavily taxed, or even taxed away, without diminishing the available supply of land or, therefore, the productive potential of the economy as a whole

- Efficient b/c tax doesn’t alter quantity supplied of resource being taxed

- Criticisms

- A single land tax wouldn’t bring in enough $ for the gov’t

- Would be difficult to determine how much of an income payment amounted to economic rent

- A piece of land can change ownership many times

Productivity + rent differences

- Different pieces of land vary in productivity

- Strategically-located land is more expensive

- Causes rent differentials

Alternative land uses

- Farming

- Building houses, highways, etc.

Interest - Price paid for use of money

- Stated as percentage

- Money is not a resource

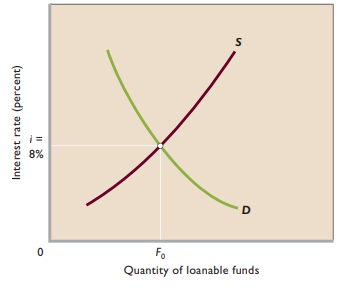

Loanable funds theory of interest - Explains the interest rate not in terms of the total supply of and demand for money but, rather, in terms of the supply of and demand for funds available for lending (and borrowing)

- Upward sloping supply of loanable funds

- Households will make available a larger quantity of funds at high interest rates than at low interest rates

- Downward sloping demand for loanable funds

- At higher interest rates fewer investment projects will be profitable and therefore a smaller quantity of loanable funds will be demanded

- At lower interest rates, more investment projects will be profitable and therefore more loanable funds will be demanded

Extending the model

- Households place savings in financial institutions

- Anything that causes households to be thriftier will prompt them to save more at each interest rate, shifting the supply curve rightward

- Conversely, a decline in thriftiness would shift the supply-of-loanable-funds curve leftward and increase the equilibrium interest rate

- On the demand side, anything that increases the rate of return on potential investments will increase the demand for loanable funds

- A decline in productivity or in the price of the firm’s product would shift the demand curve for loanable funds leftward, reducing the equilibrium interest rate

Time-value of money - A specific amount of money is more valuable to a person the sooner it is obtained

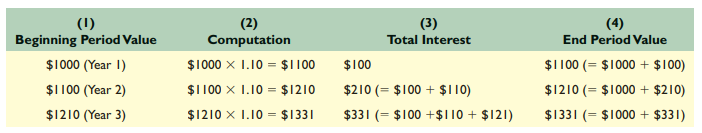

- Compound interest is the total interest that cumulates over time on money that is placed into an interest-bearing account

- Future value - Amount to which some current amount of money will grow to as interest compounds over time; forward-looking

- Present value - Today’s value of amount of money to be received in the future

- Higher interest rate → Greater future value of specific mount of $

Range of interest rates

- Risk - The greater the chance that the borrower will not repay the loan, the higher the interest rate the lender will charge to compensate for that risk

- Maturity - The time length of a loan or its maturity (when it needs to be paid back) also affects the interest rate

- Loan size - If there are two loans of equal maturity and risk, the interest rate on the smaller of the two loans usually will be higher

- Taxability - Interest on certain state and municipal bonds is exempt from Federal income taxation

Pure rate of interest - Best approximated by the interest paid on long-term, virtually riskless securities such as long-term bonds of the U.S. government (20-year Treasury bonds)

Role of the interest rate

- Lower interest rate → Encourages businesses to borrow more for investment

- Rations available supply of loanable funds to investment projects

- Lower cost of borrowing funds → More R&D spending

Nominal interest rate - The rate of interest expressed in dollars of current value

Real interest rate - Rate of interest expressed in purchasing power—dollars of inflation-adjusted value

Usury laws - Specify a maximum interest rate at which loans can be made

- Non-market rationing

- Gainers + losers

- Inefficiency

Economic profit - What remains after all costs—both explicit and implicit costs, the latter including a normal profit—have been subtracted from a firm’s total revenue

- Explicit costs - Payments made by firm to outsiders

- Implicit costs - The monetary income the firm sacrifices when it uses resources that it owns, rather than supplying those resources to the market

- Normal profit - Minimum payment necessary to retain the current line of production

Sources of economic profit

- Static economy - One in which the basic forces such as resource supplies, technological knowledge, and consumer tastes are constant and unchanging

- Profit linked to dynamic nature of real-world capitalism + accompanying uncertainty

- Risk + profit

- Insurable risks - Avoid losses by paying annual fee to insurance company

- Uninsurable risks - Uncontrollable and unpredictable changes in the demand and supply conditions facing the firm (and hence its revenues and costs)

- Changes in general economic environment

- Changes in economic structure

- Changes in gov’t policy

- Innovations + profit

- Innovations undertaken by entrepreneurs entail uncertainty and the possibility of losses, not just the potential for increased profit

- Some of the economic profit in an innovative economy may be compensation for dealing with the uncertainty of innovation

- Monopoly + profit

- Monopoly power → Reduce business risk

- Sustain firm + economic profit

Functions of profit

- Motivates innovation

- Allocates resource among production