Lecture 8 - Oligopoly

11.1: What Does Equilibrium Mean in an Oligopoly?

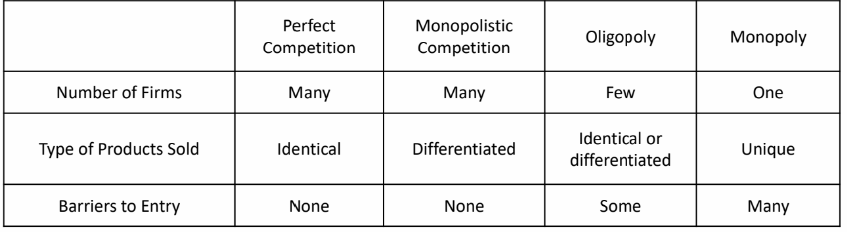

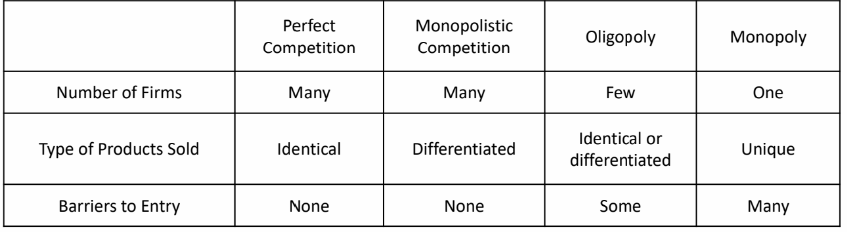

11.1.1 Definition and characteristics

An oligopoly is a market structure characterized by a small number of firms that dominate the market. These firms have significant market power, which allows them to influence prices and output levels. Key features include:

Few Sellers: Only a handful of companies control the majority of the market.

Interdependence: Firms must consider the actions of their competitors when making decisions.

Barriers to Entry: High costs or other obstacles prevent new competitors from easily entering the market.

Examples include the automotive and airline industries.

Oligopoly Characteristics

Competition among a small number of firms.

Each firm's actions influence others.

11.1.2. What is a Nash Equilibrium?

Nash Equilibrium NE: Each firm does its best given the actions of others.

In oligopoly, each company’s actions influence what the other companies want to do. We want to determine an outcome when no firm wants to change its decision.

11.2: Oligopoly with Identical Goods: Collusion and Cartels

11.2.1. Definition and assumptions

Collusion

Firms coordinate production and pricing to act as a monopoly.

Cartel

the organization formed when firms collude, e.g. OPEC.

Model Assumptions for collusion and cartels.

Firms produce identical products.

Firms agree to coordinate decisions.

No firm deviates from the agreement.

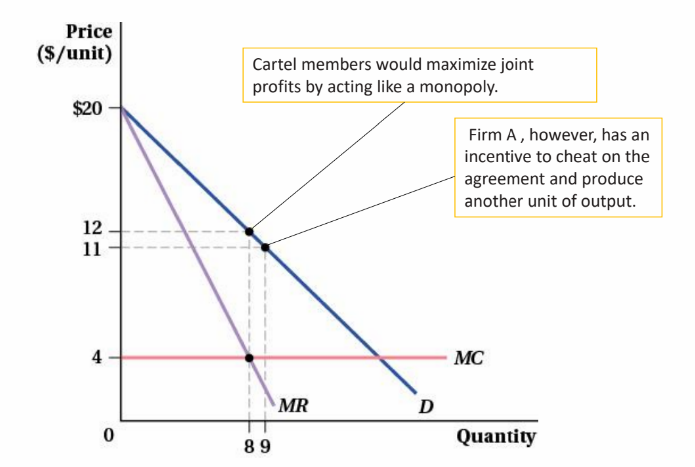

11.2.2. Instability of collusion

Instability of Collusion

Collusion doesn’t have an equilibrium/NE outcome.

Incentive for firms to cheat on collusion agreements making it hard to maintain.

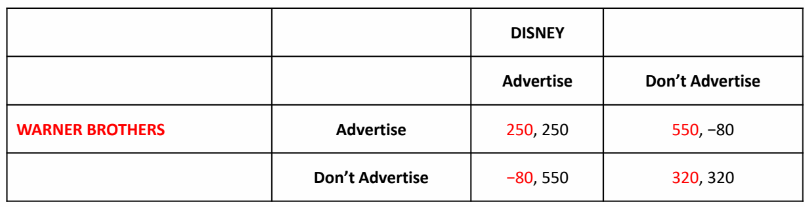

Example: Two firms colluding to produce monopoly output but facing incentives to increase individual output.

11.2.3. How to maintain collusion?

Factors Making Collusion Easier

Easy detection and punishment of cheaters.

Little variation in marginal costs (less production costs).

Long time horizons increase the cost of defection, forcing long-term vision.

11.3: Oligopoly with Identical Goods: Bertrand Competition

11.3.1. Definition and assumptions

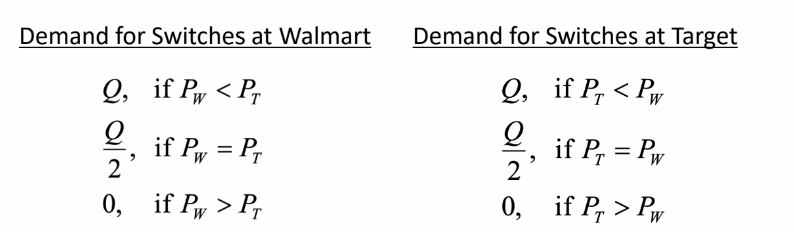

Bertrand competition is a model in oligopoly where firms compete by setting prices rather than quantities. In this scenario, firms assume that their competitors' prices are fixed and will lower their own prices to capture market share. This can lead to a price war, driving prices down to marginal cost, resulting in zero economic profit for firms in the long run. The model highlights the importance of price competition in markets with a few dominant firms.\

In Bertrand competition with identical goods, the firm with the lower price captures the entire market share, assuming the products are perfect substitutes and customers will always buy from the firm offering the lower price. In opposite case, 0 market share.

—> Here we set P = MC instead of MC = MR, because we are competing price not quantity.

Model Assumptions:

Firms compete by setting prices of its products.

Firms sell identical products.

Prices are set simultaneously.

11.3.2. NE in Bertrand competition

A firm will tend to charge lower price than others to capture more of the market.

In a Bertrand oligopoly, Nash equilibrium is achieved when firms set prices such that no firm can increase its profit by unilaterally changing its price. Here's how it works:

Price Competition: Firms compete by setting prices rather than quantities.

Identical Products: If firms offer identical products, the firm with the lower price captures the entire market.

Price Matching: If one firm lowers its price, others will follow to avoid losing customers.

Equilibrium Point: Eventually, firms reach a point where prices stabilize at marginal cost, and no firm has an incentive to change its price, resulting in Nash equilibrium.

In this state, all firms earn zero economic profit.

Nash Equilibrium in Bertrand Oligopoly

Equilibrium occurs when firms charge marginal cost.

Price equals marginal cost, like perfect competition.

11.4: Oligopoly with Identical Goods: Cournot Competition

11.4.1. Definition and assumptions

Cournot competition is a model of oligopoly where firms compete on the quantity of output they produce. Each firm decides how much to produce, assuming the output of its competitors remains constant. The key features include:

Simultaneous Decision-Making: Firms choose quantities at the same time.

Reaction Functions: Each firm's output decision depends on the expected output of others.

Nash Equilibrium: The market reaches a point where no firm can benefit by changing its output alone.

This model illustrates how firms in an oligopoly can reach a stable market outcome through strategic interaction.

Cournot Competition Model

Firms choose production quantities rather than prices.

Model Assumptions:

Firms produce identical products.

Firms choose a quantity and choose it simultaneously

Market price is determined by total quantity produced.

11.4.2. How does Cournot oligopoly reach NE?

Equilibrium in Cournot Oligopoly

Each firm's output depends on the other firm's output.

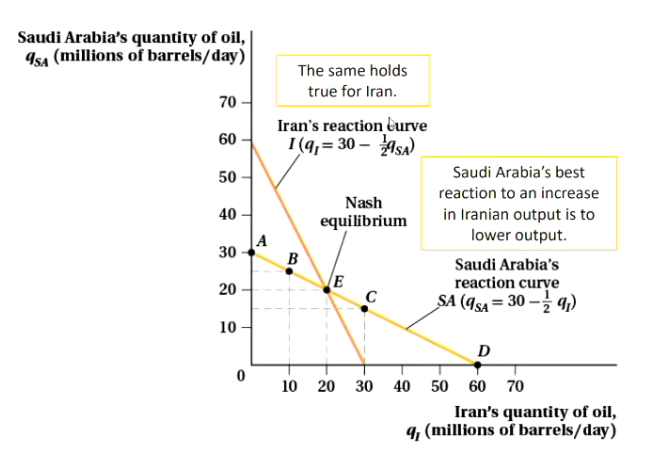

Example: Saudi Arabia and Iran's oil production decisions.

—> If a firm decided to increase its quantity produced, within the market, there are more quantity now that will decrease the market price (i don’t think this belong to this chapter).

In a Cournot oligopoly, Nash equilibrium is reached when each firm chooses its output level assuming the output levels of the other firms are fixed. The steps to find the equilibrium are:

Determine Reaction Functions: Each firm derives its reaction function based on maximizing its profit given the output of its competitors.

Simultaneous Solution: Solve the system of reaction functions simultaneously to find the equilibrium output levels for all firms.

Check Stability: Ensure that the output levels are stable and no firm has an incentive to deviate.

At this point, no firm can increase its profit by unilaterally changing its output.

Each firm's curve shows optimal output based on the other’s output. The intersection represents the Nash Equilibrium where neither firm can benefit by changing output unilaterally.

11.4.3. Residual demand curve

In Cournot competition, the residual demand curve represents the demand faced by a firm after accounting for the output of its competitors. It shows how much of the market demand remains for a firm to sell at different price levels, given the quantities produced by other firms.

Firms can calculate expected profit maximization based on the residual demand curve.

11.4.4. Reaction functions/curves

Reaction curves illustrate how one firm's optimal output decision responds to the output levels of its competitors. Each firm's reaction curve shows the quantity it will produce based on the quantity produced by others, reflecting strategic interdependence in output decisions.

11.4.5. What if there are more than 2 firms in Cournot oligopoly?

As number of firms increases, market outcomes reach perfectly competitive cases:

more competitors mean higher industry output, lower market price, and lower industry profit.

Differences between Cournot and Bertrand.

Comparing Cournot to Collusion and Bertrand

Output and Profit Comparison:

Collusion: Highest price, lowest output, highest profit.

Bertrand: Lowest price, highest output, zero profit.

Cournot: Intermediate price and output, positive profit.

Feature | Cournot Competition | Bertrand Competition |

Assumption | Firms compete on quantity | Firms compete on price |

Market Structure | Oligopoly | Oligopoly |

Equilibrium | Firms choose quantities simultaneously | Firms choose prices simultaneously |

Price Setting | Prices are determined by total output | Prices are set based on competitors' prices |

Profit Maximization | Firms maximize profit based on output | Firms maximize profit based on price |

Outcome | Higher prices, lower quantities | Lower prices, potentially higher quantities |

Strategic Variable | Quantity | Price |

As there are a greater number of firms increases, market outcomes will fall between monopoly and perfect competitive:

outcomes will approach the perfectly competitive case

more competitors mean higher industry output, lower market price, and lower industry profit.

11.5: Oligopoly with Identical Goods but with a First-Mover: Stackelberg Competition

11.5.1. Definition

Stackelberg Competition Model

Firms make production decisions sequentially.

First-mover advantage allows one firm to set output before others.

Stackelberg Competition in Oligopoly

Stackelberg competition is a strategic model in oligopoly where firms make decisions sequentially rather than simultaneously. One firm, the leader, sets its output first, and the other firms, the followers, react to this decision. This model highlights the advantages of being a first mover, as the leader can influence market prices and quantities, leading to different equilibrium outcomes compared to Cournot competition, where firms choose outputs simultaneously.

11.6: Oligopoly with Differentiated Goods: Bertrand Competition

11.6.1. Definitions and assumptions

Assumptions:

Firms sell products that are not perfect substitutes.

firms choose the price at which it sells.

firms set prices simultaneously

Each firm faces a unique demand curve.

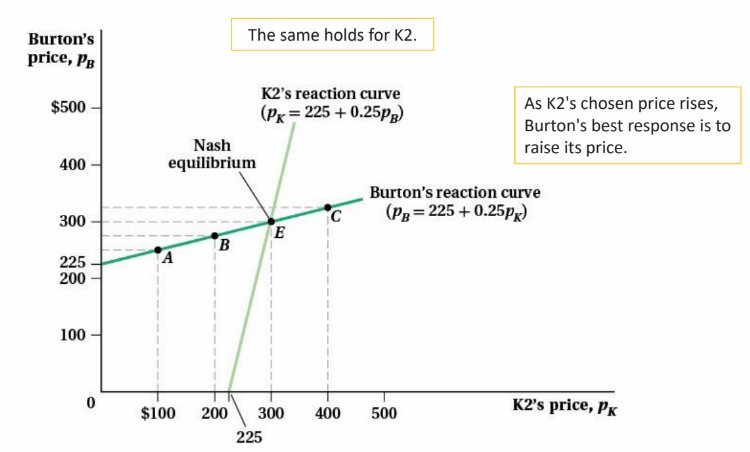

In Bertrand competition with differentiated products, firms compete on price while offering products that are not perfect substitutes. Each firm sets its price considering the perceived differences in their products. This can lead to a situation where firms have some market power, allowing them to maintain higher prices than in perfect competition, but they still face downward pressure on prices due to competition. The outcome often results in a balance between price and product differentiation.

11.6.2. How is NE achieved in differentiated product Bertrand oligopoly?

In a differentiated product Bertrand oligopoly, Nash equilibrium is achieved when firms set prices such that no firm can increase its profit by unilaterally changing its price. Each firm considers the price set by its competitor and chooses its own price to maximize profit, given the demand for its differentiated product. The equilibrium occurs when the price adjustments stabilize, leading to a situation where each firm's price reflects its marginal cost and the perceived value of its product, resulting in no incentive for further price changes.

11.7: Monopolistic Competition

11.7.1. Definition and assumptions

Characteristics of Monopolistic Competition

Many firms sell differentiated products.

No barriers to entry, leading to zero economic profit in the long run.

Assumptions:

Industry firms sell differentiated products that consumers do not view as perfect substitutes

Other firms’ choices affect a firm’s residual demand curve, but the firm ignores any strategic interactions between its own quantity or price choice and that of its competitors

Allow for free entry and exits

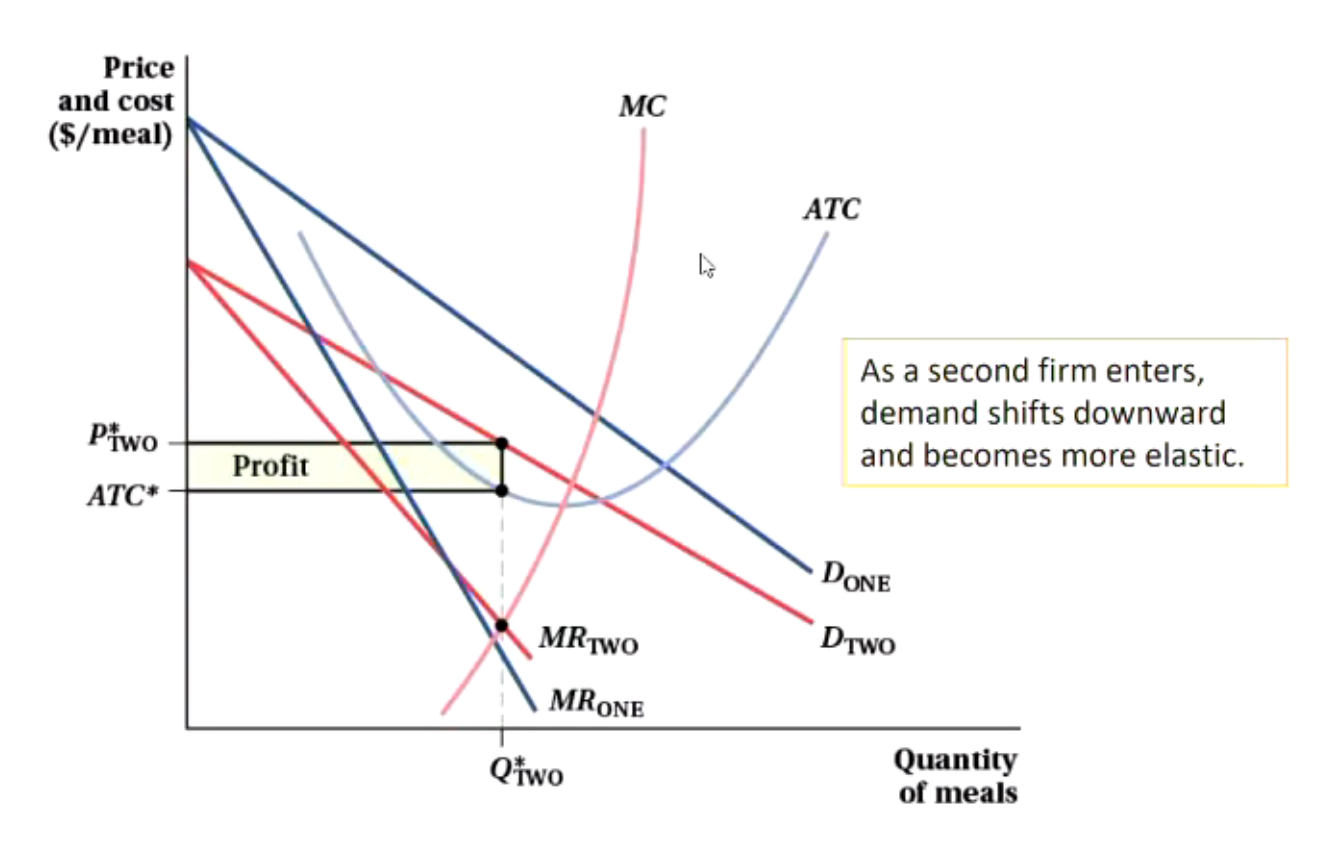

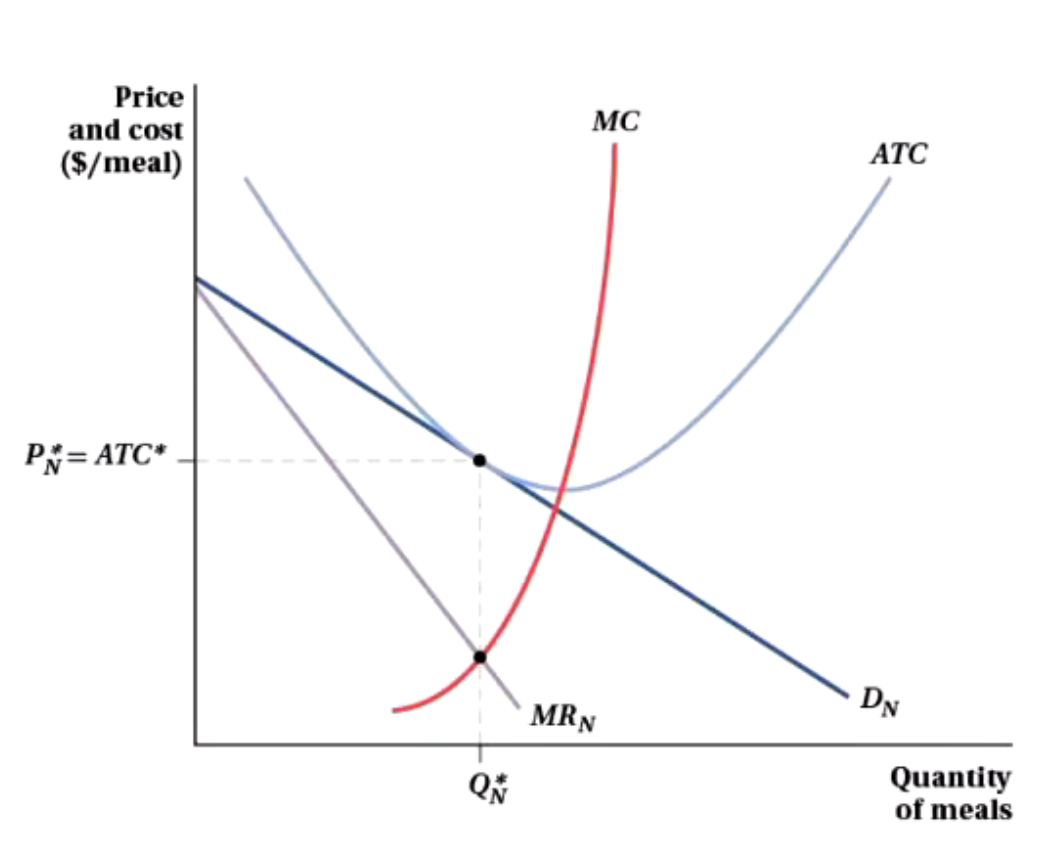

11.7.2. When does monopolistic competition hit zero long run economic profit?

Since there are free entry in the long run, meaning there would be more competitors.

each firms faces a downward-sloping demand curve that are more elastic

in the long run, ATC is not minimized in monopolistic competition

0 economic profit when demand tangent with the ATC curve, covering all their costs.

In monopolistic competition, firms earn zero long-run economic profit when:

Entry and Exit: New firms enter the market when existing firms are making profits, increasing competition.

Product Differentiation: Firms differentiate their products, leading to a downward-sloping demand curve.

Long-Run Equilibrium: In the long run, the entry of new firms continues until economic profits are driven to zero, where price equals average total cost (P = ATC).

At this point, firms cover their costs but do not earn excess profits.