Chapter 35: Extending the Analysis of Aggregate Supply

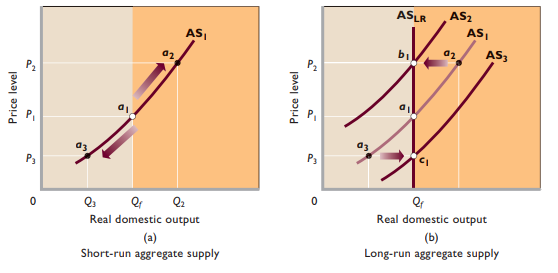

From short run to long run

- Short run - Input prices are inflexible or totally fixed

- Long run - Input prices are fully flexible

- The short-run aggregate supply curve is an upward sloping line, whereas the long-run aggregate supply curve is a vertical line situated directly above the economy’s full employment output level

Short-run aggregate supply

- Higher prices will increase firms’ revenues → Because their nominal wages and other input prices remain unchanged, their profits rise

- Higher profits lead firms to increase their output

- Lower prices will decrease firms’ revenues → Because the prices they receive for their products are lower while the nominal wages they pay workers remain unchanged, firms discover that their revenues and profits have diminished or disappeared

- Lower profits lead firms to decrease their output

Long-run aggregate supply

- Nominal wages are one of the determinants of aggregate supply

- Decrease in price level → Profits are squeezed or eliminated because prices have fallen and nominal wages have not

- As time passes, input prices will begin to fall because the economy is producing at below its full-employment output level

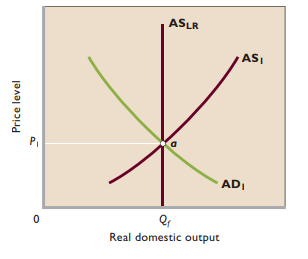

Long-run equilibrium in the AD-AS model

- Short-run aggregate supply curve adjusts

- Long run equilibrium occurs where the aggregate demand curve, vertical long-run aggregate supply curve, and short-run aggregate supply curve all intersect

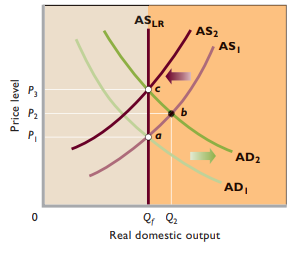

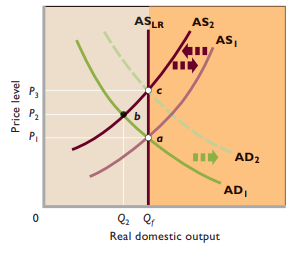

Demand-pull inflation in the extended AD-AS model

- Demand-pull inflation occurs when an increase in aggregate demand pulls up the price level

- This shift might result from any one of a number of factors, including an increase in investment spending or a rise in net exports

- Increase in aggregate demand → Increased price level and expanded real output

- Input prices including nominal wages will rise. As they do, the short-run aggregate supply curve will ultimately shift leftward

- In the short run, demand-pull inflation drives up the price level and increases real output; in the long run, only the price level rises

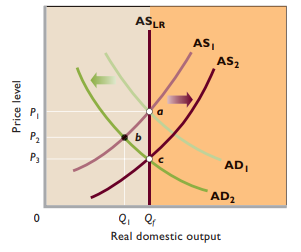

Cost-push inflation in the extended AD-AS model

- Cost-push inflation arises from factors that increase the cost of production at each price level, shifting the aggregate supply curve leftward and raising the equilibrium price level

- Increase in per-unit production costs shifts the short-run aggregate supply curve to the left and the price level rises

- Will eventually result in widespread layoffs, plant shutdowns, and business failures

Recession and the extended AD-AS model

- Recession is caused by decreases in aggregate demand

- With the economy producing below potential output, demand for inputs will be low

- Eventually, nominal wages themselves fall to restore the previous real wage; when that happens, the short-run aggregate supply curve shifts rightward

- Economists recommend active monetary policy, and perhaps fiscal policy, to counteract recessions

Ongoing inflation in the extended AD-AS model

- Ongoing economic growth causes continuous rightward shifts of the aggregate supply curve that, by themselves, would tend to cause ongoing deflation

- Central banks engineer ongoing increases in the money supply in order to cause slightly faster continuous rightward shifts of the aggregate demand curve

- The outward shift of the production possibilities curve is the same as a rightward shift of the economy’s long run aggregate supply curve

- With no change in aggregate demand, the increase in long-run aggregate supply would expand real GDP and lower the price level

- Economic growth causes increases in long run aggregate supply

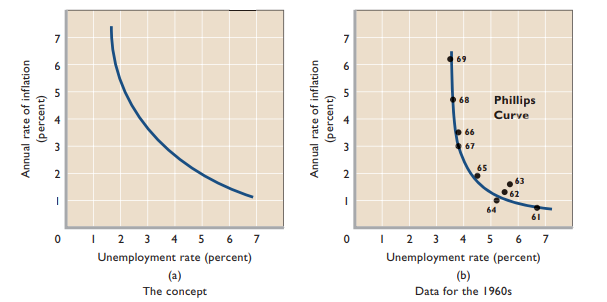

Relationship between inflation and unemployment

- Under normal circumstances, there is a short-run trade-off between the rate of inflation and the rate of unemployment

- Aggregate supply shocks can cause both higher rates of inflation and higher rates of unemployment

- There is no significant trade-off between inflation and unemployment over long periods of time

Phillips Curve - Suggests an inverse relationship between the rate of inflation and the rate of unemployment

- Assuming a constant short-run aggregate supply curve, high rates of inflation are accompanied by low rates of unemployment, and low rates of inflation are accompanied by high rates of unemployment

- Manipulation of aggregate demand through fiscal and monetary measures would simply move the economy along the Phillips Curve

Aggregate supply shocks and the Phillips Curve

- Stagflation - High inflation and high employment rates

- Aggregate supply shocks can cause both higher rates of inflation and higher rates of unemployment

- Aggregate supply shocks - Sudden, large increases in resource costs that jolt an economy’s short-run aggregate supply curve leftward

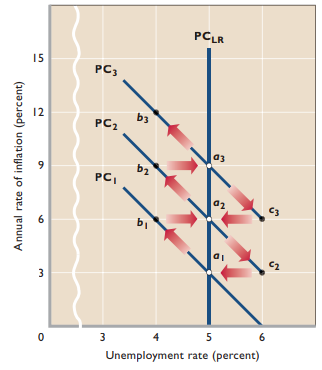

Short run Phillips Curve

- When the actual rate of inflation is higher than expected, profits temporarily rise and the unemployment rate temporarily falls

Long run vertical Phillips Curve

- Faster increases in nominal wages make up for the higher rate of inflation and restore the workers’ lost purchasing power

- Because wages are a production cost, this faster increase in wage rates will imply faster future increases in output prices as firms are forced to raise prices more rapidly to make up for the faster future rate of wage growth

- A stable Phillips Curve with the dependable series of unemployment-rate–inflation-rate trade-offs simply does not exist in the long run

Disinflation - Reductions in the inflation rate from year to year

- When the actual rate of inflation is lower than the expected rate, profits temporarily fall and the unemployment rate temporarily rise

- In the long run, firms respond to the lower profits by reducing their nominal wage increases

Supply side economics - Changes in aggregate supply are an active force in determining the levels of inflation, unemployment, and economic growth

- High tax rates impede productivity growth and hence slow the expansion of long-run aggregate supply

- Lower marginal tax rates on earned incomes induce more work, and therefore increase aggregate inputs of labor

- Higher opportunity cost of leisure encourages people to substitute work for leisure

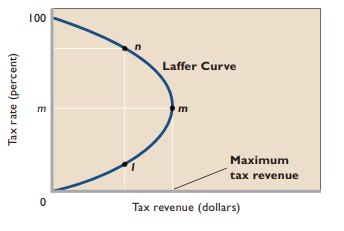

Laffer Curve - Depicts the relationship between tax rates and tax revenues

- Tax revenues decline beyond some point because higher tax rates discourage economic activity, thereby shrinking the tax base

- Lower tax rates stimulate incentives to work, save and invest, innovate, and accept business risks, thus triggering an expansion of real output and income

- Criticisms

- The impact of a tax cut on incentives is small, of uncertain direction, and relatively slow to emerge

- The Laffer Curve is merely a logical proposition