Unit 4.6: Financial Sector

Monetary Policy

Monetary policy::

A central bank’s policies of influencing nominal interest rates to help achieve macroeconomic objectives:

Price stability

Full employment

Interest rate changes impact the price level, real output, and unemployment through shifts of AD

Monetary policy’s target interest rate

When banks are unable to meets the reserve requirement, they can:

Call in loans

Sell assets

Borrow from the central bank (pay discount rate)

Borrow from other commercial banks (pay policy rate)

Policy rate::

Overnight interbank lending rate

Called the federal funds rate in the US

Central banks often set a target range for the policy rate to guide monetary policy

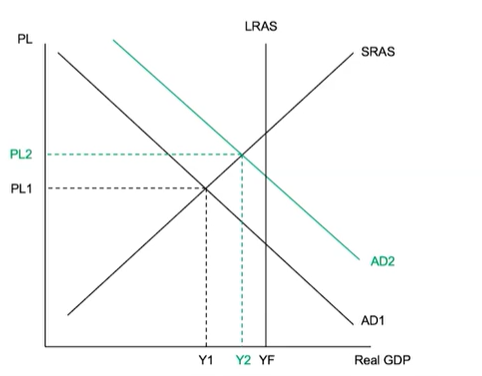

Expansionary monetary policy::

When the central bank decreases nominal interest rates in the short run to help get an economy out of a recessionary gap

Lower interest rate => less expensive to borrow => more interest-sensitive spending (investment and consumption) => increase in AD

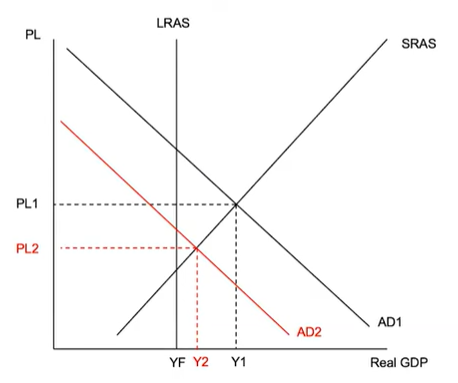

Contractionary monetary policy::

When the central bank increases nominal interest rates in the short run to get an economy out of an inflationary gap

Higher interest rates => more expensive to borrow => less interest-sensitive spending (investment and consumption) => decrease in AD

Monetary policy lags

Recognition lag::

It takes central banks time to collect and analyze the data needed to recognize problems in the economy

Impact (or operational) lag::

It takes time for the economy to adjust after the policy action is taken

Limited reserves

In a limited reserves framework, interest rate changes are brought about through shifts of the money supply

Limited reserves framework::

A banking system in which:

Reserves are not overly abundant

There is a nonzero reserve requirement

Commercial banks hold required reserves and possibly also excess reserves

Monetary policy works by changing the supply of excess reserves and therefore the supply of money

Changing the money supply results in changes to the nominal interest rate

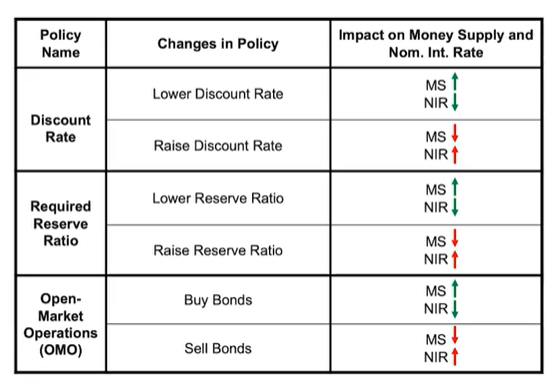

Limited Reserves monetary policy tools

a) Required reserve ratio::

The percentage of demand (checkable) deposits banks must hold in their reserves

If it decreases

Banks have more excess reserves to lend

MS (money supply) increases (nominal interest rate falls or NIR)

If it increases

Banks have less excess reserves to lend

MS decreases (nominal interest rate rises)

b) Discount rate::

The interest rate commercial banks must pay to borrow from the central bank

Decreases:

Banks encouraged to lend more

MS increases (nominal interest rate falls)

Increases:

Banks encouraged to lend less

MS decreases (nominal interest rate rises)

c) Open market operations (OMO)::

Central bank buying and selling of government bonds (securities)

Central bank buys bonds (OM purchase)

Banks’ excess reserves increases

MS increases (NIR falls)

Central bank sells bonds (OM sale)

Banks’ excess reserves decreases

MS decreases (NIR rises)

The money multiplier

OMO causes changes in reserves, so the monetary base changes

In limited reserves environments, the effect of an OMO on the MS is greater than the effect on the monetary base because of the money multiplier

An increase in excess reserves (OMO purchases) leads banks to make more loans, which leads to more deposits, which creates more excess reserves, which allows for more loans

A decrease in excess (OMO sale) works the opposite way

Maximum possible value of money multiplier:

Money multiplier = 1 / required reserve ratio

Based on assumptions:

Banks hold no excess reserves

Borrowers spend their entire loans

Customers hold no cash

Maximum possible change to MS as a result of an OMO:

Change to MS = OMO amount * money multiplier

Open market operations effects

Liabilities don’t change, but money is moved around in the assets section

change a bank’s excess reserves by the entire amount of the purchase (increase) or sale (decrease)

Required reserve ratio doesn’t apply to OMO

change a bank’s bond holding amount by the entire amount of the purchase (decrease) or sale (increase)

Ample Reserves

Tied to central bank of the US (federal reserve)

In a limited reserves framework, interest rate changes are brought about through changes to administered interest rates

Ample reserves framework::

A banking system in which:

Reserves are abundant

The required reserve ratio is zero

Changing the MS no longer leads to changes in nominal interest rates

Different monetary policy tools are needed

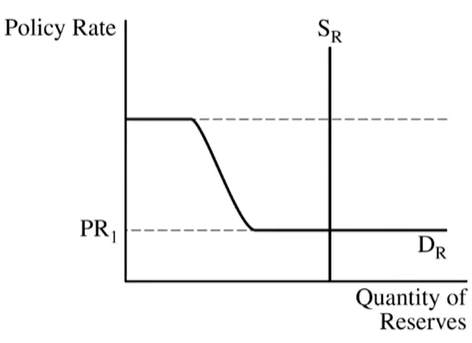

The money market graph is not used to model an ample reserves banking system, the reserve market model is

Policy rate (federal funds rate in the US) is important in the model used for this framework

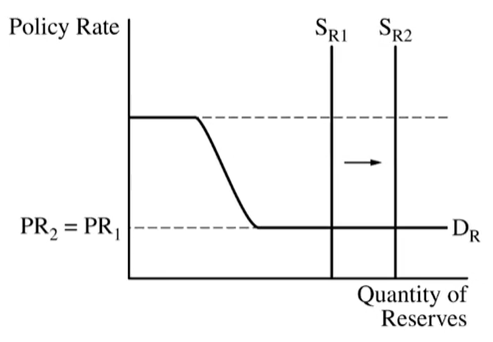

Policy rate is set at the intersection of SR (supply of reserves) and DR (demand for reserves)

In ample reserves, SR intersects the lower horizontal portion of DR

Buying bonds is used to maintain ample reserves (not a monetary policy tool in this case)

The monetary base increases, but there is no impact on interest rates

Reserve market model:

Ample Reserves monetary policy tools (used by Fed)

a) Administered interest rates, including:

Interest on reserves (IOR)::

The interest rate commercial banks earn on the funds in their reserve balances accounts with the Fed

Fed’s primary monetary policy tool

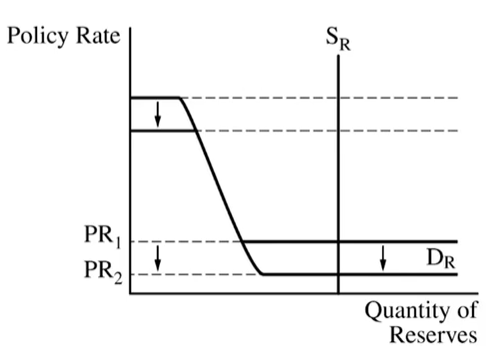

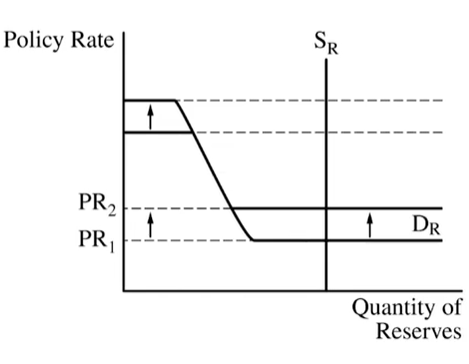

increases to IOR move up the lower bound (lower horizontal area on DR) on the reserve market model graph

Decreases to IOR move the lower bound down

Discount rate::

Same definition as under limited reserves, but the central bank is the Fed in the US

increases to discount rate move up the upper bound (higher horizontal area on DR) on the reserve market model graph

Decreases to discount rate move the upper bound down

Expansionary policy

A decrease in these administered interest rates leads to a decrease in the policy rate then a decrease in other nominal interest rates

Interest-sensitive spending and AD will increase

Contractionary policy

An increase in these administered interest rates leads to an increase in the policy rate then an increase in other nominal interest rates

Interest-sensitive spending and AD will decrease

Knowt

Knowt