1.2.2 Supply

the quantity of a product that producers are willing and able to produce at various prices over a period of time

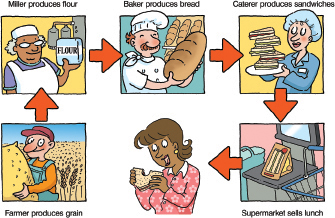

End customers dont tend to think about supply chain but a lot goes on behind the scenes.

getting the product on a reliable basis from supplier

getting the product at the cheapest possible price from their suppliers

selling the product for a price that makes a decent profit

Useful Maths:

Profit = Revenue - Costs

Revenue = selling price x number of units sold

Profit per unit = selling price - cost per unit or selling price ÷ cost per unit

If cost of production goes down then it costs less to produce which means the business can make a higher profit.

Introduction of new technology

introductions of of technology can massively reduce the costs of production. - For example, if a car manufacturer buys a robot that means they can produce 10,000 cars a year instead of only 5,000 hand made cars a year it becomes much more efficient.

Indirect Taxes

indirect taxes are taxes levied (imposed) by the government onto goods and services

In the UK you pay 20% VAT (value addes tax) on most goods and services that you buy.

There is also extra taxes put onto ‘undesirable goods’ such as alcohol and petrol to try and reduce the sale of these items.

This affects supply because if the taxes are increased it can cost the supplier and the consumer. Usually the consumer pays for it but in some cases the producer may not be able to raise the price of the item and end up having to pay for it themselves which raises the price of production and reduces the profit.

Government Subsidies

an amount paid by the government to producers in order to help lower the costs of production and encourage supply.

this is good for the government as if companies are producing more in general this will provide more jobs and also the more products they sell the more money the government can take through VAT.

External Shocks

Events in the wider world can affect businesses in positive and negative ways.

For example, Terrorist attacks in Egypt stopped flights which causes airlines to lose money.

At the same time there can be positive outcomes on business such as during a global pandemic the sales on face masks and PPE increase drastically

Physical Constraints

Physical constraints can change certain factors.

For example if there are lots of producers willing to sell at a certain price and there is a new discovery of a mine in Africa it could result in more producers willing to sell at the same price.

in the short run there is a number of producers willing and able to supply.

but in the long run, suppliers will have time to expand, find cheap labour or new materials and will be more likely to supply at the same or a cheaper price.

Ways to remember

SEPTIC

S - subsidies

E - external shocks

P - physical constraints

T - technology

I - indirect taxes

C - costs of production

When considering supply, it is helpful to think in terms of a snapshot at any given time.

At a given time a certain amount of producers are prepared to supply at a low price. However as the price rises more are willing to supply at the higher price.

So you will see a movement along the supply curve

Things may always change so that at the same given price more or less producers are willing and able to supply a product at that price. This results to a shift of the supply curve to the left or right.

Knowt

Knowt