2.1.2 Government Policies

Fiscal policy – government revenue and government expenditure

Definition of fiscal policy

Fiscal policy is the manipulation of government spending and taxes in order to achieve macroeconomic objectives.

Government revenue – direct and indirect taxes

Governments earn money through direct and indirect taxes. Direct taxes are taxes on income or profits (e.g. income tax or corporation tax). Indirect taxes are taxes on expenditure (e.g. sales taxes such as VAT).

Governments impose taxes for spending on public sector services, to redistribute wealth and income and to discourage consumption/production (e.g. alcohol)

Government expenditure – main areas of focus

Governments have three main areas of spending. Capital expenditure – spending that impacts the long run growth of the economy (e.g. infrastructure, building hospitals etc). Current expenditure – day to day spending e.g. on wages for public sector staff, medicines for hospitals. Transfer payments – government spending with no corresponding output. E.g. Jobseekers Allowance for those with no job.

Fiscal deficits and fiscal surplus

A fiscal deficit (sometimes called a budget deficit) occurs when government spending exceeds tax revenue)

The accumulation of fiscal deficits is the national debt.

A fiscal surplus occurs when tax revenues are greater than government spending.

The Impact of a fiscal deficit and fiscal surplus

If deficits build up over a period of time, the national debt gets bigger and bigger. This means that the government has to spend more and more of its revenue on paying off the debt. Many would argue that money spent on interest payments has a high opportunity cost.. Another problem with persistent fiscal deficits and rising national debt is that future generations may be burdened with the debt of ‘today’. Many would argue that this is not really fair on those people that have not even been born yet. They will be paying for the excesses of previous generations.

The impact of a fiscal surplus is likely to be positive. If a government collects more revenue than it spends in a year, the surplus could be used in a number of ways. For example, it could be used to spend on the future provision of public services or used to lower taxes in the economy. However, most governments would use it to pay off some of the national debt. This would reduce future interest payments and strengthen the nation’s finances

The impact of fiscal policy on macroeconomic objectives

Expansionary fiscal policy – increase in government spending or a decrease in tax in order to stimulate the economy.

Contractionary fiscal policy – decrease in government spending or an increase in tax in order to slow down the economy.

The examples below are a result of expansionary fiscal policy (contractionary fiscal policy would have the opposite effect

Inflation: An increase in government spending and a reduction in tax is likely to result in an increase in inflation as disposable incomes increase, consumers have more money, so consumption increases and as a result, firms increase prices.

Economic growth – expansionary policy results in an increase in economic growth. More government spending helps to boost the economy and lower taxes help to increase disposable income so spending increases.

Unemployment – as expansionary policy results in economic growth, the unemployment rate is likely to fall as economic activity increases and firms are likely to be more profitable, so they expand and demand more labour. The government may also be expanding public services and so employ more workers.

Current account – expansionary policy results in higher disposable income so there is an increase in demand for imports. This results in a deterioration in the current account.

Environment – expansionary fiscal policy may damage the environment e.g. due to increased economic growth and business activity. However, the government may spend on improving environmental problems.

Monetary policy – focused on interest rate changes

Definition of monetary policy

Monetary policy is the manipulation of interest rates and the money supply in order to achieve macroeconomic objectives.

Monetary policy is usually controlled by the Central Bank. The central bank is often independent of the government. E.g. the Central Bank in the UK is The Bank of England, the Euro’s central bank is The European Central Bank and the Central Bank in the USA is The Federal Reserve.

The main aim of the Central Bank is to control inflation. Every country has an inflation target. E.g. in the UK, the inflation target is 2% (+/- 1%)

Definition of interest rates

Interest rates are the cost of borrowing and reward for saving.

Central banks role in setting interest rates

The Central Bank sets the ‘base’ or ‘bank’ interest rate. This is rate at which the central bank set for commercial (high-street) banks. The base rate influences the rate that is offered to consumers as it affects high-street banks costs. E.g. if the base rate increases, high-street banks have to pay higher interest on their borrowing. Therefore, they pass this cost onto consumers in the form of higher interest rates for their products. (Note: it is up to each bank the extent to which they pass on the base rate to consumers)

The mechanism by which a change in interest rates affects consumers and businesses

Expansionary monetary policy: a reduction in interest rates to boost aggregate (total) demand, therefore increasing inflation

Contractionary monetary policy: An increase in interest rates to reduce aggregate (total demand), therefore decreasing inflation.

Consumers: When interest rates fall, demand for loans from households will rise. Consumers are likely to borrow money to buy goods, such as cars, furniture and holidays, because borrowing is cheaper. Also, when interest rates fall, consumers with a mortgage may find that their mortgage payments fall. This means they have more money to spend, which will also increase aggregate (total) demand. Finally, if interest rates are lower, the reward to savers is also lower as a result. The opposite is true when interest rates rise

Firms: Firms using borrowed money, such as mortgages, loans and overdrafts, to fund their business activity are likely to respond to changes in the interest rate. For example, when interest rates fall, the interest payments on current borrowings will also fall. This will help to boost their profits because costs will be lower. Lower interest rates are also likely to raise levels of business confidence and stimulate more investment.

There is also a link between the interest rate and the exchange rate. When the interest rate falls, the exchange rate is also likely to fall. This is because there is less demand for the currency from foreign investors (investors take their money out of the banks with low interest rates and put their money in banks with high interest rates to get a higher return. Less demand for the currency, causes the exchange rate to fall. If the exchange rate falls, the prices of exports become cheaper. This means that demand for them will rise. Firms will benefit because they will sell more goods and services. Also, the price of imports will rise, which means domestic consumers and firms will buy fewer. An increase in exports and a fall in imports will increase aggregate demand. This will also help to improve the balance on the current account.

The impact of changes in interest rates on macroeconomic objectives:

In the examples below I will assume there has been expansionary monetary policy (a decrease in interest rates).

Inflation – A decrease in interest rates results in a lower cost of borrowing and reward for saving. This means there is more spending, so firms increase prices, pushing up inflation.

Unemployment – Lower interest rates help to stimulate the economy. Therefore unemployment falls as firms decide to expand production and demand more labour

Economic growth – falling interest rates, increase aggregate demand, resulting in higher economic growth.

The current balance – falling interest rates increase spending so spending on imports rises. This worsens the current balance.

Awareness of asset purchasing used by central banks

In recent years, many countries have tried to control the money supply using a method called quantitative easing. This involves central banks buying financial assets, such as government bonds, from commercial banks. This results in a flow of money from the central bank to commercial banks. This extra cash can be used by commercial banks as a basis for making new loans to consumers and businesses. When more loans are granted, aggregate demand will increase. This approach was used in the USA, EU, UK and Japan when historically low interest rates failed to stimulate demand during the global recession.

However, one possible problem with quantitative easing is that it can be inflationary. This is because the money used by the government does not exist – it is created electronically. The government buys financial assets from commercial banks and increases the cash balances in their accounts without actually giving them any cash. It is like printing money. Whether this approach has worked or not may not be determined for several years.

Note: Fiscal and monetary policies are demand-side policies. They aim to influence aggregate (total) demand in an economy.

Supply side policy

Aggregate supply – the total amount of goods and services produced in an economy in a given period of time.

Definition of supply side policy

Supply side policies are measures to increase aggregate supply in an economy.

Supply side policy and its impact on productivity and total output

Supply side policies tend to be long run policies. They generally aim to increase productivity and total output.

Supply side polices include: government spending on education and healthcare, government spending on infrastructure, reduction in business taxes to increase investment, reduction in regulation to encourage more investment, measures to increase flexibility of the labour force (e.g. making it easier to hire and fire workers)

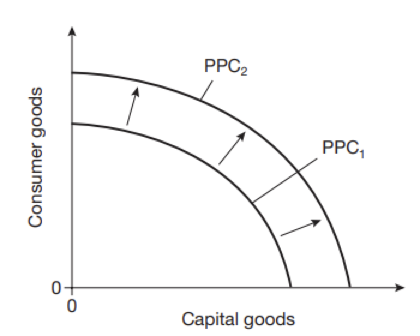

Supply side policies aim to increase the productive potential of the economy. With increased volumes of output, national income will rise and living standards will be improved. Also, if the government can increase supply, there is less chance of demand-pull inflation and more jobs would be created. Therefore, unemployment will be lower. The production possibility curve (PPC) can be used to show the impact of supply side policies on total output. Supply side policies will shift out the PPF (see below)

The impact of supply side policies on macroeconomic objectives:

Privatisation: Privatisation breaks up state monopolies and promotes competition because once they are part of the private sector, businesses have to make a profit to survive. They cannot rely on public money, if they make a loss. In the private sector, if they fail to provide services that give customers value for money, they may go out of business. Competitive pressure should improve quality and reduce prices.

Deregulation: Regulation, often called ‘red tape’, involves government controls in markets. Deregulation in business generally means tackling problems such as: excessive of paperwork, obtaining unnecessary licenses, having lots of people or committees to approve a decision. Many governments have addressed these problems by relaxing regulations that restrict competition.

Education and training: If the quality of human capital can be improved, workers will be more productive. Investment by governments and firms in education and training will help to improve the quality of human capital. Clearly, if people are educated they are more employable. Improving the skills of a nation’s workforce is a key element of supply side policies. Governments can help by investing more in schools, universities and colleges. They can also provide firms with incentives to invest in training.

Policies to boost regions with high unemployment: One of the advantages of supply side policies is that they can be targeted or used selectively. In some countries, it is likely that certain regions will have far higher unemployment than others.

Infrastructure spending: The productive potential of the economy will increase if the quality of the infrastructure is improved. The government can help by investing more in infrastructure, education and health care, for example. Investment in infrastructure will improve transport and communications systems. This will help private sector firms because people will be more geographically mobile and the distribution of goods will be easier. Investment in education and health care will improve the quality of human capital.

Lower business taxes to stimulate investment: The pace of economic growth in a country can be accelerated if businesses can be encouraged to invest more. Lowering taxes can do this.

Lower income tax rates to encourage working: Lower income taxes will encourage individuals to work. This increases the number of people in the labour force.

Government controls

Government control is other types of regulation that can influence economic activity. These include regulation, legislation, fines, pollution permits (these have all been covered previously)