Monopolistic Competition and Oligopoly - chapter 15

15.1. Oligopoly and Monopolistic Competition

- Oligopoly: a market with only a few firms that sell a similar good or service

- Firms tend to know their competition and each firm has some price-setting power, but no one has total market control

- monopolistic competition: a market with firms that sell goods and services that are similar, but slightly different

- These firms aren’t necessarily price takers, but they still face competition in the long run

- product differentiation: when goods are close but imperfect substitutes

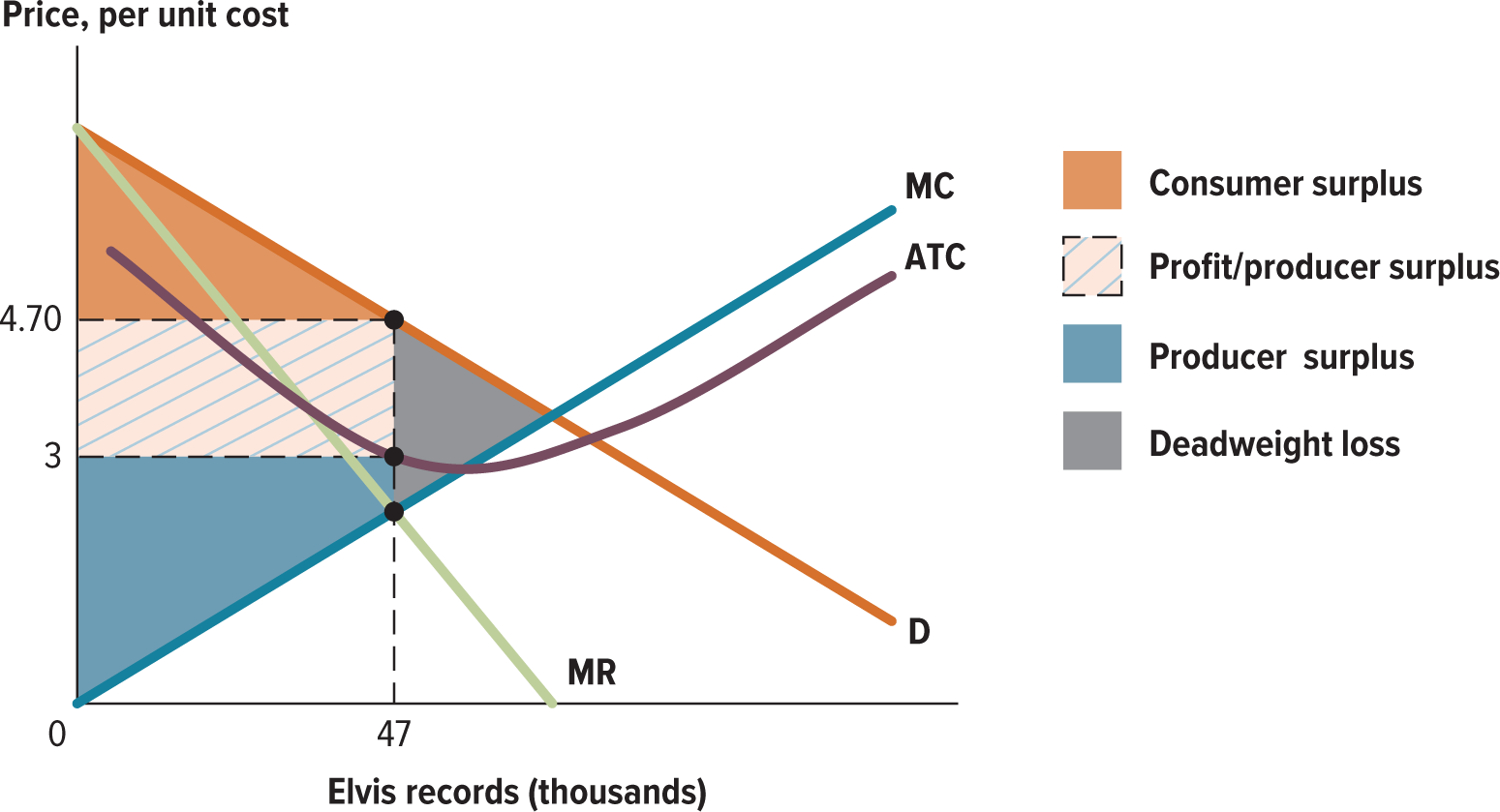

15.2. Monopolistic Competition in the Short Run

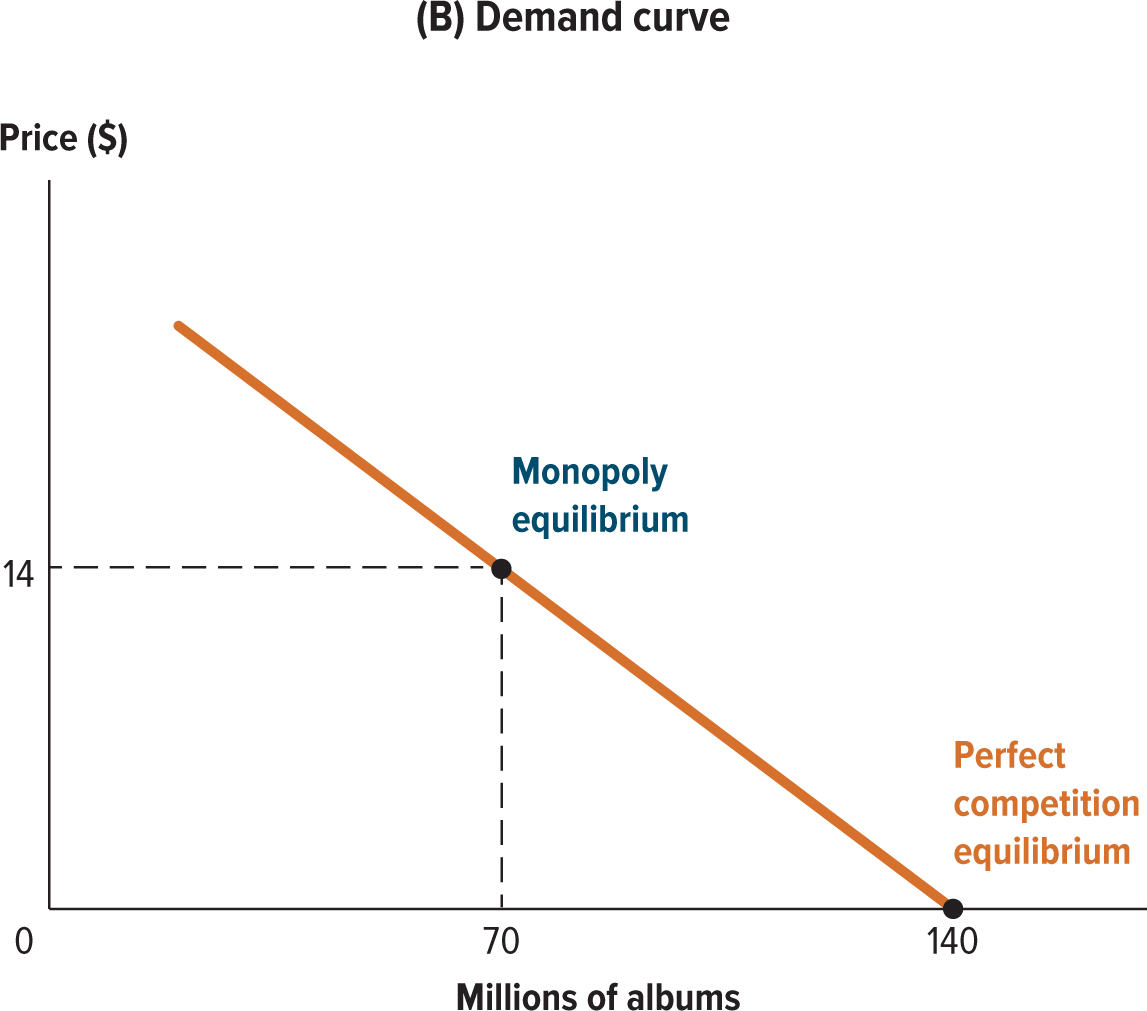

- In the short-run, monopolistically competitive firms behave like monopolists

- They face a downward-sloping demand curve and cannot change the price without causing a change in the quantity consumers demand

- The profit-maximizing production quantity is at the point where the marginal revenue (MR) curve intersects the marginal cost (MC) curve

- The profit-maximizing price is determined by the point on the demand curve that corresponds to this quantity

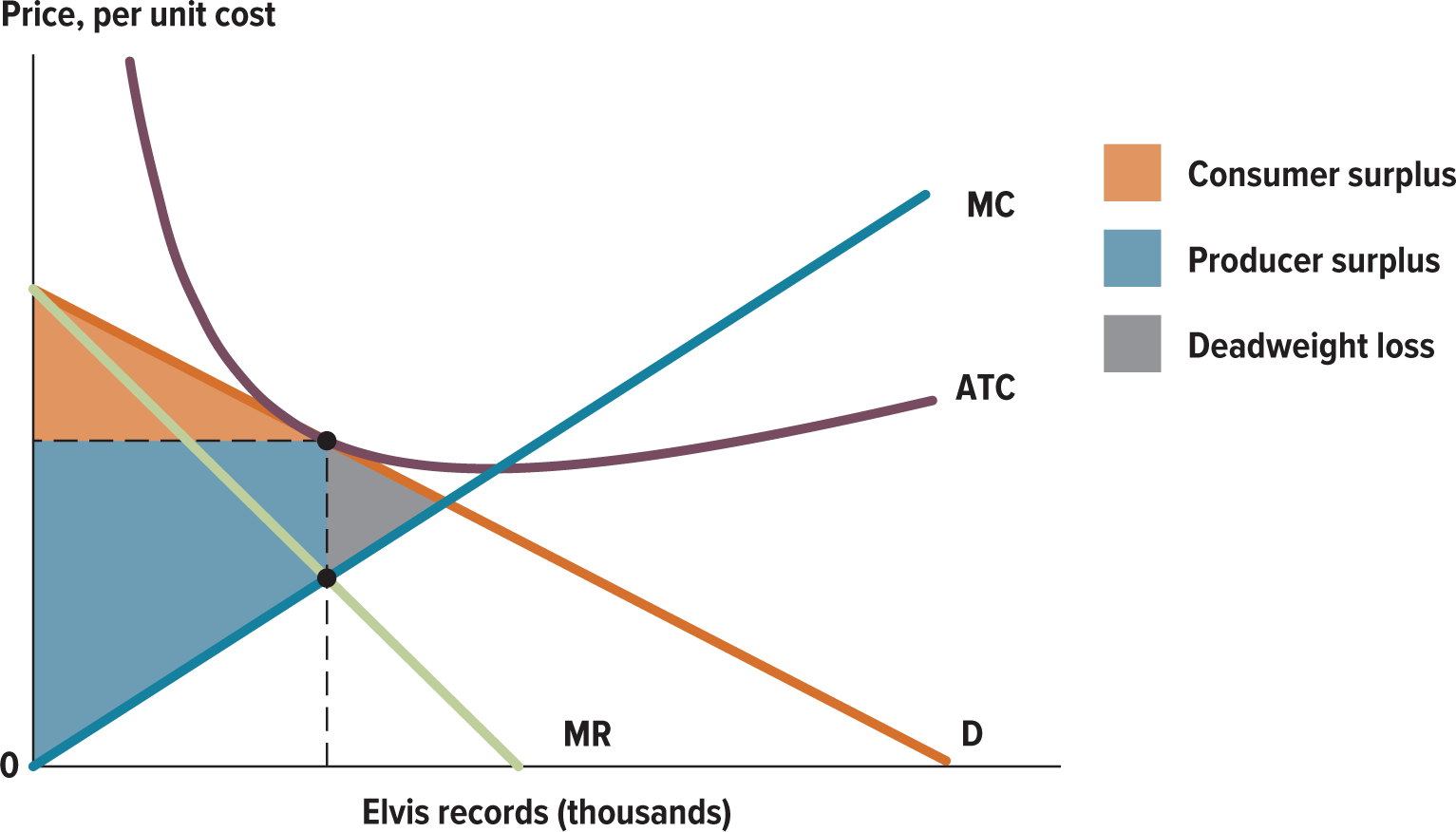

15.3. Monopolistic Competition in the Long Run

In the long run, monopolistic competition has some features in common with monopoly and others in common with perfect competition

Just like a monopoly, a monopolistically competitive firm faces a downward-sloping demand curve, which means that marginal revenue is less than price

- Marginal cost is also less than price

Like a firm in a perfectly competitive market, however, a monopolistically competitive firm earns zero economic profits in the long run

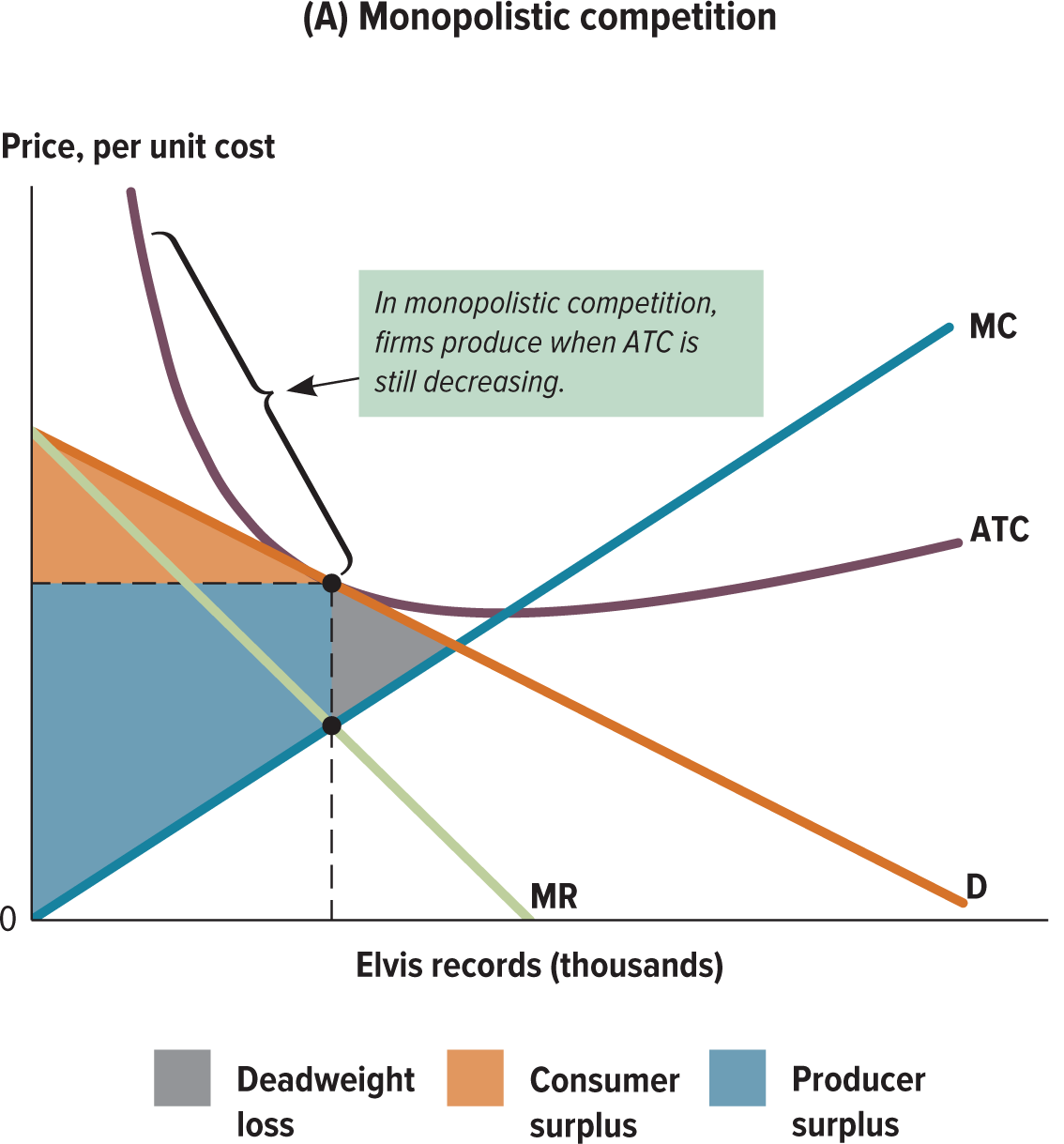

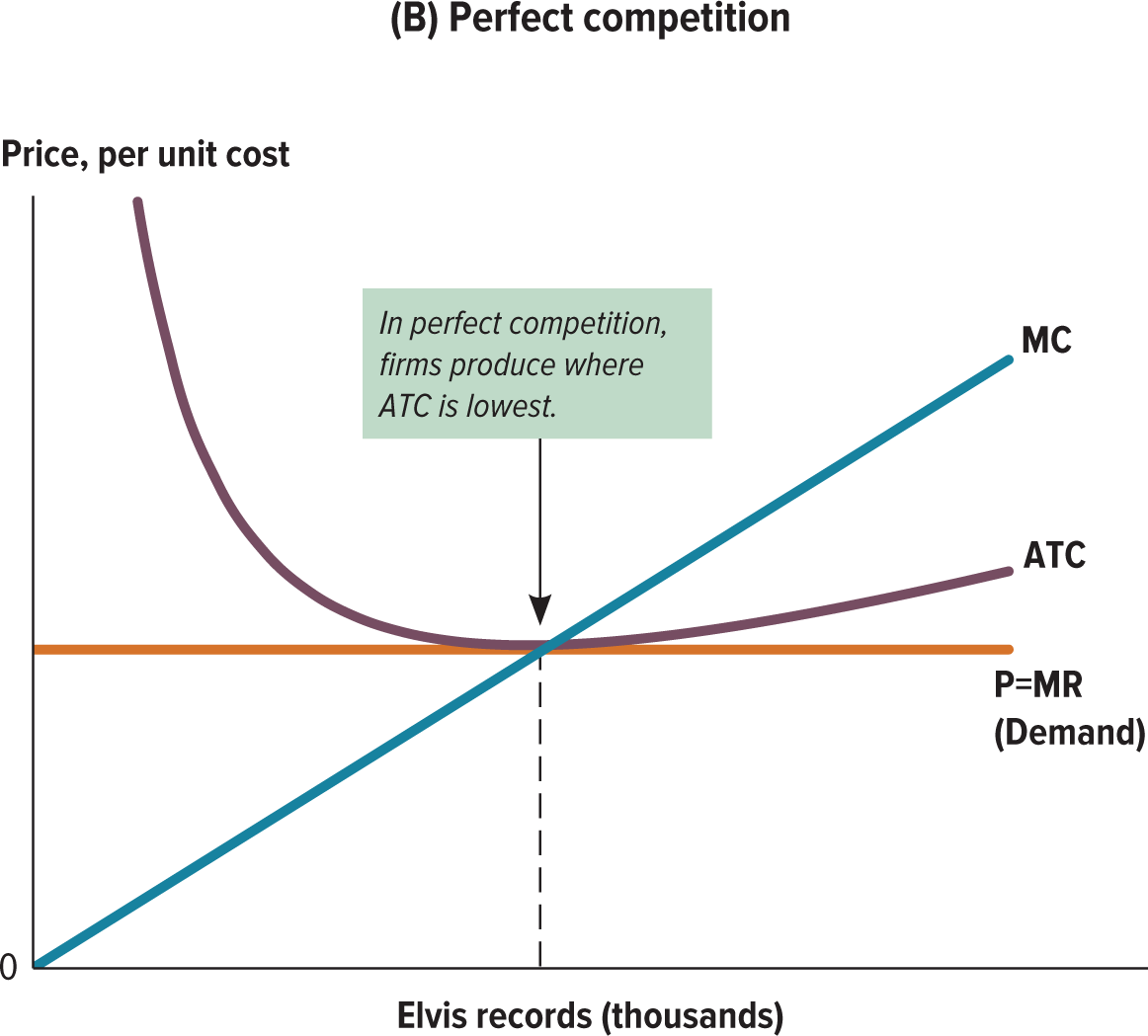

15.4. The Welfare Costs of Monopolistic Competition

- Like any deviation from the equilibrium price and quantity that would prevail under perfect competition, monopolistic competition is inefficient

- Because firms maximize profits at a price that is higher than marginal cost, some mutually beneficial trades never occur

- This means that there is a deadweight loss

- The market doesn’t maximize total surplus

- Regulating monopolistically competitive markets to increase efficiency is difficult, and it usually comes at the expense of product variety

15.5. Product Differentiation, Advertising, and Branding

- Producers invest in advertising to convince consumers that their products are different from other similar products

- The less substitutable a good seems with other goods, the less likely consumers are to switch to other products if the price increases

- Producers have an incentive to differentiate their products, either by making them truly different or by convincing consumers that they are different

- Through advertising and branding, firms either explicitly give the desired information to the consumer or signal the quality of their products

15.6. Oligopolies in Competiton

- Oliogopolists make strategic decisions about price and quantity that take into account the expected choices of their competitors

- Unlike price-taking firms in a competitive market, an oligopolist produces a quantity that affects the market price

- The increase in profit retained from an additional unit of output is called the price effect

- Typically, an oligopolistic firm will increase output until the positive quantity effect outweighs the negative price effect

15.7. Compete or Collude?

- An oligopolist has an incentive to produce more output than is profit maximizing for the market as a whole, driving down price and imposing costs on its competitors

- Collusion: the act of working together to make decisions about price and quantity

- Firms can maximize industry profits by producing the equivalent monopoly quantity and splitting revenues

- Each firm involved always has an incentive to renege on the agreements since a firm could earn higher profits by competing

- dominant strategy: the best strategy for a player to follow, no matter what strategy other players choose

- Nash equilibrium: an equilibrium reached when all players choose the best strategy they can, given the choices of all other players

- Will occur when all firms play their dominant strategies or when no players have a dominant strategy

- When the equilibrium is reached, no one has an incentive to break it by changing his strategy

- If firms recognize their production decisions as a repeated game, with future profits in mind, a firm may take an initial chance that the other firm will hold up its end of an initial agreement to collude

- Cartel: a number of firms or groups that collude to make production decisions about quantities or prices

15.8. Oligopoly and Public Policy

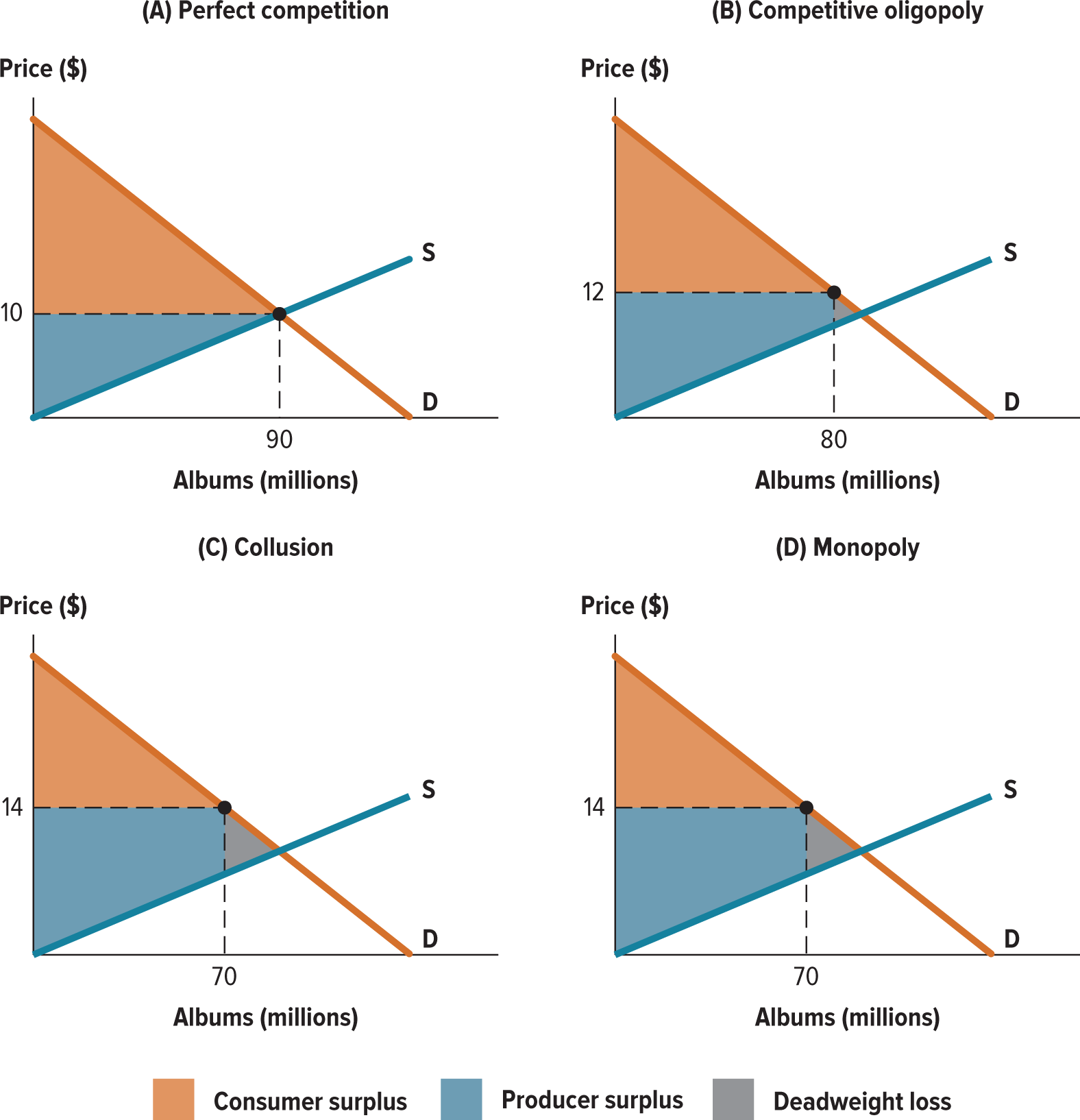

- The competitive equilibrium in an oligopoly leads to a quantity and price that are somewhere between the outcomes of a perfectly competitive market and those of a monopoly

- Because the equilibrium is not the same as in a competitive market, oligopoly results in some deadweight loss and increases producer surplus at the expense of consumer surplus

- When oligopolists collude, the equilibrium looks like a monopoly outcome and results in even higher deadweight loss and higher producer surplus