Slides PTC & Senior Review

Chapter 1: Terminology

Section 1.04

Terminology

Property: means any matter or thing capable of private ownership

Real Property: land, improvement, mine/quarry, mineral in place, standing timber, or estate/interest

Improvement: a building, structure, fixture, or fence erected on or affixed to land;

Personal Property: property that is not real property.

Tangible personal property: means personal property that can be seen, weighed, measured, felt, or otherwise perceived by the senses, but does not include a document or other perceptible object that constitutes evidence of a valuable interest, claim, or right and has negligible or no intrinsic value.

Intangible personal property: means a claim, interest (other than an interest in tangible property), right, or other thing that has value but cannot be seen, felt, weighed, measured, or otherwise perceived by the senses

Market value: means the price at which a property would transfer for cash or its equivalent

Appraised value: means the value determined as provided by Chapter 23 of this code.

Assessed value: means, for the purposes of assessment of property for taxation, the amount determined by multiplying the appraised value by the applicable assessment ratio

Taxable value: means the amount determined by deducting from assessed value the amount of any applicable partial exemption

Partial exemption: means an exemption of part of the value of taxable property.

Taxing unit: means a county, an incorporated city or town (including a home-rule city), a school district, a special district or authority

Tax year: means the calendar year

Assessor: means the officer or employee responsible for assessing property taxes

Collector: means the officer or employee responsible for collecting property taxes for a taxing unit by whatever title he is designated

Possessory interest: means an interest that exists as a result of possession or exclusive use or a right to possession or exclusive use of a property and that is unaccompanied by ownership of a fee simple or life estate in the property. However, ‘‘possessory interest’’ does not include an interest, whether of limited or indeterminate duration, that involves a right to exhaust a portion of a real property.

Conservation and reclamation district: means a district created under Article III, Section 52

Clerical error: means an error:

(A) that is or results from a mistake or failure in writing, copying, transcribing, entering or retrieving computer data, computing, or calculating; or

(B) that prevents an appraisal roll or a tax roll from accurately reflecting a finding or determination made by the chief appraiser, the appraisal review board, or the assessor; however, ‘‘clerical error’’ does not include an error that is or results from a mistake in judgment or reasoning in the making of the finding or determination.

Comptroller: means the Comptroller of Public Accounts of the State of Texas.

Section 1.07

Delivery of Notice: 1.07(a)An official or agency required by this title to deliver a notice to a property owner may deliver the notice by regular first-class mail

Section 1.08

When a property owner is required by this title to make a payment or to file or deliver a report, application, statement, or other document or paper by a specified due date, his action is timely

Section 1.111

(a)On the written request of a property owner, an appraisal office or an assessor or collector shall deliver all notices, tax bills, and other communications relating to the owner’s property or taxes to the owner’s fiduciary.

(b)To be effective, a request made under this section must be filed with the appraisal district. A request remains in effect until revoked by a written revocation filed with the appraisal district by the owner.

Chapter 5: State Administration

Glenn Hegar (Texas Comptroller of Public Accounts)

Chapter 6: Local Appraisal

Different appraisal districts (e.g., Tarrant, Harris) operate under state guidelines.

Chapter 11: Property Tax Exemptions

Types of Exemptions:

Mandatory and Total

100% Disabled Veterans

Surviving spouses of military personnel killed in action

Mandatory but Partial

General Homestead Exemptions:

General Homestead - School District

General Homestead- FM Road or Flood Control

Over 65 - School District

Disabled Persons - School District

Disabled Veterans

Disabled Veterans with Charitable Housing

Local Option and Partial

General Homestead - Cities, Counties, School Districts, Special Districts

Cannot be less than $5,000 or more than 20% of the value

Over 65 - Cities, Counties, School districts, Special Districts

Cannot be less than $3,000 - no max limit

Exemption Limitations

Limitations on Value Increases: The Appraised Value equals the LESSER of the Market Value or 10% of Last Year’s Appraised Value

Chapter 21: Situs Rules

Situs: Refers to the location where a property is taxable.

BPP is mobile and can be in different taxing units throughout the year.

Cannot be taxed in more than one county.

Different than Interstate Allocation

Four Rules for Situs: Establishes where property is taxable.

Step 1: Location on January 1 must be established.

Step 2: Determine normal location of property.

Step 3: Identify the property's return location between usages.

Step 4: Assess owner's principal place of business.

Business Personal Property

Any property that is not real property.

Movable items of property that are not permanently affixed to, or part of the real estate

Use Items

Inventory

Supplies

Owned

Leased

Consigned

Freeport

An exemption from taxation

Only applies to Inventory

Annual application required

Must leave the state within 175 days

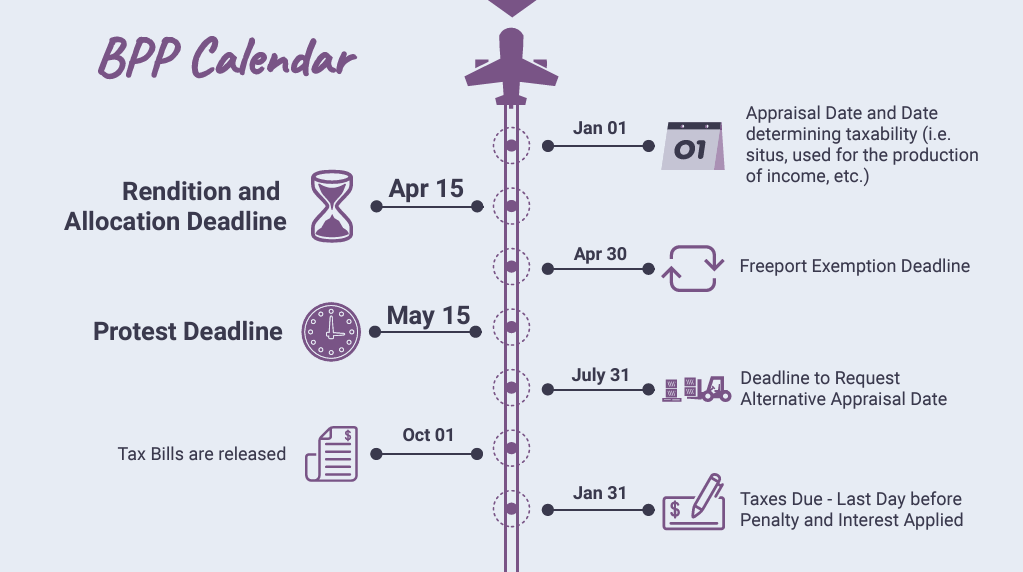

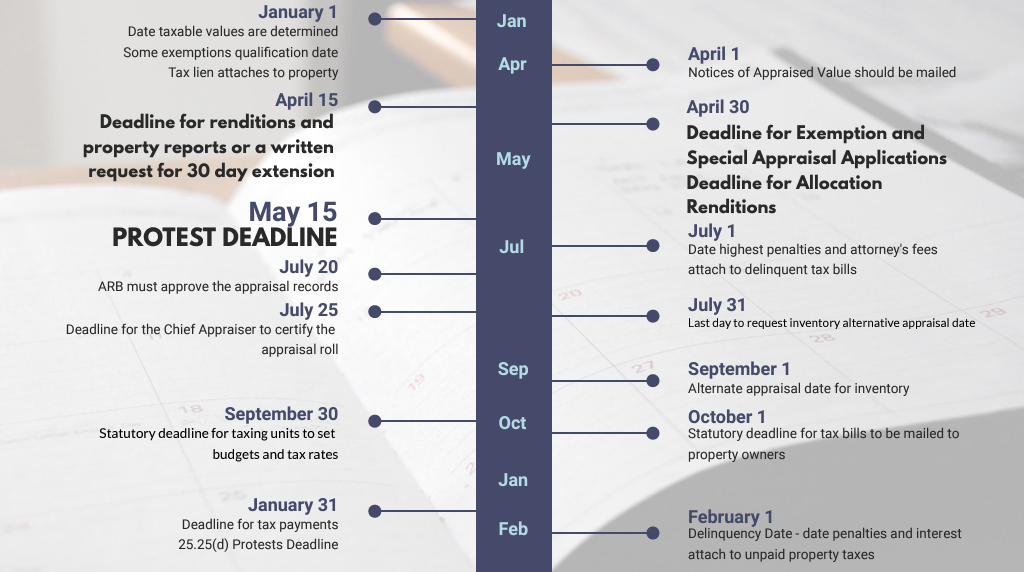

Application due by April 30

Aircraft parts allowed 730 days

Inventory must turn 2.09 times per year

Rendition Basics:

Filing required by April 15 annually, with extensions available. Property Owner can request a 30 Day extension.

Must include a good faith estimate of property value.

If the Market Value is less than $20,000, the rendition is limited.

If the property owner’s business is less than 50 employees, the opinion of value on the rendition can be based on Federal Income Tax returns.

Penalties for late/no filing(10%) or fraudulent filings(50%) of determined value.

Chapter 23: Appraisal Methods and Procedures

CAD must appraise same and similar kinds of property using the same and similar methods and techniques.

However, each property must be appraised based on its individual characteristics.

23.0101 Three Main Approaches: The chief appraiser shall consider all three in determining property value but, must only use the most appropriate.

Cost Approach: Estimates reproduction cost, useful for special-use properties.

Best used for Special Use Properties, Historic Properties, and New Construction

Sales Comparison Approach: Values based on sales of similar properties

Best used for residential Properties and Owner Occupied Commercial Properties

Income Approach: Based on the property's capacity to generate income

Primarily used for revenue-generating properties.

Special Appraisal

Inventory - 23.12

Dealer’s Inventory

Dealer's Motor Vehicle Inventory - 23.121

Dealer's Heavy Equipment Inventory - 23.1241

Oil & Gas Interests - 23.175

Appraisal of Wildlife Management Use - 23.521

Appraisal of Timberland - Subchapter E

Appraisal of Recreational, Park, and Scenic Land - Subchapter

Appraisal of Public Access Airport Land - Subchapter G

Appraisal of Restricted-Use Timberland - Subchapter H

Agricultural Appraisal

Texas allows for a property to be appraised based on the use of the property instead of the market value of the property when the property owner uses the property for agricultural purposes.

2 Main Types of Ag Land

Ag Use - 1-d

Requires agriculture to be the property owner's primary occupation.

Annual application required.

Requires the property owner to be an individual.

Open Space - 1-d-1

No income, occupation, or profit requirements.

Reapplication only required when ownership changes or the Chief Appraiser sends a request for application.

Allows individuals and corporations to own property.

Chapter 25 - Corrections

25.21 Omitted Property

Omitted from the "Appraisal Roll"

5 previous years for Real Property

2 previous years for Business Personal Property

25.25(b): Allows the Chief Appraiser to correct: Anything Any Year

25.25(c): Up to 5 Previous Years

Clerical Error

Multiple Appraisal

Not in the form or at the location as described on the appraisal roll

Incorrect Ownership

25.25(d): Substantial Error

Non-Homestead Properties: Must prove the property is 1/3 over-appraised

Homestead Properties: Must prove the property is 1/4 over-appraised

Cannot have finalized a 41.41 protest in the same year

10% Penalty if successful

Filing Deadline January 31 - before the delinquency date

Chapter 26: Assessment

Tax Calculation Formula

([Appraised Value - Exemptions]/100) * Tax Rate

(Taxable Value/100) * Tax Rate

Chapter 31: Collections

Taxes are due on January 31st

Chapter 32: Tax Liens & Personal Liability

Texas attaches a Tax Lien on every taxable property January 1 of each

year.

If taxes are not paid, taxing entities can foreclose on and sell the property on the courthouse steps in a tax auction.

Chapter 33: Delinquency

Delinquency Date Exceptions: Taxes are due before February 1

< Jan 10 = Jan 31 deadline

> Jan 10 = 1st of next month to allow 21 days

If tax bill includes previous years, then deadline = next Jan 31 that allows at least 180 days

Penalty & Interest

Month | Penalty | Interest | Total P&I |

February | 6% | 1% | 7% |

March | 7% | 2% | 9% |

April | 8% | 3% | 11% |

May | 9% | 4% | 13% |

June | 10% | 5% | 15% |

July | 12% | 6% | 18% |

August | 12% | 7% | 19% |

September | 12% | 8% | 20% |

October | 12% | 9% | 21% |

November | 12% | 10% | 22% |

December | 12% | 11% | 23% |

January | 12% | 12% | 24% |

Chapter 34: Tax Sales and Redemption

Chapter 41: Protests

What can be protested?

Section 41.03: Taxing Units / Jurisdictions (Deadline before June 1st)

Exclusion of a property

Granting of an Exemption

Determination of Special Use Appraisal

Failure to identify the taxing unit

Section 41.41: Taxpayers (Deadline on or before May 15th or 30 days after the Delivery of Notice)

Reasons

Market Value

Equal and Uniform Valuation

Inclusion of a property

Denial of an Exemption

Determination of Special Use Appraisal

Identification of a taxing unit

Determination of Ownership

Determination of a Change in Use

Any other action adversely affecting the property owner.

Section 41.411: Failure to Give Notice

A taxpayer can protest the failure of the CAD or the ARB to deliver a required notice.

Notice is considered delivered when it is deposited in the mail.

It is presumed that notice was delivered, however the presumption is rebuttable.

Filing Deadline January 31 - before the delinquency date

Section 41.43(b): Three Tests of Equity

Two Appraisal Ratio Tests

The appraisal ratio of the subject must be greater than the median of...

The appraisal ratio of a reasonable and representative sample of other properties in the appraisal district.

The appraisal ratio of a reasonable number of other properties similarly situated to, or of the same general kind or character as, the subject property.

Section 41.43(b)(3): The appraised value of the subject is greater than a…

Reasonable Number

Comparable Properties

Appropriately Adjusted

Who can file a protest?

A Property Owner

A New Property Owner

A Person claiming an interest

A Lessee

An Agent representing any of the other filers

How and where is a protest filed?

A protest must be in writing, but can be on any form.

A protest is sufficient if it:

1. Identifies the owner

2. Identifies the property

3. Gives an indication of dissatisfaction

Some CAD's and ARB's allow for electronic filing of protests.

Hearings

Scheduling Hearings

Notice of hearing must be sent 15 days prior to the date of the hearing.

Preferential scheduling before agents and other owners

Attending an ARB Hearing

By Affidavit

In Person

By Telephone

By Representative

Postponements

One-time free reschedule if not represented by an agent

Unlimited reschedule for "good cause"

Unlimited reschedule if the chief appraiser consents

If the hearing does not start within two hours of the scheduled time

Scheduled in another county and can prove the other CAD sent notice first

If the ARB reassigns a hearing to another panel without the consent of the owner/agent

CAD fails to deliver requested evidence timely

If a hearing is missed, reschedule request can be made within 4 days and granted if good cause is shown.

Evidence Inspections

If requested more than 14 days before a scheduled hearing, the CAD must deliver any evidence they intend to present at the hearing to the owner/agent.

Evidence requested timely, but not delivered timely is inadmissible in a

hearing.

However, the rule does not apply to rebuttal evidence.

Determination of Value

The burden of proof is on the CAD by a Preponderance of the Evidence

If the CAD fails to meet the Burden - the case should be determined in favor of the taxpayer!

Hearing Procedures 41.66

Three Post ARB Remedies

SOAH

District Court

Binding Arbitration

LIMITATIONS ON APPEAL: ONLY properties that are the property owner's residence homestead or that the ARB determined a value of less than $5,000,000 can be appealed through Binding Arbitration

DEADLINE: within 60 days from the receipt of the Board Order

ADVANTAGES:

relatively inexpensive

opportunity to settle

can recover filing fee if successful

relatively quick resolution

value cannot be raised

virtually no discovery

Chapter 42: Judicial Review

Value

Price = Cost = Value

4 types of Value

Market

Appraised

Assessed

Taxable

Other Types of Value

Business Value

Exchange Value

Fair Value

Insurable Value

Investment Value

Liquidation Value

Public Interest Value

Use Value

Factors of Value

Four interdependent factors of value.

Utility

Scarcity

Desire

Effective Purchasing Power

All four factors must be present for a property to have value.

Bundle of Rights

SLUGER

Sell

Lease

Use

Give Away

Enter/Exit

Refuse to do anything

Government Restrictions on the Bundle of Rights

Leased Fee(Landlord): The Landlord receives the money (rent) and holds the Leased Fee Estate.

Leasehold(Tenant):The tenant holds the property (in exchange for rent) and therefore has the Leasehold Estate.

The Leasehold Estate:

-Estate for Years

-Estate for a Period of Time

-Estate at Will

-Estate at Sufferance

Subject Analysis

Identify the Land

Site Analysis: land should always be analyzed as if vacant

Highest and Best Use

Physically Possible

Legally Permissible

Financially Feasible

Maximally Productive

The Cost Approach:

Land + RCNLD(Reconstruction Cost New Less Depreciation) = Total Cost Value

Depreciation

Physical Deterioration

wear and tear

can be curable or

incurable

Functional Obsolescence

flaw in materials, design, or structure

can be curable or incurable

Economic Depreciation / External Obsolescence

negative external influences

typically incurable

Age/Life Comparisons:

How does the age of the property compare to the life of the property?

Actual Age vs. Effective Age

Economic Life vs. Useful Life

Remaining Economic Life vs. Remaining Useful Life

The Sales Approach

Determine Elements of Comparison

Size

Condition

Amenities

Views

Time of Sale

Legal Restrictions

Determine Appropriate Adjustments

The Income Approach

Basic Assumptions:

A dollar in the future is worth less than a dollar today

Value depends directly on income

Value varies with the number of income-generating periods

Value varies with risk

Positives:

Income potential is primary

Enough data to lead to credible results

Negatives

Income estimates are weak

Data does not lead to a cap rate

Owner-Occupied properties are predominant

Other considerations besides income are prevalent

Rental Income:

Rent

Market Rent

Contract Rent

Excess Rent Effective Rent

Deficit Rent

Percentage Rent

Overage Rent

Potential Gross Income

Vacancy and Collection Loss

Stabilization

Other Income/Secondary Income

Effective Gross Income

Expenses

Allowable vs. Not Allowable

Fixed vs. Variable

Net Operating Income (NOI)

Effective Gross Income - Operating Expenses = NOI

Direct Capitalization Formula

Potential Gross Income(PGI)

-Vacancy and Collection Loss(V&C)

+ Secondary Income(SI)

=Effective Gross Income(EGI)

-Operating Expenses(OE)

=Net Operating Income(NOI)

/CAP Rate

=Value

PTC Requirements

Who does NOT have to register?

POA

Attorney

Lessee

Employee

Public Employee

Broker/RE Salesperson

CPA

Person Assisting

RE Appraiser

Preliminary Requirements:

Completed Application

HS Diploma

18+

Passed Test

Paid Fees

Completed 40 classroom hours

Prohibited Acts

A Senior Property Tax Consultant may not supervise more than 10 property tax consultants unless each additional consultant has more than six months of experience

Cannot file a protest without the approval of the property owner

May not falsify a document

May not file a protest on a single-family home without authorization from the property owner or another person authorized to sign on behalf of the property owner

May not solicit by assuring a specific outcome

May not maintain a website that appears to be a government website

Must identify the company of the consultant prominently on the homepage of the consultant’s website

May not destroy, erase, or remove client records for at least 3 years following the date of the last action taken or service performed on behalf of the client.

TDLR Code of Ethics

Shall not plan, scheme, or arrange the evasion of the rules

Shall not lend their registration to another person

Shall use reasonable care in the supervision of other persons

Shall not engage in any activity that constitutes dishonesty, fraud, or gross incompetence

Shall promptly report any known violation

Shall cooperate fully with an investigation

Shall not offer anything of value with the intent of influencing a public

employee

Shall not contract or accept compensation for services not performed

Shall not knowingly engage in false advertising

Shall not knowingly furnish inaccurate, deceitful, or misleading information

Shall not reveal confidential information

Shall not state or imply representation of a person or firm that is not in fact someone represented

Shall not solicit or advertise the promise of a specific out come

*without prior analysis

Phases of the Property Tax Calendar

Appraisal

Equalization

Assessment

Collections