Module 2

Objective:

Understand cost classifications used for assigning costs to cost objects: direct costs and indirect costs

How does this work:

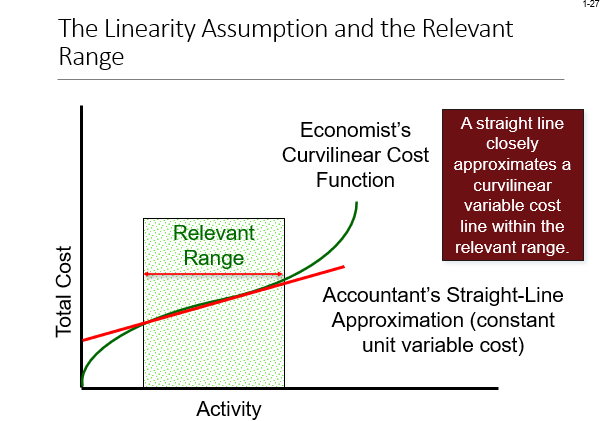

This graph explains how costs behave as activity changes, particularly in the context of businesses.

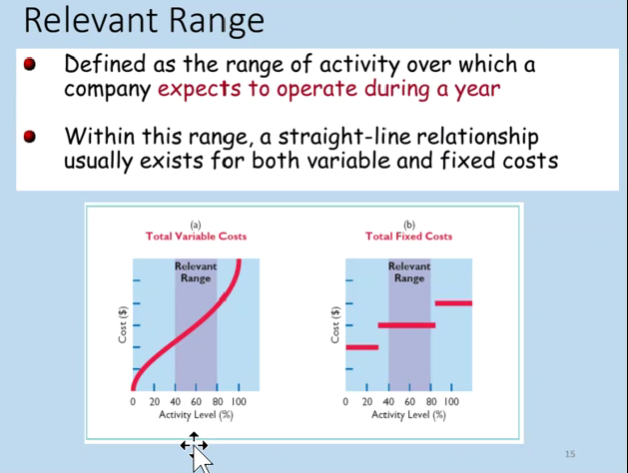

Economist’s Curvilinear Cost Function (green line): In reality, costs don’t always increase in a straight line as activity increases. Instead, they can curve upward, meaning that at some points, costs increase faster as activity grows. This is the curvilinear cost function that economists observe.

Accountant’s Straight-Line Approximation (red line): However, for simplicity, accountants often assume costs increase at a constant rate, which is represented by a straight line. This is a simplification but works well within a certain range of activity. This straight line means that for every additional unit of activity, the cost increases by the same amount.

Relevant Range (shaded area): This is the range of activity where the accountant’s straight-line approximation is a good enough estimate. Within this range, the difference between the straight line and the real curvilinear cost is small, so the straight-line assumption is useful and close enough to the actual costs.

In summary, outside the relevant range, the real costs (green curve) deviate from the straight-line approximation, but within the relevant range, the straight-line assumption is close enough to reality for practical purposes.

This graph explains mixed costs, which include both fixed and variable elements, using the example of a utility bill.

Fixed Monthly Utility Charge (blue line): This is a cost you have to pay every month no matter how much activity (kilowatt hours of electricity) you use. It’s a constant cost that doesn’t change, represented by the flat blue line.

Variable Cost per KW (red upward steps): As you use more electricity, your costs increase. This part of the cost changes based on your activity. The more kilowatt hours you use, the more you pay, so the red steps represent the extra cost for each additional amount of electricity used.

Total Mixed Cost (red line): This is the total cost, which combines both the fixed and variable parts. It starts with the fixed cost and then increases as you use more electricity. The more activity, the higher the total cost becomes.

In summary, a mixed cost has a fixed part (which stays the same regardless of activity) and a variable part (which increases with more activity). The graph shows how these two parts combine to form the total cost.

QUESTIONS:

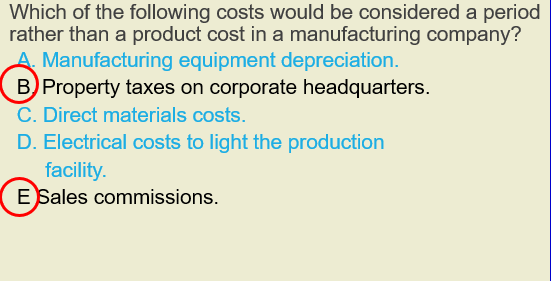

I thought property taxes were part of product costs? because they're under manufacturing overhead costs

VIDEO NOTES

Factors of prod:

land and raw materials

labor

material

entrepreneurship

short run costs- period of time which at least 1 factor of production is fixed

variable costs - vary with output

fixed costs - exact same costs; held constant, do not change w quantity

total costs - FC + VC

long run - period of time where all factors of production are variable, no fixed

opportunity costs - measured in terms of the next best alternative foregone (implicit costs)

economic profit = total revenue - explicit and implicis costs

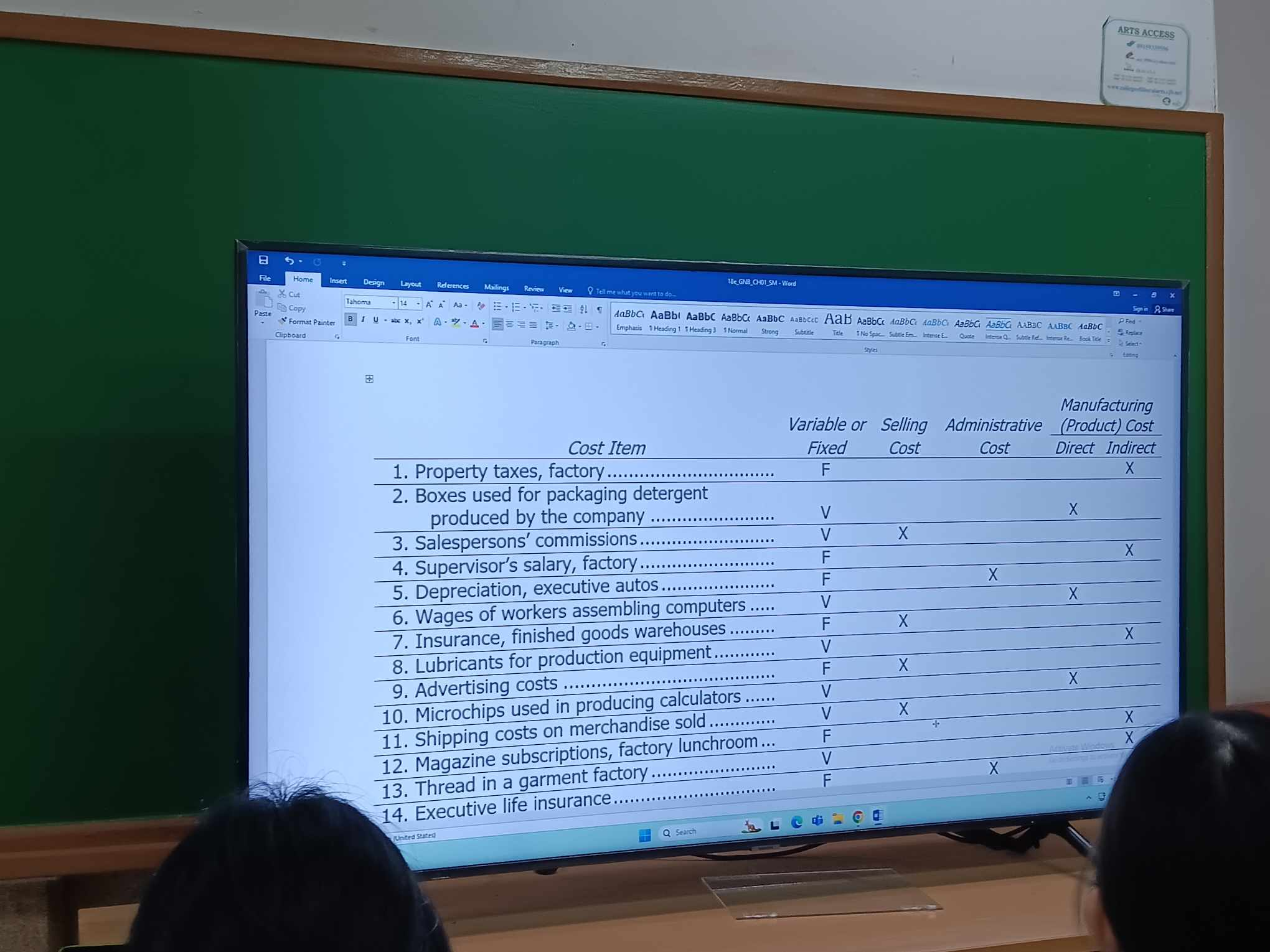

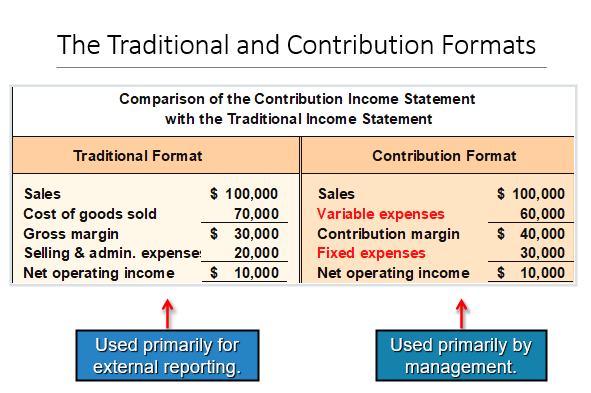

3 types of manufacturing costs - used for COGS

direct materials - materials that go into a final product ex. steel in making cards

direct labor - labor that can be traced to individual unit of production ex. employee that assembled the car NOT the janitor. labor can be traced to individual units of production

manufacturing overhead - generally not DM or DL. ex. indirect materials ex. glue gun used to put togt a component (used somewhere along the line; car isn’t made of glue), utility costs, property tax — they cant be traced to a single vehicle. indirect labor ex. janitor

basta traceable if they go into the car

non-manufacturing costs

ex. commissions

SG&A - selling, general and administrative

selling - costs to secure orders and get products to customers ex. advertising, shipping, sales commission, salary before shipping

g&a - costs in general management of the organization. ex. CEO salary, exec compensation, legal work, accounting

cost objects - any product, any job order, division, any ANYTHING which u assign a cost. broad

ex. product lines of tents, packs bags - how much cost

ex. customers - how many sg&a does it cost to serve them

ex. depts - how many costs to mkt, finance, and acct depts

why assign costs to cost objects?

track profitability

evaluate managerial performance

provide info for pricing decisions

control spending

Cost driver - activity that causes cost to occur (machine hours, direct labor hours)

changes in the activity level → changes in the amount of costs

activity-based costing

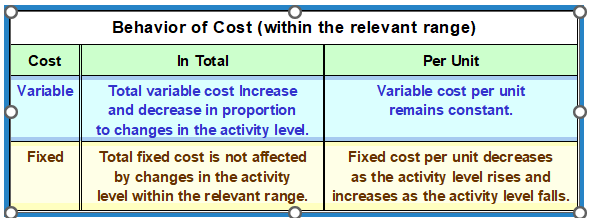

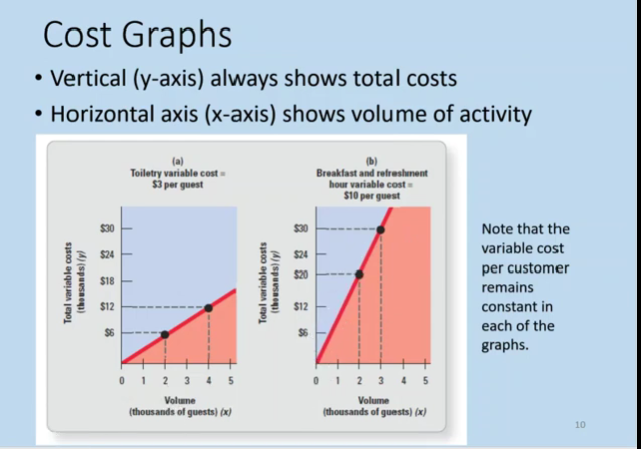

Cost behavior - how costs change as volume change

3 common cost behavior: variable, fixed, mixed

relationship of total cost to volume of activity

cable bill - fixed cost regardless of hm viewing u do

pay-per-view - how many on demand movies u watch, cost per show is constant (variable cost)

cost equation - mathematical equation for a straight line

variable cost line = variable cost per unit of activity * volume of activity

committed fixed costs - business is locked in these costs bc of previous management decisions

discretionary fixed costs - result of annual management decisions ex. advertising

mixed costs - variable + fixed costs (y = vx + f)

relevant range - band of volume where total fc remains constant and vc remains constant

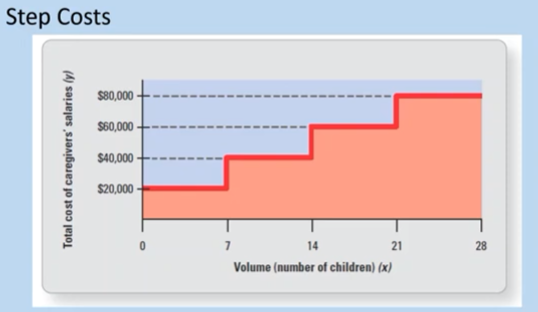

step costs

curvilinear costs - approximate it as mixed cost