Better Money - 5. Bitcoin standard

Bitcoin was the first and most successful cryptocurrency.

1. What Bitcoin is

An owner of bitcoin units (UTXOs) can transfer them using its native ledger (blockchain).

Blockchain associates each UTXO with a specific address.

The holder of the UTXO has its cryptographic private key.

The ledger is distributed across a network of nodes, not kept by a single entity.

While Bitcoin can serve as a medium of exchange, it does not serve as a commonly accepted medium of exchange.

Therefore, it isn't considered money yet.

Bitcoin's best niche use derives from the fact that it doesn't go through government-controlled banks, so it avoids censorship.

Users in China or Cuba have used them to make purchases outside of their strictly controlled countries.

But its transparency on the blockchain can expose users if they are not careful, which limits its appeal for illicit activities.

Bitcoin is intangible.

It is fiat, but not issued by a government.

Platforms like Binance facilitate transactions.

It was launched by Satoshi Nakamoto in 2009, as a kind of hobby project, to demonstrate that a secure system for transferring a scarce private non-commodity money could work in practice.

His real identity remains unknown.

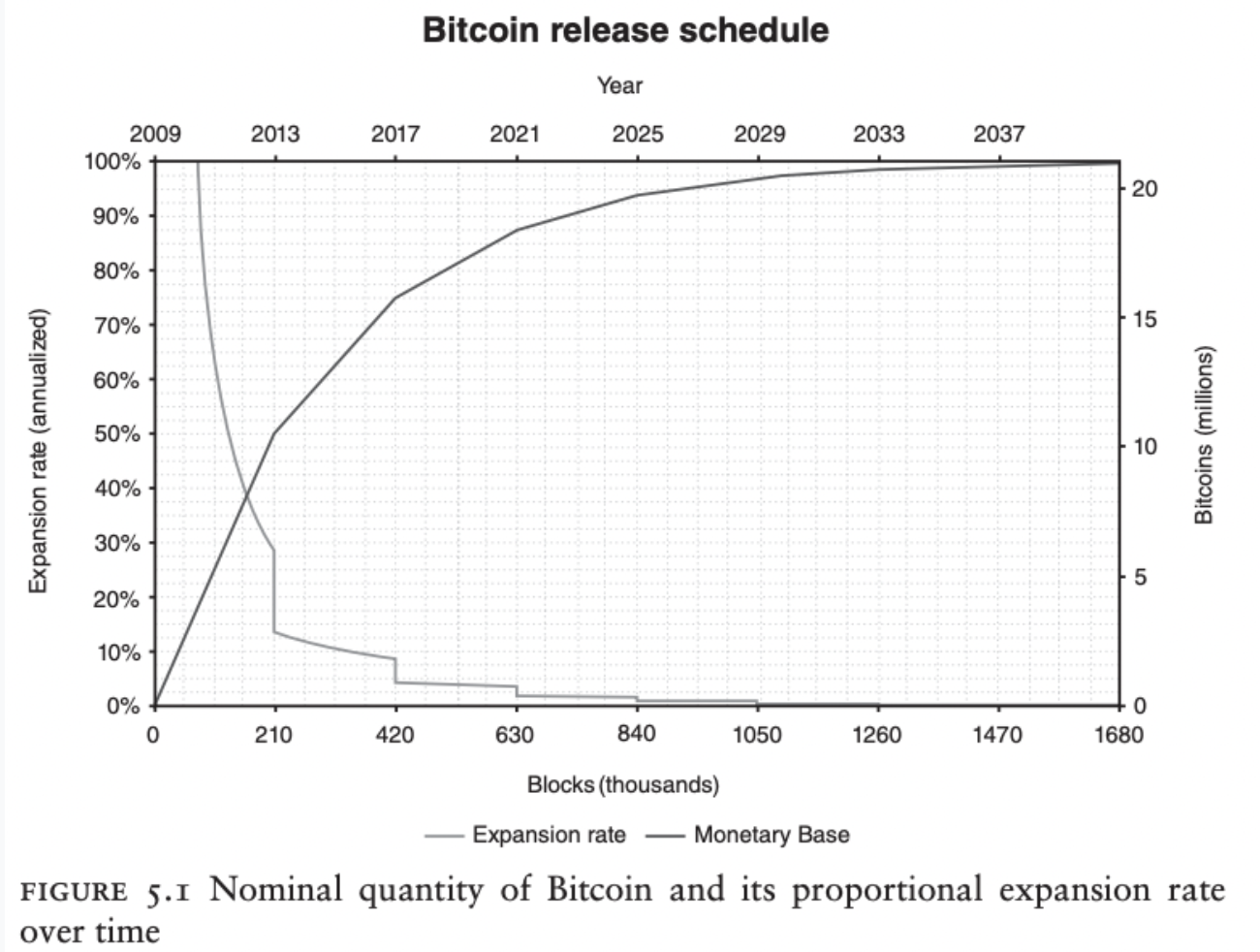

The program releases quantities of new Bitcoins according to a fixed schedule, at an ever-slowing annual rate, with the quantity of Bitcoin set to max out at 21 million coins around the year 2140.

At the end of 2021, about 19 million (or 90 percent) had been released.

The source code that governs the issue schedule is changeable only by consensus of the validators (miners).

A cryptocurrency fork is a blockchain software update that can either implement minor changes to the existing protocol or cause it to split into two separate and incompatible protocols.

2. The background to bitcoin

DigiCash allowed financial institutions to issue peer-to-peer electronic currency, denominated in fiat.

Double-spending prevention via cryptography, while maintaining user privacy (activity blinded from the bank).

Launched in 1989.

Failed due to lack of consumer interest and limited bank participation.

Also called Chaumian banknotes, in honor of its creator David Chaum.

Mondex was a prepaid card system, allowing peer-to-peer money transfers without bank involvement.

Launched in the early 1990s.

Licensed to Mastercard and Chase, but failed in the U.S. due to limited appeal over debit cards.

Hashcash was created to block spam emails through proof-of-work, requiring senders to solve a computational problem (a cryptographic hash function).

Created in 1997.

Later became the basis for Bitcoin mining.

These developers, including Nakamoto, were members of Cyberphunk and other libertarian online communities.

Nakamoto emphasized the root problem with conventional currencies:

Trust required in central banks not to debase currency.

Trust in banks not to mishandle money or invade privacy.

Bitcoin was designed as a trustless, decentralized system to solve these issues.

3. A timeline of bitcoin developments

1976: F.A. Hayek publishes The Denationalisation of Money, advocating for competition among private non-commodity monies over fiat currencies.

Research on unregulated market money systems (free banking) follows.

1979-2001: Development of cryptographic tools necessary for Bitcoin begins.

Innovations include Merkle trees, public key cryptography, cryptographic timestamps, and proof-of-work systems.

21 September 1992: The Cypherpunks mailing list launches, discussing cryptography and digital money.

Key figures include Wei Dai, Hal Finney, Nick Szabo, and Tim May.

22 November 1992: Tim May's Crypto Anarchist Manifesto predicts anonymous online trade and contracts enabled by cryptography.

1993: Hal Finney writes on protecting privacy with electronic cash, using systems like DigiCash for secure and private transfers.

1995: Extropy magazine discusses private digital currency and potential challenges for it to outperform fiat currencies.

1996: E-gold, a private system for transferring digital claims to gold, is founded. It is later shut down by the U.S. government due to legal issues.

26 November 1998: Wei Dai proposes b-money, a protocol for monetary exchange based on proof-of-work and pseudonyms.

1998: Nick Szabo and Hal Finney propose privacy-preserving payment systems.

Szabo introduces the idea of Bit Gold.

2004: Hal Finney produces software for Reusable Proofs of Work (RPOW), allowing tokens to be reused in a secure and transparent system.

2005: Nick Szabo describes Bit Gold, envisioning a secure digital currency system based on proof-of-work.

Early 2007: Satoshi Nakamoto begins writing the Bitcoin source code.

31 October 2008: Nakamoto publishes the Bitcoin white paper, proposing a peer-to-peer electronic cash system.

8 November 2008: Hal Finney responds positively to the Bitcoin white paper, comparing it to Bit Gold.

13 November 2008: Finney highlights that Bitcoin solves problems related to a decentralized database, noting its use of proof-of-work as a novel idea.

17 November 2008: Nakamoto announces the imminent release of Bitcoin's source code.

4. How bitcoin acquired a positive market price

Bitcoin acquired observable market value from some earlyadopter enthusiasts who were willing to pay to acquire it.

Economists have struggled to understand why anyone would pay to acquire Bitcoin when it was not yet being used as a medium of exchange.

Enthusiasts were willing to pay because they placed some positive probability on Bitcoin becoming useful as a medium of exchange and/or trading at a higher price at some future date.

In regular fiat theory, equilibrium has only two values: positive and zero.

There hadn't been a case where positive equilibrium was reach in anticipation of its use as a medium of exchange.

This is a bootstrap equilibrium.

Von Mises had previously proposed the regression theorem

Any money’s purchasing power today is determined by today’s supply and demand.

Today’s quantity demanded depends on its expected purchasing power per unit.

Today’s purchasing-power expectation derives from its observed purchasing power on yesterday’s market.

The market demands a medium of exchange based on its past purchasing power, making it hard to accept new mediums without historical context.

Mises denied the possibility of launching a new currency without a prior exchange value from another employment.

Expectations can be forward-looking, not necessarily relying on prior exchange value.

Bitcoin has never been redeemable at a fixed rate for another currency or commodity.

Bitcoin did not need historical exchange value or employment for initial market acceptance.

Views on Bitcoin's initial value:

Use-value view: it had initial value due to non-monetary use (Misesian theory).

Coordination view: a group of early adopters chose to buy in anticipation that others would join in.

Nakamoto suggested Bitcoin might first be used for niche payments, initiating a positive feedback loop of acceptance (monetary network effects).

5. What was Nakamoto trying to achieve, and how well has bitcoin achieved it?

There were three institutional problems with the status quo payment system

Inflation from central banks.

Lack of privacy and security from commercial banks.

High cost of bank-mediated payments that made online micropayments infeasible.

Nakamoto suggested that Bitcoin would behave like a gold standard.

Bitcoin’s fixed quantity path creates a different problem that inhibits its widespread use as currency.

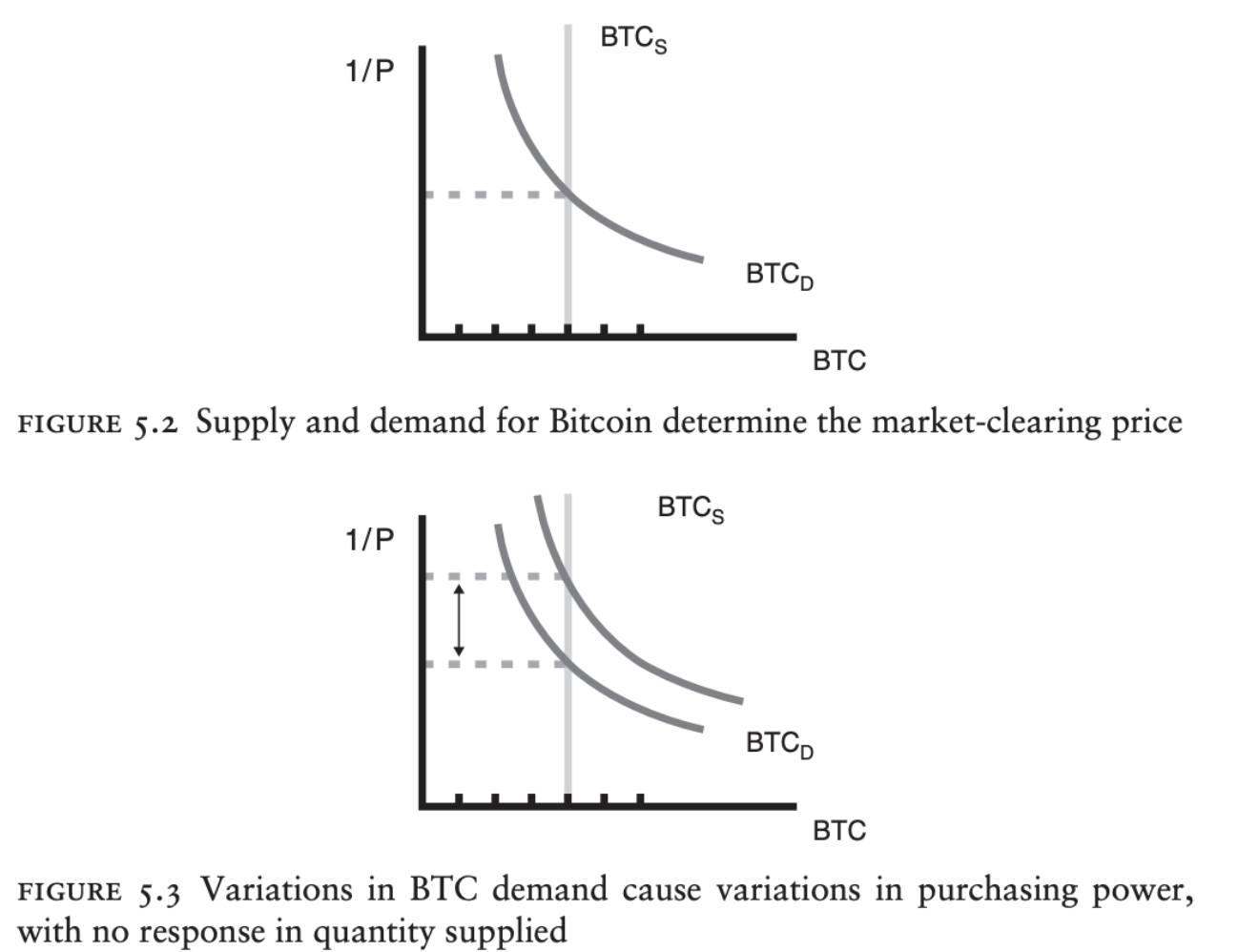

With the number of Bitcoins unresponsive to demand shifts, the burden of adjustment to those shifts falls on the relative price (purchasing power).

As a result, the market price of Bitcoin is enormously volatile week-to-week and even day-to-day.

Nakamoto did not design Bitcoin to have a demand responsive supply because he did not know how to do it without creating the need for a trusted authority

Stablecoins provide a solution for users seeking stable purchasing power, managed by a trusted party.

However, a cryptocurrency that stabilizes purchasing power based on demand remains a future challenge.

6. Transactions demand for bitcoin

Bitcoin users can be divided into two categories:

Spenders: those who treat Bitcoin like a checking account, using it for everyday transactions.

Investors: those who treat Bitcoin as a portfolio asset or retirement savings, holding it for long-term gains.

The number of retail transactions using Bitcoin is very small compared to financial transactions like exchanges.

Services like BitPay and Cryptobuyer enable retailers to accept Bitcoin while receiving fiat currency.

PayPal also accepts bitcoin.

Lightning Network allows for faster, small-value transactions.

Parties open a channel on the network to make BTC transactions off the blockchain.

It isn't as widely used as bitcoin.

Bitcoin is appealing because it is private, but it isn't commonly used because of its volatility.

7. Investment demand for bitcoin

While Bitcoin's value and trading volume has grown, it has mostly been bought as an asset rather than as a medium of exchange.

Some economists argue that the demand for Bitcoin rests on a greater fool theory.

Bitcoin has been accused of being:

A pyramid scheme is an organization that recruits individuals who pay to join, promising them a share of the money paid by later joiners whom they recruit.

No organization collects fees to join.

There are no recruitment-based incentive payments.

A Ponzi scheme is a fraudulent intermediary that attracts clients’ funds with promises of steady above-market returns.

No intermediary promises above-market returns.

Fundamental value of zero, any positive price, in excess of fundamental value, is correspondingly described as a “bubble.”

Bitcoin's fundamental value could be positive based on future expectations of widespread use as a medium of exchange.

A typical chain letter asks the recipient to send a sum of money to the person at the top of a list, then to send multiple copies of the same letter to others, modified to add his or her name to the bottom of the list and deleting the name at the top.

Chain letters lack an underlying economic reform agenda, while some Bitcoin proponents view it as a tool for social change and privacy protection.

Hyperbitcoinization is a hypothetical scenario where Bitcoin replaces all fiat currencies globally could give it substantial value.

8. The supply of bitcoin

The source code contains a Bitcoin generation algorithm that governs the number of new Bitcoin units to be released with each block added to the chain.

Initially the reward was BTC 50 per block, while now (and until March 2024) it is BTC 6.25.

Halvenings: the reward per block is cut in half every four years.

This system governs only the nominal and not the real quantity (market cap) of Bitcoin.

The price of Bitcoin depends on demand, not mining costs or electricity expenditure.

Nakamoto pre-committed to a fixed Bitcoin supply to assure holders that its value wouldn't be diluted by future increases in quantity.

It will cap at 21 million bitcoin.

Coase analyzed how sellers of durable goods need to commit to limiting production to maintain value.

Bitcoin's use as a medium of exchange is niche and declining in some areas.

Tether and stablecoins have overtaken Bitcoin's role in cryptoasset trading.

9. The supply meets the demand for bitcoin

Principal demand driver: speculation on future value.

Secondary demand: use as censorship-resistant transaction medium.

Combination of demand curve and vertical supply curve determines Bitcoin’s purchasing power or market price.

Movements in speculative demand affect price, not quantity, due to the vertical supply curve.

If speculative demand faded, and Bitcoin became a common medium of exchange, volatility might decrease.

10. Who bears the cost of operating the bitcoin network?

Miners bear the costs of electricity and computer hardware.

They receive compensation through transaction fees or block rewards.

Block rewards: they keep a piece of the mined bitcoin.

Cost borne by bitcoin holders.

Function as a type of non-coercive seigniorage:

They dilute the purchasing power of existing BTC units.

The size of block rewards is pre-announced and expected to be priced in by the market.

Bitcoin’s release schedule indicates a rightward shift of the supply curve at a diminishing rate over time.

Eventually, costs of the network will be paid entirely by those who pay transaction fees.

11. Is bitcoin socially wasteful?

The Bitcoin network's high energy consumption does not automatically mean it is wasteful.

Evaluations of costs and benefits should be based on market prices and transaction quantities.

Its privacy and security should outweigh the costs.

The spillover effect of additional electricity demand on the price of electricity is a pecuniary externality, and it does not interfere with anyone's use of the resource.

The electricity consumption of Bitcoin is similar to other industries, like hospitals and airplanes.

Pecuniary externality: transmitted through the price system.

Technological externality: transmitted outside the price system.

If electricity would emit carbon dioxide, a Coasean remedy could be used (trading of emission permits).

Bitcoin miners can smooth electricity demand by agreeing to reduce usage during peak times, lowering costs but not eliminating them.

Critics claiming Bitcoin is "worthless" disregard consumer valuations and impose personal preferences.

The Efficient Markets Hypothesis suggests that the current price is the best estimate of Bitcoin's future value.

12. Cryptocurrency markets are an ongoing discovery process

On a historical scale, Bitcoin and other cryptocurrencies have existed only very briefly.

The market has hardly settled into a long-run equilibrium.

Concerns from Early Observers

Nick Szabo (2011) emphasized the need for practical testing of cryptocurrency technologies.

Gwern (2011) described Bitcoin's fixed supply as “bizarre” and its mining incentives as a “blatant bribe to early adopters.”

Wei Dai (2013) criticized Bitcoin's monetary policy and price volatility, questioning its potential for large-scale adoption.

Later cryptocurrencies aim to improve on Bitcoin’s limitations:

Transaction Speed: Faster transactions (e.g., Litecoin).

Security: Enhanced protection against "51-percent attacks."

Anonymity: Increased user privacy (e.g., privacy coins).

Utility: Support for smart contracts and decentralized finance (e.g., Ethereum, Solana).

Despite Bitcoin's growth, alternative coins have captured over half of the total crypto market capitalization.

Stablecoins are crypto tokens pegged to fiat currencies (e.g., US dollar).

They offer an alternative payment method but do not replace fiat standards.

Bitcoin's volatility remains a barrier to its widespread use as a medium of exchange.

Summary

Bitcoin is a digital asset represented by unspent transaction outputs (UTXOs) on a decentralized blockchain, controlled by private keys, ensuring final and irreversible transactions without a central authority.

It serves as a medium of exchange but lacks widespread acceptance, often used for bypassing government censorship and making private transactions.

Launched in 2009 by Satoshi Nakamoto, Bitcoin has a capped supply of 21 million coins, generated through a mining process that rewards miners with block rewards and transaction fees.

Early attempts at digital currency, such as DigiCash and Mondex, failed due to limited consumer interest, while technological advancements in cryptography laid the groundwork for Bitcoin.

The initial market value of Bitcoin arose from speculative expectations rather than historical redemption value, with its acceptance driven by network effects among early adopters.

Nakamoto aimed to address inflation and privacy concerns associated with central banking, but high price volatility has hindered Bitcoin's effectiveness as a medium of exchange.

Bitcoin's transactional demand is split between spenders and investors, with minimal retail usage and increasing reliance on payment processors and the Lightning Network for quicker transactions.

Investment demand is primarily speculative, with Bitcoin criticized as lacking intrinsic value, though it holds potential as a future global currency.

Bitcoin's supply is governed by a fixed algorithm that limits total coins, influencing price dynamics based on demand rather than production costs.

Operating costs for the Bitcoin network are borne by miners, who face expenses for electricity and hardware, offset by rewards from transaction fees and block rewards.

The social wastefulness of Bitcoin's energy consumption is debated, with its benefits needing to justify the infrastructure costs.

The cryptocurrency market continues to evolve, with Bitcoin facing competition from alternative cryptocurrencies and stablecoins, impacting its market dominance and role as a transactional medium.