Chapter 3

Adjusting Accounts For Financial Statements

Importance of Periodic Reporting and Accrual Accounting

Accounting Period

Time Period Assumption: an organization’s activities can be divided into specific periods such as a month, a three-month quarter, a six-month interval, or a year

Annual Financial Statements: covering a one-year period

Fiscal Year: consecutive 12-month (or 52 weeks)

Periodic Reporting: Essential for providing timely financial information.

Accrual Basis Accounting: records revenues when services and products are delivered and records expenses when incurred (matched with revenues)

Accrual Basis vs. Cash Basis

Accrual Basis:

Revenue recorded upon delivery of goods/services.

Expenses recorded when incurred.

Unexpired premium is reported as a Prepaid Insurance asst on the accrual basis balance sheet

Example: When prepaid insurance is bought for three years, it is expensed/allocated at the end of each month for each of the three years.

Cash Basis:

Revenues are recorded when cash is received.

Expenses are recorded when money is paid.

Cash basis balance sheet never reports a prepaid insurance asset since it is immediately expensed

Example: If insurance expense is paid for over three years, the amount is paid in the same year and for the next two years $0 is paid.

Revenue Recognition Principle

Revenue Recognition: Revenue is recorded when goods/services are provided at an amount expected to be received from customers

Adjustments ensure that revenue is recognized (reported) in the time period when those services and products are provided.

Expense Recognition Principle

Matching Principle: Expenses recorded in the same period as the revenues they help generate.

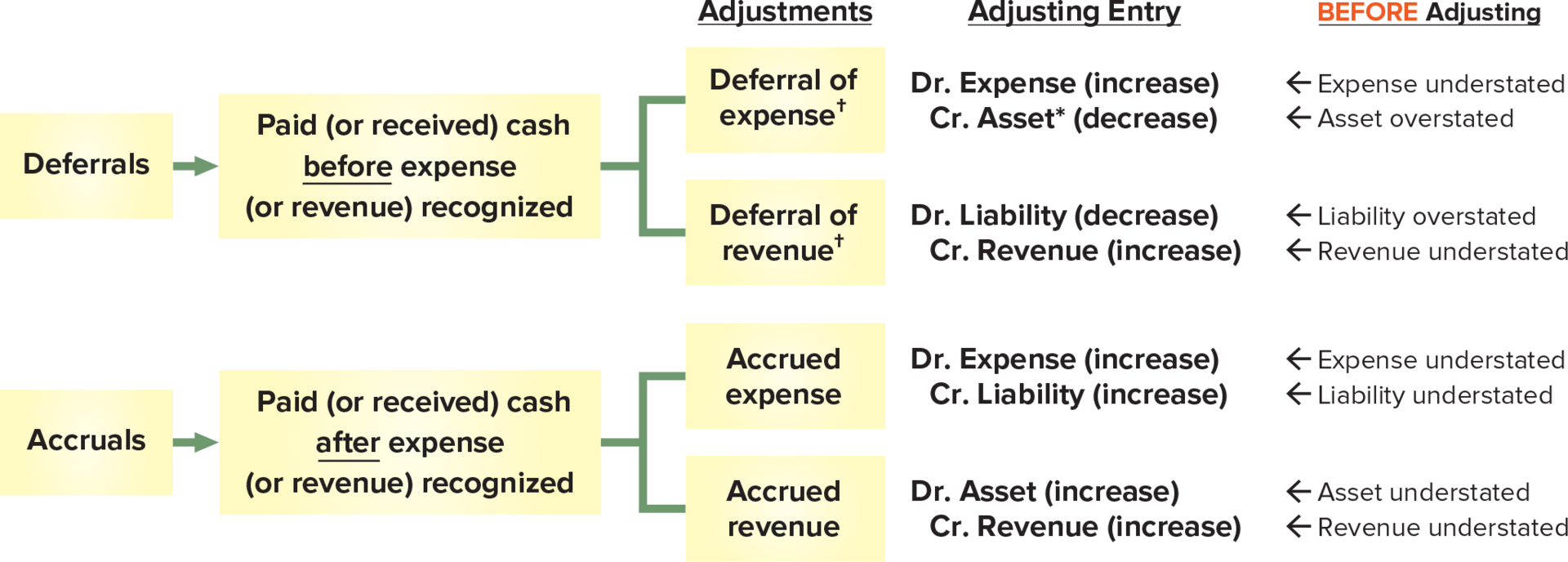

Framework for Adjustments

Types of Adjustments

Adjustment Entry (journal entry): at the end of an accounting period to bring an asset or liability account to its proper amount and update the related expense or revenue account

Process for Adjusting Entries

Step 1: Determine what the current account balance equals.

Step 2: Determine what the current account balance should equal.

Step 3: Record adjusting entry to get from step 1 to step 2.

Deferral of Expenses

Prepaid Expenses

Definition: Payments made in advance for benefits to be received later.

Examples: Prepaid insurance, prepaid rent, supplies.

Adjusting for Prepaid Insurance

Prepaid insurance expires with time

Prepaid insurance credited; Insurance expense debited

Process:

Step 1: Record total prepaid insurance at a given amount for a specific period of policy.

Step 2: Adjust monthly insurance expense to recognize the portion used.

Step 3: Report remaining prepaid insurance on the Balance Sheet and insurance expense on the Income Statement.

Adjustments for Supplies

Supplies are counted at period-end

Steps:

Step 1: Record purchased supplies.

Step 2: Conduct a physical count to determine the remaining supplies. (Take total supplies and subtract by unused supplies)

Step 3: Adjust supplies and recognize expired supplies on financial statements.

Reduce supplies account, as well as T-account postings

Depreciation

Plant Assets: a special category of prepaid expenses (Property, Plant, Equipment)

It is long-term tangible assets used to produce and sell products and services

Provide benefits for more than one period

All plant assets (excluding land) wear out or become less useful

Example: buildings, machines, vehicles, equipment

reported on the balance sheet

Cost of plant assets are reported as expenses in the income statement over the assets’ useful lives (benefit periods)

Depreciation Definfition

It is the allocation of the costs of these assets over their expected useful lives (does not measure decline in market value)

Depreciation expense is recorded with an adjusting entry similar to prepaid expenses

Straight-Line Depreciation Formula

Depreciation Formula:

Asset Cost - Salvage Value / useful life

Depreciation Adjustment:

using straight-line depreciation, which allocates equal amounts of the asset’s net cost to depreciation during its useful life

Net cost / useful life (months) = depreciation expense.

Accumulated Depreciation: a separate contra account and has a normal credit balance

Contra account: linked with another account, and has an opposite normal balance, it is reported as a subtraction from that other account’s balance

allows the original cost to remain in the books while showing the reduction in value seperately

Book value: Accumulated Depreciation is subtracted by asset cost to get the book value or net amount

Deferral of Revenues

Unearned Revenue

Definition: Cash received before services are provided.

this is recorded as a liability

when cash is accepted, an obligation to provide products or services is accepted

recorded revenue is delayed until the product or service is provided

Adjusting Entries:

decrease liability (debit) (balance sheet)

increase revenue (credit) (income statement)

Example:

Step 1: record advance payment which increases cash; record increase in liability over the specified time customer payed for

Step 2: recognize revenue as the service is performed, adjusting the revenue account while decreasing the liability account to reflect the fulfillment of the obligation.

Example: if work was completed 5 days of out 60 days of work that needed to be done, you record the revenue by (Asset x 5/60) = unearned revenue

Step 3: Adjust the entry to reduce liability account and recognize revenue

Accrued Expenses

Definition

Accrued Expenses: Costs incurred in a period that are both unpaid and unrecorded

Adjusting Journal Entry: Increase liability (Credit) and expense (Debit) accounts appropriately at period end.

Salaries Expense

Total debited salaries expense is reported on the income statement

Total credited salaries payable is reported on the balance sheet

Interest Expense

incurred as time passes

unless interest is paid on the day of an accounting period, it needs to be adjuted for interest expense but not yet paid

interest costs must be accrued from the most recent payment date up till the end of the period

Accrued Interest Formula: principal amount owed x Annual interest rate x fraction of year since last payment

Example: If a company has a loan of $10,000 from a bank with an annual interest rate of 5%, then 30 days’ accrued interest expense would be calculated as follows: $10,000 x 0.05 x (30/360) = $41.67.

Key: interest computations use a 360-day year, called the bankers’ rule

Future Cash Payment of Accrued Expenses

Salaries payable decreases (debited)

Salaries expense decreases (debited)

Cash is decreased (credited)

Accrued Revenues

Definition and Example

Accrued Revenues: Revenues earned but not yet recorded.

Accrued Revenues = accrued assets

Example: A technician who bills customers after the job is done. If one-third of the job is complete by the end of a period, then the technician must record one-third of the expected billing as revenue in that period, although there is no billing or collection

Framework

Increases a revenue (income statement) account; and increases an asset (balance sheet) account

Usually, it comes from services, products, interest, and rent

An asset is debited and revenue is credited

Adjusting Entry: Increase accounts receivable and revenue when services have been performed.

Accrued Services Revenue

revenues are earned but unrecorded because either the buyer has not yet paid or the seller has not yet billed the buyer

accounts receivable increases and consulting revenue increases

Accrued Interest Revenue

adjusting entry is similar to accruing service revenue

Interest receivables are (debited) and Interest revenue (credited)

Preparing Financial Statements from Adjusted Trial Balance

Adjusted trial balance is prepared after adjusting entries have been recorded and posted

Profit Margin

a useful measure of a company’s operating results is the ratio of its net income to net sales, which is called profit margin

Formula:

Profit Margin = Net Income / Net Sales

Summary of Adjustments