Chapter 17: Public Choice Theory and the Economics of Taxation

Public choice theory - Economic analysis of government decision making, politics, and elections

Revealing preferences through majority voting

- Decisions about regulation of businesses, income distribution, etc.

- Made through majority voting

- Vote for officials who represent collective wishes

Inefficient voting outcomes

- Inefficient “no” vote → Too little of public good produced

- Inefficient “yes” vote → Too much of public good produced

- Majority voting cannot incorporate strengths of each person’s preferences

- Interest groups - People who share strong preferences for a public good may band together into interest groups and use advertisements, mailings, and direct persuasion to convince others of the merits of that public good

- Logrolling - Trading of votes to secure favorable outcomes

- “Vote for my special local project and I will vote for yours”

Paradox of voting - A situation in which society may not be able to rank its preferences consistently through paired-choice majority voting

- Under some circumstances majority voting fails to make consistent choices that reflect the community’s underlying preferences

Median-voter model - Under majority rule and consistent voting preferences, the median voter will in a sense determine the outcomes of elections

- Median voter is person holding middle position

- Political candidates appeal to median voter to get nomination

- Info about people’s preferences is imperfect → Politicians can misjudge true median position

Government failure - Inefficiency due to certain characteristics of the public sector

- Special-interest effect - Any outcome of the political process whereby a small number of people obtain a government program or policy that gives them large gains at the expense of a much greater number of persons who individually suffer small losses

- Pork barrel politics - Securing gov’t project that yields benefits mainly to a single district/political representative

- Earmarks - Narrow, specifically designated authorizations of expenditure

- Logrolling - “Vote for my special local project and I will vote for yours”

- Rent seeking - Appeal to government for special benefits at taxpayers’ or someone else’s expense

- Politicians favor programs w/ immediate benefits + reject programs w/ very high long-term benefits

- The citizen as a voter is confronted with, say, only two or three candidates for an office, each representing a different “bundle” of programs (public goods and services). None of these bundles of public goods is likely to fit exactly the preferences of any particular voter. Yet the voter must choose one of them.

Bureaucracy + inefficiency

- Gov’t agencies + managers have no incentive to be efficient

- Gov’t bureaucrats justify continued employment by creating + pretending to solve problems

Imperfect institutions

- Is an activity performed w/ greater success in private or public sector?

Apportioning the tax burden

- Benefits-received principle - Households and businesses should purchase the goods and services of government in the same way they buy other commodities

- Those who benefit most from government-supplied goods or services should pay the taxes necessary to finance them

- Cannot be applied to income redistribution programs

- Ability-to-pay principle - Tax burden should be apportioned according to taxpayers’ income and wealth

Types of taxes

- Progressive tax - If its average rate increases as income increases. Such a tax claims not only a larger absolute (dollar) amount but also a larger percentage of income as income increases.

- Personal income tax

- Regressive tax - If its average rate declines as income increases. Such a tax takes a smaller proportion of income as income increases. A regressive tax may or may not take a larger absolute amount of income as income increases.

- Sales tax

- Payroll taxes

- Property taxes

- Proportional tax - If its average rate remains the same regardless of the size of income

- Corporate income tax

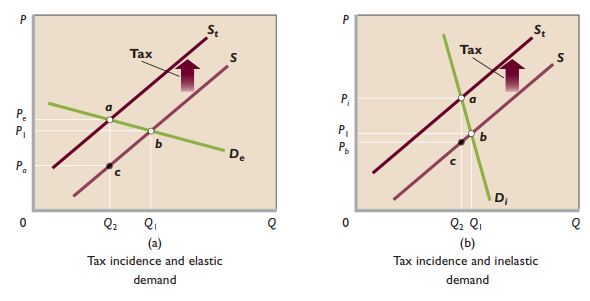

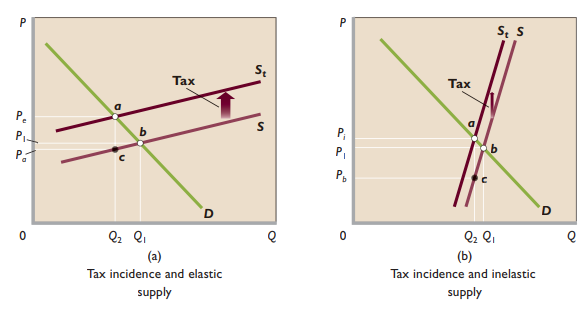

Tax incidence - Final resting place of a tax (who pays it?)

- More inelastic demand → Larger portion of tax shifted to consumers

- More inelastic supply → Larger portion of tax shifted to producers

Efficiency loss of the tax - This loss is society’s sacrifice of net benefit, because the tax reduces production and consumption of the product below their levels of economic efficiency, where marginal benefit and marginal cost are equal

- Demand more elastic → Efficiency loss greater

Probable incidence of US taxes

- Incidence of personal income tax is on individual

- Incidence of corporate income tax is on company’s stockholders

- Incidence of property tax is on property owner

US tax structure

- Federal tax system is progressive

- State + local tax structures are largely regressive

- Overall US tax system is slightly progressive