Chapter Four - Unemployment and Inflation

What is Unemployment?

It applies to labor, land and capital, occurring when some of these factors are idle

Labour unemployment is when someone who is actively seeking employment can't get a job

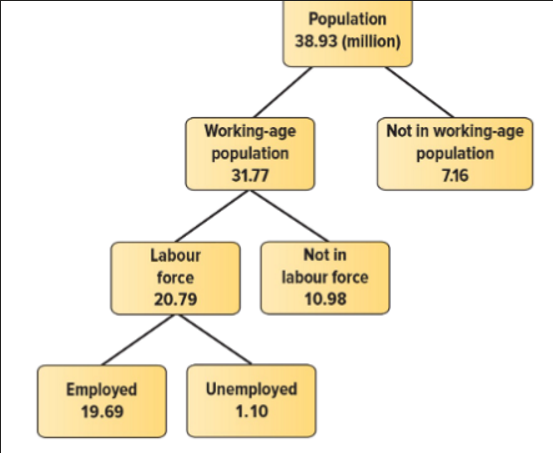

Measuring Unemployment

The working-age population is the country's total population excluding: under 15 years old, those in the 3 territories, on Aboriginal reserves, full-time residents of mental or penal institutions, hospitals or armed forces

Labour Force

Members of the working-age population, who are employed or unemployed. Full-time or part-time

Unemployed plus employed is the labour force

Employed.

Working

Unemployed

In the labor force and actively seeking employment but does not hold paid employment. Not discouraged workers

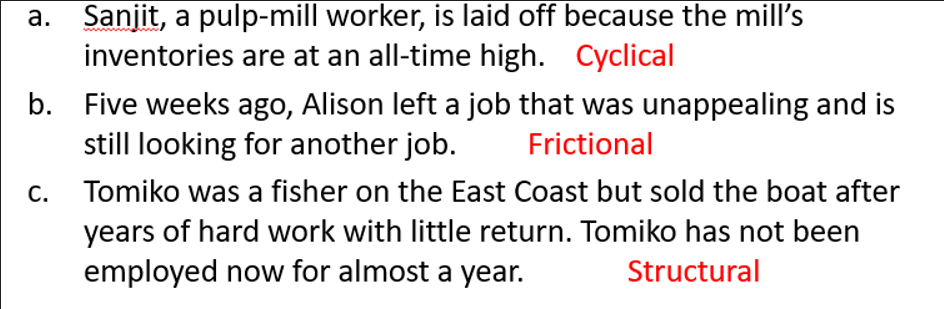

Type of Unemployment

Frictional Unemployment

Unemployment related to the time between jobs or finding first job.

Time between ending school and finding a full-time job

Structural Unemployment

Results from a mismatch in the skills or location between jobs available and the people looking to work

Possibility leaving a closed industry, re-learn or obtain education and move into new industry

Cyclical Unemployment

Occurs as a result of the recessionary phase of the business cycle

At peak of the business cycle, at or near full employment

Natural Rate of Unemployment

No cyclical unemployment, occurs when there is full employment

Number of people who are unemployed, mostly frictional and always have some natural rate of unemployment

Can change over time as a result of changes in:

Employment insurance benefit, average job search time, labor-force participation rate increasing

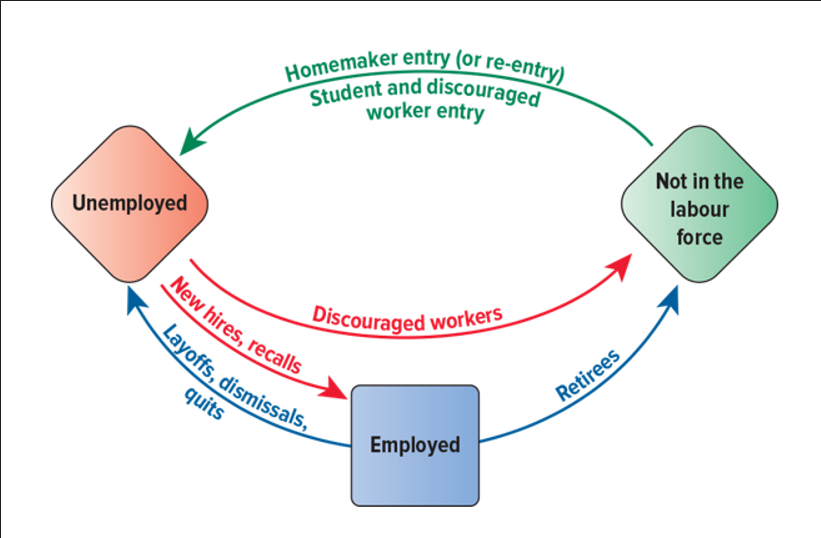

Understand the picture below

Criticisms of the Official Rate of Unemployment

The reported unemployment rate may be:

Understated because part-timers are included as full-timers

Understated because it excludes discouraged workers (people who want to work but not seeking)

Overstated because of false information from EI recipients

Overstated because of false information from those working in the underground economy

Costs of Unemployment

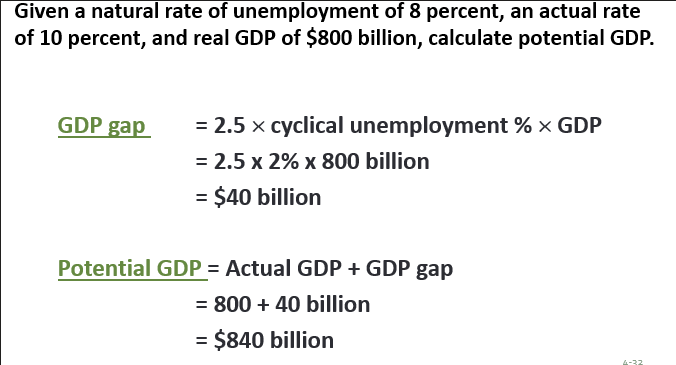

GDP Gap

Actual GDP is real or nominal

What is the cost of unemployment if the economy is functioning at seemingly full capacity? (potential question)

Okun's Law

For every 1% of cyclical unemployment, an economy's GDP is 2.5% below its potential

Inflation – increase in the general level of prices sustained over a period in an economy

Measured using a price index

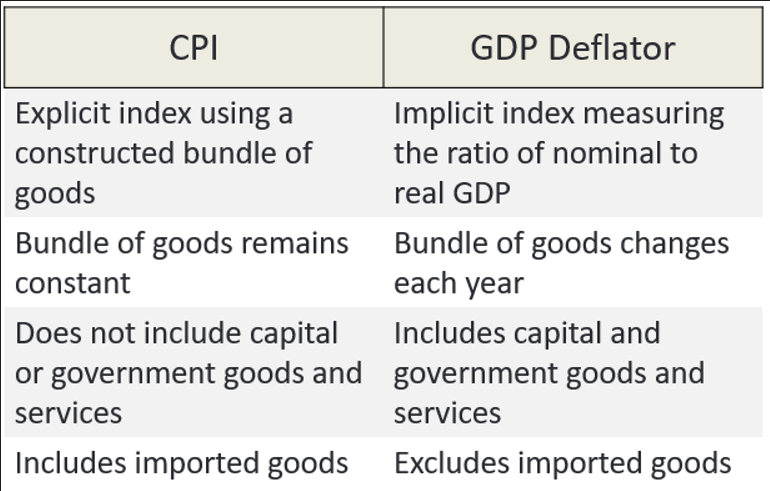

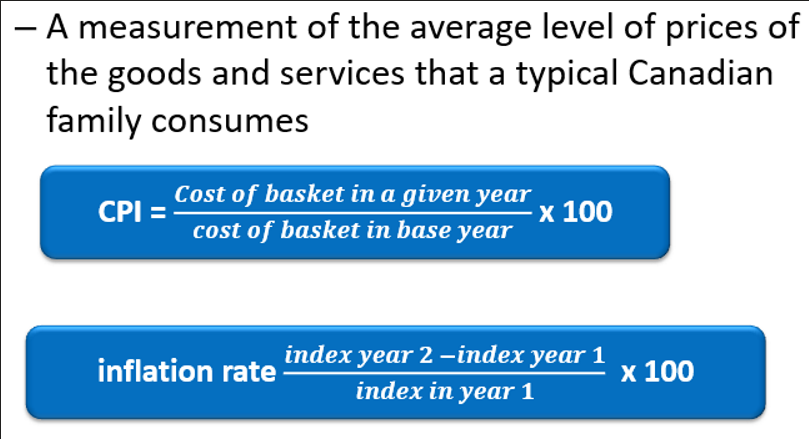

Consumer Price Index (CPI)

Base year could be last year or any year given (nominal and real GDP is the same)

Core CPI

Excludes items with highly volatile prices (fruits, vegetables, gas, fuel oil, mortgage interest rates, tobacco)

This gives a better indication of underlying long-term inflation rate

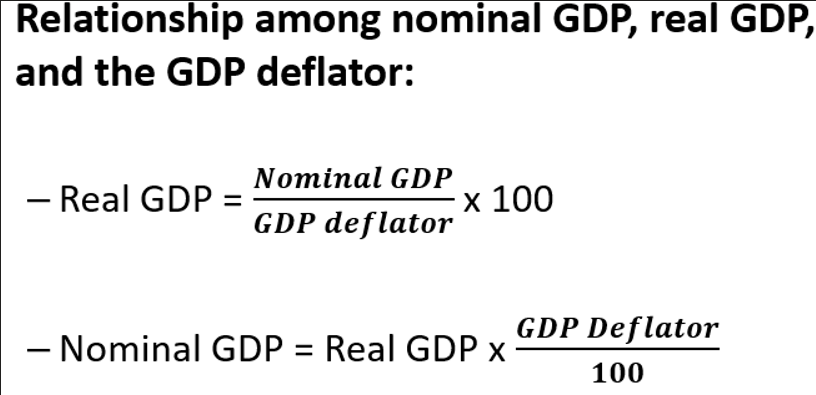

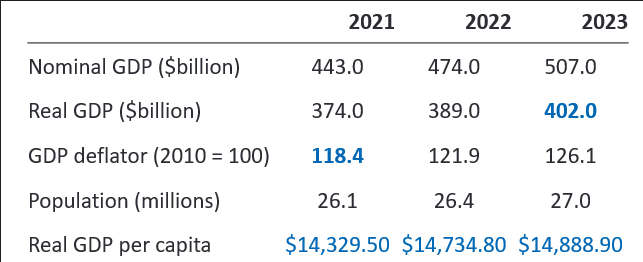

GDP Deflator

Need to know above

test question

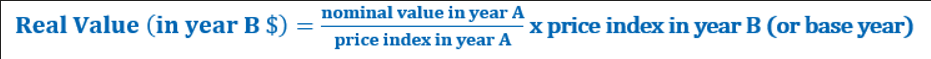

Measuring the Past

Benefits of using a Price Index

Enables us to compare values from past to present if all calculated using the same methods

Nominal Income

The present dollar-value of income

Real Income

The purchasing power of income

Nominal income divided by the price level

Rule of 70

Estimated that the time it will take for a figure to double in value given a certain percentage of growth rate (time value of money)

Costs of Inflation

Redistributive Costs

Shifts income from the economically weak to the economically strong

Shifts income from lenders to borrowers

Check textbook for better explanation

Output Costs

Reduces the level of investments and economic growth

Increase menu costs (always having to re-list prices with inflation)

Reduces export and increases imports

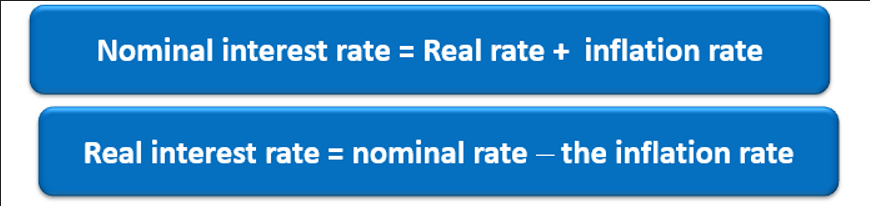

Real Interest Rates

The rate of interest measured in constant dollars OR the interest rate when inflation is zero

Causes of Inflation

Demand-side Inflation (Demand Pull)

When the demand for goods and service in the whole economy exceeds its capital to produce them, pulling prices up

Aggregate Demand is more than the economy's capable of producing, even at full employment

Demand is pulling the prices up because demand Is higher then supply

Supply-side Inflation (Cost Push)

Caused by increase in production cost due to: union pushing nominal wage rate, increase in firms profit margins (price gouging), supply chain disruptions

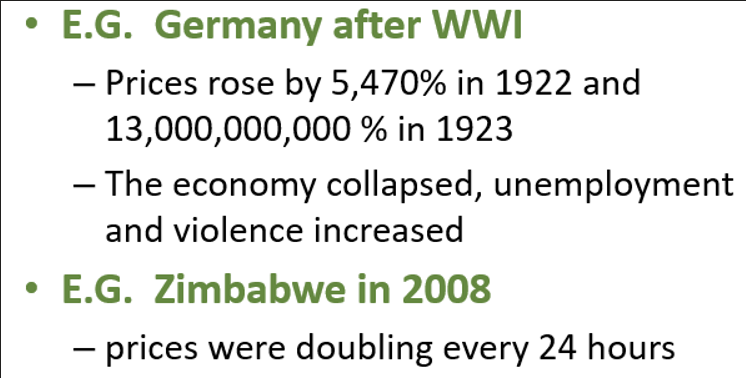

Galloping Inflation or Hyperinflation (high rates of inflation in extreme cases)