Finc203 practice questions

1. What was the name of the exchange rate system between 1944 and 1971 whereby countries fixed their exchange rate to the US Dollar?

Bretton woods( could convert usd to gold )

2. What did President Nixon do in August 15, 1971 in relation to the monetary system?

Suspended the abilty to convert usd to gold

3. What is SONIA the acronym for?

Sterling overnight index average

4. What did SONIA replace?

LiBOr

5. An investor buys a Euro 5,000,000 floating-rate CD with a life of two years, at the Euribor 6 month rate minus a spread of 0.50%, reset every six months. (on Jan 1st 2024)

The initial reference rate is 5% p.a. What does the investor receive after 6 months?

$100,000

6. How do you called an exchange rate regime whereby an exchange rate is allowed to float or move within a defined or set band relative to another currency?

Floating rate

7. What are the three components of the current account?

Net exchange (exports – imports), net exchange of services, net transfers to and from the country.

8. Insurance AAA limited wants to insure reasonably healthy people in their health insurance programme. However, a group of pipe smokers obtains the insurance by concealing their pipe smoking habits on the admission form. This is an example of what problem in the insurance industry?

Asymmetrical information

9. Lionel Messie has insured his soccer feet for 100 million dollars at Loyds of London. In the weekend he decides to go parachute jumping. This is an example of what problem in the insurance industry?

Moral hazard

10. A fund that initially sells its shares to the public to obtain cash to invest and then operates with a fixed number of shares outstanding is called what?

Closed end fund

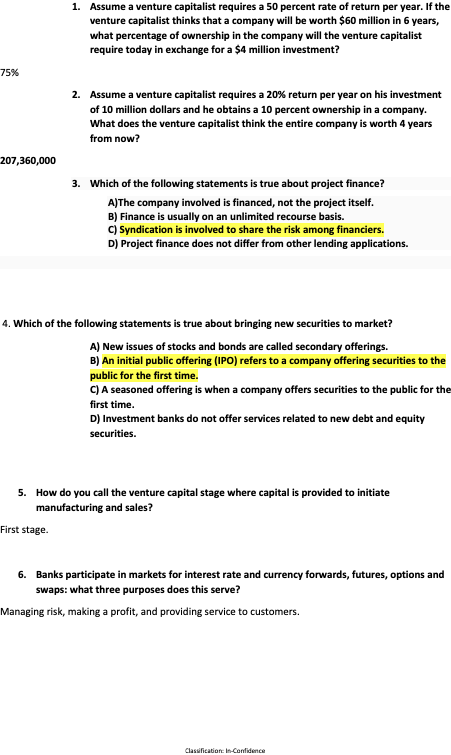

1. Assume a venture capitalist requires a 50 percent rate of return per year. If the venture capitalist thinks that a company will be worth $60 million in 6 years, what percentage of ownership in the company will the venture capitalist require today in exchange for a $4 million investment?

75%

2. Assume a venture capitalist requires a 20% return per year on his investment of 10 million dollars and he obtains a 10 percent ownership in a company. What does the venture capitalist think the entire company is worth 4 years from now?

207,360,000

3. Which of the following statements is true about project finance?

A)The company involved is financed, not the project itself.

B) Finance is usually on an unlimited recourse basis.

C) Syndication is involved to share the risk among financiers.

D) Project finance does not differ from other lending applications.

4. Which of the following statements is true about bringing new securities to market?

A) New issues of stocks and bonds are called secondary offerings.

B) An initial public offering (IPO) refers to a company offering securities to the public for the first time.

C) A seasoned offering is when a company offers securities to the public for the first time.

D) Investment banks do not offer services related to new debt and equity securities.

5. How do you call the venture capital stage where capital is provided to initiate manufacturing and sales?

First stage.

6. Banks participate in markets for interest rate and currency forwards, futures, options and swaps: what three purposes does this serve?

Managing risk, making a profit, and providing service to customers.

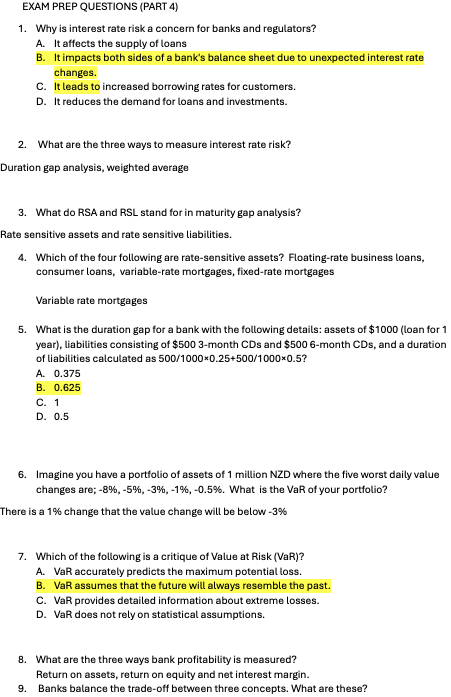

EXAM PREP QUESTIONS (PART 4)

1. Why is interest rate risk a concern for banks and regulators?

A. It affects the supply of loans

B. It impacts both sides of a bank's balance sheet due to unexpected interest rate changes.

C. It leads to increased borrowing rates for customers.

D. It reduces the demand for loans and investments.

2. What are the three ways to measure interest rate risk?

Duration gap analysis, weighted average

3. What do RSA and RSL stand for in maturity gap analysis?

Rate sensitive assets and rate sensitive liabilities.

4. Which of the four following are rate-sensitive assets? Floating-rate business loans, consumer loans, variable-rate mortgages, fixed-rate mortgages

Variable rate mortgages

5. What is the duration gap for a bank with the following details: assets of $1000 (loan for 1 year), liabilities consisting of $500 3-month CDs and $500 6-month CDs, and a duration of liabilities calculated as 500/1000×0.25+500/1000×0.5?

A. 0.375

B. 0.625

C. 1

D. 0.5

6. Imagine you have a portfolio of assets of 1 million NZD where the five worst daily value changes are; -8%, -5%, -3%, -1%, -0.5%. What is the VaR of your portfolio?

There is a 1% change that the value change will be below -3%

7. Which of the following is a critique of Value at Risk (VaR)?

A. VaR accurately predicts the maximum potential loss.

B. VaR assumes that the future will always resemble the past.

C. VaR provides detailed information about extreme losses.

D. VaR does not rely on statistical assumptions.

8. What are the three ways bank profitability is measured?

Return on assets, return on equity and net interest margin.

9. Banks balance the trade-off between three concepts. What are these?

10. Which of the following is classified as a primary reserve in bank asset management?

A. Bank loans

B. Investments

C. Vault cash and deposits at the central bank

D. Corporate bonds

11. What is the purpose of primary reserves in bank asset management?

A. To generate long-term investment returns

B. To accommodate immediate liquidity demands

C. To provide loans to customers

D. To fund expansion projects

12. Why is maintaining bank capital important for a financial institution?

A. To eliminate the need for regulatory oversight

B. To maximize short-term profitability

C. To increase the bank's liabilities

D. To provide a financial cushion and reduce the risk of insolvency

13. The use of sophisticated models to measure credit, market and operational risk is part of

A. Basel I

B. Basel II

C. Basel III

D. Basel IV

14. What is the percentage of Tier 1 capital on RWA in Basel III?

A. 4.5%

B. 5%

C. 6%

D. 8%

15. What does RWA stand for in the Basel agreements?

Risk weighted Assets

16. What is the acronym for the system used to assess the overall quality of a bank’s condition?

CAMELS

17. Which of the following is included in bank capital?

A. Deposits from customers

B. Common or preferred stock and retained profits

C. Loans provided to borrowers

D. Interest earned on investments

18. What are the three types of loan commitments?

Line of credit, term loan, revolving credit facilities

19. An investor purchases a call option on a stock with a strike price of $50. The option premium (cost) is $5 per share. At expiration, the stock price rises to $60. What is the investor's net profit per share from exercising the call option?

$5 per share

60-50 = $10 intrinsic value

At expiration so intrinsic value = value of share

$10 - $5 cost = $5 profit per share

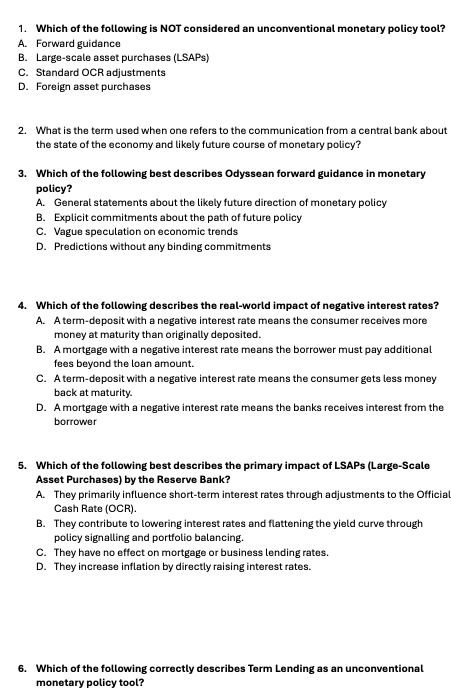

1. Which of the following is NOT considered an unconventional monetary policy tool?

A. Forward guidance

B. Large-scale asset purchases (LSAPs)

C. Standard OCR adjustments

D. Foreign asset purchases

2. What is the term used when one refers to the communication from a central bank about the state of the economy and likely future course of monetary policy?

3. Which of the following best describes Odyssean forward guidance in monetary policy?

A. General statements about the likely future direction of monetary policy

B. Explicit commitments about the path of future policy

C. Vague speculation on economic trends

D. Predictions without any binding commitments

4. Which of the following describes the real-world impact of negative interest rates?

A. A term-deposit with a negative interest rate means the consumer receives more money at maturity than originally deposited.

B. A mortgage with a negative interest rate means the borrower must pay additional fees beyond the loan amount.

C. A term-deposit with a negative interest rate means the consumer gets less money back at maturity.

D. A mortgage with a negative interest rate means the banks receives interest from the borrower

5. Which of the following best describes the primary impact of LSAPs (Large-Scale Asset Purchases) by the Reserve Bank?

A. They primarily influence short-term interest rates through adjustments to the Official Cash Rate (OCR).

B. They contribute to lowering interest rates and flattening the yield curve through policy signalling and portfolio balancing.

C. They have no effect on mortgage or business lending rates.

D. They increase inflation by directly raising interest rates.

6. Which of the following correctly describes Term Lending as an unconventional monetary policy tool?

A. It involves the central bank purchasing domestic government bonds to lower long-term interest rates.

B. It provides collateralized long-term loans to banks, supporting monetary policy transmission through the banking sector.

C. It refers to the central bank setting short-term interest rates through OCR adjustments.

D. It reduces inflation by increasing the cash rate for businesses and consumers.

7. What was the name of the funding for lending done by the Reserve Bank of Australia during Covid-19 pandemic?

Answer: the Term Funding Facility