Taxation and the Public Budget - chapter 20

20.1. Why Tax

- The most important goal of taxation is to raise public revenue

- This allows governments to provide goods and services such as education, highways, and national defence

- Another use of taxation is to change the behaviour of market participants by driving a wedge between the prices faced by buyers and sellers

- This function of a tax can counterbalance a negative externality, bringing consumption down to an efficient level

- Taxes may also be used to discourage specific behaviours, such as smoking or drinking, for reasons that are not necessarily related to negative externalities

20.2. Efficiency: How Much Will the Tax Cost

There are two sources of inefficiency associated with taxation:

- administrative burden: the logistical costs associated with implementing a tax

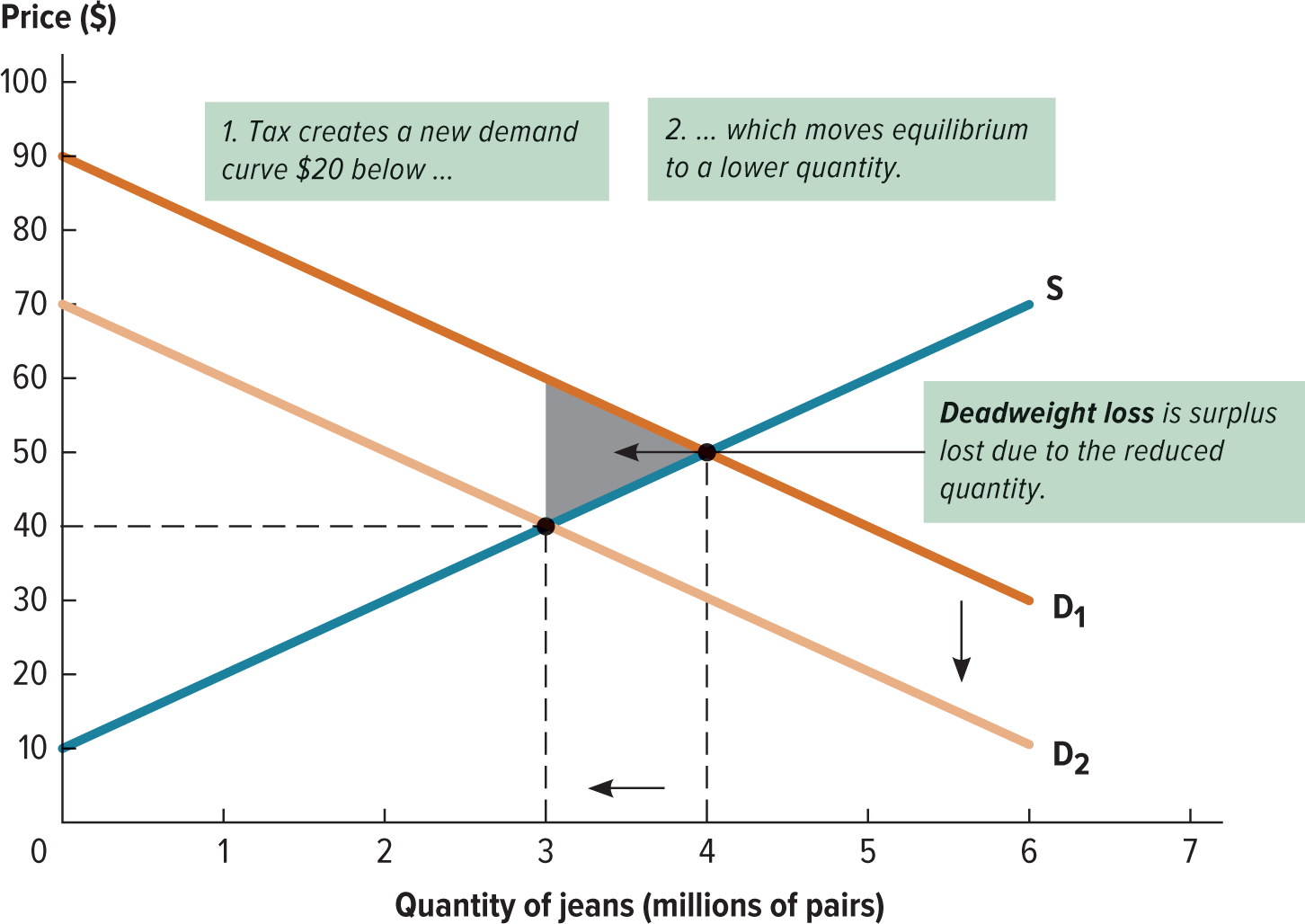

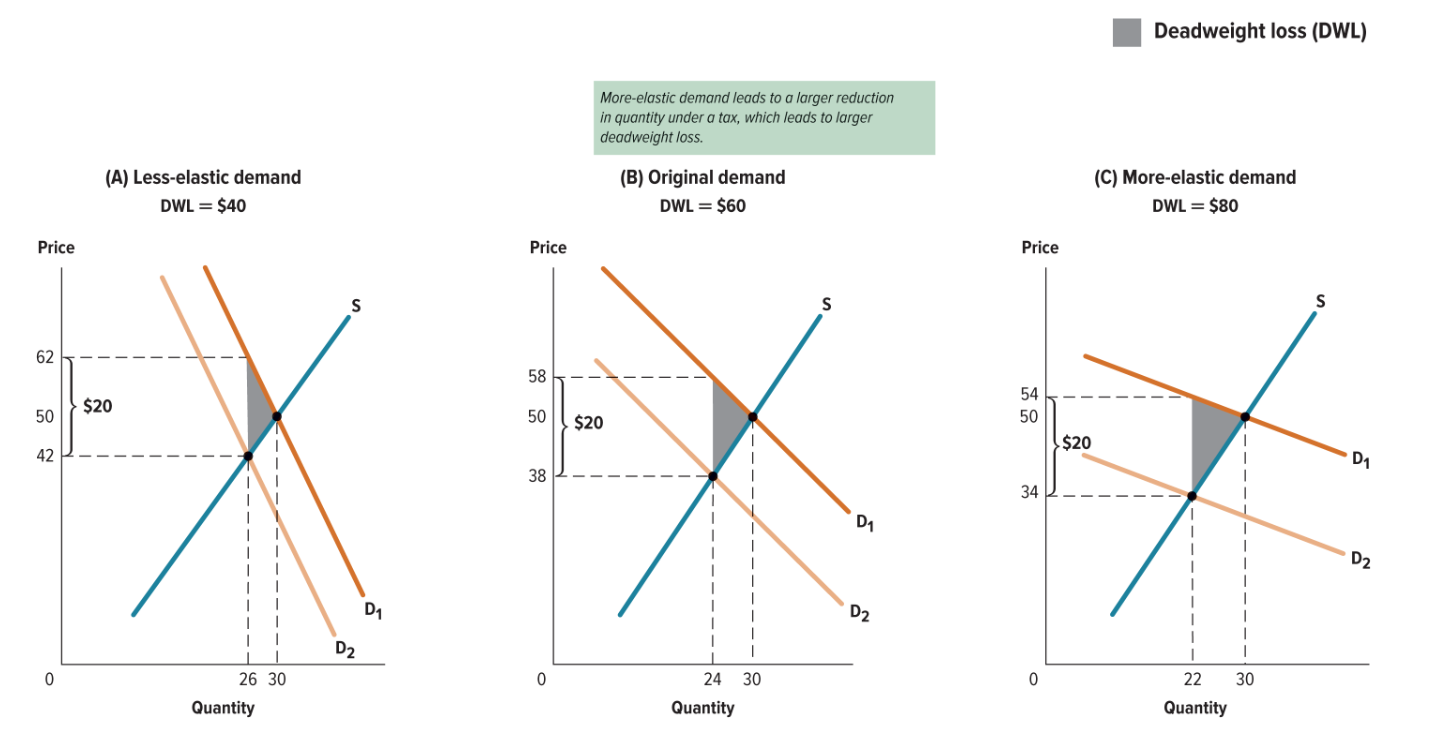

- deadweight loss: a loss of total surplus that occurs because the quantity of a good that is bought and sold is below the market equilibrium quantity

20.3. Revenue: How Much Money Will the Tax Raise

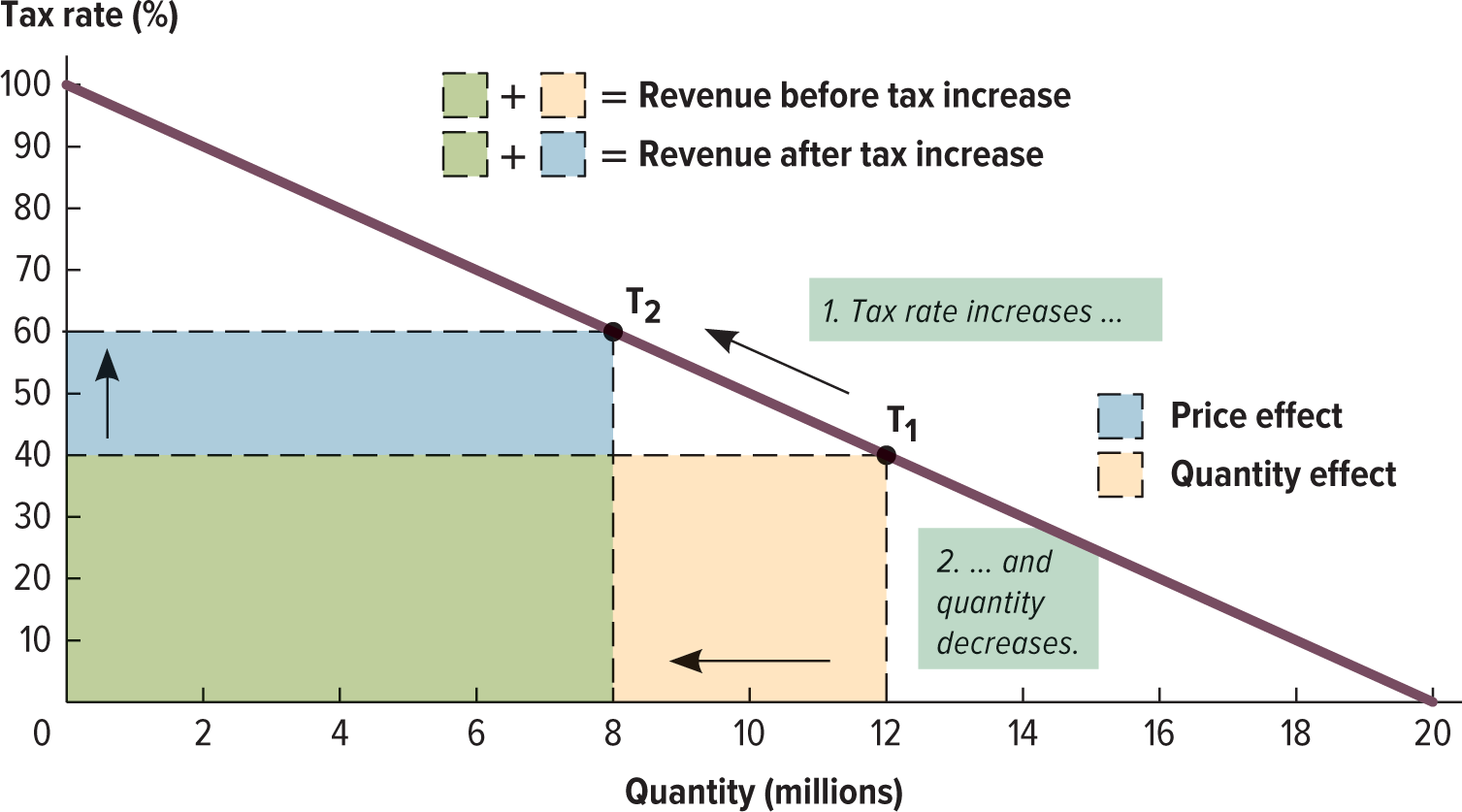

- Two forces are at play in the relationship between tax rates and revenue

- Tax revenue = Tax per unit x Number of units

- Raising taxes means that the government gets more revenue per units sold, which increases total revenue

- But the shrinking effect of a higher tax rate causes fewer units to be sold, which decreases total revenue

- A change in tax rate has both a price effect (the government collects more tax for every unit) and a quantity effect (the government collects taxes on fewer units)

- lump-sum tax (head tax): a tax that charges the same amount to each taxpayer, regardless of their economic behaviour or circumstances

- Raising taxes has diminishing returns to revenue, because the quantity effect gradually overtakes the price effect

- At some point, taxes can be so high that the price effect dominates, and raising taxes actually reduces total revenue

20.4. Incidence: Who Ultimately Pays the Tax

- Incidence: a description of who bears the burden of a tax

- Can describe whether the tax burden falls on buyers or sellers, but also on how much is paid by the rich vs the poor

- proportional (flat) tax: a tax that takes the same percentage of income from all taxpayers

- progressive tax: one in which low-income people are taxed a smaller percentage of their income than is charged to high-income people

- regressive tax: a tax that charges low-income people a larger percentage of their income than it charges high-income people

- The economic incidence of the tax describes who ultimately bears the burden of the tax and isnèt necessarily the same as the statutory incidence of the tax, which describes who is legally obligated to pay it

20.5. A Taxonomy of Taxes

- The vast majority of tax revenue Canada collects comes from personal income, consumption taxes, and corporate income

- income tax: a tax charged on the earnings of individuals and corporations

- payroll tax: a tax on the wages paid to an employee

- Consumption tax: a tax that is charged on the value of a good or service being purchased

- excise taxes: a sales tax on a specific good or service

- property tax: a tax on the estimated value of a home or other property

- marginal tax rate: the tax rate charged on the last dollar a taxpayer earns

- capital gains tax: a tax on income earned by buying investments and selling them at a higher price

- The personal income tax and corporate income tax are progressive; the payroll tax is generally considered to be regressive

- In contrast to the federal and provincial government, most municipal governments bring in their revenue through property taxes

20.6. The Public Budget

- Spending is not directly tied to government revenue

- Revenue collected at a certain time and place can pay for expenditures in a different time or place, and the federal government can and does borrow money to pay for current expenses

- The majority of federal spending goes to non-discretionary items

- discretionary spending: public expenditures that have to be approved each year

- entitlement spending: public expenditure that “entitles” people to benefits by virtue of age, income, or some other factor

- budget deficit: the amount of money a government spends beyond the revenue it brings in

- budget surplus: the amount of revenue a government brings in beyond what it spends