Lecture 6 - Monopoly

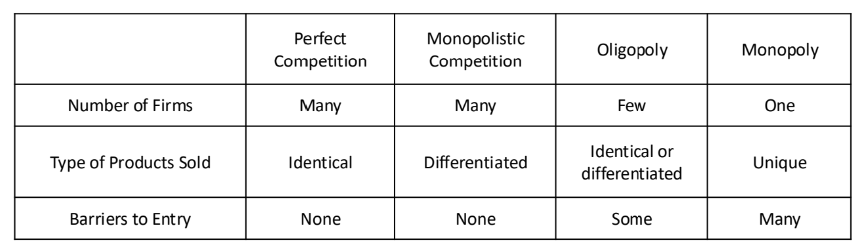

What are the 4 basic market structures?

Perfect Competition

Number of Firms: Many

Type of Products Sold: Identical

Barriers to Entry: None

Monopolistic Competition

Number of Firms: Many

Type of Products Sold: Differentiated

Barriers to Entry: None

Oligopoly

Number of Firms: Few

Type of Products Sold: Identical or differentiated

Barriers to Entry: Some

Monopoly

Number of Firms: One

Type of Products Sold: Unique

Barriers to Entry: Many

What does firm have power in a market?

Market Power

Firms often have the ability to influence market prices.

Monopoly is the extreme case of market power.

What is “barriers to entry”?

Barriers to Entry

Factors preventing new firms from entering the market.

Positive producer surplus and profitability can be maintained indefinitely due to barriers.

When does monopoly have “extreme scale economies”?

:max_bytes(150000):strip_icc()/diseconomies_of_scale_final-db85c494049d42aca10deb37e214a013.png)

Natural Monopoly

exhibits extreme economies of scale at every quantity level.

Long-run average total cost curve is downward sloping.

Diseconomies never emerge.

Example: Utilities like electricity and water supply.

producing output that having lower cost as the output across many firms.

What is switching costs and why does it happen?

Consumer switching costs which can result from:

Brand-related opportunity costs (e.g., loyalty programs).

Technology constraints (e.g., installation of specific equipment).

Search costs (e.g., comparing health insurance plans).

—> Comes down to preference of customers.

Network goods: a good that increases value to each consumer as the number of other consumers of the same product increases.

Why product differentiation from different firms?

Consumers may have preferences to what they like in a product, differentiate producer’s product may captures more part of the market.

Imperfect Substitutability

Consumers may not view products from different firms as identical even though they are the same.

Example: Different brands of bicycles.

What is a “Absolute Cost Advantages”?

Absolute cost advantages or Control of Key Inputs

Firms may have advantages in obtaining scarce resources.

controlling this input allow for lower costs than competitor

Example: A firm owning the only oil well in a region.

How does monopoly make profit?

Monopolist Demand Curve

Faces downward-sloping demand; price must decrease to sell more.

Contrast with perfect competition where firms are price takers, they can sell as much as they want at the market price.

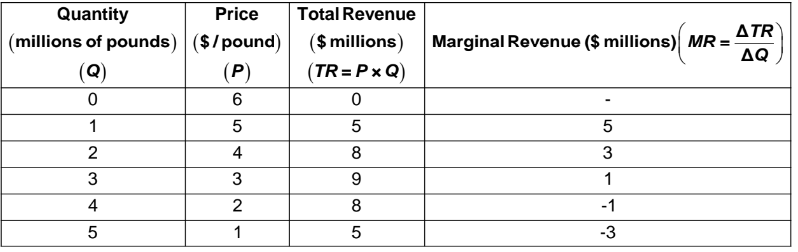

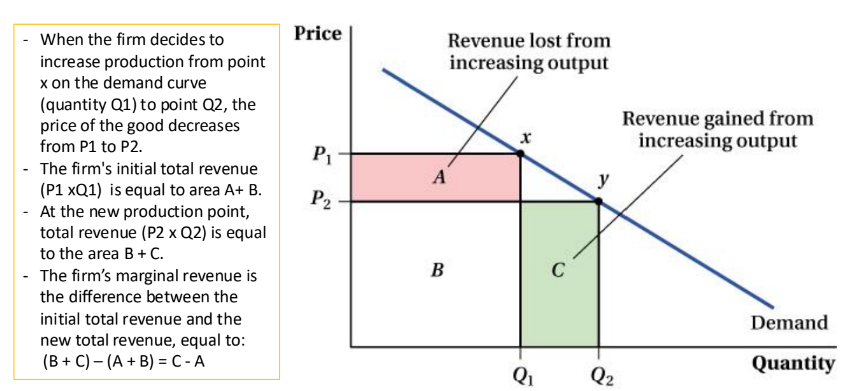

How to calculate marginal revenue?

Marginal Revenue in Different Markets

In perfect competition, MR = Price.

In monopolistic markets, MR is downward sloping and less than price.

MR curve is determined by double the slope of demand curve.

Note: if the demand function is not linear, find TR formula (TR=PQ) then derivative it to find MR.

We can calculate the marginal revenue received by the seller:

When firm produce more of a product, the price of its products should fall (to sell more).

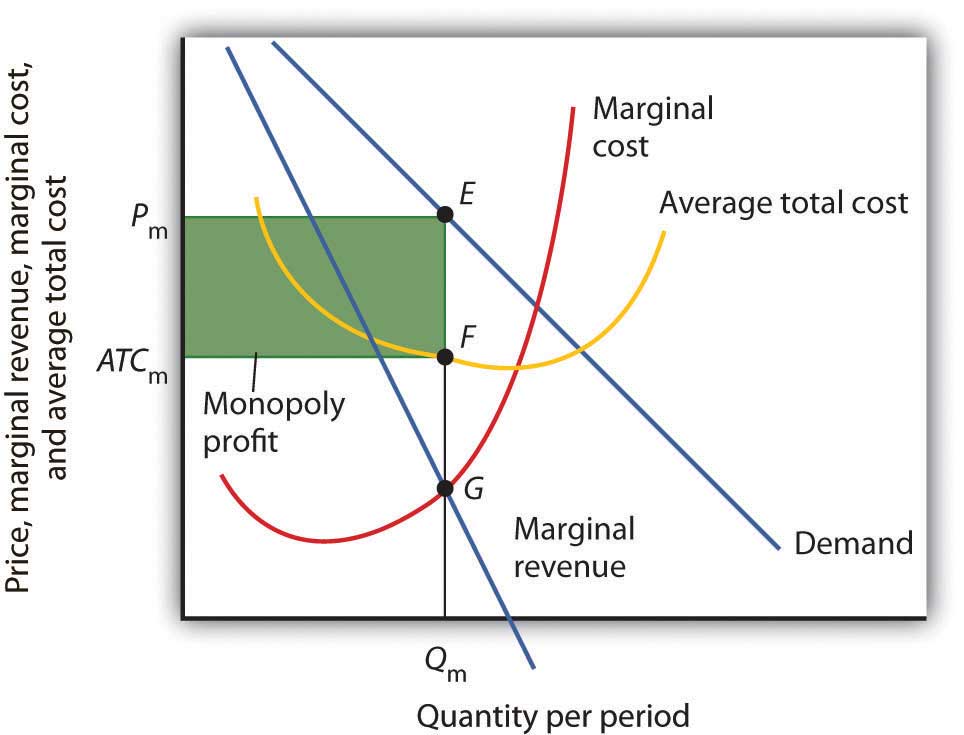

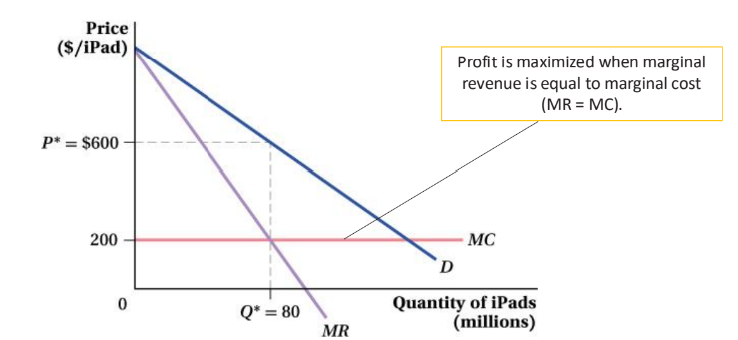

When do monopoly maximize profit?

Maximizing Profit

Firms maximize profit where MR = MC, not necessarily selling at MC.

another way to do this is the derivative of profit (max and min function) (profit = total revenue - total cost).

Production decisions influence price.

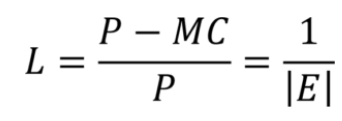

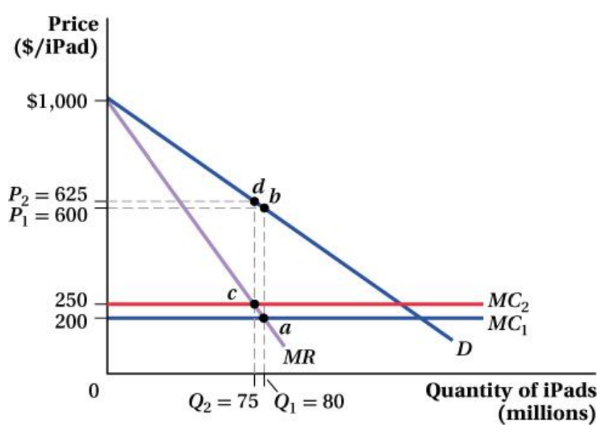

What is a Lerner Index used for?

Markup Formula

Measures a firm's markup price over marginal cost, so the percentage of profit.

Indicates the degree of market power.

Ed: elasticity

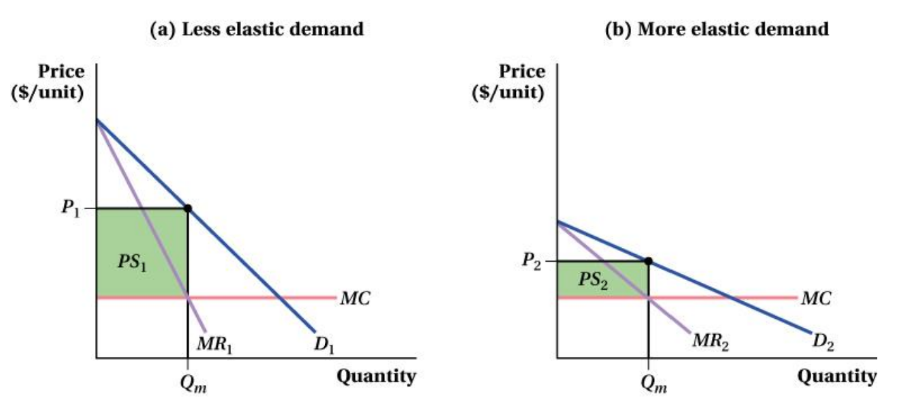

As demand becomes more elastic, optimal markup falls, why?

the more sensitive consumers are to price changes, the less firm can take advantage of them.

Note: marginal revenue always received less than the price by the firm is due to the negative elasticity demand

![since E^D is negative (<0), the whole bracket term is (<1; 1+ [-])](https://knowt-user-attachments.s3.amazonaws.com/2756dc2e-c64e-49ed-8a43-a808a9bcb984.png)

This means that if a firm raises its prices, it will lose a significant number of customers, forcing it to lower the markup to maintain sales.

In contrast, when demand is inelastic, consumers are less responsive to price changes, allowing the firm to maintain higher markups without significantly affecting sales. Ed would be negative.

If we have negative elastic, the term 1/ED will be negative.

We can use this black formula to find discount for the interested market group.

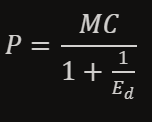

How do firm response to market changes?

Changing Marginal Costs

Firms adjust output in response to changes in marginal costs.

Example: Increase in production costs leads to decreased output.

Changing in demand

firm will also have to adjust output in response to changes in demand.

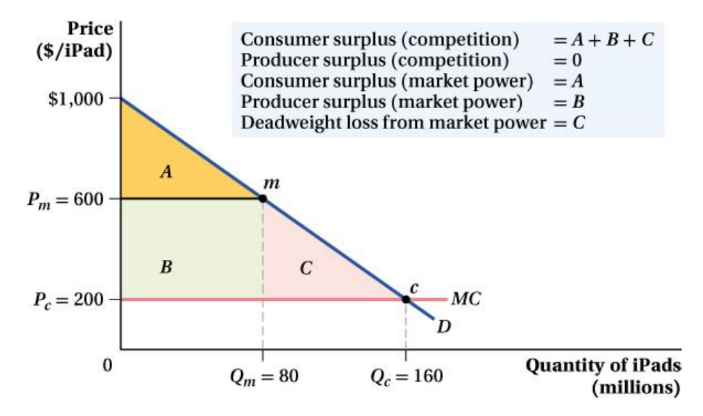

Who are the winners and losers of market power in monopoly?

Producer Surplus vs. Consumer Surplus

Market power can lead to higher producer surplus but lower consumer surplus.

Deadweight loss occurs when output is below competitive levels.

Elasticity can change the surplus as well.

Why are there government regulation?

Intervention Justification

Government may regulate prices to achieve competitive or efficient outcomes.

Example: Regulation of natural monopolies.

How do government regulate the market?

Direct price regulation: government may set the price to dismantle a monopoly and encouraging new participants (aiming to balance the 2).

Antitrust laws: promote competitiveness and restrict collusion and price fixing.

Sometimes the government may encourage monopolies:

Patents, copyrights, and licensing requirements to spur innovation.

Knowt

Knowt