Final - Economía I UFM

Price controls

Taxes and subsidies

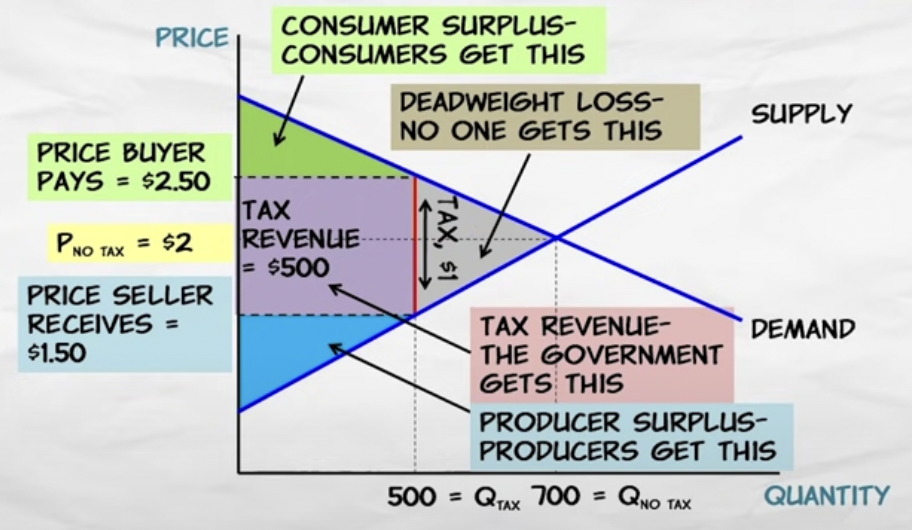

A commodity tax is a tax on goods.

Excise tax: a tax that is paid directly by suppliers to the government

Sales tax: a tax that is paid directly by consumers to the government.

The economic incidence of a tax is independent of its legal incidence.

Economic incidence: the division of a tax burden according to who actually pays the tax.

Legal incidence: the division of a tax burden according to who is required under the law to pay the tax.

Who pays the tax does depend on the relative elasticities of demand and supply.

Elastic = escape

Commodity taxation raises revenue (for the government) and creates lost gains from trade.

There is less quantity exchanged.

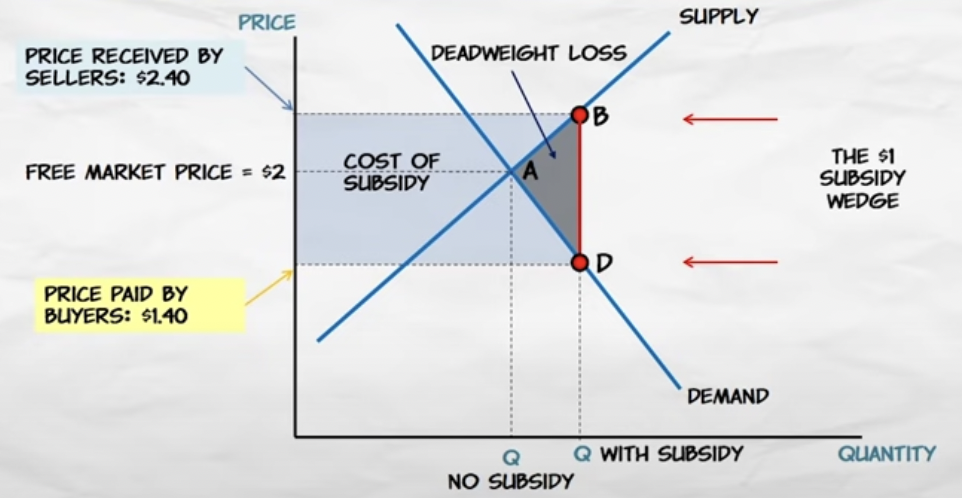

A subsidy is a "negative tax", where the government gives money to consumers or producers.

Not elastic = no entry.

Creates inefficient increases in trade.

Tariffs and protectionism

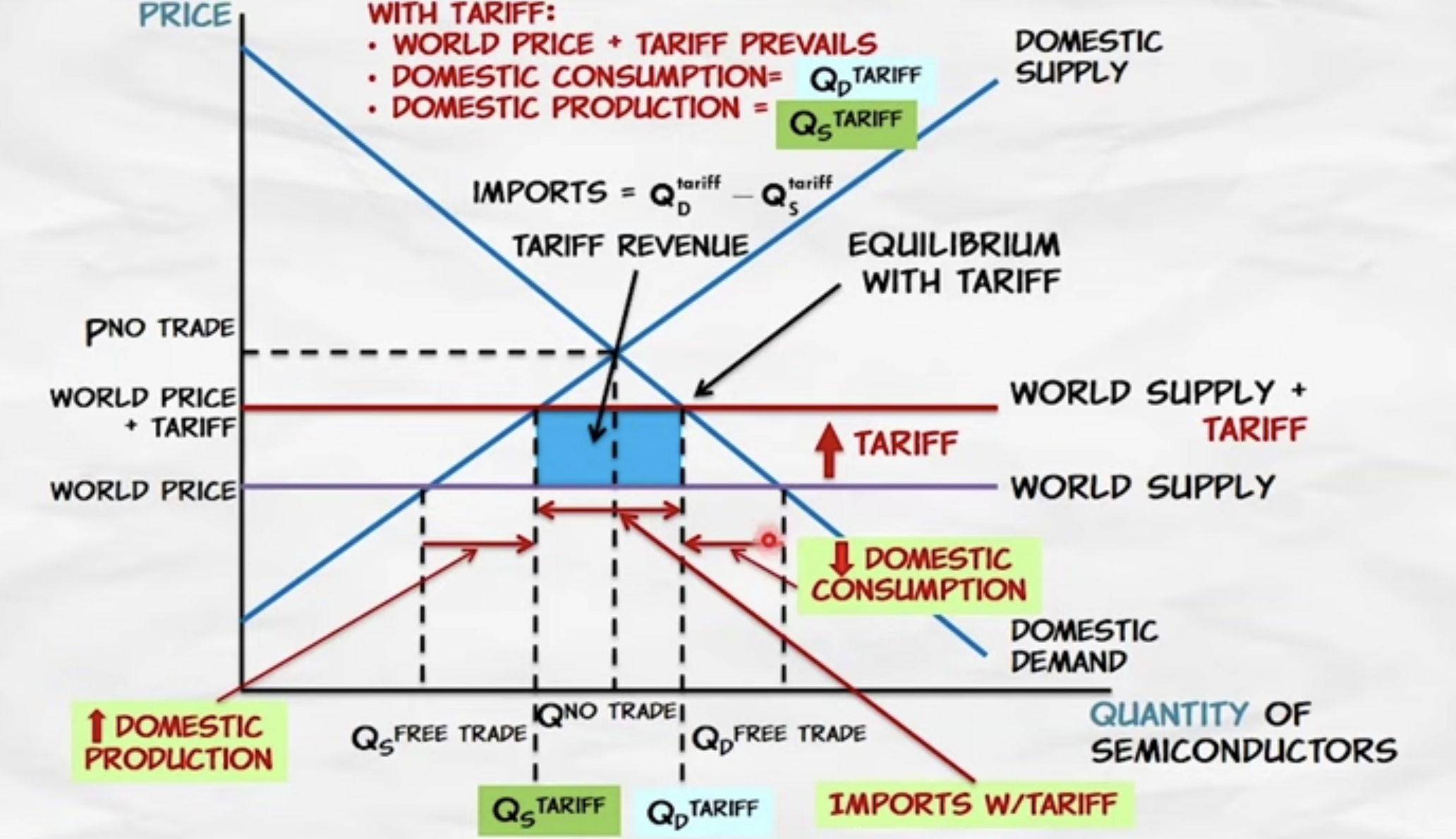

Protectionism: the economic policy of restraining trade through tariffs, quotas o other regulations that burden foreign producers but not domestic producers.

Tariff: a tax on imports.

Quota: restriction on the quantity of goods that can be imported.

A tariff has two effects that influence (reduce) welfare:

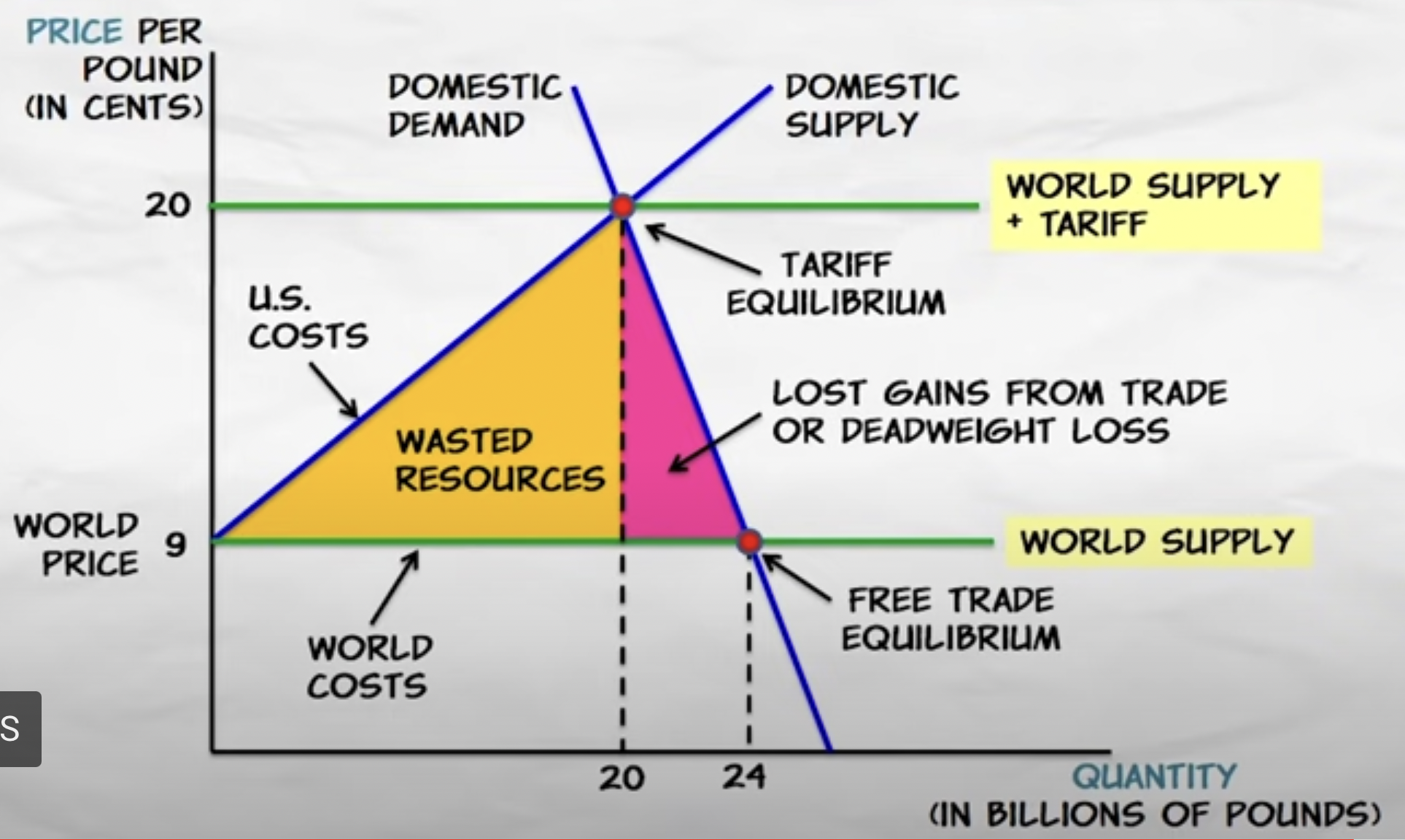

Domestic consumption falls: lost gains from trade.

Domestic production increases: wasted resources from higher-cost production.

The revenue doesn't affect the net welfare, as it goes to the government.

Tariffs increase prices to consumers so domestic consumption falls, which creates a deadweight loss.

Tariffs divert production from low-cost (world) producers to high-cost (domestic) producers and this wastes resources.

Profit and loss

Wage, rent, and interest are three important forms of earned income in a market economy.

A great deal of uncertainty has been removed by this contractual agreement.

Profit is the fourth form of earned income in a market economy.

It's the residual between revenues and costs.

Unlike the wage earned, the entrepreneur seeking profits can never be sure that their efforts will be profitable.

The search for profit means accepting greater uncertainty.

Monetary expenses do not capture the total costs of production.

The forgone wage of an entrepreneur might not appear on a ledger, but it will remain in mind and influence choices.

Business decisions are influenced by the presence (or absence) of economic profit.

Profits exist, and continue to exist, without being reduced to zero by competition, because of uncertainty.

Entrepreneurs try to reorganize activity to gain profit.

They also take the responsibility if it is loss.

They are the residual claimant.

Entrepreneurial activity is the driving force within market processes.

It takes three forms: arbitrage, innovation and imitation.

It tends to correct for errors in the market process.

The key to an efficient market process is open entry and exit.

Comparative advantage can and often does change over time.

Speculators tend to coordinate market exchanges through time.

They even out the flow of commodities into consumption and diminish price fluctuations over time.

Price searching

The usual explanation for price-setting is a simple cost-plus-markup theory: business firms calculate their unit costs and add on a percentage markup.

Marginal revenue is the additional revenue expected from an action under consideration.

The extra revenue from selling one more item.

To maximize net revenue, set a price that will enable you to sell all those units, but only those units, for which marginal revenue is expected to be greater than marginal cost.

The rest of the units adds more to costs than to revenue, because the price has to be lowered to sell more units.

But by setting that price, there will be some customers lost who are willing to buy.

Profit can be made if the owner can reduce the price only to those new customers, without reducing it to those who are willing to pay more.

Three conditions for successful price discrimination: the seller must be able to

distinguish buyers with different elasticities of demand

prevent low-price buyers from reselling to high-price buyers

control resentment.

So how do price searchers find what they’re looking for?

estimating the marginal cost and marginal revenue

determining the level of output that will enable them to sell all those units of output, and only those units for which marginal revenue is greater than marginal cost

setting their price or prices so that they can just manage to sell the output produced.