[FDNACCT] Unit 3: Financial Statements

Financial Statements

General purpose reports that provide financial information about the reporting entity’s [business] economic resources [assets], claims against the entity [liabilities and owner’s equity], and changes in those economic resources and claims [revenues, expenses, owner’s capital, owner’s drawings] that is useful to primary users in making decisions relating to providing resources to the entity

To provide financial information about the reporting entity’s assets, liabilities, equity, revenues, and expenses that is useful to users of financial statements in assessing the prospects for future net cash inflows to the reporting entity and in assessing management’s stewardship of the entity’s economic resources (includes protecting the company’s assets against price changes and technological changes as well as compliance with laws, regulations, and contracts)

only includes financial information about the reporting entity (scope)

records financial information from a specified period of time

Information about transactions and other events that have occurred after the end of the reporting period is provided if that information is necessary to meet the objective of financial statements

From the perspective of the reporting entity

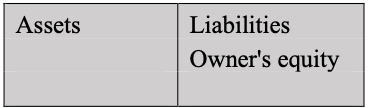

Elements of Financial Statements

[FOUND IN THE BALANCE SHEET (STATEMENT OF FINANCIAL POSITION)]

Assets

Economic resource

the right that has the potential to produce economic benefits

Control

the present ability to direct the use of the economic resource and obtain the economic benefits that may flow from it

no other party controls that asset

the right to deploy that asset in its activities

ability to enforce legal rights on that asset

A present economic resource controlled by the entity as a result of past events

Liabilities

Claims of other entities

A present obligation of the entity to transfer an economic resource

as a result of past events

Obligation

a duty or responsibility that an entity has no practical ability to avoid and owed to another party/parties (e.g., person, another entity, a group of people / a group of entities, society at large)

Transfer an economic resource

pay cash

deliver goods or provide services

exchange economic resources with another party on unfavourable terms (E.g., Forwards; Options)

transfer an economic resource if a specified uncertain future event occurs

Issue a financial instrument if that financial instrument will oblige the entity to transfer an economic recourse

Result of past events

the entity has already obtained economic benefits or taken an action

the entity will or may have to transfer an economic resource that it would not otherwise have had to transfer

Owner’s Equity

Claims of owners

The residual interest in the assets of the entity after deducting all its liabilities

Owner’s financial interest in a business

Net worth

[CHANGES IN ECONOMIC RESOURCES | FOUND IN INCOME STATEMENTS (STATEMENT OF PROFIT OR LOSS)]

Income/Revenue

Increases in assets, or decreases in liabilities, that result in increases in equity, other than those relating to contributions from holders of equity claims

Expenses

Decreases in assets, or increases in liabilities, that result in decreases in equity, other than those relating to distributions to holders of equity claims

*Other changes in economic resources and claims

Contributions from holder/s of equity claims, and distributions to them

Exchanges of assets or liabilities that do not result in increases or decreases in equity

Statement of Financial Position

A position statement that reports the financial condition (financial standing; financial strength) of an entity at the end of the period and presents an organized list of assets, liabilities, and equity

Provides information useful to assess the entity’s future cash flows, liquidity, and long-term solvency

limitations:

The entity's reported book value (assets minus liabilities) will not directly measure the company’s market value (in a public corporation, this is current market price x number of shares issued)

Many assets are measured at their historical costs rather than their fair values

Many aspects of a company may represent valuable resources but are not recorded as assets

Product knowledge

Experienced management team

Trained employees

Loyal customer relationships

FORMS:

Report Form

Account Form

*Operating Cycle

time between the acquisition of assets for processing and their realisation in cash or cash equivalents

Use cash to acquire inventory

Prepare inventory for sale to customers

(Including the production process for manufacturing business)

Deliver inventory to customer

Collect cash from customer

ELEMENTS:

Assets

Current Assets

assets that are expected to be realized (converted to cash) or intended to be sold or to be consumed within the entity’s normal operating cycle

held primarily for the purpose of trading

expected to be realized within twelve months after the reporting period

cash or cash equivalent unless the asset is restricted from being exchanged or used to settle a liability for at least twelve months after the reporting period

Cash and Cash Equivalents

Cash

cash on hand and in banks that is available for use in the operations of the business

Cash equivalents

highly liquid investments that can be quickly converted into cash, not subject to significant risk of

changes in value, and must be held for the purpose of ‘meeting short-term cash commitments’

Examples include money market funds, such as:

Investment in treasury bills (short-term debt instruments of government)

Investment in commercial papers (short-term debt instruments of corporations)

Investment in certificate of deposits (short-term debt instruments of banks)

Trade and Other Receivables

Trade receivable / Accounts receivable

receivable resulting from a company’s normal trade, that is, providing services or selling goods on account [on credit; on charge account; on open-account credit]

Notes receivable

receivable with a written promissory note from another party from a company’s normal trade, usually requiring an additional receipt of explicit interest

Other receivables

Advances to employees

advances by the company to employees

Loans receivable

loans given by by the company to individuals and other entities

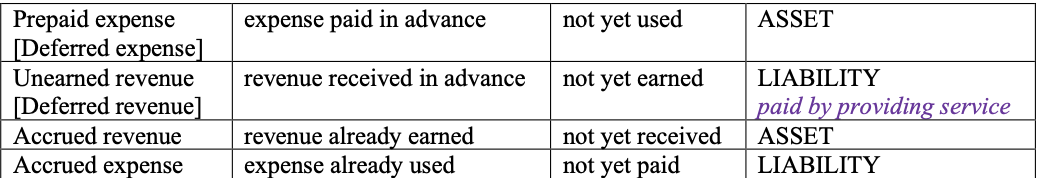

Accrued revenue

revenue already earned, but not yet received (recorded as part of adjusting entries at period-end)

Inventory

encompass goods that are:

purchased and held for resale

merchandise purchased by a retailer and held for resale [Merchandise Inventory]

land and other property held for resale

raw materials and factory supplies awaiting use in the production process

work in progress being produced by the entity

finished goods produced

Prepaid Expense [Deferred expense]

expense paid in advance, thus creating benefits, but not yet used

includes office supplies

Non-current Assets

residual by definition, an entity shall classify all other assets as non-current

Property, plant, and equipment

tangible items that are held for use in the production or supply of goods or services, for rental to others (except for land and building), or for administrative purposes

are expected to be used during more than one period

(e.g., Land, Land improvements, Building, Machinery, Vehicles, Furniture and fixtures, Fittings, Office equipment, Bearer plants)

Liabilities

Current Liabilities

liabilities that are expected to be settled in the entity’s normal operating cycle

owed primarily for the purpose of trading

are due to be settled within twelve months after the reporting period

do not have the right at the end of the reporting period to defer settlement of the liability for at least twelve months after the reporting period

Trade and other payables

Trade payable / Accounts payable

payable resulting from a company’s normal trade, that is, buying assets and goods on account [on credit; on charge account; on open-account credit]

Notes payable

payable with a written promise to pay cash at some future date (legal IOUs), usually requiring an additional payment of explicit interest

Other payables

Accrued expense

expense already used, but not yet paid (recorded as part of adjusting entries at period-end)

Loans payable – current portion

a portion of long-term Loans Payable that is payable within the next year

Unearned Revenue [Deferred revenue]

revenue received in advance, but not yet earned

Non-Current Liabilities

residual by definition, an entity shall classify all other liabilities that are not current as non-current

Loans payable – noncurrent portion

long-term Loans Payable that is not yet due within the next year

Long-term notes payable

long-term promissory notes that is not yet due within the next year

Mortgage payable

long-term promissory note secured by an asset whose title is pledged to the lender

Owner’s Equity

*Deferrals and Accruals

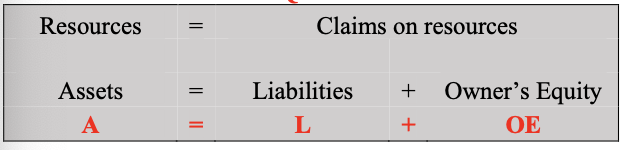

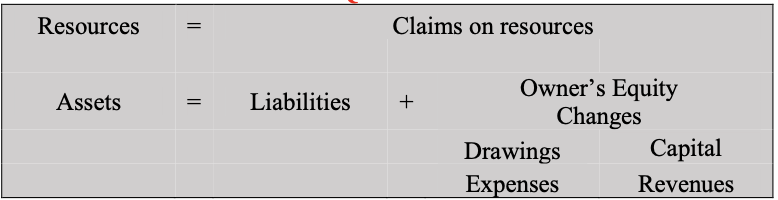

*Basic Accounting Equation

Statement of Profit & Loss

A change statement that summarizes the profit-generating transactions that changes the owner’s equity for the period and reports an entity’s financial performance, that is, its net profit or net loss, for the period

Provides information useful to assess the entity’s profitability, return on owner’s investment, its operations and various functions and predicting future expenses and cash outflows

FORMS:

Nature of expense method

Classifies expenses within profit or loss according to their nature

Function of expense method

Classifies expenses by their function within the entity

Cost of sales

cost of providing service/cost of goods sold

Distribution cost

expenses related to selling and distributing the goods to the customers

Administrative costs

expenses related to the general administration of the business

Finance costs

interest expense

ELEMENTS:

Income

Earnings of an entity

Inflow of resources resulting from services provided or goods sold to customers

Increases in assets, or decreases in liabilities, that result in increases in equity, other than those relating to

contributions from holders of equity claims

Service revenue/Professional fees

revenue from services provided to clients

Sales

revenue from sale of goods to customers

Other income

revenue from sources other than the main line of business

Interest income

Rent income

Commissions income

Income from investments

Gain on sale of plant, property, equipment item

Expenses

Outflow of resources incurred for generating revenues

Decreases in assets, or increases in liabilities, that result in decreases in equity, other than those relating to distributions to holders of equity claims

Delivery expense

Insurance expense

Interest expense

Marketing expense (advertising, promotion)

Office supplies expense

Professional fees (accounting, audit, legal)

Rent expense

Repair & maintenance expense

Representation & entertainment expense

Salaries & wages expense

Employee benefits

Taxes & licenses expense

Transportation & travel expense

Utilities expense

Miscellaneous expenses / Other expenses / Sundry expenses

Bad debts expense

Doubtful debts expense

Depreciation expense

Statement of Changes in Equity

A change statement that discloses the events that caused the owner’s equity to change for the period

Provides information useful to understand the transactions with owners in their capacity as owners, showing separately contributions by and distributions to owners

ITEMS AFFECTING EQUITY:

Income [revenues] and expenses

Contributions [investment] by owner

Owner’s capital

financial investment of the owner

Cash

Other assets

Recorded at its fair market value at the time of investment

Distributions to [withdrawal by] owner

Owner’s drawings

temporary withdrawal of the profit of the business

Capital

Capital / Owner’s capital

financial investment of the owner

Capital employed

the long-term source of financing, which includes both the capital of the owner and non-current liabilities

Working capital

refers to net current assets (Current assets minus Current liabilities)

Capital expenditures

expenditures for purchase of non-current assets

Capital budgeting

the process of investment appraisal

Expanded Accounting Equation

Statement of Cash Flows

A change statement disclosing the events that caused cash to change for the period

Provides information useful to assess the entity’s ability to generate cash and cash equivalents and to utilize those cash flows

Notes to Financial Statements

present information about the basis of preparation of the financial statements and the specific accounting policies used

disclose the information required by IFRSs that is not presented elsewhere in the financial statements

provide information that is not presented elsewhere in the financial statements, but is relevant to an understanding of any of them