Week 2

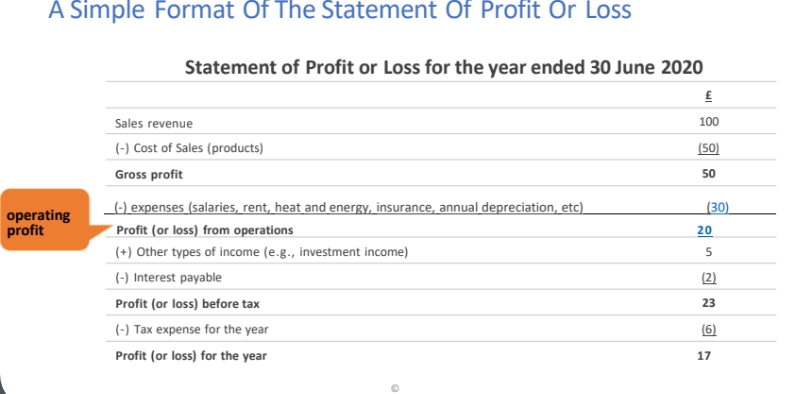

Statement of profit or loss

. measures and reports how much profit the company has generated over a period

. Total revenue for the period − Total expenses incurred in generating that revenue

Revenue

. inflow of economic benefits

. increase in asset or a decrease in liability

. for example, sales of goods, fees for service or subscriptions

Expenses

. Outflow of economic benefits

. Decrease in asset or an increase in liability

. For example, wages and salaries, rent or the cost of buying/making the goods.

Statement of profit or loss with the accounting equation

. Assets = equity + revenue - expenses + liabilities

. revenue - expenses = statement of profit or loss

Accrual- basis accounting

. Accounting transactions should be recorded in the periods in which they occur ( rather than when the cash flows related to them occur)

. Companies should recognise revenues when they perform services (rather than when they receive cash)

. Expenses should be recognised when incurred (rather than when paid)

Recognition of revenue