Chapter 6

Little setting the scene

Although supply and demand determine the quantity and price at which goods are sold. Government can influence this market outcome through laws, regulations, and taxes

firms always want to charge higher prices, and that doesn’t change when there’s a tax

Example:

Minimum wage may determine how much you get paid.

Taxes impact your take-home pay or the price you pay when buying something.

Government policy can influence the costs and benefits of getting married and/or having children

The government does not stop the forces of supply and demand, rather

It shapes costs and benefits, thus changing the decisions that sellers and buyers make

Supply and demand are like gravity, they are always there.

But, we can engineer things that allow us to overcome gravity with various degrees of success.

How Taxes and Subsidies Change Market Outcomes

Soda Tax:

drive up the price of the tax so people will drink less

The soda tax affects both buyers and sellers:

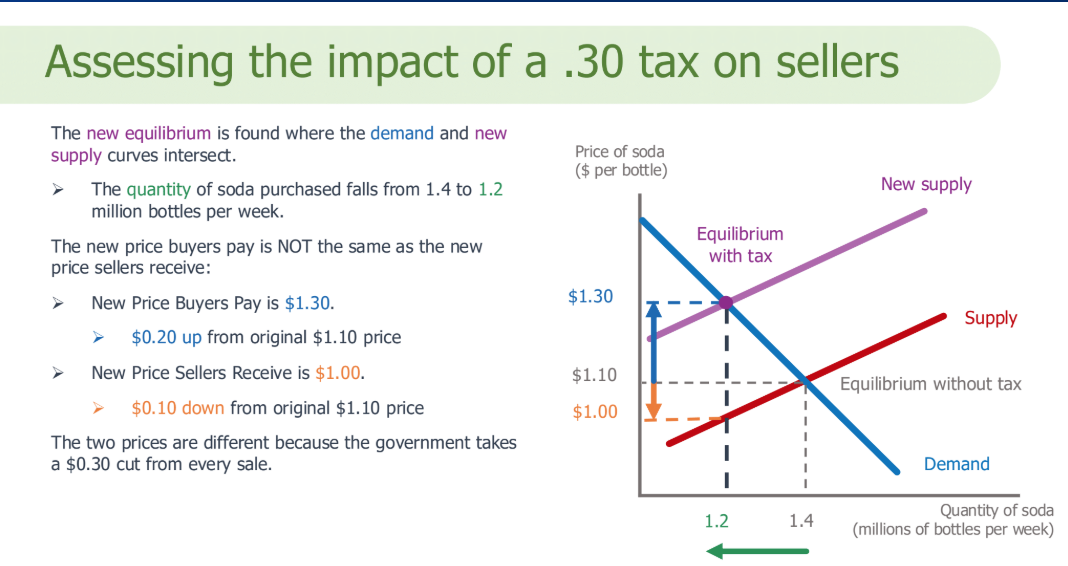

Soda tax drives UP the prices of soda for consumers (Old price = Price for both consumers and sellers to New price = price for only the consumer)

Leads to a lower quantity demanded

Soda tax drives DOWN the prices of soda for sellers (Old price = Price for both consumers and sellers to New price = price for only the seller)

Leads to a lower quantity supplied

BIG QUESTION: why is there a difference between the price buyers pay and sellers receive,

-—Because the GOVERNMENT takes a cut in the form of a tax

Since of the per unit will be the New price for the buyer - New price for the seller

A tax placed on the Seller example

In 2017, Philadelphia introduced a tax on sellers of sweetened beverages of 1.5 cents per ounce.

When you buy a 20-ounce soda, you pay whatever price the seller posted.

But the seller does not keep that entire posted amount for themselves

The seller keeps whatever the consumer paid minus the tax.

they are responsible for sending the tax to the government:

$0.015 per ounce x 20 ounces = $0.30

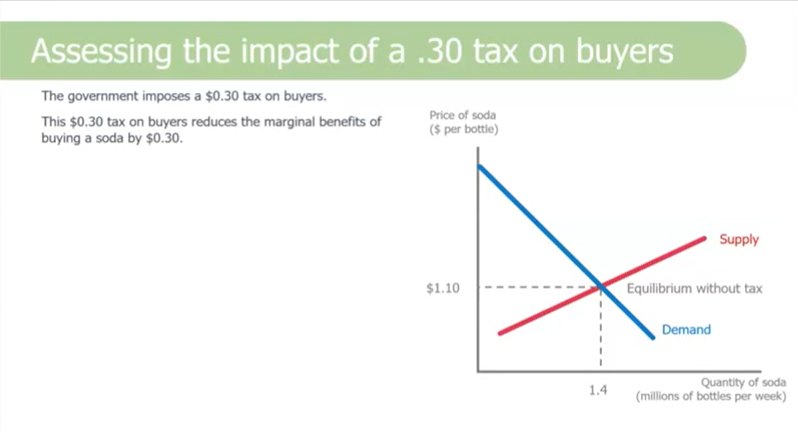

Suppose, instead, the government imposed a tax on buyers.

The way this works:

➢stores post the price without the tax

sellers keep this entire posted amount

you pay the tax as you check out

consumer pay = posted price + tax

➢the store does you the convenience of mailing in the tax

Statutory burden: The burden of being assigned by the government to send a tax payment.

The $0.30 per ounce tax is placed on buyers or sellers.

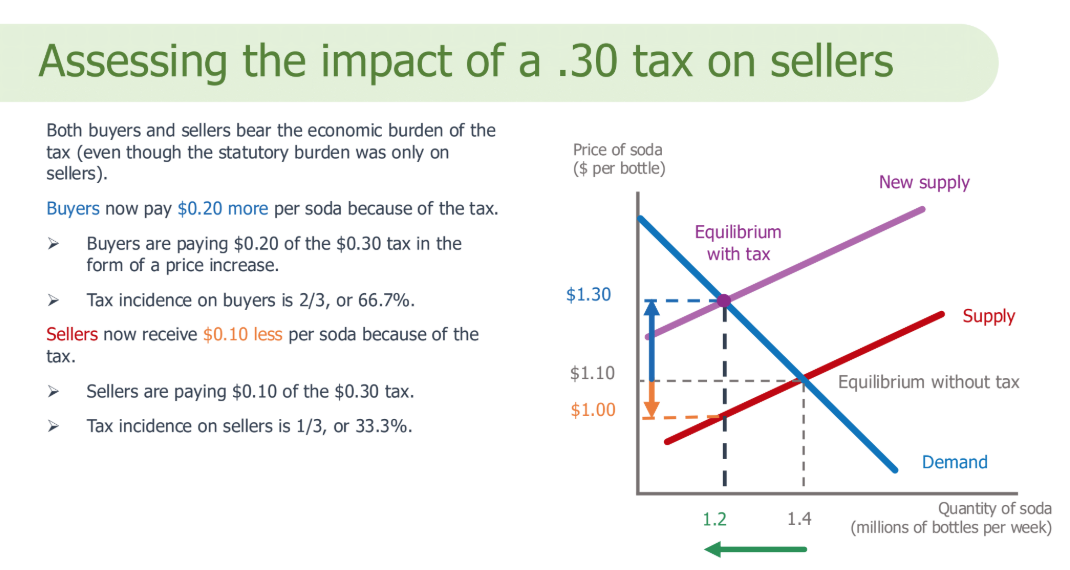

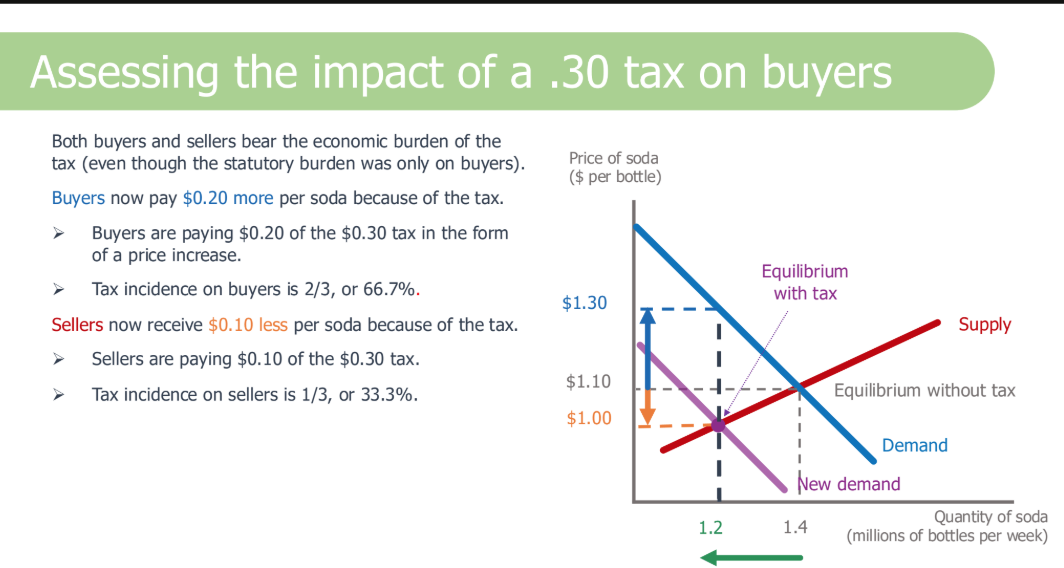

Economic burden: The burden created by the change in the after-tax prices faced by buyers and sellers.

The price the buyers pay (Pbuyer)and the price the sellers receive (Pseller)will now deviate by a total of$0.30.

Tax incidence: The division of the economic burden of a tax between buyers and sellers.

How much of the $0.30 do sellers pay and how much of the $0.30 do buyers pay?

If the tax is placed on sellers and they are legally responsible for turning over a tax of $0.30 per ounce to the government, then the statutory burden falls on the sellers.

However, the economic burden is determined in the same way equilibrium prices were determined before the tax.

Buyers still want to pay low prices and sellers still want to charge high prices.

Sellers will not want to receive a price that is$0.30lower, and they will try to pass it on to the buyers.

But if sellers can simply charge$0.30more, why weren’t they already doing that?

Because buyers don’t want to pay the$0.30extra either.

The split of the economic burden(the tax incidence) is determined by the push and pull of supply and demand.

Specifically, elasticity is going to be very important in determining the incidence of the tax.

You cannot simply look at the tax policy as written to determine the economic burden of tax

The tax incidence is determined by the relative elasticities of the market’s supply and demand curves.

The more inelastic side of the marker bears more of the economic burden

If sellers are relatively more inelastic, then sellers will ultimately pay more of the tax

If Buyers are relatively more inelastic, the buyers will ultimately pay more of the tax

Visually

-The flatter the curve = the less they will have to pay the curve

-The steeper the curve =, the more they will have to pay (more inelasticity, more insensitive to the price change (will accept the price, won’t change their demand | and not because they want to, they just have less of a choice)

The bigger the difference between the elasticities, the more of the total tax the inelastic side pays

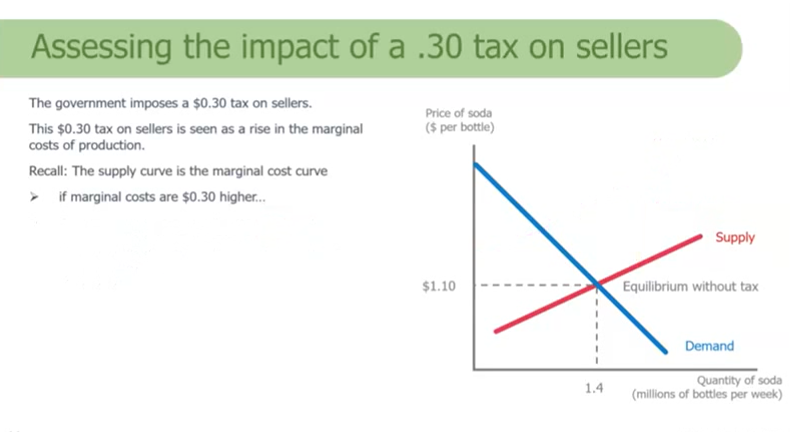

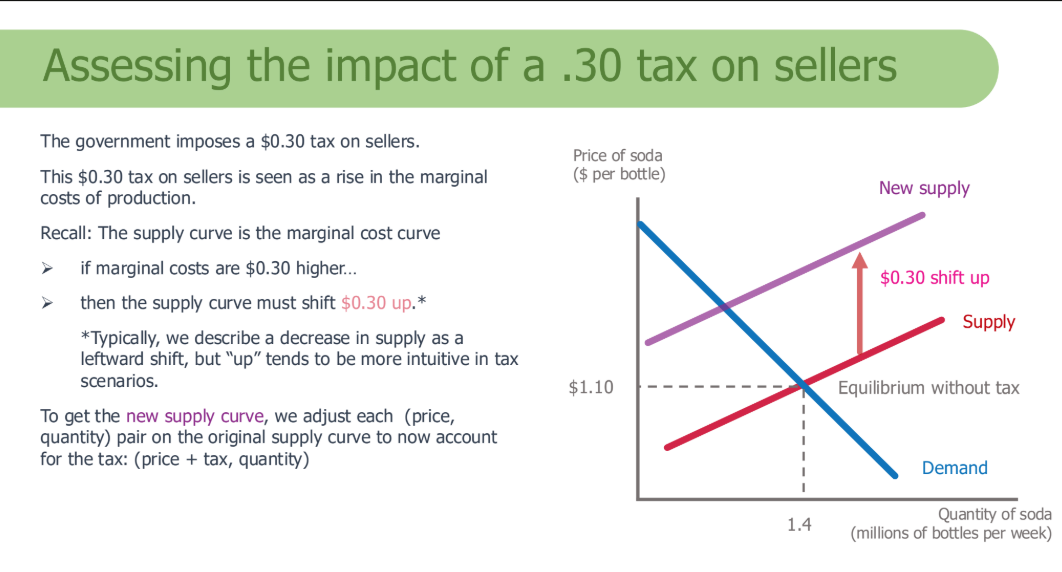

EXAMPLE 1: Assessing the impact of a .30 tax on seller

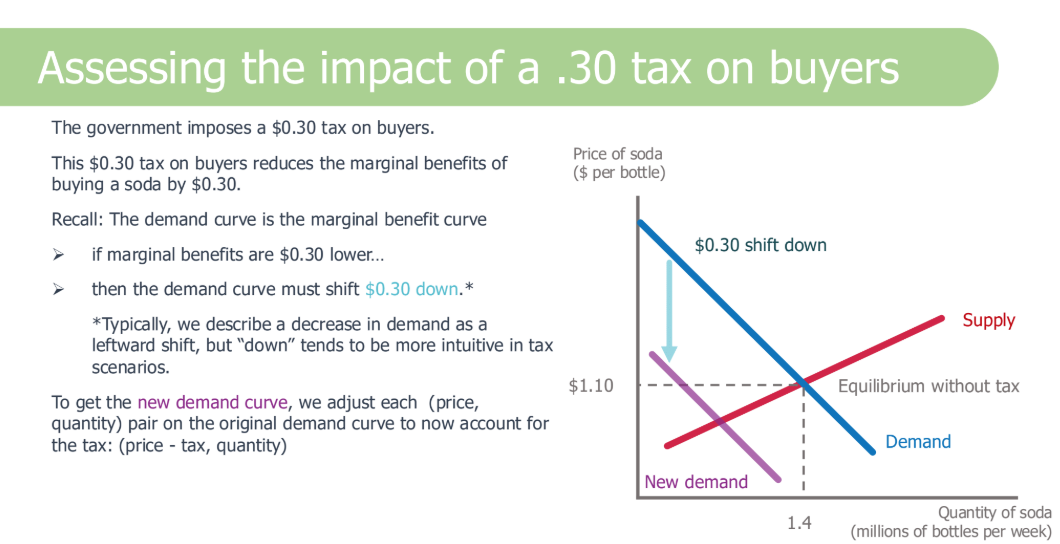

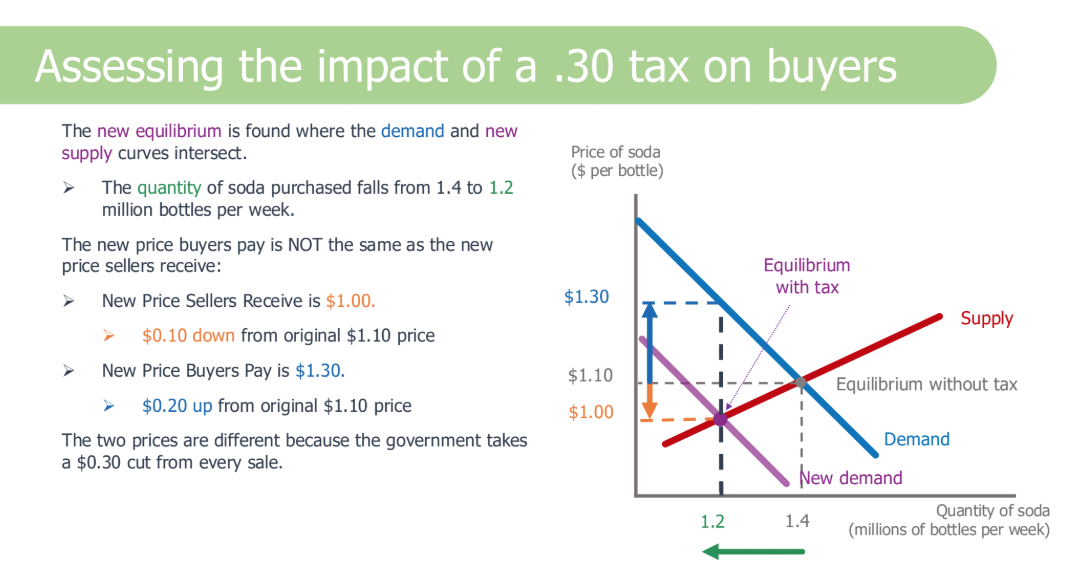

EXAMPLE 2: Assessing the impact of a .30 tax on BUYERS

(Price Sellers, Buyers have to pay + Equilibrium with tax is the same with each assessing the impact. This shows that")

The law doesn’t determine who pays the tax, elasticity and supply and demand determine who pays the tax

The only that changed was who the tax was being put on

The more inelastic side bears more of the tax burden

Calculating the impact of tax

Which curve is shifting?

Shift that curve to show a decrease by the amount of the tax

If supply, the decrease appears as a shift “up” to a parallel curve

If demand, the decrease appears as a shift “down” to a parallel curve

Find the new price

If the price at the new intersection (or equilibrium) of S and D is above the old equilibrium, the Price of the buyer alters drastically

If the price at the new intersection (or equilibrium) of S and D is BELOW the old equilibrium, the Price of the seller alters drastically

To find the other price (Price of buyer OR Price of seller) draw a vertical line from the new intersection to the old curve

Compare pre and post tax outcomes

Subsidy

The opposite of tax

Subsidies lower the price to buyers, and as a result, increase the quantities demanded

Subsidies increase the price sellers receive and, as a result, increase the quantities supplied

Economic Benefit: determined by the relative price elasticities of demand and supply curves

The more inelastic side receives more of the benefits of the subsidy

Subsidy Incidence

Calculating the impact of subsidy

Which curve is shifting?

Shift that curve to show a decrease in the amount of the tax

If supply, the increase appears as a shift “down” to a parallel curve

If demand, the increase appears as a shift “up” to a parallel curve

Find the new price

If the price at the new intersection (or equilibrium) of S and D is above the old equilibrium, the Price of the seller alters drastically

If the price at the new intersection (or equilibrium) of S and D is BELOW the old equilibrium, the Price of the buyer alters drastically

To find the other price (Price of buyer OR Price of seller) draw a vertical line from the new intersection to the old curve

Compare pre and post-tax outcomes

Price Regulations

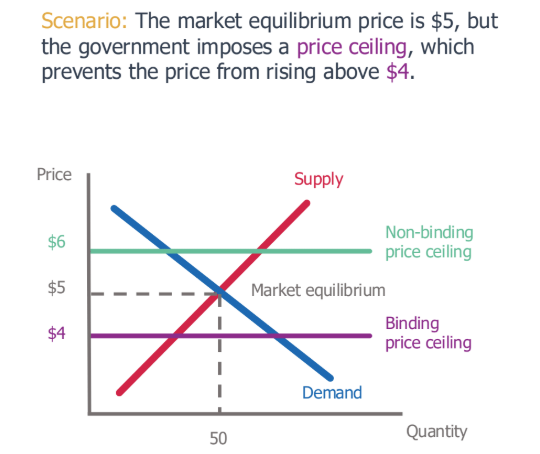

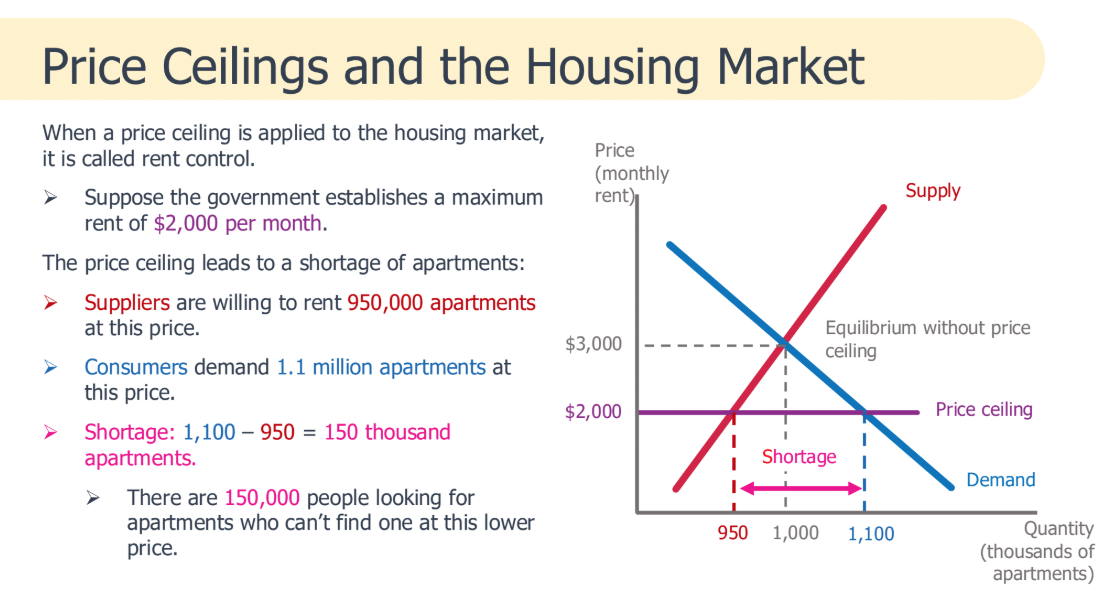

Price ceilings: A maximum price at which you can buy or sell a good

Specifically, it is a maximum price set by the government.

It makes it illegal to exchange goods or services for price ABOVE the established max. price

Binding price ceilings: A price ceiling that prevents the market from reaching the market equilibrium price

A binding price ceiling must be set BELOW the equilibrium price ceiling

EXAMPLE

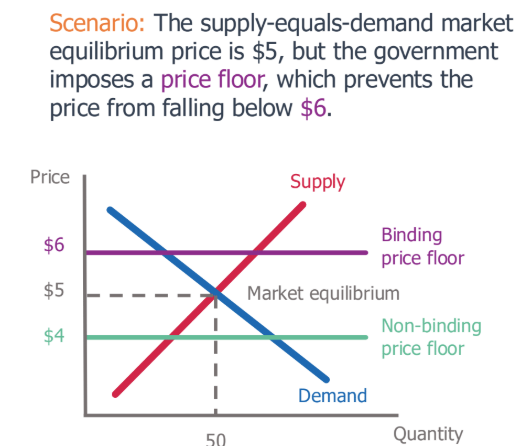

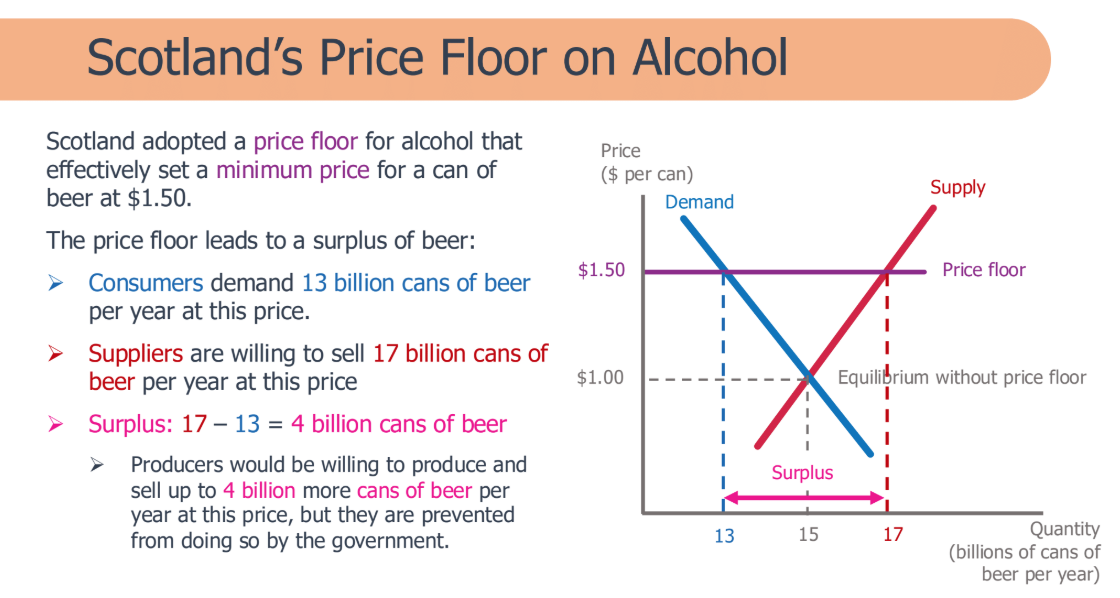

Price floor: a minimum price that sellers can charge

Specifically, it is a minimum price set by the government.

It makes it illegal to exchange goods or services for price BELOW the established max. price

Binding price floor: A price ceiling that prevents the market from reaching the market equilibrium price

A binding price floor must be set ABOVE the equilibrium price ceiling

Reasons the government may want to set a binding price floor:

The government wants to raise prices in order to help sellers.

Example: Minimum wages price floor that raises the wages received by the lowest-wage workers.

Instead of selling their labor for $5 per hour, the current federal minimum wage guarantees workers will receive at least $7.25 per hour when they sell their labor on the labor market.

Government wants to reduce the quantity sold in the market.

Example: Many governments set minimum prices for alcohol in order to reduce alcohol consumption

Knowt

Knowt