Accounting

Module 1

Chapter 1

Accounting - an a information system that reports on the economic activities and financial condition of a business or other organization

Market- group of people or entities organized to exchange items of value

Common terms for added value:

Profit

Income

Earnings

Sources of financial resources (money) :

Investors- give organizations money in exchange for a portion of ownership

Creditors- lends money to organizations, expect payment back+ interest

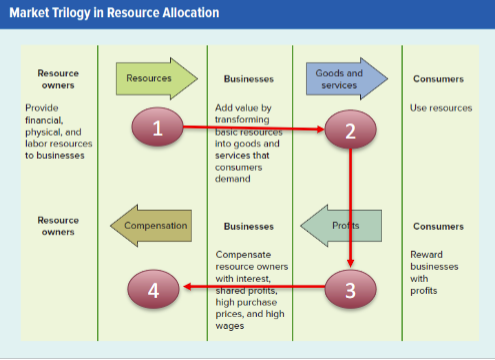

Market trilogy in resource allocation

Physical resources- in their most primitive form they are natural resources

-owners of PR seek to sell those resources to businesses with high earning potential \

Labor resources- intellectual and physical labor

Stakeholders- many users of accounting info

-resource providers

-finical analysts

-news reporters

-brokers

Nonbusiness resource usage

Not all entities allocate resources based on profitability

Governments allocate resources for national defense, to reallocate wealth or to protect the environment

foundations, religious groups, and various benevolent organizations protizr resources usage based on humanitarian concerns

^ non profit entities

Accounting improves commutation

FASB- Financial Accounting Standards Board-

GAAP-Generally-Accepted-Accounting- Principles

Financial accounting reports disclose the financial activities of particular individuals or organizations described as reporting entities

Public Accounting- CPA, Audit services, tax services, consulting services

Private Accounting- Certified management accountant, Certified Internal Auditor

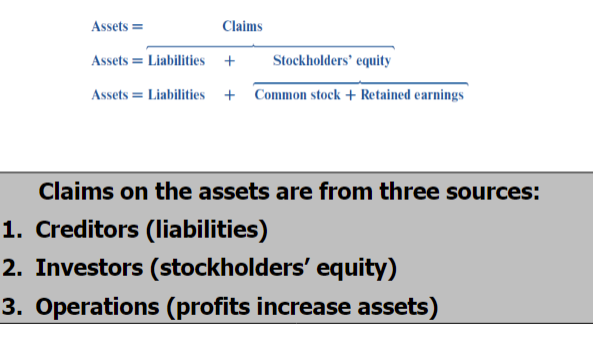

Accounting equation

Assets= Liabilities+ Stock holders equity

Stockholders equity= common stock and retained earnings= a business’ commitment to the stockholders

Assets= the resources a business uses to earn money

Liabilities= obligations a business has to its creditors

Common stock= commitments made to investors are described in certificates

Retained earnings= increases to stockholders equity from earnings

Dividends= distribution of assets through earnings

Detailed info about the accounting equation is maintained in records called accounts

Not all business entities use the same accounts of account names

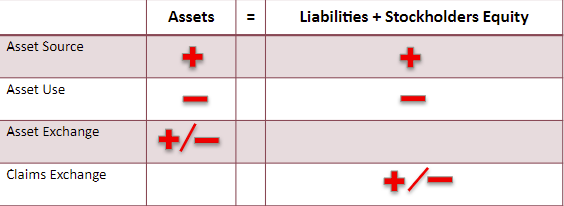

Transaction types

Asset source= assets and L& SE increase

Asset use= assets and L&SE decrease

Asset exchange= assets exchanged for another

Claims exchange= L&SE exchanged for another

Recording business events under the accting equation

Companies typically report about business activity over a span of time called an accounting period

accounting event- an economic occurrence that changes an enterprises assets liabilities or stockholders equities

Transaction- a particular kind of event that involves transferring something of value between two entities

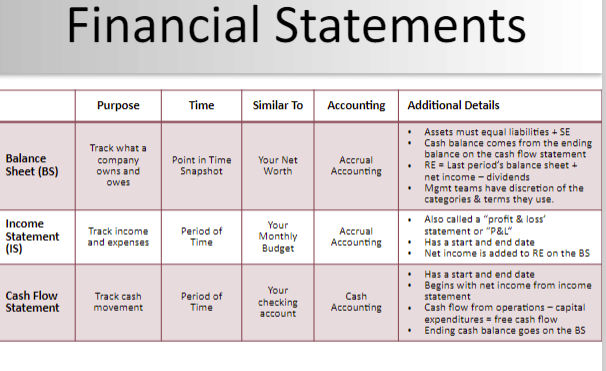

Financial statements

Balance sheets- financial statement that reports a company’s assets and the corresponding claims (liabilities& equities) on those assets as of a specific date (usually at the end of the accounting period)

Income statement- financial report of profitability; measures the difference between revenue and expenses for the accounting period (whether or not cash has been exchanged)

/

Statement of cash flows- financial statement that reports a company’s cash inflows and outflows for an accounting period, classifying them as operating investing or financing activities

statement of changes in stockholders equity- statement that summarizes the transactions that affect the owners equity during an accounting period

Business liquidations

if a business ceases to operate its remaining assets are sold and the sale proceeds are returned to the creditors and investors through a process called liquidation

creditors have priority in business liquidations and investors receive any residual

Reporting info

accounting information is normally presented to external users in four general purpose financial statements

The information in the ledger accounts is used to prepare these financial statements

Closing temporary accounts to retained earnings

the process of transferring information from the revenue expense and dividend (temp) accounts to the retained earnings account is called closing

Since the retained earnings carries forward from one accounting period to the next it is considered a permanent account

Chapter 10

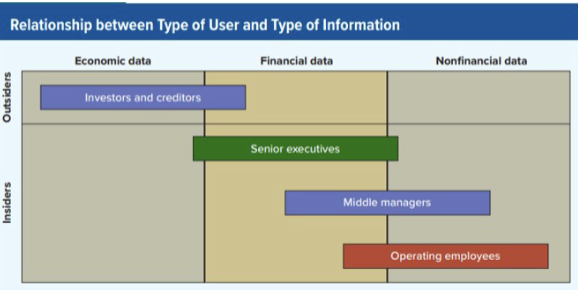

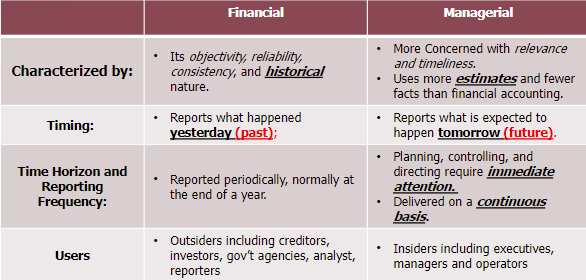

Financial accounting is not designed to satisfy all the info needs of business managers. Its scope is limited to the needs of external users such as investors and creditors

managerial accounting focuses on info for executives managers and employees who work inside the business

internal users need info to plan direct and control business operations

external users have greater needs for general economic information

External users generally desire global information that reflects the perfoemance of a company as a whole

internal users focus on detailed info about specific subunits of the company

To meet the needs of the different user groups,

financial accounting data are

more aggregated than

managerial accounting data.

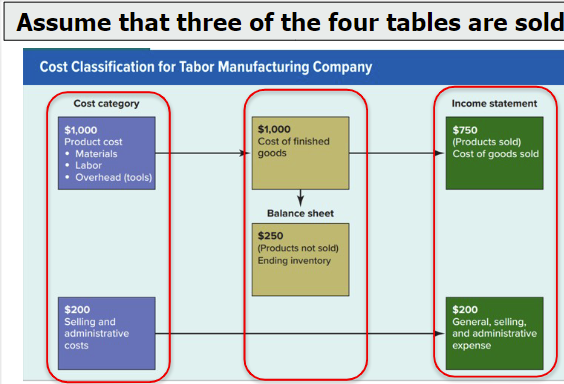

product costing in manufacturing companies

a major focus for managerial accountants is determining product costs

managers need to know the cost of their products for a variety of reasons

for example cost plus pricing is a common business practice

product costing is also used to control business operations

manufacturing product cost summary “the big 3”

direct materials- sometimes called raw materials

-if the amt of a material in a product is known it is usually classified as DM

-the cost of the DM can be easily traced to specific products

-the cost of raw materials is first recorded in an asset account (inventory)

-The cost is then transferred from the Inventory account to

the Cost of Goods Sold account at the time the goods are

sold.

• Materials cost is only one component of total

manufacturing costs.direct labor

-labor paid to workers involved in hands on contact with product being made

-labors costs that can be easily tracked to specific products in order to be classified as a direct cost

-labor cots that can be easily and conveniently traced to products called direct labor costs

-salaries paid to selling and admin employees are expensed immediately

-production wages are added to inventory and expensed as a part of cost of goods sold at the time the inventory is sold

manufacturing overhead

-costs that cannot be easily traced to specific products, these are considered indirect costs

-ex. utility costs

cash asset—>inventory(asset)= cost (asset exchange)

-depreciation cost totaled 1600 (600 office furniture and 1000 on manufacturing equipment

only 600 of depreciation on the office equipmet is expenced directly on the inome statement

the deprecation on thr manufacturing is spilt between the

income statement (cost of goods sold) and the balance sheet (inventory).

the expense will only recognized when the goods (inventory) is sold

costs can be assets or expenses

All product costs (mats,labor,overhead) remain in an inventory account until revenue is earned when the inventory is sold

costs that are not classified as product cots are normally expensed in the period in which they are incurred

they include general selling and admin costs, intrest taxes, and income taxes

Product costs- include direct materials, direct labor, and manufacturing overhead

period costs-include all selling costs and admin costs (income statement)

Inventory goes on the BALANCE SHEET

cost classification in service and merchandising companies

Service- organizations provide services to customers rather than physical products

Merchandising- businesses sometimes called retail or wholesale companies; they sell goods to other companies

Manufacturing- companies make the goods to sell to customers

Manufacturing inventory accounts:

raw materials inventory: includes lumber, metals, paints, chemicals that will be used to make companies products

work in process inventory WIP: includes partially completed products

finished goods inventory: includes completed products that are ready for sale

BASE model:

B=beginnings

A= Additions

S= Subtractions

E=Ending

Just in time inventory JIT:

many inventory holding costs are obvious: financing, warehouse space, supervision, theft, damage, and obsolescence

Other costs are hidden: dimished motivation, sloppy work, inattentive attudes, and increased production time

Many businesses have been able to simultaneously reduce their inventory holding costs and increases customer satisfaction by making products available JIT for customer consumption

certified management accountant IMA statement of ethical professional practice:

Competence

confidentiality

resolution of ethical conflict

integrity

creditability

CH TAX (17)

TAX-

payment that:

is required

imposed by a government agency

not directly tied to the benefit received

not intended to punish

Tax liability-

tax base* tax rate

Objective of the tax system is to raise the revenue for the govt

The tax base for the indv federal income tax is called axable income

the indv income tax is a progressive tax

avg tax rate= total tax/ taxable income

Effective tax rate= total tax/ total income

marginal tax rate= change in tax/ change in taxable income —> tax owed on next dollar of income

Income taxes

tax base = wages up to 160200

tax rate 12.4%

social security taxes are regressive because SS tax burden decreases for higher level of income

self employed indv pay the entire social security tax burden

employees and employers each pay half

regular medicare tax base= all wages

regular medicare tax rate =2.9%

the regular Medicare tax is a proportion tax

self employed indv pay the entire social security tax burden

employees and employers each pay half

additional medicare tax base= wages in excess of 200000S, 250000MFJ

additonal meducare tax rate .9%

addtl medicare tax is progessive

Corporate income tax

the tax base is taxable income and the tax rate is a flat 21%

the corporate income tax is a proportional tax

corprate income is subject to double taxation because shareholders are taxed on diviends distrubuted to them

all corporations must file form 1120 by apr 15

partnership taxes

businesses may also be organized as partnerships

all partnerships must file form 1065 but they are not subject to an entity level tax like corporations

partnership incomes and expences flow through to the partnership owners based on their ownership percentages

the partnership reports this to the owners on a schedule K1

the owners then regcognize their share of partnership income and expences on the indv tax return

form 1065 is due by march 15

Estate tax

paid by the estate

40% tax on fiar market value of the the estate in excess of 12.92M in 2023

gift tax

paid by the giver

not taxed unless the gift is more than 17000 in 2023

each giver then has a lifetime gift exclusion of 12.92M

Module 2

Chapter 11- cost behavior and profitability

Cost behavior- how a cost will react to changes in the level of activity

the most common classifications are:

fixed, mixed, and variable costs

total amount of fixed cost does not change when volume changes

When volume increases total variable cost increases, vise versa

Considering cost behavior enables managers to more effectively plan and control costs

Total vs per unit fixed costs behave differently

the term fixed cost is consistent with the behavior of total cost

fixed costs behavior patterns

total cost remains constant (fixed)

fixed cost per unit decreases as volume increases

fixed cost per unit increases as volume decreases

risk and reward assessment

Risk- the possibility that sacrifices may exceed benefits

a fixed cost represents a commitment to an economic sacrifice

it represents the ultimate risk of undertaking a particular business project

shifting the cost structure from fixed to variable cost enables avoiding the fixed cost risk

the risk of incurring a loss is eliminated by the variable cost structure

variable cost behavior

Total cost increases in direct proportion in relation to # of units sold

the variable cost per unit remains the same regardless of # of units sold

when activity increases—> total variable cost increases protanomaly & variable cost per unit remains constant

mixed costs (semivariable)

include both fixed and variable components

Total cost = FC+(VC*#of units)

Y=a+bX

Y= total mixed cost

a= total fixed cost (vert intercept)

b= varible cost per unit

X= numbe of units

relevant range

the range of activity over which the definitions of fixed and variable costs are valid is commonly called the relevant range

contribution margin CM approach

the impact of cost structure on profitability is so signicant that managerical accountants frequentky construct income statements that classift costs according to their behavior patterns

such income statemenrs first subtract variable costs from revune; the resulting subtotal is called the contribution margin

the CM is the amoiunt available to cover fixed expences and thereafter to provide company profits

SALES-Varible Costs =CM

CMperunit= Sales perunit - VC per unit

break even point

where profit = 0

sales- VC- FC= Net income (profit) (equation method)

Fixed expenses/ Unit CM = unit sales to break even

break even volume in dollars

to determine the amount of break even sales measured in dollars multiply the number of units times the sales price per unit

CH 12 cost accumulation, tracing, and allocation

managers must have reliable cost estimates to

price products

evaluate performance

control operations

prepare financial statements

Managers need to know the cost of many different things. the things for which we are trying to determine the of of is called a cost object

accountants use cost accumulation to determine the cost of a particular object

cost accumulation begins with identifying the cost objects

The costs of the secondary cost objects are combined to determine the primary cost object

use of cost drivers to accumulate costs

cost driver is any factor that causes of DRIVES an activity’s cost

a cost driver has a cause and effect relationship with a cost object

EX the # of labor hours is a cost driver for the labor cost object

estimated vs actual costs

estimated cost- managers uses estimated costs to make decisions about the future

^^ timely, potential inaccuracies, relevant

^^ use cost estimates to: set prices, bid on contracts, eval proposals, set goals

use actual cost data to: publish financial reports, managerial performance evaluation

identifying direct and indirect costs

assigning costs to the departments (cost objects) requires cost tracing and cost allocation

direct costs can be easily traced to a cost object

indirect costs cannot be easily traced to a cost object

whether or not a cost is easily traceable requires cost/ benefit analysis

whether a cost is direct or indirect is independent of whether it is fixed or variable

common costs- support multiple cost objects but cant be traced to any specific object

the departmental managers should be held responsible for controllable costs

cost allocation- involves dividing total costs into parts and assinging the parts into designated cost objects

^first, ID a cost driver for each cost to be allocated,

- for example store size drives rent cost.

• Then, achieve a rational allocation of the rent cost using the following two-step process.cost allocation process 2 step process

step 1: compute allocation rate

total cost to be allocated/ total cost driver= allocation rate

step 2: multiply the allocation rate by the weight of the cost by the weight of the cost

driver to determine the allocation per cost object,Allocation rate x cost driver (per) = per cost object

determining the cost to be allocated using cost poolsallocating indv every single indirect costs a company incurs would be tedious and not useful

instead companies frequently accumulate many and costs into a single cost pool

the total polled cost is then allocated to the cost objects

You should used the drivers with the STRONGEST cause and effect relationship

cost drivers for variable overhead costs

a causal relationship between variable overhead product costs and the volume of production

volume measures are good cost drivers for allocating variable overhead costs

fringe bene= labor hurs

machine maintenance= machine hours

cost drivers for fixed overhead

by definition the volume of production does not drive fixed costs

the objective of allocating fixed costs to products is to distribute a rational share of the overhead costs to each product

selecting an allocation base that spreads total overhead costs equally over total production often produces a rational distribution

cost allocation: the human factor

they many influence managers performance evaluations and compensation

they may dictate the amt of resources various departments divisions and other organizational received

control over resources usually offers managers prestige and influence over organization operations

Chapter 13- relevant information for special decisions

Two primary characteristics distinguish relevant from useless information:

Relevant info:

differs among the alternatives

is future oriented

sunk costs and opportunity costs

sunk costs- historical costs, made in the past

Sunk costs ARE NOT relevant for making current decisions

Sunk costs CANNOT be changed

opportunity costs- the sacrifice that is incurred in order to obtain and alterative opportunity

relevance is an independent concept

the concept of revelence is INDEPENDENT from the concept of cost behavior

relevance is context sensitive

a particular cost that is relevant in one context may be irrelevant in another

relationship between relevance and accuracy

info need not to be exact to be relevant

quantitative vs qualitative characteristics

relevant info can have both quantitative and qualitative characteristics

differential revenue

since revenue differs among the alterative it is sometimes called differential revenue

avoidable costs

are the costs managers can ELIMINATE by making specific orders

Cost hierarchy

unit level costs- incurred each time a company generated one unti of product

batch level costs- costs batched together

product level costs- costs incurred to support specific products or services

facility level costs- incurred to support the entire company

avoidable costs^

Unit level—> avoided by eliminating one unit of product

batch level - avoided when a batch of work is eliminated

product level- avoided if product line is eliminated

facility level- avoid if a facility segment is eliminated

relevant information and special decisions

5 types of special decisions are frequently encountered in business practice

special order

outsourcing

segment elimnation

asset replacement

special order quanative analysis steps

1.determine the amount of the relevant revenue you will earn by accepting the special order

2.determine the amount of relevant costs you will incur by accepting

3.accept the special order of the relevant revenue exceeds the relevant costs

qualitative characteristics

regular customers may demand reduced prices like special order

special order does not induce repeat business

CH 14/15

Budgets

Importance of Planning:

Planning is crucial to operating a profitable business.

Types of Planning:

Short-Term Planning: Focuses on the upcoming year.

Intermediate Range Planning: Typically spans 3-5 years.

Long-Term Planning: Extends beyond 5 years.

Types of Planning

Strategic Planning:

Involves making long-term decisions, such as defining the scope of the business, determining which products to develop or discontinue, and identifying the most profitable market niche.Capital Budgeting:

Focuses on intermediate-range planning and involves decisions such as whether to buy or lease assets, stimulate sales, or increase the asset base.Operations Budgeting:

Focuses on short-term plans and is a key component in the master budget. It deals with short-term objectives.

Master Budget

Master Budget: Covers one year and compiles all individual budgets into a single comprehensive plan.

Advantages of Budgeting

Planning: Helps in outlining the financial path for the business.

Coordination: Ensures all departments are aligned toward common objectives.

Performance Management: Tracks actual performance against budgeted performance to evaluate success.

Corrective Action: Allows for adjustments when discrepancies arise.

Participative Budgeting:

Invites participation from personnel at all levels of the organization. This encourages more cooperation and facilitates information flow both from the bottom up and top down during budget preparation.

Components of the Master Budget

Operating Budgets:

Focus on day-to-day operations. Key components include:Sales Budget

Inventory Purchases/Manufacturing Budget

Sales and Administrative Budget

Cash Budget

Capital Budgets:

Focus on capital expenditures and long-term investments.Pro Forma Financial Statements:

Based on projected (future) information rather than historical data.

Order of Preparing the Master Budget

Set the Sales Budget first.

Determine the Inventory Purchases/Manufacturing budget.

Prepare the Sales and Administrative budget.

Prepare the Cash Budget.

Pro Forma Financial Statements

Pro Forma Statements: Based on projected data rather than historical data, these statements provide insight into the expected financial outcomes.

Responsibility Centers

Responsibility Center – An organizational unit that controls identifiable revenue or expense items.

Cost Center – A unit that incurs expenses but does not generate revenue.

Evaluation Measure: Ability to keep costs within budget parameters.

Profit Center – Incurs costs and generates revenue.

Evaluation Measure: Ability to produce revenue in excess of expenses.

Investment Center – Responsible for revenues, expenses, and the investment of capital.

Evaluation Measure: Accountability for assets and liabilities.

Controllability Concept

States that managers should only be evaluated on revenues and costs they can control.

Holding individuals responsible for things they cannot control is demotivating.

Because the exercise of control may be clouded, managers are usually held responsible for things they have predominant rather than absolute control over.

Flexible Budgets and Their Uses

An extension of the master budget that shows expected revenues and costs at various volume levels.

A static budget remains unchanged even if actual activity volume differs from planned volume.

Uses of Flexible Budgets:

Examine "what-if" scenarios.

Flexible budgets are prepared using the same per-unit variable costs and total fixed cost data as the static budget.

The only difference is the expected number of units sold.

Managers use flexible budgets for both planning and performance evaluation.

Flexible budgets are critical for an effective performance evaluation system.

Return on Investment (ROI)

The ratio of wealth generated (Operating Income) to the amount invested (Operating Assets) to generate wealth.

ROI Formula: ROI= OI/OA

Left side (Margin): Measures management’s ability to control operating expenses relative to sales.

Right side (Turnover): Measures the amount of operating assets employed to support sales.

Residual Income (RI)

Evaluating managers based on ROI alone may lead to profitable projects being rejected.

RI encourages managers to accept profitable investments that might otherwise be rejected under ROI evaluation.

Suboptimization occurs when managers act in their own best interest at the expense of the organization.

Residual Income Formula: RI=Net Operating Income-(Avg. Operating Assets*Minimum Required Rate of Return)

Responsibility Accounting and the Balanced Scorecard

The Balanced Scorecard includes financial and nonfinancial performance measures.

Financial Measures:

Standard costs, income measures, ROI, and residual income.

Nonfinancial Measures:

Defect rates, cycle time, on-time deliveries, number of new products or innovations, safety measures, and customer satisfaction surveys.

The Balanced Scorecard provides a holistic approach to evaluating managerial performance.

Module 3 CH 2, 3,4

Chapter 2 Accounting for Accruals and Deferrals

Accrual accounting

Accrual- revenue or expense event that is recognized before cash is exchanged

Deferral- revenue or expense event that is recognized after cash is exchange

regardless when cash is exchanged it is commonly called accrual accounting

what is a receivable

account receivable- amount which will be received from the customer against the credit purchase of goods and services from the business

increases cash

recoded as an asset

what is a payable

account payable- amount which will be payable to the vendor/supplier against the credit purchase of goods and services from them

decreases cash

recorded as a liability

transaction classification

asset source: asset account increases and corresponding claims account increases

asset use: asset account decreases and corresponding claims account decreases

asset exchange: asset account increases and another asset account decreases

claims exchange: claims account increases another claims account decreases

expenses

expenses that are recognized before cash is paid are called accred expenses

Knowt

Knowt