Rules of Professional Conduct

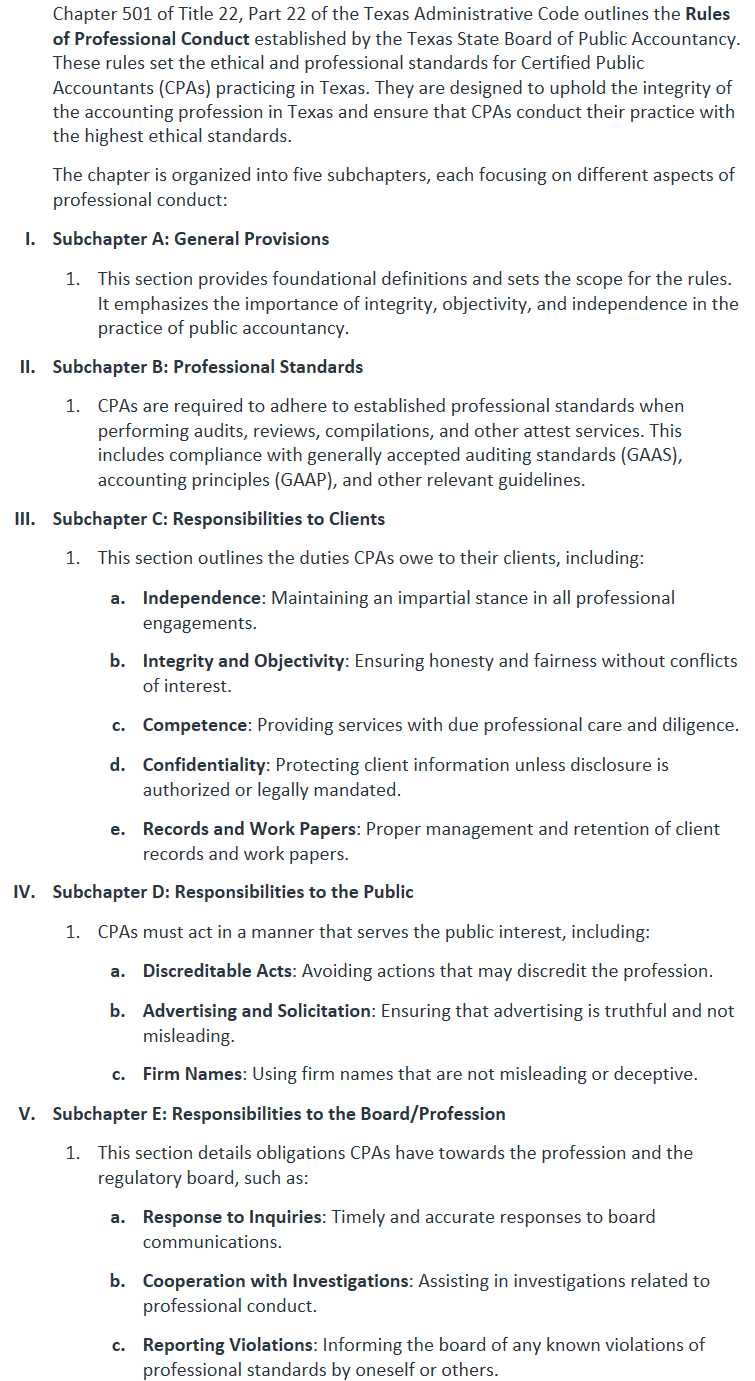

Chapter 501 of Title 22, Part 22 of the Texas Administrative Code outlines the Rules of Professional Conduct established by the Texas State Board of Public Accountancy. These rules set the ethical and professional standards for Certified Public Accountants (CPAs) practicing in Texas. They are designed to uphold the integrity of the accounting profession in Texas and ensure that CPAs conduct their practice with the highest ethical standards.

The chapter is organized into five subchapters, each focusing on different aspects of professional conduct:

Subchapter A: General Provisions

This section provides foundational definitions and sets the scope for the rules. It emphasizes the importance of integrity, objectivity, and independence in the practice of public accountancy.

Subchapter B: Professional Standards

CPAs are required to adhere to established professional standards when performing audits, reviews, compilations, and other attest services. This includes compliance with generally accepted auditing standards (GAAS), accounting principles (GAAP), and other relevant guidelines.

Subchapter C: Responsibilities to Clients

This section outlines the duties CPAs owe to their clients, including:

Independence: Maintaining an impartial stance in all professional engagements.

Integrity and Objectivity: Ensuring honesty and fairness without conflicts of interest.

Competence: Providing services with due professional care and diligence.

Confidentiality: Protecting client information unless disclosure is authorized or legally mandated.

Records and Work Papers: Proper management and retention of client records and work papers.

Subchapter D: Responsibilities to the Public

CPAs must act in a manner that serves the public interest, including:

Discreditable Acts: Avoiding actions that may discredit the profession.

Advertising and Solicitation: Ensuring that advertising is truthful and not misleading.

Firm Names: Using firm names that are not misleading or deceptive.

Subchapter E: Responsibilities to the Board/Profession

This section details obligations CPAs have towards the profession and the regulatory board, such as:

Response to Inquiries: Timely and accurate responses to board communications.

Cooperation with Investigations: Assisting in investigations related to professional conduct.

Reporting Violations: Informing the board of any known violations of professional standards by oneself or others.